designer491

The Invesco Variable Rate Preferred ETF (NYSEARCA:VRP) provides exposure to variable rate preferred equity and hybrid securities. Its historical performance has been muted, especially in 2022, as the asset class is susceptible to higher credit spreads, like junk bonds and senior loans. However, the asset class does have investment merit, as VRP has historically outperformed LQD and JNK both in terms of absolute and risk-adjusted returns. It also has a comparable distribution yield to JNK. I think VRP is a viable alternative to junk bond ETFs like the JNK.

Fund Overview

The Invesco Variable Rate Preferred ETF provides exposure to variable rate preferred stock and hybrid securities. The VRP ETF has $1.8 billion in assets and charges a 0.50% expense ratio.

Strategy

The VRP ETF tracks the ICE Variable Rate Preferred & Hybrid Securities Index (“Index”). The index is designed to track the performance of floating and variable rate investment grade (“IG”) and non-investment grade (“junk”) preferred stocks issued by U.S. companies.

What Is Preferred Equity?

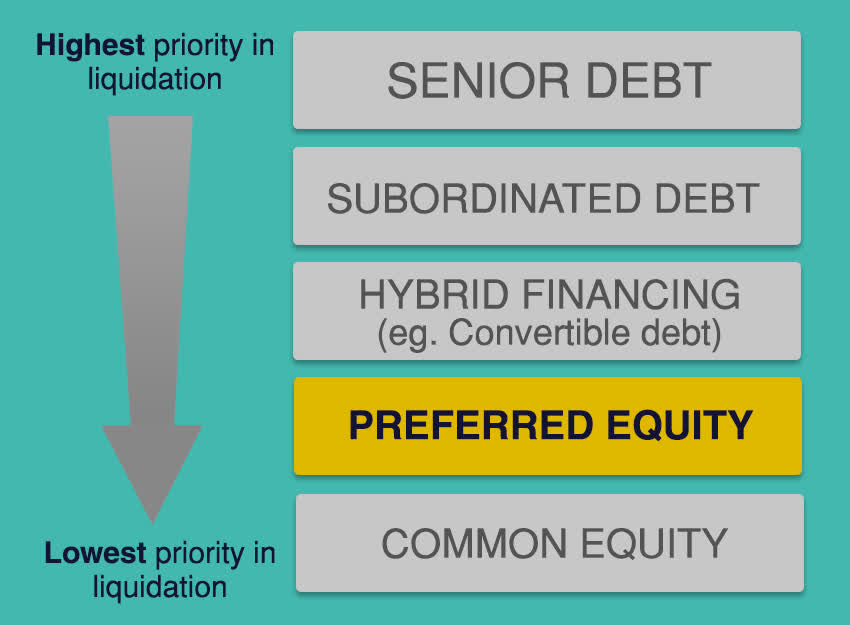

Preferred equity is a type of security that sits within a company’s capital structure between bonds and common equity (Figure 1). In the event of a bankruptcy, preferred equity has higher claim on a company’s assets than common equity, but a subordinated claim compared to debt.

Figure 1 – Preferred equity ranks lower than bonds but higher than common equity in capital structure (royalbank.com)

Preferred equity differs from common equity in that there are usually no voting rights attached to preferred equity when it comes to corporate matters. Also, preferred equity has limited appreciation upside, as they are usually issued with call provisions allowing the company to redeem the shares at a certain price. Preferred equity typically have stated dividends (either fixed or floating rate) that must be paid before the company can issue common stock dividends.

Compared to bonds, preferred equity usually carries a higher distribution yield to compensate for their lower priority claim in the capital structure. However, unlike bond interest payments, preferred equity dividends can be skipped without putting a company into default (although this is highly frowned upon).

