gremlin

Triumph Group (NYSE:TGI) design, manufacture, repair and overhaul various products related to aerospace and defense system, subsystems, components and structures. With the aim to innovate and develop industry-leading products, the company serves the global aviation industry through the aircraft life cycle.

Product catalog (corporate website)

Also, the company operates through two major segments: Triumph systems & support and Triumph airspace structures. And provides a wide range of products to the aircraft manufacturers, such as cockpit control levers, fuel metering units, gearbox assembly, composite duct, floor panels, and various related services.

Also, most of the company’s revenue is dependent on the airline industry, therefore the operating results are most likely to fluctuate significantly due to the cyclical nature of the airline industry.

Furthermore, due to significant deterioration in the business model, over the period, the stock price has been dropping significantly and has reached $11.8 per share from last year’s high of $27 per share; such a significant drop is a result of a considerable debt burden and consistent losses. Although there is a substantial drop in the stock price, I assign a sell rating to the company because having a huge debt burden, consistent losses, and low liquidity conditions might put the company at significant risk.

Historical performance

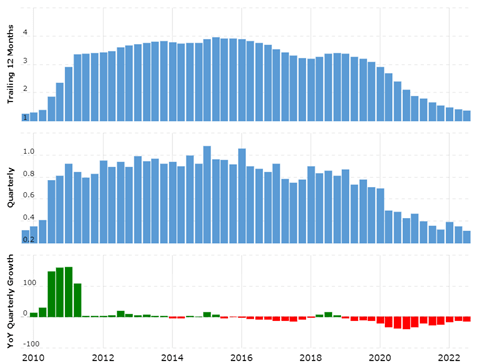

Revenue growth (macrotrends.net)

Over the last ten years, the revenue has dropped consistently. From FY 2016 onwards, revenue started declining consistently and reached $1.45 billion by 2021 from $3.8 billion in 2016. Also, net profit margins turned negative during the same period, leading to significant losses. The company has managed losses through asset sales, increased borrowing, and equity dilution. Therefore, due to massive losses incurred in the last few years, the net borrowing reached $1.5 billion to date; along with that, the size of the balance sheet declined from $2.9 billion in FY2020 to about $1.5 billion by the latest quarter. A significant deterioration in the business was also reflected in the share price, resulting in a substantial drop in the share price over the period.

Furthermore, cash flow from operations remained negative and subdued from 2018 onwards. As a result, the company had to depend on debt and equity dilution. Along with that, the company had to sell significant assets, resulting in a substantial devaluation of the company.

Due to huge losses, substantially low fixed assets and inadequate liquidity, increased debt levels have become a huge burden on the company. Such conditions might significantly affect the business, and if the company fails to produce desirable earnings, the financial situation can worsen. Therefore, I believe investors must seek a significant margin of safety before investing in such companies.

Strength in the business model

Over the period, the financial situation of the company has declined significantly. However, there is still considerable strength in the business model, which has been helping the company sustain intense competition.

Proprietary Rights

The company has many proprietary rights related to design, manufacturing processes and overhaul procedures, which significantly strengthen the business model. As the customers with specific part requirements have to depend on the company to produce specially designed products, the company could sell the products to its customers even in the intense competition. The company has been focusing on developing and acquiring new Patents, the profit margins might improve if the company could successfully bring innovative products.

High backlog

Having long-term agreements with most of the customers provides significant stability to the business model. A higher backlog and long-term contracts might help the company during debt refinancing, as such a condition offers the certainty of consistent payment.

Risk

Although the company produces specific patented products, the company has been facing significant pricing pressure from customers. As a result, the company couldn’t make profits over the last few years. If the condition lasts longer, the company will have to sell significant assets to comply with such losses; in such situations, financial strength might be affected significantly.

Upcoming debt maturity

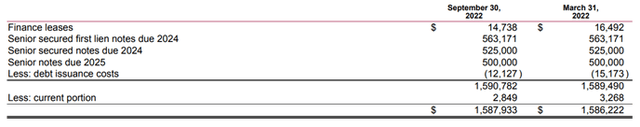

Debt maturity (Annual report)

In the next two years, over $1.5 billion of debt is going to mature, which might put significant pressure on the financial condition. The company has been selling fixed assets to comply with the current liabilities, and as a result, overall assets and liquidity have dropped significantly. And if the company fails to produce positive cash flows, the company might face significant trouble in complying with debt maturities.

Although the company could gain refinancing due to a higher backlog, interest rates on refinanced debt might increase, which can further put significant pressure on the operating results.

Recent development

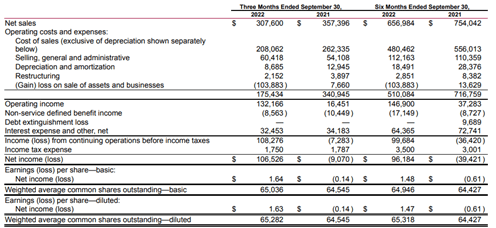

Quarterly results (Quarterly reports)

In the latest quarter, revenue declined from $357 million in the same quarter last year to about $307 million. But the company has posted net profits of $106 million, primarily contributing to significant gains in asset sales.

Also, over the last nine months, the revenue has been declining consistently, which might result from weaker prospects in the airline industry. Note that to comply with the current liabilities, the company has been selling its assets and diluting equity, which might further affect the business model.

The company has achieved solid growth driven by a higher backlog as the commercial volumes returned to normal. But the supply chain issues remain significant, resulting in delays in sales.

Although the system and support segment has been growing consistently, the overall results of operations are unsatisfactory and might take a very long time to recover.

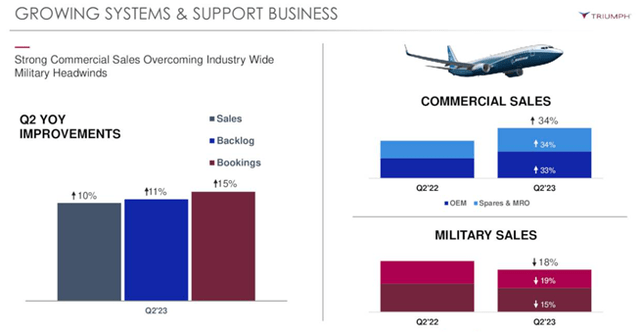

System and support segment (investors presentation)

Despite having significant proprietary rights, the company couldn’t produce considerable cash flows and has been selling its assets to maintain the business. In my view, such a financial situation brings a huge risk of permanent capital loss. Therefore, avoiding stocks with high debt and long-standing losses is the best decision one can take.

As the company has been developing its support and system business, over the period, the company could turn profitable. Still, due to high debt, the risk of stock price correction is significantly high.

Currently, the company has a market cap of $769 million. In contrast, it has been losing money consistently and has over $1.5 billion in long-term debt, which might bring a significant risk of further deterioration in the financial condition. Therefore, I assign a sell rating to the stock.

Be the first to comment