Spencer Platt

Where Are We At Right Now?

Although I am not a trader, I have bought and sold Verizon (NYSE:VZ) a few times. Specifically, I’ve sold out of my VZ position at least a couple of times. I’ve bought in $40 range and sold in the $60 range. That’s worked out well, allowing me to also pocket some dividends along the way.

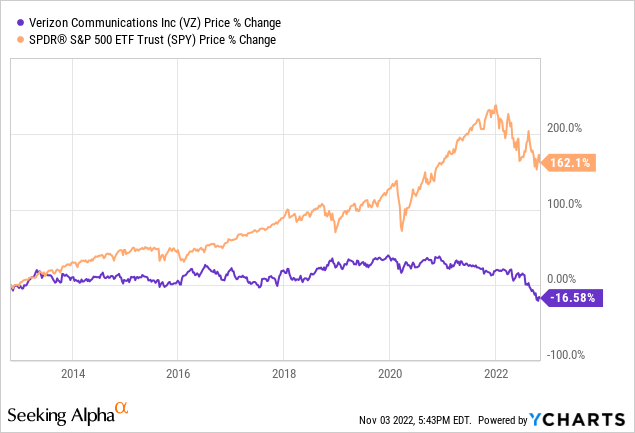

Let’s look at how VZ has done against the S&P 500 (SPY) to get a feel for how the stock has performed in a relative sense.

That’s the 10-year view. It looks bad and the truth is simple. SPY has easily beaten VZ over one year, three years, five years and ten years.

Honestly, it’s a bit sad but there is a silver lining in this little cloud. If you’re opportunistic, you can grab VZ and hold it for the dividend. The yield is around 7% so it’s not painful to hold. It could be perfect for income investors. I will also add that VZ could spike in price. Then, there’s a choice to sell for the capital gains, or keep holding for the dividend. That’s not a terrible choice.

Before going on, let me be clear. I rate VZ as a Hold right now. For most investors, doing nothing is probably rational. The dividend is high and selling almost certainly means eating a loss. That’s for most people. However, selling for tax purposes could make sense since we’re near the end of the year. Also, buying more could be reasonable for serious income investors. Let’s face it. VZ is very much a bond proxy.

I shall use the rest of this article explaining why now might be a good time to buy VZ. Again, although I rate it as a Hold buying VZ might be exactly what you want to do. Personally, I’m not buying or selling but many people are looking at VZ, so I will share three key ideas.

Idea #1: VZ is Undervalued

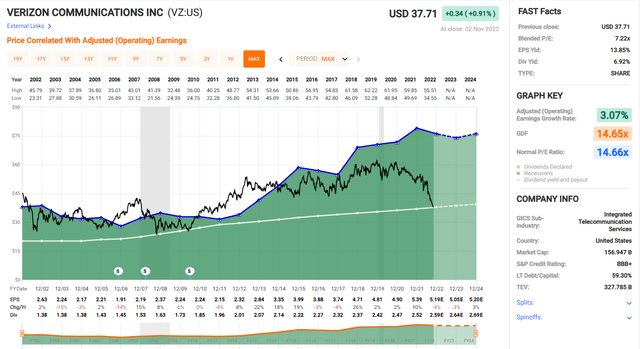

You’re getting a lot of earnings when you buy VZ. Even with EPS expected to drop, there’s plenty of cash for the dividends.

VZ is Undervalued (EPS is Strong vs. Price) (FASTgraphs)

With a P/E of just over 7 right now we’re looking at real undervaluation. You can also see that over the long haul, VZ’s Normal P/E is just under 15. If we compress that down to five years, the P/E drops to 12. Very roughly speaking, if VZ returned to a P/E of 12 from here, by 2024, we’d see an annualized rate of return some between 25% and 30%.

There are a few things to recognize here. I’m not terribly interested in getting the numbers perfect. Besides, that’s folly. I’d much rather be roughly right than precisely wrong. If my numbers are wrong, they’re not way off. That tells me that VZ is in the dumps, relative to the value in the business. In turn, we have a Margin of Safety. This is one of the best opportunities to buy VZ I’ve seen in 10 years.