Portfolio Holdings

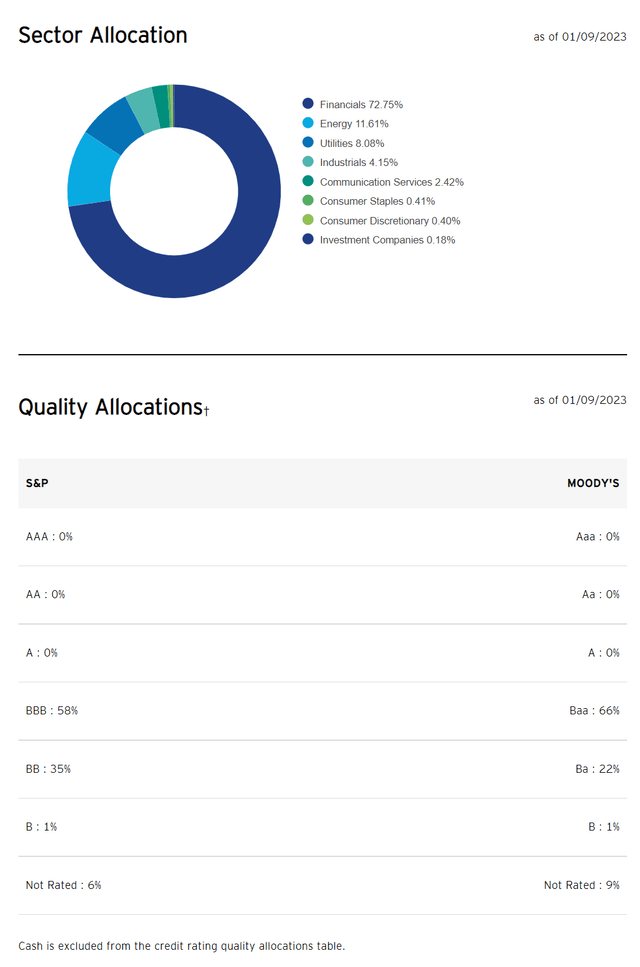

Figure 2 shows the VRP ETF’s sector allocation and credit quality allocation. The most prolific issuers of preferred equity securities are financial companies (usually banks and insurance companies); hence, Financials make up 73% of the VRP fund’s portfolio.

Figure 2 – VRP Sector and Credit Quality allocation (invesco.com)

Like bonds, preferred equity issues can be rated by the rating agencies like S&P and Moody’s. 58% of the fund’s portfolio is rated BBB according to S&P, and 35% is rated BB (non-investment grade).

Figure 3 shows the fund’s top 10 holdings, which account for 12.4% of the fund.

Figure 3 – VRP top 10 positions (invesco.com)

Returns

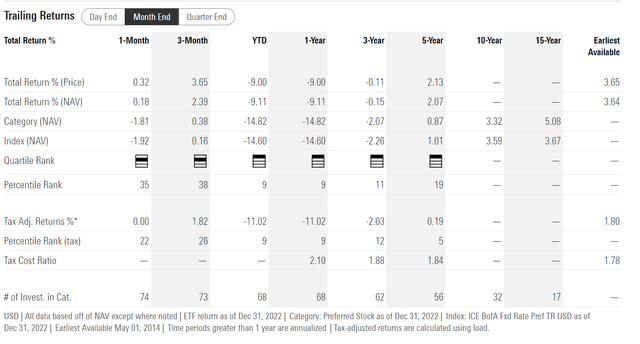

Figure 4 shows the historical returns of the VRP ETF. The fund has had muted historical returns, with 3 and 5Yr average annual returns of -0.2% and 2.1% respectively to December 31, 2022.

Figure 4 – VRP historical returns (morningstar.com)

However, investors should note that relative to the Morningstar fund category of Preferred Stock, VRP has delivered first quartile performance over a 1/3/5Yr timeframe. So VRP’s muted investment performance is more of an issue with the asset class rather than the fund manager.

Distribution & Yield

The VRP ETF pays a modestly high distribution of $1.20 /share in the trailing 12 months, which equate to a 5.3% yield. VRP’s distribution is paid monthly, but is variable and depends on the distributions received from the underlying portfolio.

