metamorworks/iStock via Getty Images

Things have definitely changed for MACOM Technology Solutions Holdings (MTSI), but not in a good way. The stock was in an uptrend for months, but it has now fallen out of it. MTSI has lost 17% of its value as a result. However, the stock is fast approaching a couple of support levels, which may stem the slide. Some may see this as an opportunity to get in on a stock at a discount, betting on a rebound, but others may still want to stay clear of MTSI, at least for now. Why will be covered next.

The trend has changed

The chart below shows how MTSI spent months trending higher in an ascending channel, a bullish chart pattern formed by two parallel trendlines sloping upwards. The upper bound of the channel is formed by a series of higher highs and the lower bound of the channel is formed by a series of higher lows.

The former is considered resistance and the latter is support. The former was able to reject several attempts to break through. Support did likewise for a while, but it failed to do so on the last attempt. The stock fell below the lower trendline when support was unable to hold its ground after succeeding at first.

The stock gained 42% in 2021, but it’s now down 17% YTD in 2022. The stock has fallen into oversold territory with an RSI below 30, being just above the 200-day moving average. If it falls below the 200-day moving average, the stock may find support at $62.5-63.0. If that does not hold, then the next stop could be around $60.

Why some may not want to be long MTSI even if there’s a bounce

The stock is likely to find support and bounce in the short term, if only because the stock is oversold. Some may even be betting on this. On the other hand, others may still want to pass on MTSI because of valuations. The table below shows the multiples MTSI trades at. MTSI comes at a premium, regardless of which metric is used.

|

MTSI |

|

|

Market cap |

$4.53B |

|

Enterprise value |

$4.75B |

|

Revenue (“ttm”) |

$606.9M |

|

EBITDA |

$151.0M |

|

Trailing P/E |

120.48 |

|

Forward P/E |

52.51 |

|

PEG ratio |

– |

|

P/S |

7.34 |

|

P/B |

9.50 |

|

EV/sales |

7.83 |

|

EV/EBITDA |

31.50 |

Source: Seeking Alpha

For instance, MTSI trades at 53 times forward earnings with a trailing P/E of 120. The median P/E is closer to 29. MTSI has an enterprise value of $4.75B, which is roughly equal to 31.5 times EBITDA. MTSI did manage to reduce the amount of leverage from where it used to be, which is why its credit ratings were recently upgraded by the ratings agencies. Still, the balance sheet needs more work. The stock trades at 9.5 times book value.

Growth may not be fast enough for some

There are other factors out there that may sway people’s opinions of MTSI. Another factor that could play a role has to do with growth, or the lack thereof. While MTSI is growing, the rate of growth may not be fast enough for everyone’s liking, especially with multiples where they are. The most recent quarterly report shows why.

According to the Q4 report, revenue increased by 5.4% YoY to $155.3M. GAAP EPS increased by 9% YoY to $0.24 and non-GAAP EPS increased by 52.5% YoY to $0.61. Adjusted EBITDA was $52.5M in Q4 FY2021, up from $49.7M in Q3 FY2021 and $40.8M in Q4 FY2020. Adjusted operating margin exceeded 30%, a milestone for MTSI.

Note that GAAP net income was $15.49M or $0.22 per share in Q4 FY2020, but it would have been less if not for one-time gains. The bottom line in Q4 FY2020 benefited from $4.6M of other income, including a warrant liability gain of $2M. In contrast, Q4 FY2021 totaled $7.5M in non-operating expenses, skewing the YoY comparisons. The table below shows the numbers for Q4 FY2021.

|

(GAAP) |

Q4 FY2021 |

Q3 FY2021 |

Q4 FY2020 |

QoQ |

YoY |

|

Revenue |

$155.211M |

$152.622M |

$147.249M |

1.70% |

5.41% |

|

Gross margin |

58.1% |

57.2% |

52.8% |

90bps |

530bps |

|

Income from operations |

$26.282M |

$23.674M |

$12.685M |

11.02% |

107.20% |

|

Net income |

$17.129M |

$15.005M |

$15.489M |

14.16% |

10.59% |

|

EPS |

$0.24 |

$0.21 |

$0.22 |

14.29% |

9.09% |

|

(Non-GAAP) |

|||||

|

Revenue |

$155.211M |

$152.622M |

$147.249M |

1.70% |

5.41% |

|

Gross margin |

61.1% |

60.3% |

56.4% |

80bps |

470bps |

|

Income from operations |

$46.839M |

$43.862M |

$34.117M |

6.79% |

37.29% |

|

Net income |

$43.270M |

$40.296M |

$27.570M |

7.38% |

56.95% |

|

EPS |

$0.61 |

$0.57 |

$0.40 |

7.02% |

52.50% |

Source: MTSI Form 8-K

If the Q4 numbers are available, then so too are the numbers for all of FY2021. FY2021 revenue increased by 14.5% YoY to $606.9M. MTSI finished with a GAAP loss of $46M or $0.69 per share in FY2020, but turned it around with a GAAP profit of $37.97M or $0.54 per share in FY2021. Non-GAAP EPS increased by 119.4% YoY to $2.15.

