cagkansayin

Author’s note: This article was released to CEF/ETF Income Laboratory members on November 21st, 2022.

I last covered the Vanguard Short-Term Corporate Bond Index ETF (NASDAQ:VCSH) in late 2021. In that article, I argued that VCSH’s high-quality, short-term, low duration would reduce losses and lead to outperformance if rates were to rise, which seemed like a distinct possibility. I rated the fund a buy, and argued it seemed particularly appropriate for conservative investors concerned about rising interest rates.

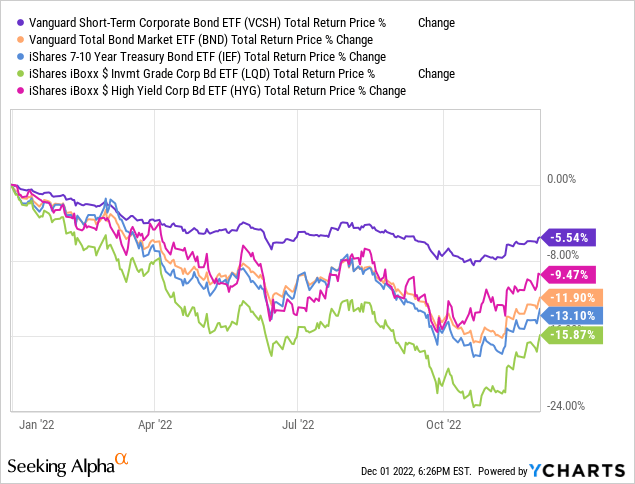

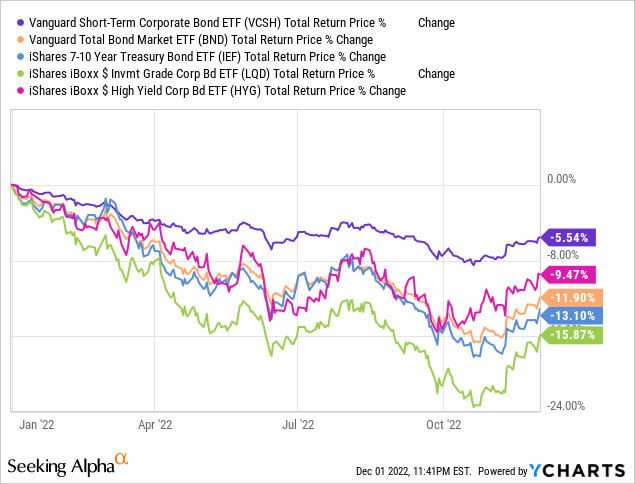

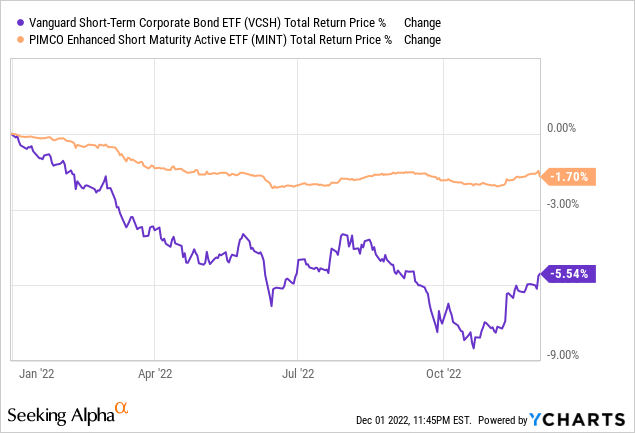

Since then, rates have risen, and the fund has outperformed relative to peers, but remains down on an absolute basis.

VCSH remains a high-quality, short-term bond fund, would almost certainly keep outperforming if rates continue to rise, and so is a reasonable investment opportunity for more conservative investors. On the other hand, the fund only yields 2.1%, and there are several bond funds out there with similar, but stronger, value propositions to VCSH. Of these, the PIMCO Enhanced Short Maturity Active Exchange-Traded Fund (MINT) stands out.

MINT has similar credit quality to VCSH, but lower interest rate risk, stronger dividend growth, and will very likely yield a bit more than VCSH in the coming months. VCSH is fine, but MINT seems broadly better. As such, I would not be investing in VCSH at the present time.

