Scott Olson

Investment Thesis: I take a bullish view on Volvo Group due to strong sales growth, continued growth in cash reserves and an attractive P/E ratio.

In a previous article back in November, I made the argument that Volvo Group (OTCPK:VLVLY) may need to see further earnings growth to justify a bullish view, in spite of sales growth remaining strong.

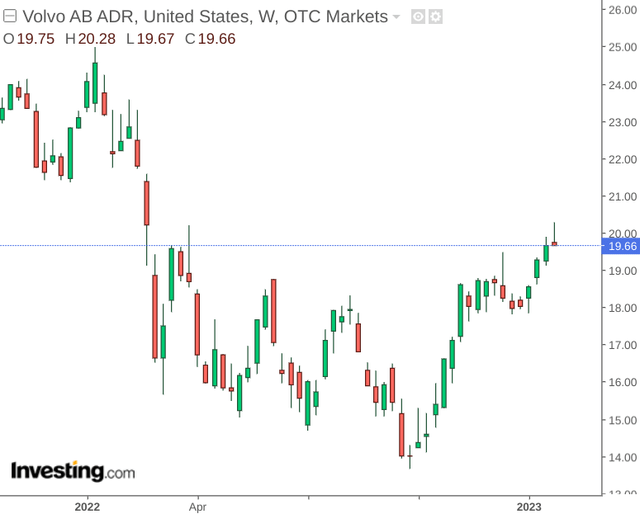

With that being said, the stock has seen a significant rebound since then – up by nearly 10% since my last article – with the stock appreciating back from the lows seen last year:

The purpose of this article is to assess whether we can expect further appreciation in the stock from here.

Performance

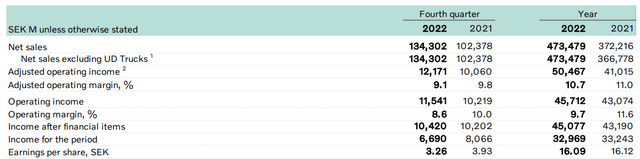

When looking at Volvo Group’s performance for the fourth quarter and full year of 2022, we can see that net sales on a yearly basis are up by 27% on that of last year.

Volvo Group: Report on the Fourth Quarter and Full Year 2022

However, we can see that earnings per share saw no growth on a yearly basis, and saw a decrease from that of the fourth quarter in the previous year.

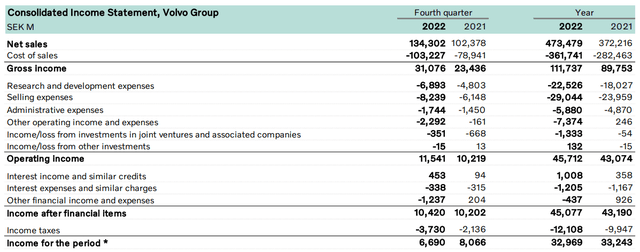

When looking at Volvo Group’s income statement – we can see that although net sales have seen significant growth – a substantial rise in research and development as well as selling expenses, along with a rise in income taxes had significantly lowered earnings growth:

Volvo Group: Report on the Fourth Quarter and Full Year 2022

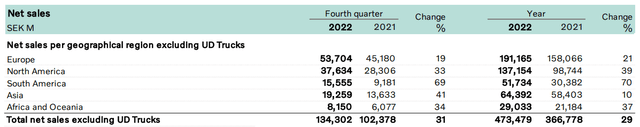

When looking at the breakdown of net sales by geographic region and by product, we can see that across the company’s two largest geographic markets – North America saw greater sales growth than that of Europe.

Volvo Group: Report on the Fourth Quarter and Full Year 2022

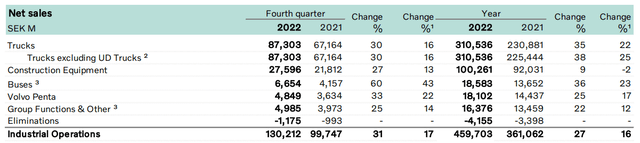

Additionally, we can also see that when adjusted for exchange rate fluctuations – the Trucks segment (excluding UD trucks – which was divested of in April 2021 to Isuzu Motors (OTCPK:ISUZY)) saw the largest percentage growth on a yearly basis at 25%.

