ArLawKa AungTun

Thesis

Upstart Holdings (NASDAQ:UPST) has had a rough 2022 and investors are wondering if they can perform better in 2023. The answer to that depends on how Upstart’s business model performs in the coming years. We are going to look at the good, bad, and ugly factors that make Upstart a binary opportunity with the potential to bring buyers of the stock large rewards or massive losses.

The Good

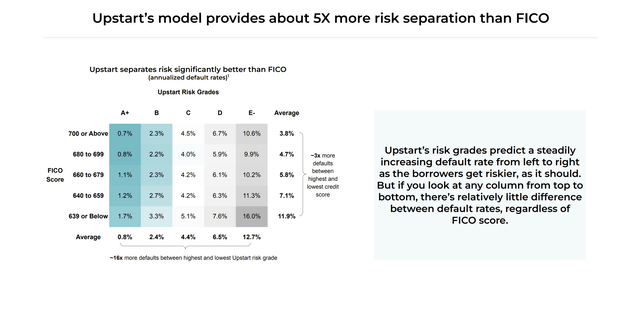

Upstart claims to have a better model for assessing the risk of borrowers than FICO. There is some merit to their claims, and academic research by Harvard and LSU seems to support the company. Upstart shows a slide in their earnings presentation that could sum up the entire bull case on its own:

Upstart Q3 Earnings Presentation

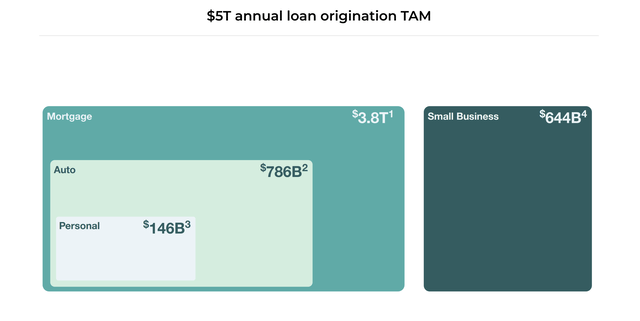

This risk separation is the main advantage Upstart provides over a traditional FICO score. This is where the majority of the potential upside in the stock comes from. The bull case is that this advantage is durable and can be expanded into other markets of significantly larger size such as auto, home, and small business lending.

Upstart Q3 Earnings Presentation

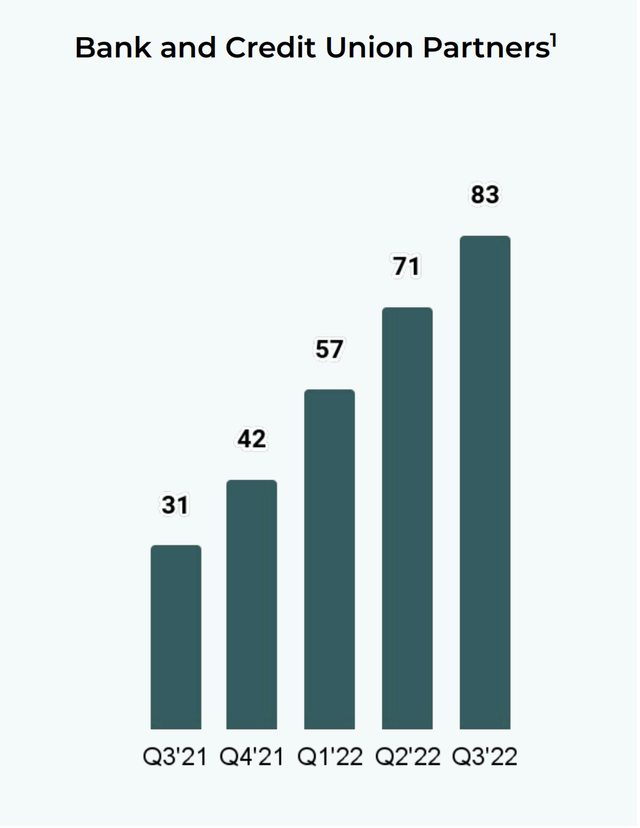

Upstart has done well to increase their bank and credit union partners, but as we will cover later their revenue concentration is still very high though improving. Investors should continue to watch their partner additions over the coming years to see if their risk assessment solution is continuing to gain traction. In fairness to the company, banks are traditionally very conservative when it comes to changing their internal processes. Even if Upstart’s risk assessment turns out to be the best it will take time for financial institutions to adopt it.