VCSH – Basics

- Sponsor: Vanguard

- Underlying Index: Bloomberg U.S. 1-5 Year Corporate Bond Index

- Dividend Yield: 2.09%

- Expense Ratio: 0.04%

- Total Returns CAGR 10Y: 1.35%

VCSH – Overview and Benefits

Diversified Holdings

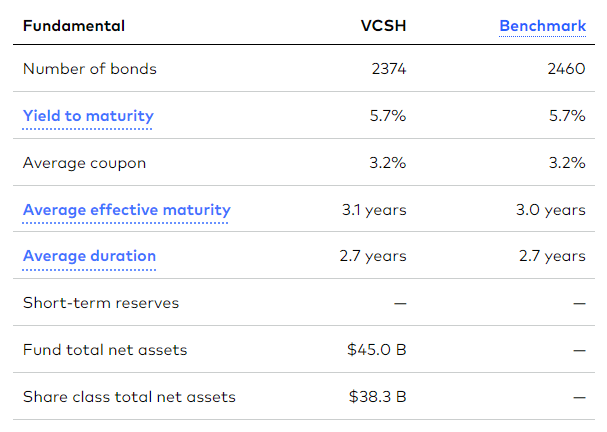

VCSH is a short-term, investment-grade corporate bond fund. It tracks the Bloomberg U.S. 1-5 Year Corporate Bond Index, an index of these same securities. It is a relatively simple index, including all short-term, dollar-denominated, investment-grade, fixed-rate, corporate bonds from financial, industrial, and utility issuers, meeting a basic set of inclusion criteria.

VCSH’s underlying index is quite broad, which results in a well-diversified fund with thousands of holdings from the aforementioned industry segments.

VCSH

VCSH’s diversified holdings reduce risk, volatility, and the possibility of significant losses from the bankruptcy or default of any one specific issuer.

On a more negative note, the fund provides comparatively little in industry and bond sub-asset class diversification. Although this is something of a negative, at least in comparison to broader bond funds, I do not believe it to be a significant negative, as the fund’s holdings are quite safe, and have low risk, broadly construed.

Low Credit Risk

VCSH exclusively invests in investment-grade corporate bonds, with the fund’s underlying holdings sporting an average credit rating of A.

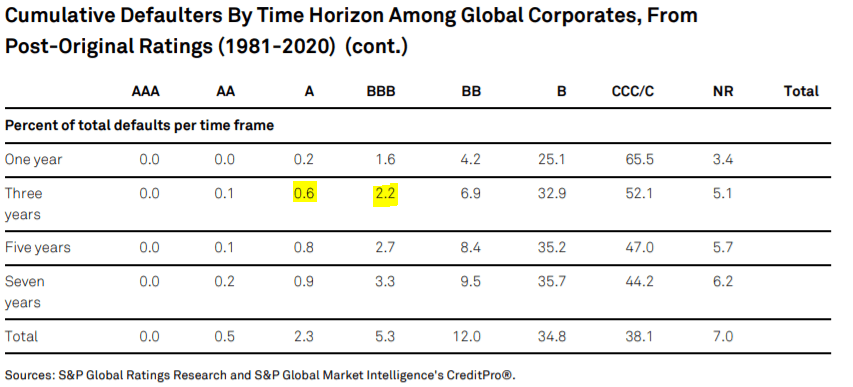

VCSH’s underlying bonds are almost entirely issued by blue-chip companies with strong financials and balance sheets, as evidenced by their strong credit ratings. In general terms, these issuers have more than sufficient revenues and earnings to fulfill any and all financial obligations, even during most adverse economic or market scenarios. Default rates are low, and tend to remain low during recessions, downturns, and the like. As per S&P, bonds with VCSH’s credit ratings have long-term cumulative default rates of around 1.5%. Default rates should be a bit higher right now, considering worsening economic conditions, but only marginally so.