Preferred Equity Is Inversely Correlated To Credit Spreads

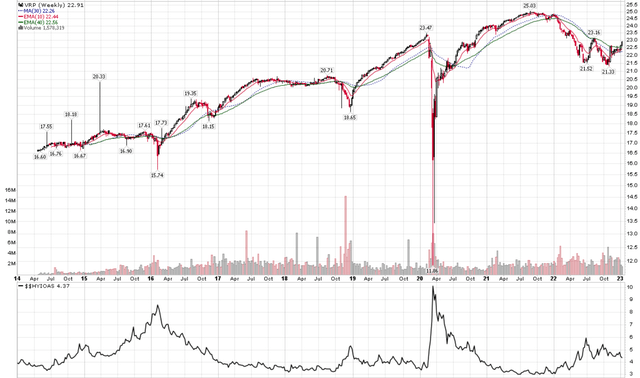

Given preferred equity’s position in the capital structure, they often trade like high yield bonds. If we overlay the price performance of the VRP ETF vs. the ICE BofA High Yield OAS Spread, we can see that VRP’s market price declines when high yield credit spreads rise (Figure 5).

Figure 5 – VRP price is inversely correlated to credit spreads (Author created with price chart from stockcharts.com)

During extreme market events like the COVID-19 pandemic in 2020 or the Great Financial Crisis in 2008, preferred equities can get dislocated as issuers elect to skip dividend payments to conserve capital.

Are Preferred Equities Better Than Junk Bonds?

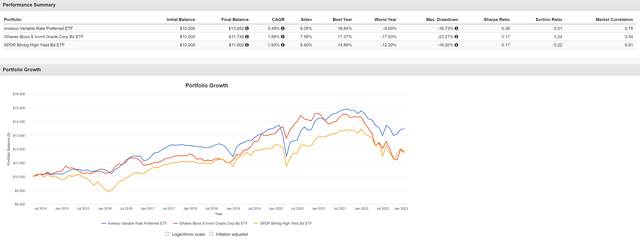

If we compare the VRP ETF to the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) representing corporate bonds and the SPDR Bloomberg Barclays High Yield Bond ETF (JNK) representing high yield bonds, we can see that the preferred equity asset class does have investment merit relative to its corporate and junk bond cousins.

Figure 6 – VRP vs. LQD and JNK (Author created using Portfolio Visualizer)

Measured from May 2014 to December 2022 (since inception for VRP), the VRP ETF has delivered a higher CAGR return of 3.5% compared to the LQD and JNK ETFs of 1.9% respectively. The volatilities of all three funds are very similar, with standard deviation of returns ~8%. Higher returns and similar volatilities lead to the VRP ETF having a Sharpe Ratio of 0.36, more than twice that of LQD and JNK’s 0.17 Sharpe Ratio.

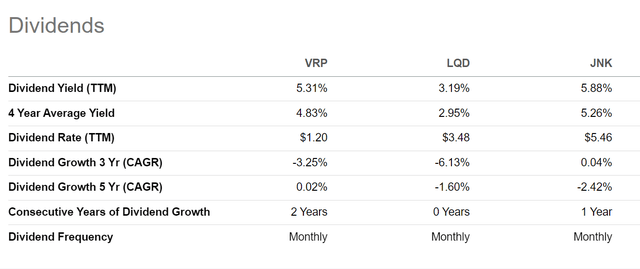

In terms of yield, the VRP ETF has a distribution yield comparable to the JNK ETF, and far higher than LQD’s (Figure 7).

Figure 7 – VRP vs. LQD and JNK yield (Seeking Alpha)

So for investors looking for yield, the preferred equity asset class may be superior compared to the corporate bond and junk bond asset classes, judging by their historical performance and distribution yields.

Conclusion

The VRP ETF provides exposure to variable rate preferred stock and hybrid securities. Its performance has been muted in 2022, as the asset class trades inversely to credit spreads. However, investors seeking yield may want to take a look at the VRP, as the asset class has outperformed corporate bonds and junk bonds, as judged by VRP’s historical performance vs. LQD and JNK.

Be the first to comment