Upstart Q3 Earnings Presentation

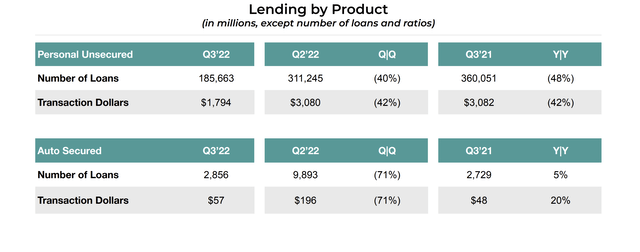

Upstart is doing a good job expanding their auto product. This is a key area of growth for investors to monitor as the bull case rests on their ability to enter new loan markets with larger volumes and lower risk profiles than personal lending.

Upstart Q3 Earnings Presentation

Unfortunately for investors the good news ends here, and we begin to see why the company’s stock has sold off so dramatically and still has a short interest of 38.38%.

The Bad

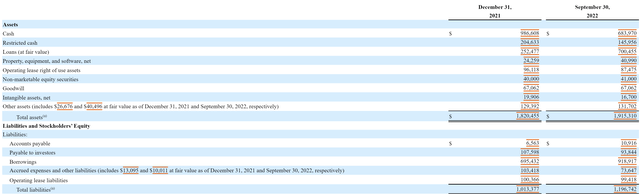

Banks have been less willing to originate loans in a rising rate environment, causing funding to dry up for Upstart’s platform. The lack of funding has caused Upstart to retain more loans on their balance sheet.

Upstart Q3 Earnings Presentation

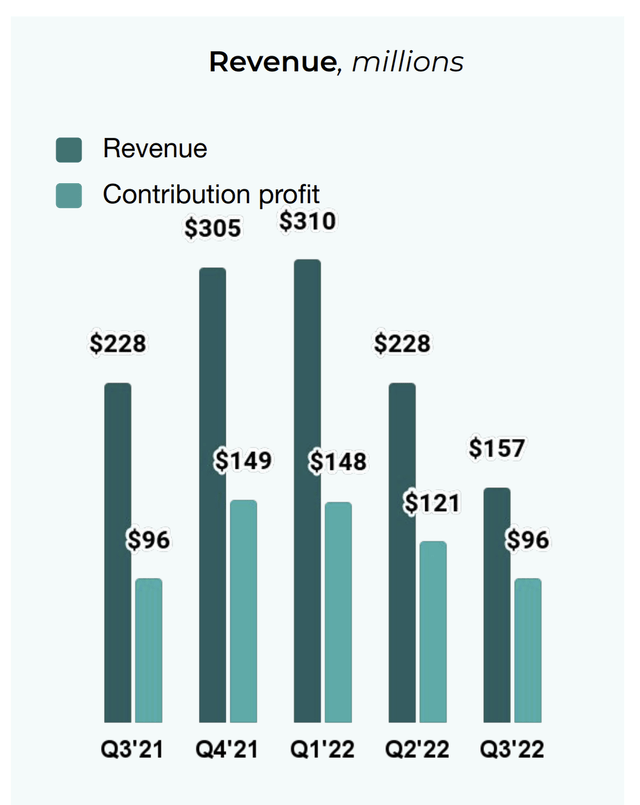

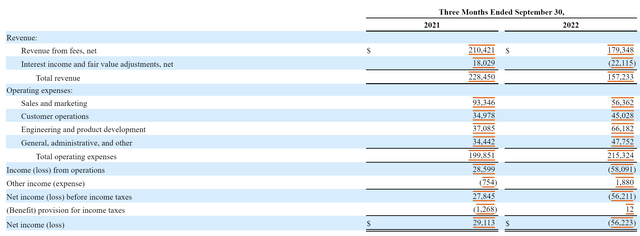

The shrinking number of originations has resulted in a sharp revenue contraction over the past two quarters.

