chaofann/iStock via Getty Images

The U.S. Dollar remains strong in the foreign exchange markets.

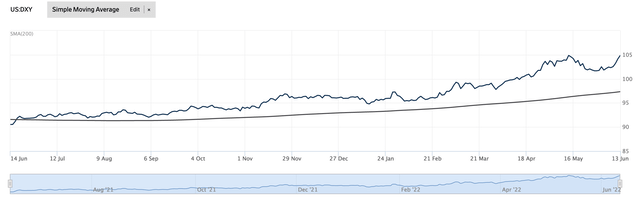

On Monday morning, June 13, 2022, the U.S. Dollar Index (DXY) was just under 105.00.

On June 1, 2021, the value of the U.S. Dollar Index was 89.89.

The index was up almost 17.0 percent for the year.

U.S. Dollar Index (DXY) (Wall Street Journal)

The increase, as can be seen, has been steady and continuous.

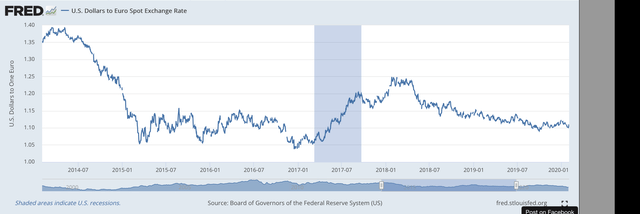

The same thing can be seen in the U.S. Dollar/Euro exchange rate.

On June 1, 2021, it took $1.2220 to purchase one Euro.

On June 13, 2022, it takes only $1.0457 to buy a Euro.

The U.S. dollar is up 16.7 percent from one year earlier.

U.S. Dollar/Euro Exchange Rate (Federal Reserve)

The Past

I was interested in this year-long strengthening of the dollar, especially with all the other things that the Federal Reserve had to focus on, like inflation, and so I took a look further back in history.

First, however, I eliminated the period that was heavily impacted by the spread of the Covid-19 pandemic and subsequent recession.

Basically, I took out the data between February 1, 2020 and June 1, 2022.

Then, I did not only go back through the early part of the Powell term as Federal Reserve chair, but I also went back and took a look at the time period Janet Yellen was the chair of the Fed.

Here is what I came up with.

U.S. Dollar/Euro Exchange Rate (Federal Reserve )

Janet Yellen’s term as the Federal Reserve chair went from January 1, 2014 to March 5, 2018, when Mr. Powell took over for his first term as the Chair.

When Ms. Yellen took over the chair, it took $1.3500 to purchase one Euro.

When Mr. Powell took over, the Euro cost only $1.2330.

So, the value of the U.S. dollar against the Euro rose by 9.5 percent during Ms. Yellen’s tenure.

Note, however, that the value of the U.S. dollar fell, beginning in the first half of 2017, and continued to fall until Mr. Powell took over the chairman’s position. (This is represented by a rise in the chart.)

What happened during this time period?

Well, Ms. Yellen lost the favor of President Donald Trump. So they were at odds during this time period and traders in the foreign exchange market reflected this separation with a decline in the value of the U.S. dollar.

Mr. Powell became the Chairman… and the value of the U.S. dollar began to rise again.

And, the value of the U.S. dollar rose against the Euro by 13.0 percent from the time that Mr. Powell took over until the pandemic hit in February 2020.

Conclusion: The Federal Reserve, under the leadership of Janet Yellen and Jerome Powell (up to the time the pandemic hit) were experiencing a rise in the value of the U.S. dollar.

This rise continued after the Federal Reserve started to move on from the pandemic to fight inflation.

So, for most of the past eight years, the leaders at the Federal Reserve have overseen a substantial rise in the value of the U.S. dollar.

When Ms. Yellen became Fed chair, it took $1.3500 to purchase one Euro.

Monday morning, June 13, 2022. it took only $1.0457.

The rise is 29.0 percent!!!

Why Would The U.S. Want A Strong Dollar?

So, why would the U.S. want to strengthen the value of the U.S. dollar during this particular period of time?

My first response to this is that the Fed wants to maintain a strong dollar so that the dollar can remain the world’s major reserve currency.

During the past decade, there has been a lot of discussion about the growing global weakness of the United States and the growing weakness of the U.S. dollar in world trade.

Although Ben Bernanke got the United States out of the Great Recession and created the environment for a lengthy economic recovery, the value of the U.S. dollar actually declined a great deal during his tenure as the Chairman of the Federal Reserve.

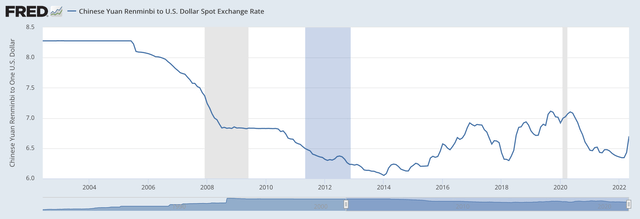

Furthermore, the Chinese economy was growing and growing and growing and the Chinese government worked to increase the amount of trade that took place using the Chinese Yuan and to build up its currency every day possible to make it a safe and useful substitute for the U.S. dollar.

One can see in this chart, how the value of the Chinese Yuan has grown stronger over the past twenty years.

Chinese Yuan/U.S. Dollar Exchange Rate (Federal Reserve)

And, this even includes the past eight years when the U.S. was working to make the value of the U.S. dollar stronger.

But, one can also see that even though Mr. Bernanke did good things for the U.S. economy, his efforts did not maintain a strong value for the dollar versus the Yuan.

So, it seems that the Federal Reserve must be very cognizant of what the Chinese are doing in order to produce policies that battle the Chinese attempt to become the reserve currency of the world.

The U.S. Dollar Remains Strong

One other thing we have seen over the past decade, particularly over the past five years or so, is that foreign “risk averse’ monies seeking a safe haven have generally flowed to the United States in times of disruption and uncertainty.

During times of “uncertainty” over the past six or seven years, major flows of money have come into the U.S., strengthening the dollar, and channeling lots of money into the U.S. financial system.

In terms of global capital flow data, the U.S. was number 3 up until 2017. In 2017, it jumped up to the number 2 spot in the world.

In 2019, the U.S. jumped to number 1 global capital flow and has remained there since then.

The U.S. still remains one of the major “havens” for placing money when uncertainty begins to take over “nervous” foreign investors.

Investor Focus

Now to the point of this message.

I started looking at these data because the value of the U.S. dollar had been increasing in foreign exchange markets, especially as the Fed appeared to be moving on to battle inflation.

Looking back before the pandemic hit, it became apparent that the value of the U.S. dollar had been getting stronger even before the advent of the pandemic. Chairman Powell had overseen a rise in the value of the dollar from the start of his term until the advent of the pandemic in the U.S.

Looking back even further, it seemed to be true that the value of the U.S. dollar strengthened during the term of Chairperson Janet Yellen.

Given the continuation of these results over the past eight years, excluding the period of time between February 2020 and June 2021, the steady rise in the value of the U.S. dollar just seemed to be too continuous to have “just happened.”

Now, we need to look forward and contemplate what the Fed is going to do about the value of the U.S. dollar given that it has a major battle on its hands fighting the strength of rising prices.

Be the first to comment