MarsBars/E+ via Getty Images

Trying to time an absolute bottom for a stock is a losing gamble. I’ve never been able to do it myself nor have I met anyone who can do it consistently. That’s why it’s helpful, instead, to layer in capital whenever a stock becomes attractive, thereby giving one the flexibility to average down should the price weakness continue.

This brings me to Unilever (NYSE:UL), which, again, is trading at levels not seen in recent times since its failed bid for GlaxoSmithKline’s (GSK) consumer health unit. This article highlights why UL presents an attractive opportunity at present, so let’s get started.

UL: Why It’s Time To Layer Into This High Dividend Stock

Unilever PLC is a British multinational consumer goods company that’s headquartered in London, England. It boasts a diversified product base of 400 brands that includes personal care and packaged foods, with top brands including Hellmann’s mayonnaise, Ben & Jerry’s ice cream, Dove, Axe, and Seventh Generation. It generated $60B in revenue over the trailing 12 months.

Unilever trades at a significant discount to its peers on a number of valuation metrics. At present, UL trades at a forward P/E of 16.5x, which is a ~20% discount to the historical consumer staples sector average.

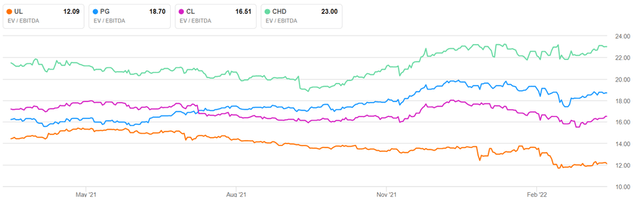

UL also appears to be cheap on an EV/EBITDA basis, which is a good apples-to-apples comparison, since Enterprise Value includes both debt and equity. This is reflected by its EV/EBITDA of just 12.1, sitting well below that of peers Procter & Gamble (PG), Colgate-Palmolive (CL), and Church & Dwight (CHD), as shown below.

UL Peer Comparison (Seeking Alpha)

Meanwhile, management seems to have taken the cue from shareholders that they don’t see the value in aggressive and pricey acquisitions that are outside of the company’s core competency. Instead, I believe management is taking the right approach of focusing on inward value creation by investing in its best brands.

Moreover, UL has built fast-growing new businesses in Prestige Beauty and Functional Nutrition, putting its disposable products portfolio in position to capitalize on increased consumer travel. Headwinds to the business include upstart brands that seek to draw in consumers with local and artisanal products. However, UL’s durable cost advantages provide a good offset and shouldn’t be ignored, as outlined by Morningstar in its recent analyst report:

We think Unilever has a wide economic moat derived from two sources: its entrenchment in the supply chain of retailers (an intangible asset) and a cost advantage. The firm’s broad portfolio of products across multiple categories and supermarket aisles creates a virtuous cycle of competitive advantages, comprising intangible assets and cost advantages that new entrants simply could not replicate.

Unilever’s portfolio spans multiple household and personal product categories as well as food and, to a lesser extent, beverages, and the firm generates over EUR 52 billion in revenue. This makes Unilever one of the most important suppliers to retailers globally and differentiates it from narrow-moat competitors with smaller product portfolios.

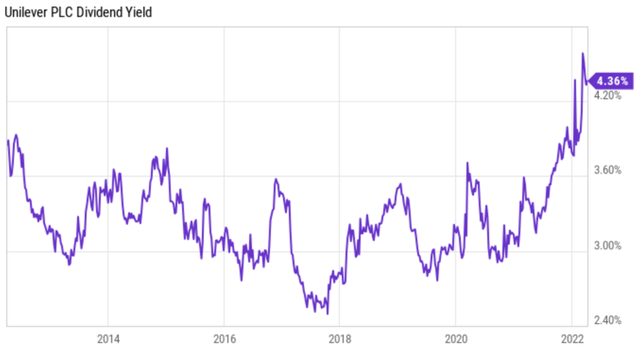

Meanwhile, UL has a decent track record of capital returns, through retiring 8.4% of outstanding shares over the past 5 years. Additionally, its 4.4% dividend yield currently sits at one of the highest points over the past decade. It comes with a safe 65% payout ratio (based on full-year EPS of €2.62) and a 7% 5-year dividend CAGR.

UL Dividend (YCharts)

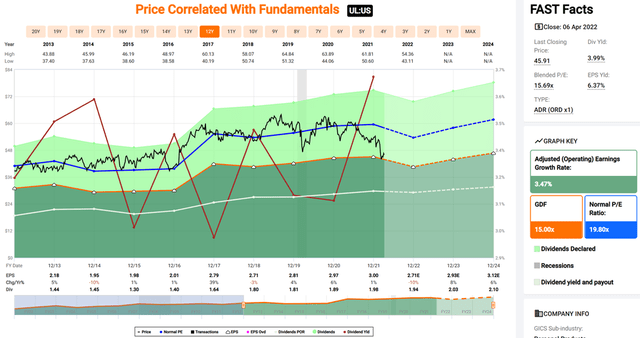

I see value in the stock at the current price of $45.91, as management repivots the company towards growth. Plus, its blended PE of 15.7 sits well below its normal PE of 19.8 over the past decade. Wall Street Analysts have a consensus Buy rating on UL, with an average price target of $58, implying a potential one-year 30% total return including dividends.

UL Valuation (FAST Graphs)

Investor Takeaway

Unilever appears to be an attractive opportunity at present, trading at a significant discount to its peers on a number of valuation metrics. Moreover, management seems to be taking the right approach of focusing on inward value creation by investing in its best brands. Accordingly, I believe UL has significant upside potential from its current price of $45.91, with strong potential returns in the near and long-term.

Be the first to comment