400tmax/iStock Unreleased via Getty Images

Introduction

On May 11, 2021, I wrote my most recent article covering the Oshkosh Corporation (NYSE:OSK). This industrial company has been on my radar for years as it’s a fantastic way to track economic growth due to its cyclical exposure. Recently, the company has been in the news as it got a big order for the next USPS vehicle – both electric and with “traditional” combustion engines. In this article, I’m going to re-assess the situation with a focus on dividends and dividend growth. Moreover, last time I highlighted that the stock is only a buy during weakness:

I believe that the best way to deal with Oshkosh is to buy the company during severe sell-offs. Use the company as a wild card to buy some cheap exposure in a time when everyone sells. The 2020 stock market crash and the 2015 manufacturing recession are good examples of that. Also, keep in mind to maintain a low exposure if you buy. I wouldn’t invest more than 1-1.5% of my exposure in Oshkosh.

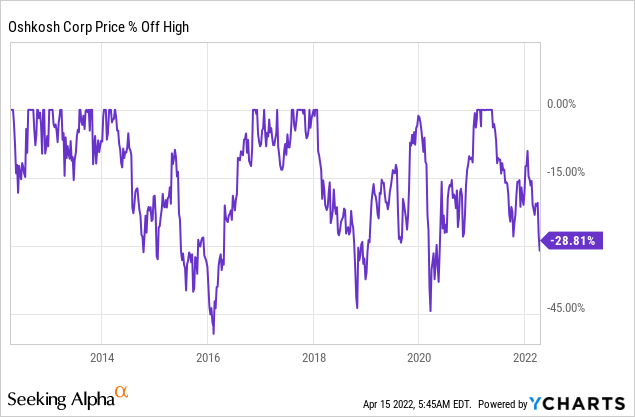

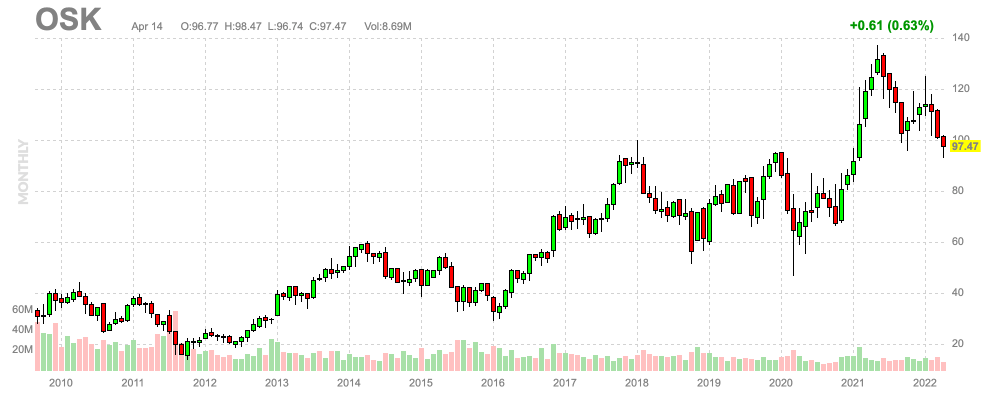

Right now, the stock is close to 30% below its all-time high and 14% lower on a year-to-date basis. I’m going to explain why that is and why it matters.

So, bear with me!

Good News

The tweet below is what got my attention after I had somewhat lost track of Oshkosh. South Carolina Senator Tim Scott used Twitter to celebrate the fact that Oshkosh Defense will build the next USPS vehicle in his home state – in Spartanburg, to be precise. Spartanburg is also home to the only BMW manufacturing facility in the US.

On March 24, the news that Oshkosh Defense bagged a big order hit the wires. The US Postal Service had placed its first order of Next Generation Delivery Vehicles with Oshkosh Defense, a subsidiary of Oshkosh Corp. The initial order is for 50,000 NGDVs valued at $2.98 billion.

Oshkosh Defense will manufacture both zero emission battery electric vehicles and fuel-efficient low-emission internal combustion engine vehicles for the USPS in their Spartanburg, South Carolina factory.

Moreover, according to Oshkosh investor relations:

Oshkosh Defense will manufacture both zero emission battery electric vehicles (BEV) and fuel-efficient low-emission internal combustion engine vehicles (ICE) for the USPS in their Spartanburg, South Carolina factory. The first order will include a minimum of 10,019 BEVs. The NGDV contract allows the flexibility, when funding is provided, to increase the percentage of BEVs to be produced even after an order is placed.

