tripelem/iStock via Getty Images

“Instinct is a marvelous thing. It can neither be explained nor ignored.” – Agatha Christie

The Economy

Sorry to keep beating the recession drum, BUT the data doesn’t lie and lately it’s been poor. Another week of ugly reports.

For starters, the year begins with a continuation of the disappointing manufacturing reports that were a constant theme in 2022.

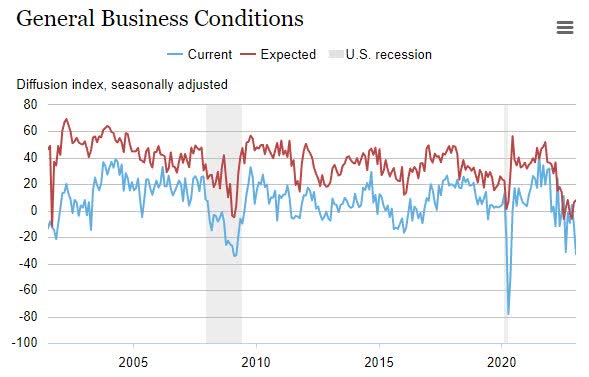

The Empire State manufacturing index collapsed 21.7 points to -32.9 in January, much weaker than projected, after plunging 15.7 points to -11.2 in December. This is the lowest level since May 2020 and is the third lowest in the history of the index. The index was in contractionary territory in eight of the 12 months of 2022 and starts the new year below zero too. The components were mixed.

NY Fed manufacturing

Economists can call that picture what they want – I call it a recession.

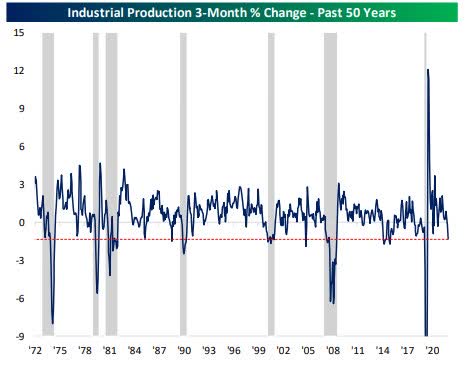

Industrial production also showed a reading that is consistent with past recessions having come in far weaker than what had been forecasted. On a rolling 3-month basis, the 1.33% drop has been the largest decline since the spring of 2020.

Ind Prod. (bespokepremium.com)

Looking further back, such a sharp decline in industrial production has mostly-but not always (i.e. 2015, 2005, & 1989)-been observed within recessionary periods.

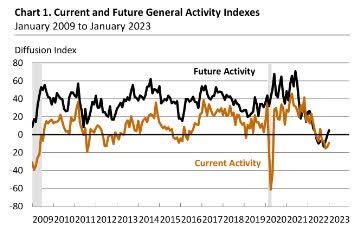

The Philadelphia Fed Manufacturing Index rose from a revised reading of -13.7 in December to -8.9 in January. It’s the fifth consecutive negative reading and the seventh negative reading in the past eight months. More than 33 percent of the firms reported declines in activity, exceeding the 24 percent that reported increases.

Philly Fed

The consumer is slowing down.

Headline retail sales declined 1.1% in December, as did the ex-auto component. Sales were down 1.0% and 0.6%, respectively, in November. Sales excluding autos, gas, and building materials were 0.8% from 0.2 in November. Back-to-back retail sales declines only happen during – wait for it – a recession.

And the overall economy is weak.

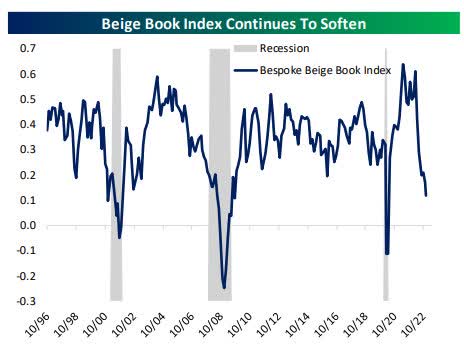

The first of the year’s eight releases of the Federal Reserve’s Beige Book hit the tape yesterday. The report noted that activity was little changed versus the prior report released in November and only a little growth is expected for the near future. While the report consists of qualitative information regarding the economy, using natural language processing, at right we show our Beige Book Index which seeks to quantify the frequency of constructive and negative words in the report.

Beige Book (bespokepremium)

As shown on the left, the January report showed further deterioration and is down around levels consistent with past recessions. Historically, this index has tended to track GDP growth as well, and this latest reading would be consistent with flat GDP.

Housing

Housing starts fell 1.4% to 1.38 million in December, not as weak as forecast, after tumbling 1.8% to 1.40 million in November and sliding 2.7% to 1.42 million in October. It is a fourth straight monthly drop and is the lowest since July. Building permits were down 1.6% to 1.33 million the weakest since May 2020.

Existing home sales dropped 1.5% to 4.02 million in December, not as weak as forecast, after dropping 7.9% to 4.08 million in November. Sales have declined for eleven straight months. This ties the slowest pace of sales since November 2010 and the weakest since October 2010. Limited supply and rising mortgage rates have been the major culprits hammering the housing market.

Will the cheerleading analysts please stop by and leave a comment to explain how this economy is strong?

Finally, some good news. Inflation continues to cool and a “change” in Housing Sentiment.

PPI fell 0.5% in December and rose 0.1% excluding food and energy. Those follow gains of 0.2% and 0.2%, respectively. The annual pace slowed to 6.2% year over year for the headline, from 7.3% y/y. The core rate came in at 5.5% y/y from 6.2% y/y.

