Roger Utting Photography/iStock Editorial via Getty Images

Mr. Market Is Now Looking Past A Tough Q1

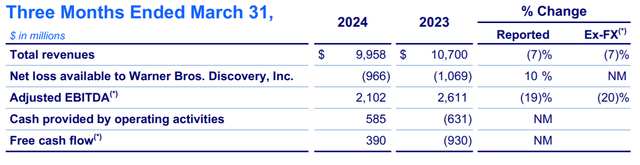

Warner Bros. Discovery (NASDAQ:WBD) had another tough quarter in Q1 2024. Looking at the headline numbers, the company had a revenue decline of 7% compared to Q1 2023, similar to the year-on-year decline they reported last quarter. Adjusted EBITDA posted a bigger decline, down 19% to $2.1 billion. Free cash flow continues to be a bright spot, however. I noted last quarter that FCF should have a headwind as spending on production resumed after the writers and actors strikes, but FCF came in at a positive $390 million in Q1, compared to a big cash outflow a year ago.

The market reaction to the results was different than it was last quarter. The stock dropped 10% when the 4Q results were released. This time, although the bears ruled in the pre-market, the stock turned around during the earnings call and traded up slightly for the day.

Think or Swim (Charles Schwab)

This seems like a small consolation, as the stock is still down 5% from my last purchase of $8.44 which I mentioned in my last article when I rated the stock a Buy. Nevertheless, when a stock fails to trade down on an earnings miss, it can be a sign that the bad news is fully priced in, and the turnaround may finally be coming.

Each of WBD’s segments had some positive developments that should help their earnings going forward. I will review each one below. As a result, I expect no change to the $10.34 billion 2024 adjusted EBITDA estimate I made last quarter. WBD is still cheap compared to peers and remains a Buy.

Studios – Gaming Flop Is Over, Movies Still Strong

Studios’ year-on-year result was particularly impacted by a big flop in the gaming business, Suicide Squad: Kill the Justice League. The comparison to the prior year was made worse by the great performance of Hogwarts Legacy in 2023, when it was the top-selling game of that year. WBD plans to focus on its core franchises for future game releases, such as the Harry Potter: Quidditch Champions game now in development.

The theatrical business is strong, and WBD has the #1 share of box office year-to-date at $1.8 billion. During Q1, Dune: Part Two came out on March 1, while Godzilla x Kong was not released until the very end of the quarter on March 29. This is a good sign for Q2 results, along with the release of Challengers in April and Furiosa in May. A lot of the promotional expense for these films was incurred in Q1, however, cost within the Studios segment was still lower than last year.

TV production revenue was also down in Q1 as there was still some delay in getting back up to speed from the strikes. This is also favorable for results in the next couple quarters as the studios catch up.

Networks – Advertising Turnaround Continues

The Networks segment faces a secular headwind from cord cutting, impacting both distribution and advertising revenues. WBD is helped a bit by its international exposure, as this trend is slower in other regions, such as Europe. Within the Networks segment, advertising revenues were up sequentially compared to Q4, while still down year-on-year. The company is, however, growing advertising quickly in the Direct-to-Consumer segment, which I will discuss in more detail below. As I noted previously, the Olympics and presidential election should also help drive advertising in 2024.

On the distribution side, some of the decline compared to last year was due to the exit from regional sports programmer AT&T SportsNet. The NBA is another big driver in the Networks segment, where TNT has shown games for decades. WBD stock hit its lows for the year on April 30, when news came out that NBC (CMCSA) may have outbid WBD for the rights. On the earnings call, CEO David Zaslav mentioned that the company has the opportunity to match competing offers, so it is not a done deal yet. There is still the risk that margins from a new NBA deal could shrink due to the high price required for a winning bid.

D2C – Ad Growth, Better Content, Partnerships

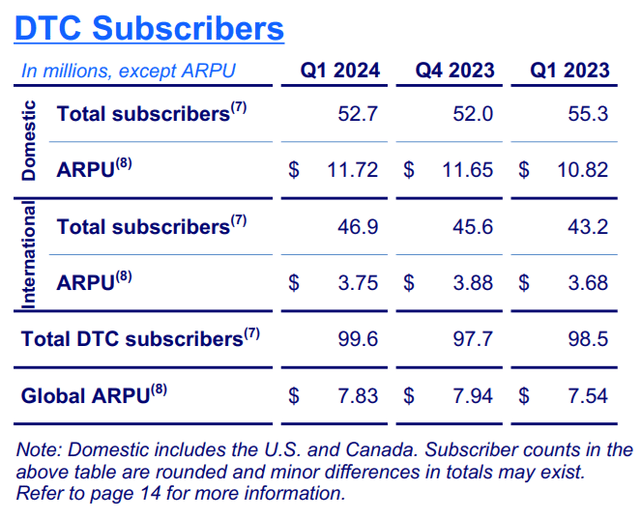

With the Direct-to-Consumer segment being the future of the company, WBD is applying a lot of effort to grow the business in a profitable way. Advertising revenues within D2C grew 70% from last year. That is from a small base and remains much less than ad revenues in the Networks segment. The company is using AI to optimize where to insert ads in streaming programs and to customize ads to the viewer.

