buzbuzzer/E+ via Getty Images

Vontier Corporation (NYSE:VNT) is an industrial technology company based in North Carolina. Through its ownership of Gilbarco Veeder-Root, Matco Tools, and Teletrac, the company provides both manufacturing and industrial solutions, providing both components and repair, as well as software needed for industrial processes. The primary clientele is retail and commercial fuel operators, repair businesses, and government institutions. These tech solutions come in the form of fleet asset management, repair, and diagnostic tools, fueling solutions, smart city infrastructure, and other related services.

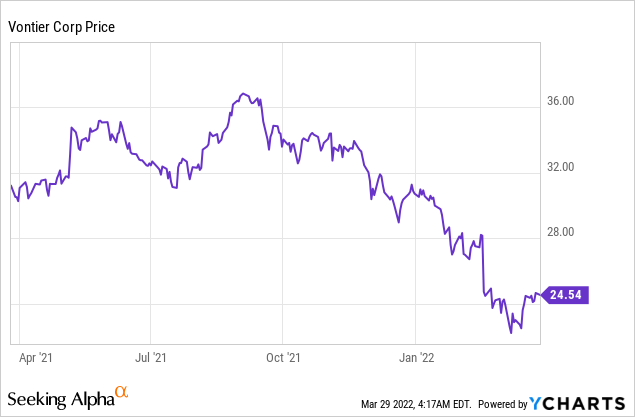

ycharts.com

Past issues regarding shipment delays caused by the global supply chain crisis resulted in a reduced supply of products and negatively affected revenue. Further compounding this problem was the chip shortage, which directly affects the automotive industry, resulting in an overall blockage of products and services that complete what is today an often technologically complex vehicle assembly. Vontier presents itself as an essential component of the industry and makes for an interesting case study into the market’s recovery and why investors should be bullish about the company’s future.

ESG Targets

Vontier announced early this year an investment towards Driivz, a company that supplies EV charging and energy management software, in an effort to stay true to the company’s ESG roadmap. While the acquisition announcement did not reveal much detail about the financials involved, it was nevertheless seen as a positive effort toward the company’s stated goals. The purchase will see Vontier add to its portfolio software with the capability to support over 500 different charger types for electric vehicles, providing access to 100,000+ charging ports. This is just one of many acquisitions and investments the company will make as it strives to stay ahead of trends and ensure its long-term future.

Staying true to trends seen in 2021, Vontier continued to make headlines towards a more progressive ESG strategy in the first quarter of 2022, with the company announcing that it would work together with a consortium of 16 companies working together with MIT to provide strategic innovation that will help the global manufacturing industry more environmentally friendly. This collaboration, appropriately coined as the MIT Climate and Sustainability Consortium (MCSC), includes leaders from all industries and speaks volumes of how Vontier is a leader in its own specific area. Collaboration in challenging times, such as what the industry has experienced in the last two years, is essential for the company’s survival and longevity. The company also announced an effort to significantly reduce greenhouse gas emissions by 2030, stating a 45% reduction as the company’s short-term goal and the intent to achieve net-zero emissions by 2050. The company will utilize its Vontier Business Systems to track its ESG targets, ensuring that the company stays on track and provides some form of transparency into how such changes are being implemented.

Company & Industry Developments

Vontier made some noteworthy headlines in 2021. The company’s retail and commercial fueling operations, Gilbarco Veeder-Root, announced that it would waive its call option to acquire Tritium, a manufacturer of DC fast chargers for electric vehicles. The announcement came in the third quarter of 2021, with Tritium seeking a public listing through a special purpose acquisition company (SPAC).

Gilbarco has been involved with Tritium as a strategic investor and made a deal in 2018 for an exclusive option to acquire Tritium. The company’s growing portfolio will help it secure strategic aspects of the business as the automotive industry continues to evolve rapidly. Adding to the company’s appeal is its environmental, social, and governance (ESG) philosophy, something any company in the changing industry will need to sharpen up on if it intends on surviving the inevitable changes toward prioritizing better environmental policies.