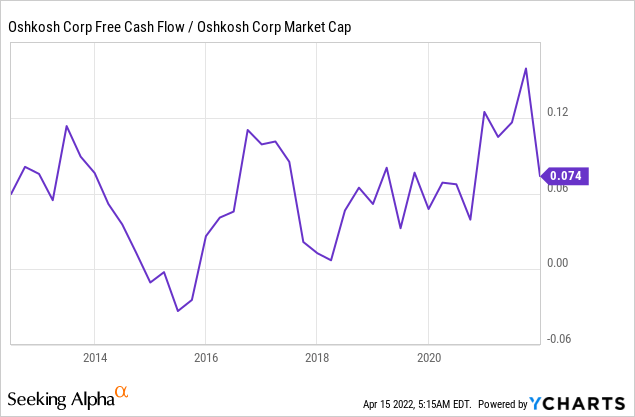

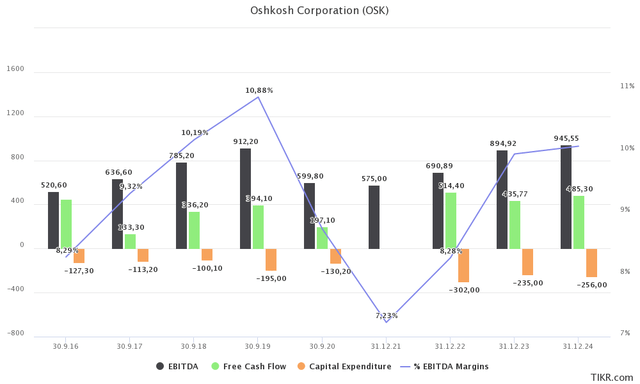

Related, the good news continues. The company is set to do $690 million in EBITDA this year, which would be the first significant improvement since 2020. Next year, EBITDA could exceed pre-pandemic levels with more than $430 million in free cash flow. Free cash flow is basically net income adjusted for non-cash operating items and capital expenditures. It’s cash a company can spend on dividends, buybacks, and debt reduction. In this case, I added capital expenditures, which show the company’s increased investment requirements. Note that if these requirements fall again, the company could end up with an additional $100 million in free cash flow.

According to the company, higher spending levels reflect higher CapEx in NGDV (the USPS vehicle we just discussed) and capacity expansion projects at Access Equipment and Fire & Emergency.

If we use 2023 free cash flow expectations of $895 million and the company’s $6.5 billion market cap, we end up with a 13.8% free cash flow yield. Even compared to historic highs, 13.8% is truly spectacular. Essentially, it means that the company could use excess cash to distribute a 13.8% dividend yield. Just to give you an idea of how much a 13.8% free cash flow yield is. As the company is not spending 100% of free cash flow on dividends, further debt reduction and share buybacks are almost guaranteed.

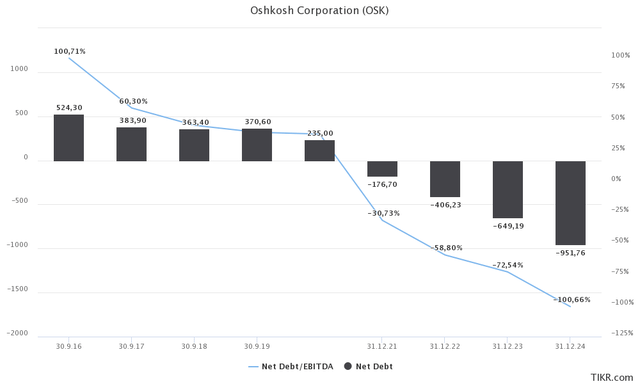

The graph below shows that high free cash flow is indeed resulting in a very healthy balance sheet. In 2021, the company lowered net debt below zero for the first time. Next year, the company is expected to lower net debt to minus $650 million, implying net cash (more cash than gross debt).

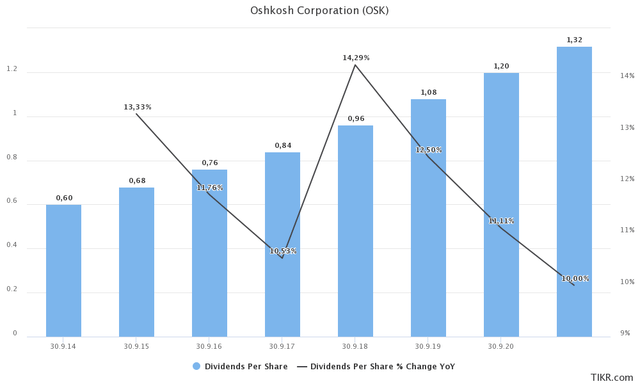

This means we can expect dividend growth to continue. Over the past five years, dividend growth averaged 11.8%. The most recent hike was announced on October 28, 2021. Back then, the company hiked by 12.1%. I expect dividend growth to continue at that pace as it’s fully backed by free cash flow.

The current dividend yield of 1.5% is not very high, but if double-digit dividend growth is maintained, it quickly turns into a more satisfying yield – on cost.

