shotbydave/E+ via Getty Images

Investment Thesis

Vaalco (NYSE:EGY) is a crude oil exploration and production company based in West Africa. That sentence in and of itself notes the main worries that investors need to be mindful of — oil prices and West Africa business.

If investors still feel that they have the stomach to read on, you’ll be met with a relatively well-managed company, that is hedged to approximately a third of its production.

Meanwhile, its production guidance for Q2 and beyond is rapidly ramping up. Indeed, Q2 production volumes are going to be approximately 24% higher than in Q1 2022.

Consequently, paying 3x my own approximated free cash flow estimates for 2022, I believe already prices in a lot of negativity.

Consequently, I rate this stock a buy.

Vaalco’s Near-Term Prospects

Vaalco is an energy exploration and production company focused on crude oil-producing properties. Based on offshore West Africa, Vaalco is focused on its Gabon resources.

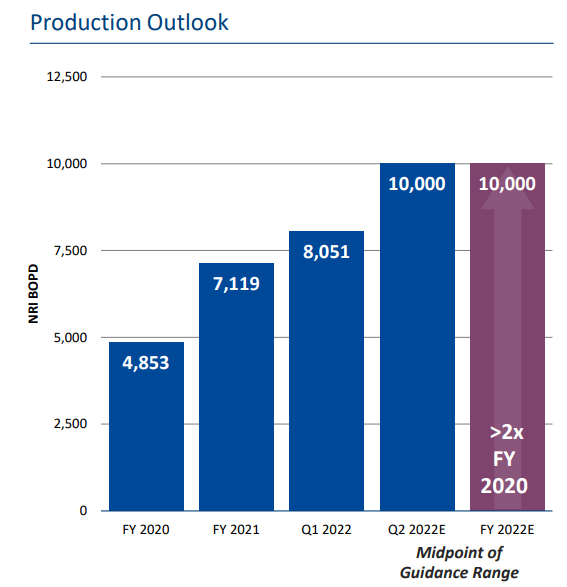

Part of the bull thesis facing Vaalco is that the business is clearly eyeing strong production volumes for Q2 and beyond.

Vaalco Q1 2022 supplemental presentation

As you can see above, Q1 2022 saw 8,051 BOPD, while Q2 is being guided to 10,000 BOPD. That means that for Q2 2022 Vaalco is going to produce around one million barrels of oil.

Clearly, more production together with higher WTI prices is a very compelling dynamic for investors.

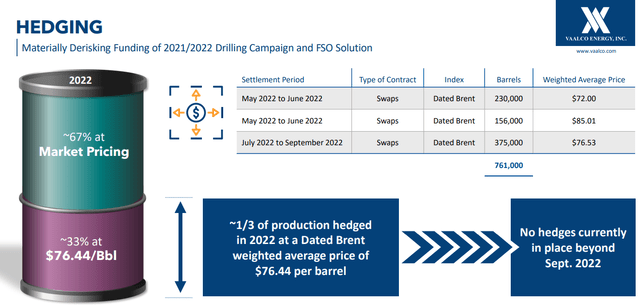

Vaalco Q1 2022 supplemental presentation

The other significant consideration that investors need to think about is that Vaalco is approximately 33% hedged. This is clearly less than half of its production volume, meaning that Vaalco is very well-positioned to participate from strong oil prices.

Next, we’ll discuss Vaalco’s capital allocation strategy.

Vaalco Energy’s Capital Allocation Strategy

Vaalco doesn’t hold any debt on its balance sheet. Consequently, given the strong pricing environment, one would have hoped to see Vaalco substantially raising its capital return to shareholders.

What’s more, Vaalco said during its earnings call,

[…] a lot of our capital expenditures and commitments fall off through Q3 of this year. Q4 will have some, but not the level of spending that we got through the first 3 quarters of this year.

We can see a business that is going to be reporting very strong free cash flows. But management does not appear, at this stage, to be aggressively considering returning capital to shareholders.

EGY Stock Valuation – 3x Free Cash Flow

Next, let’s discuss Vaalco’s valuation.

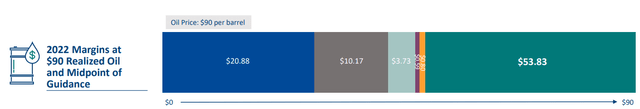

Vaalco Q1 2022 supplemental presentation

For Q2 2022, Vaalco is guiding for approximately one million barrels of oil. That translates very roughly into somewhere close to $55 million of free cash flow for Q2.

If we assume that WTI prices stay in the ballpark of $105, that could mean that Vaalco’s free cash flow over the next twelve months could be around $200 million.

Obviously, assuming that oil prices stay around $105 is a huge assumption. Realistically, to get a margin of safety, we should base Vaalco’s next twelve months’ free cash flows probably closer to $150 million.

This more conservative assumption would put the stock priced at somewhere around 3x free cash flow. I believe this is a cheap multiple.

The Bottom Line

Needless to say, there are a few risks on the table. The first risk is that investors have to build confidence around investing in West Africa. That is arguably the most significant and unavoidable risk factor here.

That being said, there’s a price that investing in West Africa still makes sense.

The other notable risk is that investors will have to take significant exposure to oil prices. Oil prices are notoriously volatile. And when things hit the fan, as they will from time to time, the first companies to meet with an investor sell-off will be the riskiest assets. I would put Vaalco very firmly in that basket.

On the other hand, I have built my assumptions with a significant margin of safety. It’s not inconceivable that Vaalco could actually be priced closer to 2x free cash flow.

At some point, it starts to become the case that the multiple is not likely to meaningfully compress further. That’s not to say that Vaalco can’t trade for 1x free cash flow. It can. But the likelihood of that happening appears to be relatively small, particularly given its debt-free balance sheet.

In sum, there’s a lot to like from this investment. I rate this stock a buy.

Be the first to comment