Idea #2: The Dividend Looks Safe

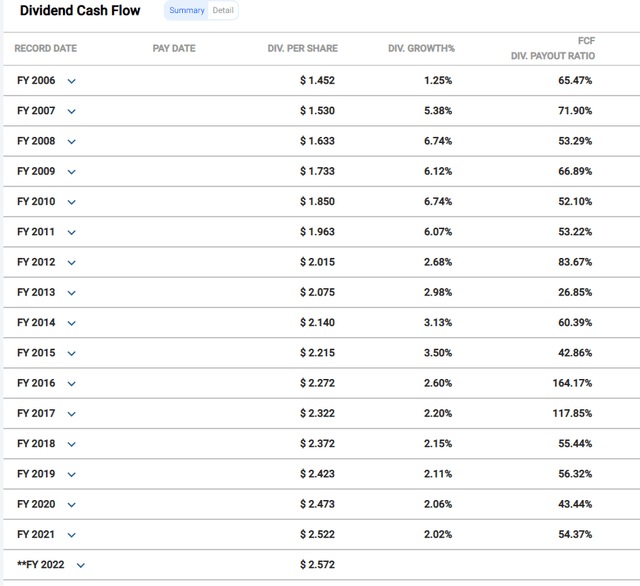

I don’t believe that the payout ratio using EPS is great for a debt-heavy, capital intensive business like VZ. Instead, I like to look at the dividend payout ratio with respect to free cash flow. It’s not perfect, but it’s better than EPS. It’s more difficult to hide things if nothing else.

So, here’s a good view. You can see the dividends per share, slow but steady dividend growth and also the FCF dividend payout ratio. It’s a good view.

VZ Payout Ratio Using FCF (FASTgraphs)

Over the years, the average dividend growth has compounded at 3.6%. Obviously, growth is slower now. Since 2017, the raises have been limping along at just over 2%. Not great, but the starting yield has been high.

Again, the starting yield has always been good. Sometimes, it’s quite high. Right now, it’s borderline ridiculous. According to Seeking Alpha, the dividend is relatively safe. Plus, there’s good communications about it:

This is the 16th consecutive year Verizon’s Board has approved a quarterly dividend increase.

“Our consistently disciplined approach to the market to maximize growth and profitability has again put the Verizon Board in a position to raise the dividend,” said Chairman and CEO Hans Vestberg. “We will continue to execute our network-as-a-service strategy to deliver long-term shareholder value.”

See? Not terrible at all. 16 years in a row and there’s a sense of continuity, success and pride. I realize the CEO won’t slam the dividend in public. But, what I like here is that the language is supportive, not neutral. Perhaps I’m being too generous. The dividend safety isn’t clean; think Christmas Tree. There is a lot of color there.

Idea #3: How Starting Yield Wins “Forever”

On a relative basis, and because the starting yield is so high, VZ will provide way more income than other stocks with low yields but high dividend growth.

I want to keep this very simple. I’m only talking about the starting dividend and the dividend growth rate. I’m not talking about total return via capital appreciation. It’s important to get that out of the way.

We’re going to compare two stock with lower starting yields with VZ. First, we have Lowe’s (LOW) and second we have Apple (AAPL).

VZ has a current yield of 6.9% and a 2.5% dividend growth rate over the last 10 years. LOW has a current yield of 2.3% but a whopping 19% dividend growth rate over 10 years. AAPL has a yield of 0.67% and a relatively strong 9% over the last 9 years. For AAPL I’m leaving out FY 2013 because of the 330% growth rate, which twists things up a bit.

Here are the facts. Assuming no reinvestment, it would take LOW about 9 years to generate more income per year from dividends than VZ. With reinvestment, and assuming no taxes, it would take LOW 12 years to beat VZ in terms of dividend income.

Next, here comes the real shocker. It would take AAPL far greater than 25 years to generate more dividend income per year than VZ. Assuming reinvestment, and no taxes, it gets even worse. In fact, just running the numbers, under this scenario, AAPL would “never” generate more dividend income than VZ.

There are some simple observations here. Starting yield is tremendously important. It’s far more important than most investors realize, and that includes some rather hardcore income investors that I know. There’s serious power in a high starting yield combined with even small but relentless increases year after year. Frankly, this is the great appeal of Dividend Champions and Dividend Kings. I wrote about this recently. You might also want to play around with Miller Howard’s Income Yield tool to see for yourself.

Wrapping Up

If you’re thinking about buying make sure you know why you’re buying. Have your goals clear in your mind. There’s a lot of income available with VZ. At the same time, there will probably be opportunities to sell in the future.

Holding isn’t a terrible idea. The dividend is high. There’s a pinch of growth in the business and the dividend. The dividend seems safe. There aren’t many great alternatives for this kind of income. Just remember that VZ hasn’t beaten SPY. This isn’t a stock that’s going to give you strong total return.

Selling is probably not a great idea. You’re selling out when VZ is hurting, at least in terms of share price. It’s likely you’ll face a capital loss. Waiting is prudent given the ups and downs over time. In a sense, you’re getting paid to wait for a better price, or even a much better price. VZ is not a sell.

Be the first to comment