By January, Vontier also made headlines by announcing that the remaining shares held by Fortive Corporation, formerly Vontier’s parent company, with the commencement of 33,507,410 in common stock shares, launching what would be the secondary equity offering in exchange for indebtedness owned by Goldman Sachs. The company acted as the selling stockholder in the offering and will sell the shares to underwriters connected with the public offering.

Vontier announced its plan to raise capital by exchanging all of its outstanding unregistered senior notes, previously only offered privately, with $500 million due in 2026, another $500 million in senior notes due in 2028, and senior notes due in 2028 of $600 million. The proceeds raised from these were valued at about $1.6 billion minus commissions and offering expenses, with a sale closed at the end of the first quarter.

Financials

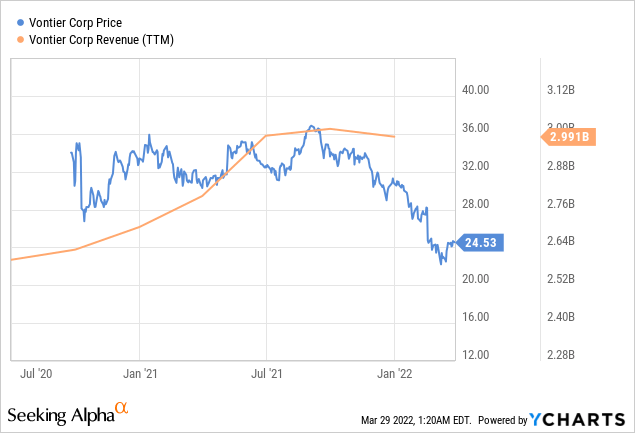

ycharts.com

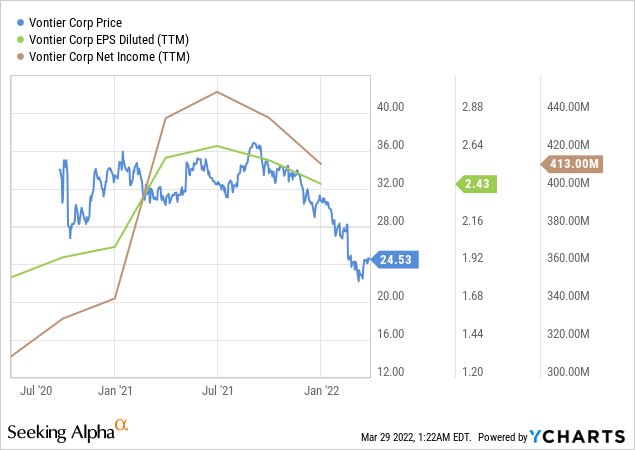

Vontier saw substantial growth on a year-to-year basis, seeing its annual revenue appreciate 10.6% in 2021, for a total reported $2.99 billion as per the year-end. The company has slowly seen its revenue go up since 2019, with the final quarter demonstrating this gradual but consistent rise, finishing with the highest quarterly record at $790.2 million. The fourth quarter wasn’t the highest reported in net income, which closed at $112.4 million in Q4, as opposed to third-quarter results of $127.3 million.