S&P

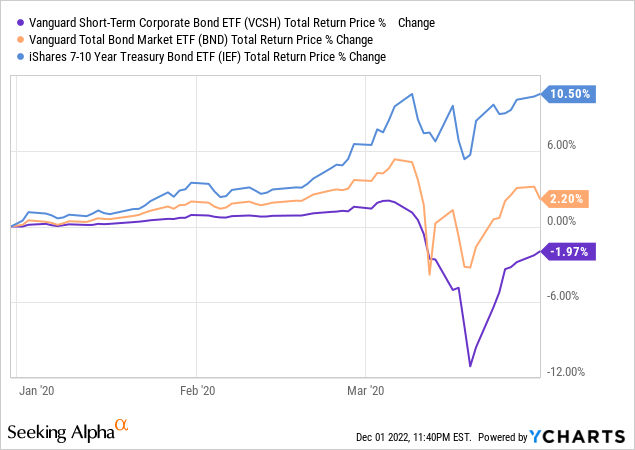

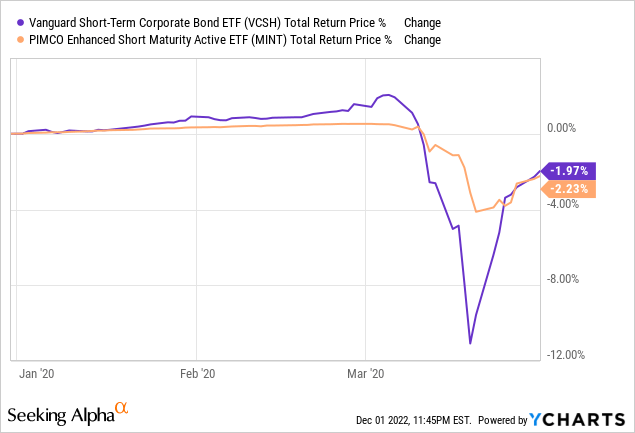

VCSH’s investment-grade bonds are only marginally impacted by recessions, so they should perform reasonably well during these. As an example, the fund only suffered losses of 2.0% during 1Q2020, the onset of the coronavirus pandemic. Losses were quite low, and at least partly caused by liquidity issues and excessively bearish market sentiment: security fundamentals remained more than adequate. On a slightly more negative note, unlike treasuries, VCSH’s holdings rarely experience a flight-to-quality effect during recessions, so don’t expect gains during these.

VCSH’s high-quality holdings reduce risk, volatility, and potential losses during downturns and recessions, an important benefit for the fund and its shareholders.

Low Interest Rate Risk

VCSH focuses on short-term bonds, with remaining maturities of between one and five years. Doing so reduces risk in two key ways.

First, short-term bonds have lower interest rate risk than comparable long-term bonds. The math behind this is quite complicated, but the logic is quite simple.

Most bonds are fixed-rate bonds, so retain their original coupon rates when interest rates move. When rates rise, investors tend to sell their older, lower-yielding fixed-rate bonds to buy newer, higher-yielding alternatives. Selling pressure causes their market prices to decrease, leading to capital losses for bond investors when interest rates rise. Losses should cease when older bonds mature, and investors receive their money back. Short-term bonds mature in a relatively short amount of time, so experience lower, shorter-lasting losses compared to long-term bonds, which take a long time to mature, and hence to recover. VCSH focuses on short-term bonds, so experiences lower, shorter-lasting losses relative to most bond funds when interest rates increase. This has been the case YTD, a period of rapidly rising interest rates, as expected.

VCSH’s short-term holdings have low interest rate risk, a significant benefit for the fund and its shareholders, and one which is particularly important when interest rates are rising, as they currently are.

VCSH – Dividend Analysis

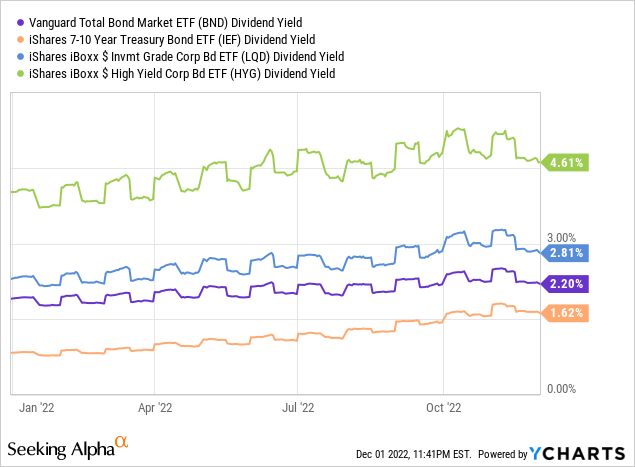

VCSH provides investors with several important benefits, but one key downside: a meager 2.1% dividend yield. It is a relatively low yield on an absolute basis, and quite a bit lower than average for a diversified bond index fund. Treasury funds do yield a bit less, but only marginally so.