|

(GAAP) |

FY2021 |

FY2020 |

YoY |

|

Revenue |

$606.920M |

$530.037M |

14.51% |

|

Gross margin |

56.3% |

51.0% |

530bps |

|

Income from operations |

$81.002M |

$3.388M |

2290.85% |

|

Net income (loss) |

$37.973M |

($46.078M) |

– |

|

EPS |

$0.54 |

($0.69) |

– |

|

(Non-GAAP) |

|||

|

Revenue |

$606.920M |

$530.037M |

14.51% |

|

Gross margin |

59.6% |

55.0% |

460bps |

|

Income from operations |

$170.302M |

$95.978M |

77.44% |

|

Net income |

$151.863M |

$67.107M |

126.30% |

|

EPS |

$2.15 |

$0.98 |

119.39% |

Source: MTSI Form 10-K

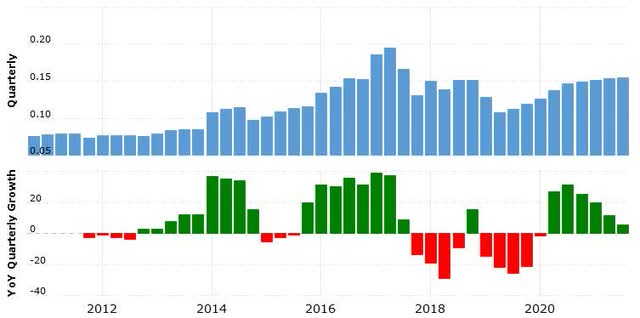

However, the subdued pace of topline growth is worth noting. Quarterly revenue has increased by a total of just $8M in the last four quarters combined. The bottom line has done better due to higher margins, but the bottom line will be hard-pressed to keep going if there’s a lack of topline growth. If the topline goes flat, then it’s only a matter of time before the same happens to the bottom line. The chart below shows how the topline is nearly flat.

Guidance calls for Q1 FY2022 revenue of $157-161M, an increase of 2.4% QoQ and 7% YoY at the midpoint. The forecast expects non-GAAP EPS of $0.60-0.64, a QoQ increase of $0.01 and a YoY increase of $0.16 or 34.8% at the midpoint. While guidance did not extend beyond Q1, the outlook does expect FY2022 revenue to grow by at least 10% YoY. From the Q4 earnings call:

“As I have noted, we maintain a long-term perspective on executing our strategy, and we are confident that we can continue to improve our financials and take market share in the months and years ahead. Based on the opportunities in front of us, we believe that MACOM has the potential to achieve at least 10% year-over-year revenue growth in FY 2022. In addition, we believe our business model has leverage to improve profitability. Our product portfolio is stronger than it was a year ago. And for this reason, we are confident we can meet or exceed our FY2022 targets.”

A transcript of the Q4 FY2021 earnings call can be found here.

Keep in mind that MTSI is targeting $1B in revenue by FY2025, which requires a CAGR in the low to mid-teens in the coming years since FY2021 revenue was nearly $607M. In comparison, while FY2021 revenue increased by 14.5% YoY, growth dipped in Q4 when it grew by 5.4% YoY. Guidance expects Q1 growth of 7% YoY. In other words, MTSI is not growing fast enough at its current pace and it will need to step up the pace if it is to hit its target in FY2025.

In addition, FY2021 earnings growth was enabled in part by windfalls that are not expected to be present in FY2022.

“For fiscal year of 2021 total adjusted operating expense was $191.2 million, down 2.4% from fiscal year 2020 levels. For fiscal year 2022, we believe that operating expenses will increase as we expand sales and marketing activities and enhance our R&D capabilities by investing in new programs to support our future growth, while also continuing to be very disciplined with our discretionary spending.”

Operating expenses are expected to go up after going down last year. Higher expenses will in all likelihood translate into less earnings growth, all else being equal.

Investor takeaways

It wasn’t that long ago that long MTSI made a lot of sense. The stock was in an uptrend, being in an ascending channel with its clearly defined boundaries. This made it easier to determine when it was a good time to add to the stock or to lock in profits. There was simply no question as to where the stock was heading. The direction was clear from the chart patterns and it was up.

However, the channel is no longer intact. The lower trendline gave way and the stock has yet to regain its footing. The stock is down 17% YTD and this number will only increase unless the stock finds the support needed to stem the decline. The good news is that the stock is approaching a couple of possible support levels. The stock is also oversold, which combined with support nearby may be enough to halt the decline, if only temporarily.

MTSI still has a number of positive attributes. Its product lineup is diverse and includes those that offer exposure to rising industries like silicon photonics. Dozens of new products are expected to be introduced in FY2022. In theory, MTSI is a stock with a lot of potential due to its exposure to markets that are expected to expand rapidly in the coming years like 5G.

Still, betting on MTSI may be too tall a hurdle for some, even if the stock winds up finding support and bounces. Multiples are too high to qualify MTSI as a bargain. MTSI trades like a stock with growth to spare, but growth seems to be slowing down. Growth of 10% in FY2022 seems underwhelming considering the premium assigned to the stock.

In addition, market conditions are not as conducive to stocks that trade at high multiples like they used to be until recently. The Federal Reserve intends to pull back on stimulus, which helped many stocks to rise to valuations that they probably would not have received if not for the Fed. Tighter conditions do not bode well for a stock like MTSI that may not be growing fast enough to warrant its multiples.

I consider MTSI a hold. While the recent decline has lowered multiples, they haven’t come down enough, considering MTSI is not growing all that fast. While supply chain issues likely held down sales in recent quarters and earnings have done better, it’s difficult to keep earnings growth going if sales are flat. If the stock is to attract enough buyers for it to regain its uptrend, multiples will have to become more appetizing. While that happens, it’s best to wait it out when it comes to MTSI.

Be the first to comment