Upstart Q3 Earnings Presentation

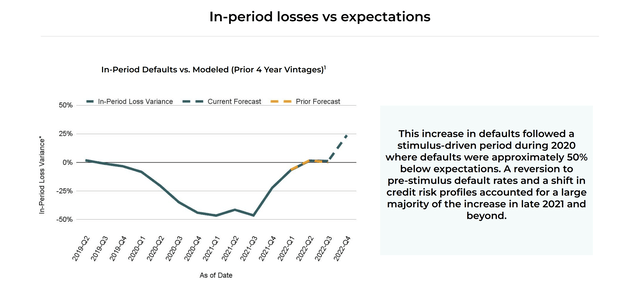

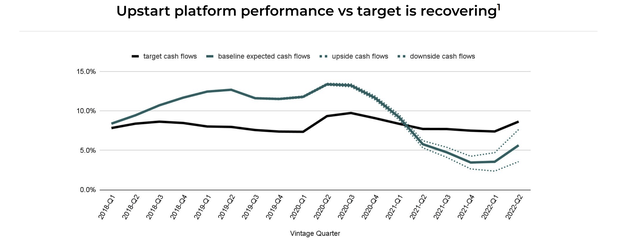

Upstart has seen their loans start to perform worse due to a lapse in government assistance and higher inflation straining consumer’s finances. These trends will need to be monitored because if Upstart’s loans turn out to default at the same rate as FICO when measured over long periods of time, the bull thesis is completely busted.

Upstart Q3 Earnings Presentation Upstart Q3 Earnings Presentation

The Ugly

Upstart’s operating losses have begun to accelerate, which is unfortunate considering the company was once quite profitable. This is mostly due to the macro environment being difficult for personal loan originations. Unlike many recent IPOs, management has already shown they can run a profitable business. These losses aren’t great but management will likely be able to right the ship once the macro improves.

The company has been forced to hold more loans on their balance sheet because funding for their platform has dried up. This is a gigantic issue because it not only increases their financial exposure to potentially bad loans, it also erodes the bull case for them to have a platform-like valuation. The more loans they hold on their balance sheet the more they will be valued like a bank that doesn’t have access to a low cost deposit base.

The company is looking to secure long-term funding arrangements to mitigate this in the future, but it remains to be seen how successful they will be at that.

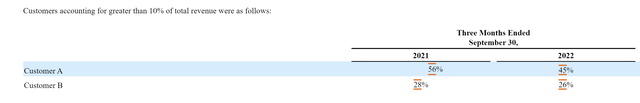

Revenue concentration remains high, with two of their customers making up 71% of their revenue. While this is showing improvement from the year-ago period, such a high level of revenue concentration is alarming and remains a significant risk to the company.

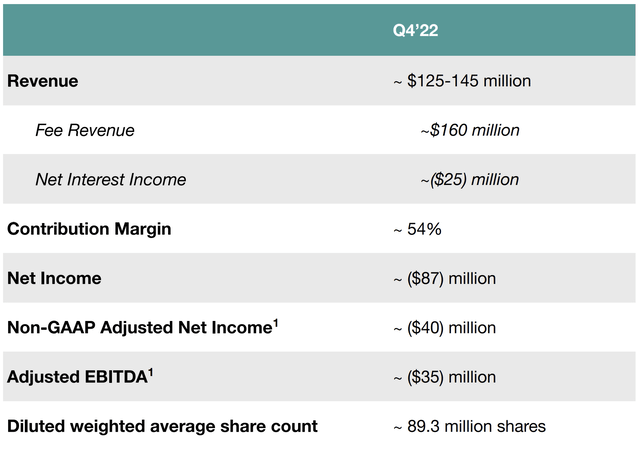

Finally, Upstart’s guidance for Q4 was horrendous. Most if not all of these numbers are lower than the market expected. Q4 should be Upstart’s trough quarter for this cycle. If it isn’t investors should prepare for more potential downside and think about whether the bull thesis is busted.

Upstart Q3 Earnings Presentation

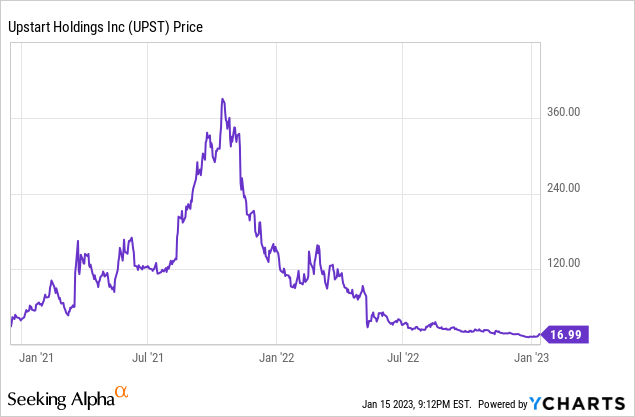

Price Action

Upstart’s stock has had a wild ride since their IPO. After becoming a momentum stock the company has seen their stock brutally sell off for over a year.