VCSH’s low dividend also compares unfavorably to other asset classes. T-bills are yielding 3.6% or more, some banks offer 1-year CDs with similar +3.5% rates, and some savings accounts yield 3.0% or more. VCSH’s 2.1% dividend yield is quite low, and lower than that of many of its peers.

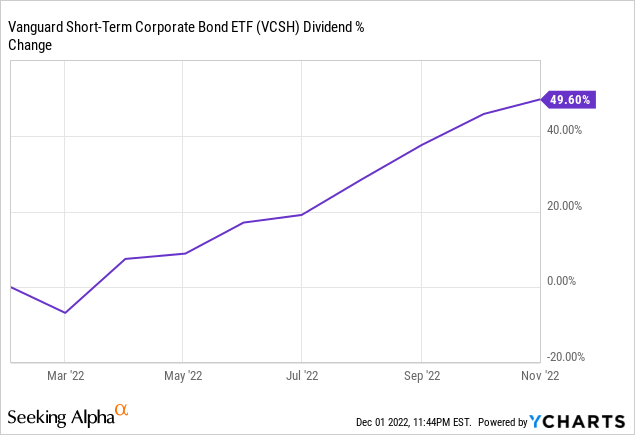

On a more positive note, the fund’s dividends should almost certainly see strong growth moving forward, due to rising interest rates. VCSH currently sports an SEC yield, a standardized measure of short-term underlying generation of income, of 5.3%. The vast majority of ETFs distribute any and all income generated to shareholders as dividends. VCSH is currently generating 5.5% in income, so the fund’s dividends should increase to around 5.3% in the coming months and years. VCSH’s dividends are already seeing strong growth, increasing by around 50% YTD, equivalent to the yield increasing by 0.8 percentage points.

VCSH’s SEC yield is much higher, and compares much more favorably to that of its peers / other asset classes. In my opinion, the fund’s SEC yield is a much more informative metric than a more backwards-looking dividend yield. As such, I’m willing to overlook VCSH’s relatively meager 2.1% dividend yield.

VCSH – Peer Comparison

VCSH is a reasonable investment opportunity, but I believe there are better ones out there, including MINT.

MINT is an actively-managed short-term bond ETF, administered by PIMCO.

Both funds have comparable credit quality, and so perform similarly during downturns and recessions.

MINT focuses on shorter-term bonds relative to VCSH, so outperforms when interest rates increase.

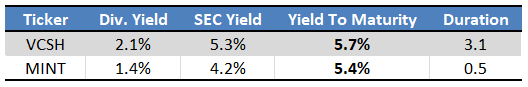

MINT has a lower dividend yield and SEC yield than VCSH, but more than makes up for this with higher expected capital gains / total returns. MINT has a slightly higher yield to maturity, a long-term measure of a bond fund’s expected total returns including both dividends and capital gains, than VCSH.

A quick table with key metrics for these two funds.

Fund Filings – Chart by Author

In my opinion, MINT’s stronger expected long-term returns and lower interest rate risk make it a better investment than VCSH.

Besides MINT, there are several other funds that seem stronger than VCSH right now. These include the iShares 0-5 Year High Yield Corporate Bond ETF (SHYG), the JPMorgan Ultra-Short Income ETF (JPST), and the SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL). These funds do have some downsides relative to VCSH, so the latter might prove to be a better fit for some specific investors, but I do believe that these other funds are, on net, stronger than VCSH.

Conclusion

VCSH is a diversified, high-quality, short-term corporate bond ETF. Although the fund might make for a reasonable investment opportunity for more conservative investors, I believe that there are stronger choices out there. As such, I would not be investing in VCSH at the present time.

Be the first to comment