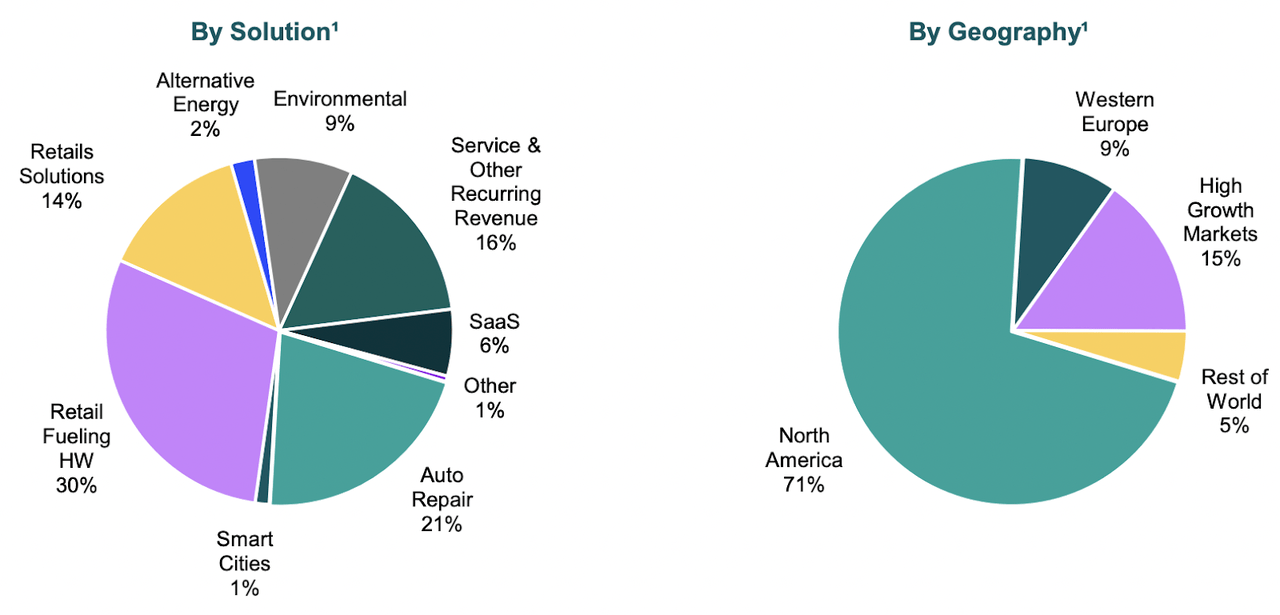

Despite hindrances caused by COVID, the company was able to see positive net earnings, bumping up total net income from $342 million in 2020 to $413 million by the end of 2021. Most of the company’s sales came from North America, which accounted for a total of 71% of sales, brought in primarily through Retail Fueling (30%), Auto Repair (21%), Services and Recurring Revenue (16%), Retail Solutions (14%), with the company’s many other services providing the remaining income. While the aforementioned issues haven’t been entirely resolved, the growing rise in the company’s products and an estimated increase in orders that will attempt to make up for previous losses can be expected towards the end of the year.

Earnings per share in the fourth quarter were reported at $0.66, or $0.83 of adjusted diluted net earnings per share. This positive outcome could be attributed to successful growth initiatives despite outside factors offsetting some of the gains made.

investors.vontier.com

The company allocated nearly a billion towards strategic investments, with a total of $965 million reported in capital deployment towards acquisitions, showing the company’s commitment to investing in the future as early as possible. A glimpse into the company’s ability to diversify will shed light on expected growth in 2022, as it is overwhelmingly expected to see continued positive growth. Earnings per share are expected to be anywhere between $0.64 to $0.67 in the first quarter, soon to wrap up under shifts towards more sustainable business conduct. A return to form in the supply chain industry will lead to substantial revenue growth, which is expected to show by the year’s second quarter.

ycharts.com

Conclusion

The industrial technology industry is built on a simple premise; provide a product or a service that can make a job cheaper, more efficient, and sustainable, and companies will buy it. Vontier seems to understand that simple concept and has already established a strong foothold on the market. There could be cause for concern masked behind the apparent stability of the company. Still, upon further analysis, there seems to be nothing that could shake the foundations of this company. All Vontier needs to do is keep innovating with its wide range of products, expand its portfolio to meet growing trends, and keep track of its ESG goals to avoid falling out of favor with regulators and an ever more environmentally conscious industry. With the company’s ESG roadmap proactively working against this concern and its relatively strong financials even in the face of a stark decline in price, Vontier likely has a robust recovery in its near future, making it a solid buy in its current state.

Be the first to comment