Max continues to add and improve content. The streaming service has been showing college and pro basketball playoff games and will be streaming the Olympics this summer in Europe. The child actor documentary Quiet on Set has been a hit and season 2 of House of the Dragon is coming in June with further Game of Thrones spinoffs to follow later.

WBD has been busy launching Max in international markets, with Latin America done in Q1 and many European countries this quarter in time for the Olympics. International has been a big driver of subscriber growth, outpacing Domestic, however these customers come with lower revenue per user.

WBD is increasingly turning to partnerships as a way to expand subscriber growth. Last quarter, I mentioned the proposed sports joint venture with Fox (FOX) (FOXA) and Disney (DIS). More recently, the company announced plans to create a bundle with Disney containing Max along with Disney+ and Hulu. This should help subscriber growth overall but will cannibalize some existing Max subscribers and could lower ARPU as the bundle will be priced at a discount to the separate services.

Capital Management

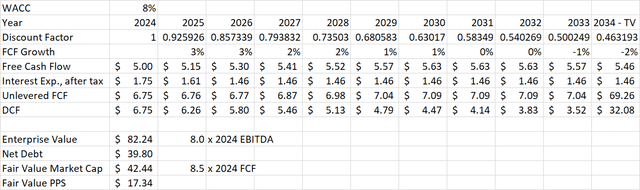

WBD continues to pare down its debt. During Q1, the company paid off $1 billion of debt. They used cash on the balance sheet to do this, so net debt was down just $100 million to $39.8 billion. The company also just announced a tender offer for up to $1.75 billion of outstanding debt. Free cash flow over the trailing 4 quarters has been $7.5 billion. This was helped by production shutdowns from the strikes in the second half of last year, so I am conservatively estimating $5 billion FCF for the full year in 2024. That is unchanged from my estimate last quarter. This level of FCF exceeds the amount of debt due in any single year going forward.

Valuation And Peer Comparison

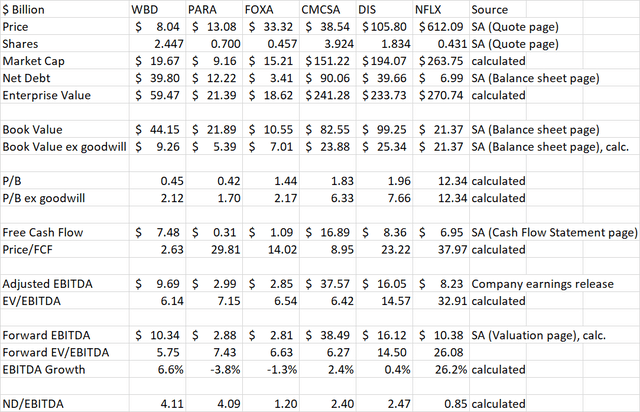

There was nothing new this quarter to change my 2024 EBITDA estimate of $10.34 billion. That gives WBD a forward EV/EBITDA multiple of 5.75. This is below peers with lower projected EBITDA growth including Paramount (PARA), Fox, and Comcast. The average multiple of these three stocks is about 18% above WBD.

Nothing has changed with my future cash flow assumptions, discount factor, or the resulting fair enterprise value from my DCF analysis of $82.24 billion, or 8x 2024 EBITDA. Subtracting the latest value for net debt, we get a fair market cap of $42.44 billion, or $17.34/share.

Conclusion

Warner Bros. Discovery was not beaten up by the market after the latest earnings release, even though the company missed expectations. This could be a sign that the bad news is already priced in, and investors are starting to believe the turnaround story. These positives include a strong slate of movies, a recovery in advertising, and partnerships to bundle sports and entertainment offerings with other services.

WBD remains cheap compared to its low growth peers Paramount, Fox, and Comcast, who similar challenges. If we value WBD at a similar EV/EBITDA multiple, there is about 18% upside to WBD share price. Using a DCF model, I get a fair value of $17.34, more than double the current price. This value depends on continued low single digit FCF growth for the next several years.

Risks to this valuation include a faster than expected decline in the linear TV business, renewal of the NBA contract under low-profit terms, and failure of international expansion or domestic bundling to grow D2C subscriber count or ARPU. As I stated last quarter, this makes WBD more of a trade than an investment. While this trade is down 5% from my entry point, the market action following the last earnings release is encouraging and WBD remains a Buy.

Be the first to comment