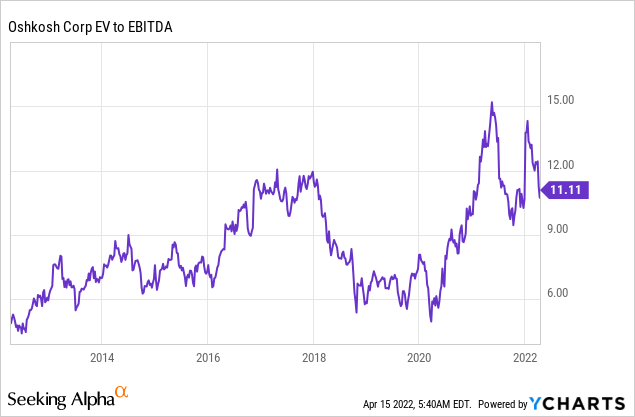

These numbers also indicate that OSK is too cheap. Using the aforementioned $6.5 billion market cap and $650 million in expected 2023 net cash, we end up with an implied enterprise value of $5.9 billion.

This is 6.6x next year’s expected EBITDA of $890 million. That’s too cheap. The company is small and cyclical, but trading at an implied double-digit free cash flow yield and less than 7x EBITDA is just too cheap.

This brings me to the bad news.

The Bad News

Despite all of the good news in this article, OSK is trading roughly 29% below its all-time high, which makes it yet another steep decline in its volatile history. In the past 10 years alone, investors have been through a sell-off like this at least three times.

However, this is not a random walk, but somewhat that’s rather “predictable”.

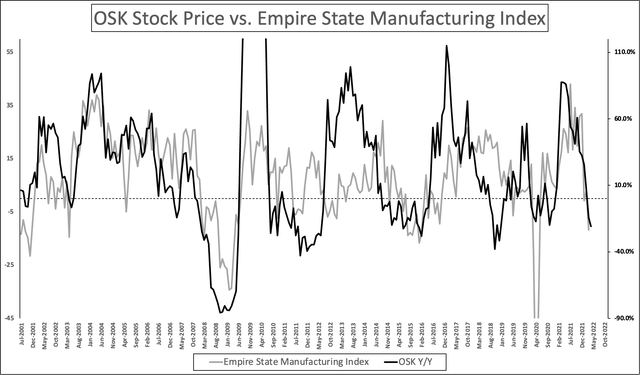

The following graph shows the year-on-year performance of the OSK stock price compared to the Empire State Manufacturing Index. This index is a survey-based, forward-looking economic indicator comparable to the ISM index. What we’re seeing here is an almost “perfect” correlation – at least when it comes to the bigger picture.

What we’re seeing here is simple de-risking. Investors and traders are getting rid of pro-cyclical investments during this economic downturn. They move money into more defensive industries to buy back into cyclical once economic indicators bottom.

That is annoying for existing OSK shareholders, but it’s an opportunity as it does not make OSK a bad company. If anything, OSK has gotten much stronger. The company is now a trusted long-term supplier of government agencies (defense and postal) and a company with a fantastic balance sheet and a lot of room to invest in its business if it sees opportunities.

Yes, its business model is cyclical, but on a long-term basis, there’s just too much value to ignore this stock.

While I don’t know where OSK is going to bottom, I have a feeling that the stock won’t fall below $80. I think we’re seeing a bottom in the high $80s, depending on the development of the economy. Rising mortgage rates, related housing weakness, supply chain issues, high inflation, and imploding consumer confidence are a dangerous mix.

FINVIZ

With that in mind, I expect the next upswing in economic momentum to take this stock to $170. While this environment is not resulting in investors rushing back to buy OSK, higher economic growth (in the future) will push a lot of money into OSK once the market finds out how cheap the stock is.

Takeaway

I’ve followed Oshkosh for years. This small-cap industrial company from the town with the same name has evolved into more than just a producer of machinery. It has now long-term deals with government agencies for the delivery of defense and postal vehicles. The company has boosted capital spending to increase its production capabilities, resulting in strong EBITDA and free cash flow expectations.

The company’s implied free cash flow yield of 13% is wild and it seems sustainable. The company remains in a terrific spot to reward investors with long-term dividend growth, and buybacks, and it reduces risk by running a balance sheet with an increasing net cash balance.

While I expect the stock to run to at least $170 during the next upswing, I remain “neutral” for the time being. Lower economic growth expectations are keeping a lid on the stock price as investors are de-risking. This happens every 2-3 years, which is fine as investors can use it to their advantage.

I recommend investors buy the stock in the high $80s. At that point, the dividend is much more attractive and the risk/reward is almost unbeatable – unless the economy suffers so much that we get a bigger sell-off on the stock market.

Long story short, if you’re looking into an industrial dividend growth opportunity, I think OSK offers an opportunity. I just would not go overweight because OSK is volatile and there are stocks with better, less cyclical yields. Hence, I would not exceed 2% total exposure.

(Dis)agree? Let me know in the comments!

Be the first to comment