Volvo Group: Report on the Fourth Quarter and Full Year 2022

From this standpoint, we can see that sales growth remained strong for Volvo Group in 2022 despite inflationary pressures. However, rising costs ultimately hindered earnings growth. Despite this – a rising stock price indicates that investors continue to be encouraged by sales growth, which has the potential to eventually outpace that of rising costs.

From a balance sheet perspective, we can see that Volvo’s quick ratio (calculated as cash plus accounts receivable plus other receivables plus marketable securities all over current liabilities) has risen slightly from September – indicating that the company is in a slightly better position to service its current liabilities using existing liquid assets.

| Dec 2021 | Jun 2022 | Sep 2022 | Dec 2022 | |

| Cash and cash equivalents | 62,126 | 54,268 | 71,906 | 83,886 |

| Accounts receivable | 40,776 | 47,015 | 45,640 | 48,220 |

| Other receivables | 16,742 | 17,578 | 17,715 | 19,373 |

| Marketable securities | 167 | 92 | 98 | 93 |

| Current liabilities | 190,457 | 213,694 | 233,429 | 238,978 |

| Quick ratio | 0.63 | 0.56 | 0.58 | 0.63 |

Source: Figures sourced from Volvo Group: Reports on the Second Quarter, Third Quarter and Fourth Quarter 2022 Results. Figures provided in millions of SEK (Swedish Krona), except the quick ratio. Quick ratio calculated by author.

In this regard, it is encouraging that even with the pressure of rising costs – Volvo Group has still been able to bolster its cash reserves under this environment.

Looking Forward

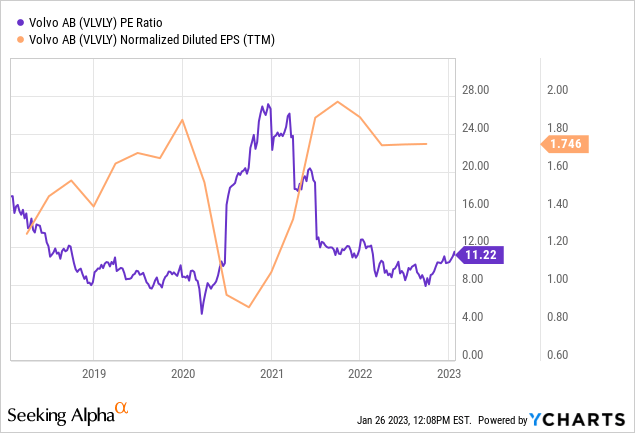

I take the view that given recent performance – Volvo Group is continuing to experience strong demand in spite of inflationary pressures. Moreover, we can also see that even with the recent appreciation in stock price, the P/E ratio continues to remain significantly lower than that seen in 2021. Moreover, EPS (on a normalized diluted basis) continues to trail near a five-year high.

ycharts.com

Additionally, there does not appear to be signs of any particular slowdown in truck demand. In fact, given the strong growth that we have seen across North America across the Trucks segment – a continuation of such growth this year would be highly encouraging and bolster overall sales growth.

For Volvo Group, there are the two main risks for growth in my view. The first is potential supply chain issues whereby a shortage of necessary components means that the company is unable to meet demand. The second is potential competition in the North American market from rivals.

For instance, Daimler Truck Holding AG (OTCPK:DTRUY) has traditionally held 40% of the market share across the heavy-duty vehicles segment. While supply chain issues are affecting companies across the industry as a whole – there is a risk that Volvo might see sales growth plateau across the region due to lower market share.

Conclusion

To conclude, Volvo Group has continued to see strong sales growth in spite of inflationary and supply chain pressures – while also continuing to bolster its cash position.

In addition, the company looks attractive from a P/E standpoint in spite of the recent run-up in the stock price. Taking these points into account, I take a bullish view on Volvo Group.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment