simpson33

Company Overview And Investment Thesis

Netflix (NASDAQ:NFLX) is primarily a streaming entertainment service that provides consumers with a subscription-based model for their original content. Most of Netflix’s model surrounds its subscription service to its movies and television shows. Netflix operates using a B2C business approach, directly targeting its end consumers with subscription services from various price points and tiers. Founded in 1997 by Reed Hastings and Marc Randolph, Netflix has been established in the entertainment industry for over 25 years and has cemented itself as a streaming giant. In January of 2007, Netflix launched its streaming service, years ahead of most of its industry competitors, giving it more time to grow and establish itself globally.

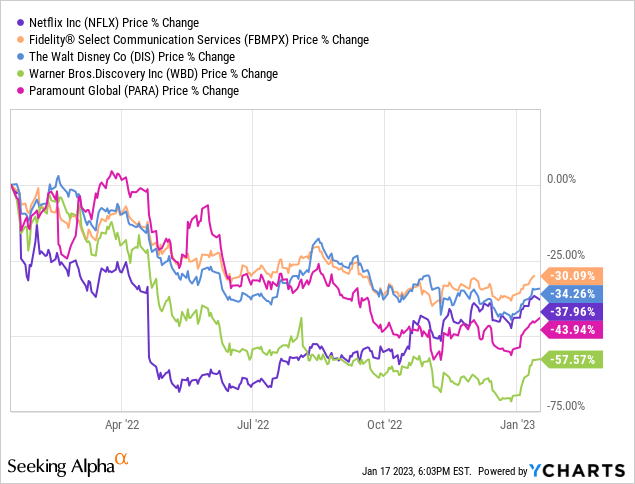

Data From (YCharts)

Netflix currently operates under three main segments: Domestic Streaming, International Streaming, and Domestic DVD. Domestic Streaming consists of its business in the US and the revenue that Netflix derives from its monthly subscriber fees for streaming. The International Streaming segment involves the fees Netflix collects from monthly members outside the US. The Domestic DVD segment is one that was much more prominent in the early stages of Netflix, but this includes the revenues from services consisting of DVD-by-mail. With just over 223 million global subscribers, Netflix currently has the most streaming members worldwide, edging out Amazon’s Prime Video by about 20 million and rapidly growing Disney+ by around 60 million.

I’m currently instating a buy and overweight rating on Netflix. As you can see above, Netflix has rebounded significantly from its June floor at around $150/share. However, it still suffered significant losses that outpaced all of the broader market indices and its respective sector and industry average returns. Although it has rallied really nicely off of its summer lows following the poor Q1 numbers and weak guidance, Netflix has some great catalysts in the works that can significantly bolster subscriber and ARPU growth.

Recent Earnings Report’s Summaries And Guidance

The first two quarters of 2022 were very underwhelming for Netflix. As a result of two consecutive quarters of recording a loss in total monthly subscribers, Netflix saw its stock price tumble from a peak of just north of $700/share in November of 2021 to a low of $162/share in May 2022. Not only did monthly subscribers disappoint, but top-line numbers in Q1 were a miss coming in at $7.87 billion vs. an analyst expectation of $7.93 billion. As expected, the stock cratered by more than 25% from the moderate top-line miss and a huge let down on monthly subscriber numbers (expected +2.73 million, actual -200,000). Furthermore, management was weary of its business in Russia, so it guided down, forcing the stock to move even lower. Because of its business suspension in Russia, the company lost 700,000 subscribers in that region. An important note is that the actual subscriber numbers would have seen a net addition of 500,000 if it weren’t for the Russia-Ukraine conflict.

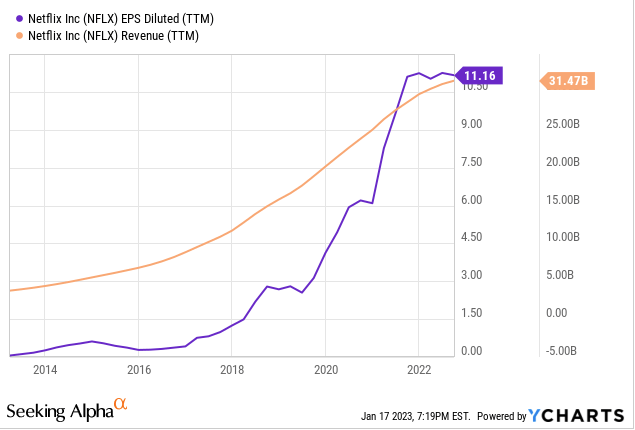

Data By (YCharts)

On top of Q1, Netflix released another quarter of subscriber losses in Q2 of 2022 (July). However, the stock rose on earnings this time because management reported a much lower-than-expected loss in subscribers at -970,000 vs. an anticipated -2,000,000 loss. Moreover, they had optimistic guidance of a password sharing crackdown, its new lower-costing ad-supported tier, and a bottom-line beat. While revenue was slightly disappointing, earnings or EPS came in at $3.20 vs. an expected $2.94, around a 9% surprise. Coming off two troubling quarters, Netflix finally had a blowout quarter in Q3 on all three critical metrics: Subscribers, top-line/revenues, and bottom-line/earnings. An addition of 2.41 million net subscribers blew out expectations of only 1 million added subs, as well as a huge EPS beat of nearly a dollar per share and a marginal revenue beat. Lower revenue anticipations for Q4 2022 result from overseas forex headwinds, which are short-term issues and should not be accounted for in the stock price. As a result of this outstanding quarter in terms of sales, earnings, subscriber growth, and guidance, Netflix’s stock price surged 15% intraday.

Entertainment Industry Comp Analysis

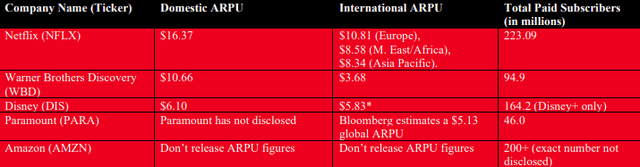

Within the communication services sector is the movies+entertainment industry, which is where Netflix and some other prominent streaming giants sit. Below is a portrayal of a significant metric in the streaming space called ARPU which is defined as the average revenue per unit or user. In the case of Netflix, the company oftentimes uses ARM, which is average revenue per member and is very similar to ARPU. ARPU focuses on the amount of value and money that is extracted from the average subscriber per month, and at $16.37 in the U.S. that means most U.S. consumers are utilizing the standard (most common) and premium member tiers coming in at $15.49/month and $19.99/month respectively.

Comparative Subscriber and ARPU Numbers in the Streaming Space (TheWrap)

As you can see above, Netflix has the strongest ARPU both domestically and internationally when compared to its relative peers. Some other notable figures is that Netflix still remains at the top of the throne in terms of monthly subscribership. edging out Amazon (NASDAQ:AMZN) Prime Video by 20 or so million and the fast growing Disney+ by about 60 million. Disney (NASDAQ:DIS) as a whole has more monthly subscribers across all of its streaming platforms (Disney+, Hulu, ESPN+). However, in terms of solo services, Netflix still has the highest numbers. Disney+ $5.83 in international ARPU also excludes its Indian service Disney+ Hotstar which would bring the ARPU number down to a meager $0.58 if factored in.

Long-Term Growth Plans And Capital Allocation

Reed Hastings (current CEO) and his management team have continued with their view of reinvesting extensive amounts of capital and utilizing its robust free cash flow to push out successful content. Netflix’s proven “binging” business model of releasing entire seasons at a time has hooked its users to stay with their platform. Additionally, with an overperforming slate of original content in Q4 and several exciting releases coming up in Q1 of 2023, like Kaleidoscope and Vikings: Valhalla Season 2, Netflix’s numbers should continue to be in line or outperform its already aggressive guidance to add anywhere in the ballpark of 4.5 million members next quarter. Some of its most significant and exciting growth catalysts moving forward will be the highly sought-after basic with ads tier that will offer prospective consumers a much cheaper entry point. Because we’re in turbulent macroeconomic times and potentially a recession, this plan can make newer members join Netflix for as low as $6.99/month.

Additionally, cracking down on passwords is another stream of sales growth that Netflix plans on perfecting in 2023. Netflix will enforce password-sharing rules through IP addresses, device IDs, and account activity, ultimately charging those engaging in these activities around $3/month on top of the standard membership fees. This will inevitably grow the company because Netflix can monetize from the estimated 30 million North American and 100 million global households engaging in password sharing. The recent acquisition of Boss Fight Entertainment in 2022 is another business route Netflix plans on growing and attracting more attention. Netflix is relatively new and unpopular in the gaming space; however, with multiple in-house gaming studios and the recent M&A activity with boss Fight Entertainment, the company is on track to grow its business in that field.

In the Q3 2022 shareholders letter, management shared:

There’s no change to our capital allocation approach. Our first priority is to continue to invest appropriately in our business for the long term, including new initiatives such as games and advertising, followed by selective acquisitions. After that, excess cash above our minimum cash levels (equivalent to roughly two months of revenue) will be returned to shareholders through share repurchases.