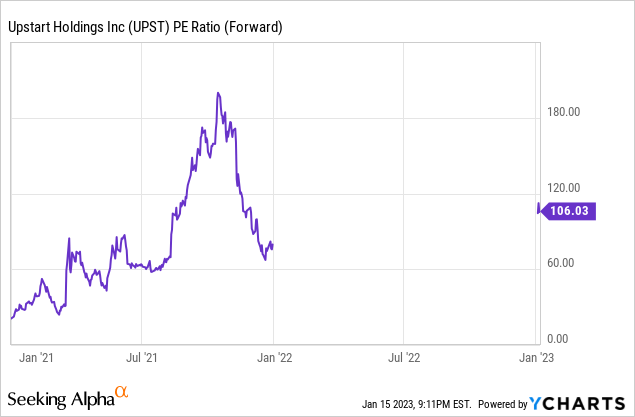

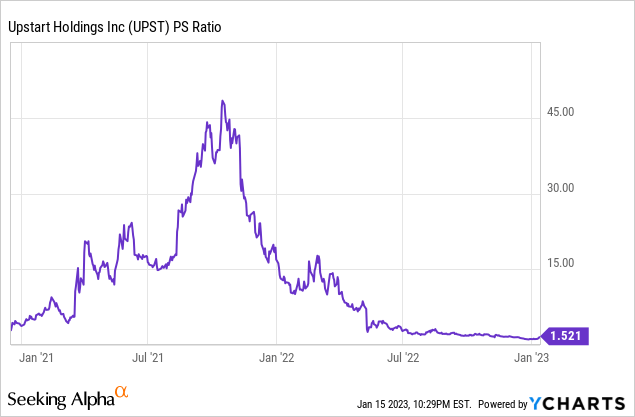

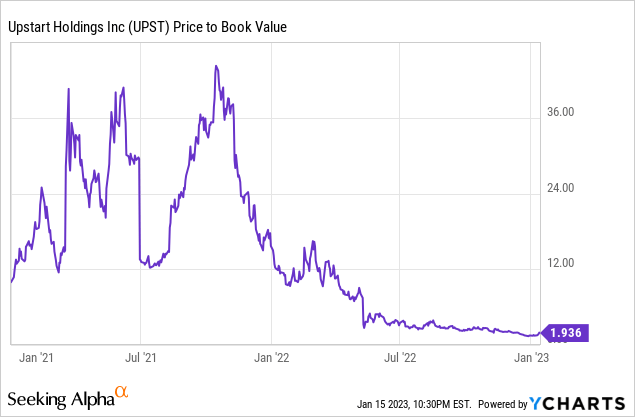

Valuation

Upstart has always traded at a premium valuation, but recently has started to trade at very low P/S and P/B ratio. If the business can stabilize itself and earnings come in better than expected an investment case can actually be made based on valuation alone.

Until the business stops its rapid deterioration investors may want to watch from the sidelines. We believe that Upstart is a binary outcome with high potential rewards and losses. If Upstart’s model proves to be superior and they can expand into new loan markets and return to profitability the stock can reach $300 or even higher. If their model is broken and their loans actually perform worse than FICO over the long-run the stock could potentially go to 0 or liquidation value as there would be no reason for a financial institution to acquire them. There are very few public companies that currently have this much variance in potential outcomes.

Risks

Since our thesis is neutral in nature there are risks to the upside and downside.

Upside risks include the company’s ability to improve their risk assessment model and successfully expand into other loan markets. The auto market may end up being a large area of success for them with a lower risk profile than personal loans currently have.

Downside risks include the company being unable to assess risk better than FICO and being unable to expand into new loan markets or attract new partners. The company may have difficulty attracting and retaining talent due to their declining stock price.

Key Takeaway

If Upstart can come out of this period and show that their AI risk assessment model is superior to FICO they will thrive and be able to expand into new loan markets and attract new partners. If their risk assessment model turns out to be inferior to FICO when measured over a long period of time the company may be unable to survive. Despite the potential for massive rewards, the risks lead us to believe that investors should stay on the sidelines until there is more clarity.

Be the first to comment