The NAHB home builder index rose 4 points to 35 in January after falling 2 ticks to 31 in December. That was the lowest level since April 2020. Both components improved, supported by the slide in mortgage rates. The current single-family index rose to 40 from 36 previously. The future index edged up to 37 from 35. The index of prospective buyer traffic increased to 23 from 20. The report noted it appears the low point for builder confidence for this cycle was reached in December.

The market’s reaction to this data last Wednesday was telling and shows what my theme for ’23 is all about. Stocks fell as Inflation is in the rearview mirror while the economy and corporate earnings take center stage.

The Global Economy

It’s a different story abroad and a big week for data in China, as most of the reports were better than expected. Industrial Production increased by 1.3% y/y which was better than consensus forecasts for a gain of just 0.1%. On the consumer side, Retail Sales only fell 1.8% compared to forecasts for a decline of 9.0%.

Lastly, GDP growth for 2022 came in at 3% which was 0.3 percentage points better than the 2.7% forecast. Despite the better-than-expected reading, it was the second weakest year for Chinese economic growth since 1980 (2020 was the weakest). Similarly, Retail Sales, while better than expected, have been negative on a y/y basis in six of the last ten months. Before COVID negative retail sales in the country were unheard of. Looking ahead, Chinese officials expect a return to normal consumption and trade trends in 2023.

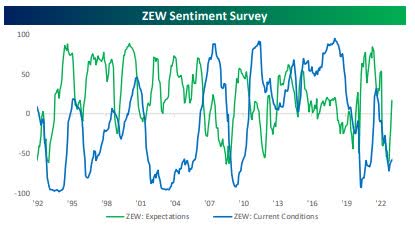

One reason the STOXX 600 and other EU indices are doing well is the change in sentiment. The January ZEW sentiment survey of investors was released this week, and as shown in the chart below, even as sentiment towards current conditions remains deeply depressed and showed a smaller-than-expected increase, expectations flat out surged more than 40 points for the second largest m/m increase on record. The only month with a larger increase was April 2020.

ZEW (bespokepremium.com)

History shows a positive performance for EU markets when the ZEW Expectations Index jumped 70+ points over six months. None of these prior periods occurred at or near a market top.

Bespoke Investment Group;

One month later, the STOXX 600 rallied by a median of 6.3% with gains six out of seven times. Six and twelve months later, performance was even more impressive with median gains of 18.3% and 21.7%, respectively. Not only that but over each time frame, the STOXX 600 was higher seven out of seven times.”

So if history repeats there are more gains ahead.

Investment Backdrop

This week’s set of index charts tells an interesting story. The S&P 500 (SPY) shows another attempt to move above short-term resistance and potentially break the BEAR trend that has kept just about every sector in check. This time around the BULLS have a supporting cast. The Homebuilders are indicating that the worst is over in that part of the US economy. The Global market is telling us for the moment, that despite the woes, there is light at the end of the tunnel and the worst-case scenarios may have to wait for another day. Commodities are looking better. This action is reflecting the China reopening and better data on inflation.

Yes, we have seen this before and yes the BULLS have been fooled before. While it may not be time to toss caution to the wind, we should respect ALL of this positive price action. If the evidence continues to lean toward a bullish outcome, and if any rally is to continue, the next clue will be the magnitude of any pullback. That is THE KEY, because, in the past, minor pullbacks quickly turned into waterfall declines.

Now we have a new clue to work with. Every rejection at resistance in 2022 resulted in the S&P tagging a new low – except for the last pullback in December. Now that we have the opportunity to look back, it was a sign that the scene could be changing. However, the landscape is complicated and filled with landmines. The Small caps (IWM) struggle at support, and the Nasdaq (QQQ) is still lagging behind the DJIA (DIA) which is very close to a new BULL market trend.

I’ve set my parameters to take “action” not only for this near-term rally but for the remainder of Q1.

Investors will have to deal with this headline-driven market, and that also tells me to stay within my boundaries. While in the context of following the PRIMARY BEAR trend, I remain flexible to all outcomes.

Final Thoughts

The market rallies and analysts get more bullish, the market dips and they get bearish. It’s time to keep emotions in check. Don’t get too high, and don’t get too low as these battle lines have been drawn.

In the interim, the “narrative” changed and the price action both here and abroad started to reflect that. The entire Global MACRO scene started to take on a more positive tone. China is reopening. For the moment the EU has dodged the “energy” bullet, and inflation is rolling over here in the US. The talk of a ‘soft landing” is gaining more traction.

I noted the muted reaction to the positive inflation report during the week and that is signaling what I’ve mentioned before. My forecast for ’23 is coming to fruition early. Selling came after a cooler-than-expected PPI report but a miss in Retail Sales among some other negative economic news, it appears that it’s no longer about inflation anymore. Earnings and macro news are also getting to be more market-moving now. We could already be at the point in time where inflation is put on the back shelf and corporate earnings and the economy are front and center on investors’ radar screens. The latter is the “reality check” that represents the opposing side of the “positive soft landing” narrative.

One look at the latest NY manufacturing report followed by retail sales numbers that were followed by a lousy Beige book report bolsters the reality view. But will this ugly economy matter in the short term? That’s the dilemma investors face now. It may come down to the other factor we have talked about – earnings. If the earnings picture can stay stable here in the US, there is a chance it keep stocks stable in Q1 as well. So depending on which way the wind is blowing, the daily narrative goes from a “soft landing” view to a global recession backdrop. It sure appears some are now jumping on the cheerleading bandwagon. All is well and this lousy economic backdrop is priced in.

Being prepared to act on several contingencies that are often at odds with one another is not easy. Yet these are critical aspects of navigating the markets in the short term that one must master to have success in the long run.

THANKS to all of the readers that contribute to this forum to make these articles a better experience for everyone.

Best of Luck to Everyone!

Be the first to comment