Clearly, Netflix prioritizes its original content and makes sure it reaches audiences all around the world, as it has done a stellar job with in the past. Paying off debt and reinvesting capital into content will continue to be the priority in the next few years, as it has to battle the constantly growing competitive pressures.

Netflix’s Valuation And Growth Numbers

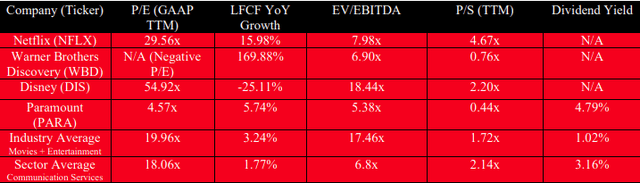

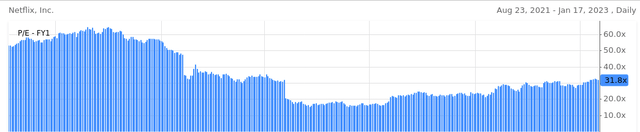

As shown below, Netflix stock is anywhere from fairly valued to slightly overvalued when looking at most of these metrics. Specifically, when looking at the trailing-twelve-month P/E ratios across the group of peers and sector/industry averages, Netflix’s 29.56x multiple is higher than Paramount’s (NASDAQ:PARA) by a wide margin and significantly higher than its relative industry and sector. This means investors would be paying a premium for Netflix when looking at this specific valuation metric. However, it’s essential to note that the company has a cheaper P/E ratio than Disney and WBD (NASDAQ:WBD), which currently has a negative multiple. On the FactSet chart, Netflix was trading as high as a 60x+ multiple at its peak and as low as 15-16x in the summer of 2022, so investors can still get in Netflix at a relatively low-fair value historically.

Netflix Relative Valuation to Peers and Sector/Industry Averages (Seeking Alpha)

In terms of year-over-year levered free cash flow growth, Netflix shares a very robust 15.98% growth and 26.99% five-year average growth. Although this isn’t a specific valuation metric, it’s a growth metric I thought was critical to look at because LFCF is crucial when seeing how effective streaming companies are at paying their obligations. Netflix has strategically positioned itself to tackle its obligations, buy back shares, and aggressively reinvest leftover capital into fan-favorite content. NFLX’s 15.98% YoY levered free cash flow growth places them ahead of most of its peers and industry/sector means.

Netflix P/E Multiple From 8/2021-1/2023 (FactSet)

Regarding the EV/EBITDA multiple, Netflix is fairly valued at 7.98x when looking at its comparable peers and sector. This metric takes out debt costs, taxes, and depreciation/amortization, so it gives investors a transparent look at a company’s financial performance. P/S is where Netflix trades at the highest premium and can be viewed as overvalued due to its 4.67x multiple, which is more than double its industry and sector values. Netflix has a lower ratio of sales compared to its market capitalization compared to its peers, which can be seen as a negative to prospective investors. However, a lot of these numbers are inflated from Netflix’s poor quarterly performance in early 2022 and big stock price recovery from the summer.

Risk Factors And Red Flags Going Forward

Red Flags include but are not limited to:

- Capitally intensive business model. Netflix takes on a large debt burden to continue its cycle of constant new original content. Of course, Netflix replaces its bonds with new debt as they mature, so as rates remain high in terms of the last decade, the company will be paying higher interest rates.

- On the bright side, the company doesn’t have much short-term debt. Netflix has done a solid job spreading maturities; however, they still have roughly $16.5 billion in total debt.

- Continuous increase in competitive pressure and quality of competition, hinders growth opportunities.

Risk Factors include but are not limited to:

- F/X headwinds overseas all throughout 2022, moving into 2023 as the U.S. Dollar continues to remain strong and exchange rates remain elevated. The USD has fallen from its highs in late 2022 at around 115, so some top and bottom line pressures have eased.

- Growing competition at a rapid pace in the streaming space. Netflix no longer has a huge comparative advantage. However, the still hold the most monthly subscribers and highest ARPU among single streaming service platforms.

- Risks of the password-sharing plan falling through as it has not had many tests and is relatively new in the LatAm nations.

- Continued high rates in the economy make it more capitally intensive to take on debt, thus creating more interest expense for Netflix’s debt fueled business model.

- Low popularity in Basic With Ads tier, or large groups of members trading down to the cheaper $6.99/month tier, which would lower ARPU and margins.

Be the first to comment