FinkAvenue/iStock Editorial via Getty Images

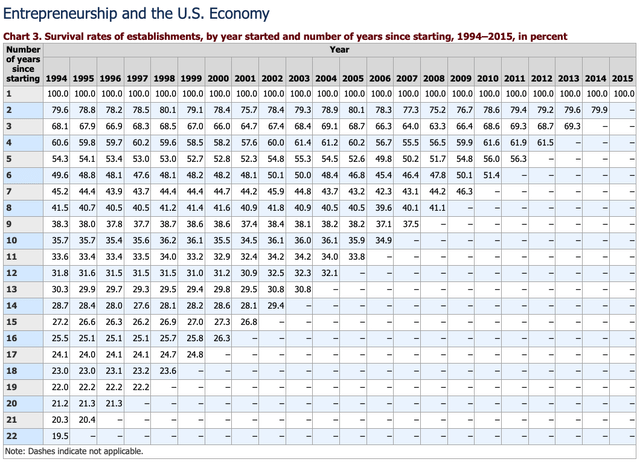

Starting a company is a challenging endeavor on multiple levels. According to the U.S. Bureau of Labor Statistics, only about half of new businesses survive five years after they start and this includes everything from a high tech startup to a mom-and-pop restaurant down the street.

BLC Company Survivorship Data (BLS.gov)

The survivorship rate for professionally backed startups that receive venture capital is estimated at 25% and according to a Startup Genome report, the number of new startups that survive is less than 10%.

This is one of the reasons angel investors, venture capitalists and private equity firms spread their bets across dozens and in some cases hundreds of individual investments. For every Airbnb that succeeds, there are thousands of other startups that go bust. The financial and emotional toll on the entrepreneurs, early employees and sometimes even the deeply involved early investors can be high.

The startup ecosystem in Silicon Valley and other high-tech hubs rely on a small fraction of these startups becoming immensely successful (achieving unicorn status if you will) and eventually going public. The next level down are companies that don’t quite reach the scale originally envisioned but enjoy a certain modicum of success that allows them to exit to large companies like Meta Platforms (NASDAQ:META), Microsoft (MSFT), Alphabet (GOOG) (GOOGL) or Amazon (AMZN). The entrepreneurs and their investors benefit from an exit and the large companies end up feeding their innovation engine as well as pick up driven employees with broad ranging skills. These successes end up paying for the next generation of dreamers, risk takers and innovators.

When we report on public company M&A every Monday in our Merger Arbitrage Mondays series of articles, one of the things that I look into is the level of regulatory risk an announced merger or acquisition is likely to run into. Regulatory risk can come from one of several governmental agencies including the FTC, DOJ, FCC, OCC, CFIUS, etc. depending on the industry and location of the company. Over the last decade, we have seen several deals fail because of regulatory issues and some of the larger ones that come to mind include Baker Hughes/Halliburton, Allergan/Pfizer, Office Depot/Staples, Cigna/Anthem and Pacific Biosciences/Illumina.

Unbridled capitalism with no checks and balances is not good for consumers or society at large. Unfortunately, you could also go to the other extreme where onerous regulations and red tape stifle growth and innovation. If the Federal Trade Commission (FTC) or the Department of Justice (DOJ) decide to step in and sue to block a merger of large public companies, most companies give up and the deal falls apart. Every once in a while you end up with a situation like UnitedHealth Group’s acquisition of Change Healthcare (CHNG) where the companies decided to take their slim chances in court.

When the Biden administration named Lina Khan as the Chair of the FTC in June 2021, arbitrageurs who focus on picking up the spread between where a company is currently trading and the price an acquirer will pay for the company when the announced acquisition closes, realized that the regulatory environment is going to change and deals will go through increased scrutiny.

This is one of the reasons I have stayed away from Microsoft’s pending acquisition of Activision Blizzard (ATVI). Microsoft will pay $95 per share in cash when the deal closes, providing for a juicy 18% spread on the deal. The Oracle of Omaha who occasionally dips into large merger arbitrage situations is long this deal. We wrote about the acquisition in more detail in this Seeking Alpha article in January, shortly after the deal was announced.

Last week, Lina Khan overruled staff to block Meta Platforms’ acquisition of a Virtual Reality app developed by privately held company Within Unlimited. The Bloomberg article discussing her decision states,

“In public comments and writings, Khan has emphasized the need to rein in the biggest technology companies, particularly Facebook parent Meta, which she argues has used acquisitions as a form of “land grab” to conquer new markets and “neutralize competitive threats.”

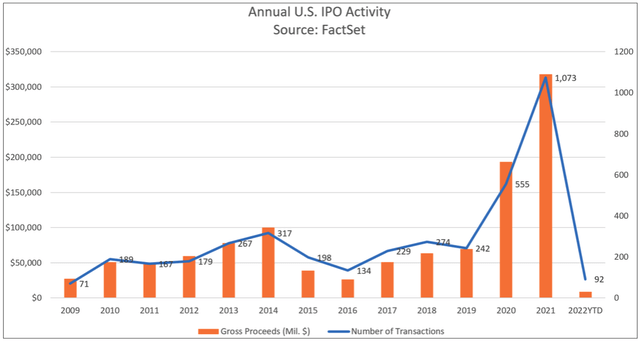

Unless this is a one-off situation, the FTC stepping in to block small private company acquisitions by the FAANG gang is going to throw a monkey wrench into the Silicon Valley machine. With their public market counterparts down anywhere from 70% to 95% peak-to-trough, funding for private startups has already dried up. To make matters worse, exits through IPOs have dropped precipitously. According to FactSet,

1073 companies IPO’d in 2021, raising $317 billion; in the first half of 2022, the total was just 92 companies, raising just under $9 billion.

Meta Platforms has its own company specific issues whether it is a 14% year-over-year drop in average price per ad, difficulty monetizing properties like WhatsApp, huge capital spending on its ambitious bet on a virtual world, reputation issues and low single digit growth in key metrics like monthly active users (MAUs), daily active users (DAUs) and family daily active people (DAP).

It is not surprising that the stock trades like a value stock, trading at a forward EV/EBITDA of less than 8 despite net margin of over 28%, double digit expected revenue growth in 2023 and a cash rich balance sheet. That revenue estimate for 2023 might be a tad optimistic considering revenue declined in Q2 2022. The company announced an additional $50 billion buyback last October and so far this year has already repurchased $14.7 billion worth of stock. If regulators start blocking Meta’s acquisitions, the company’s capital allocation options will be limited.

I agree that some large technology companies have been highly acquisitive and sometimes do so to stifle competition. However, an overtly restrictive regulatory environment even as the Fed is pursuing a policy of quantitative tightening will have ripple effects that go far beyond the intended big technology company targets.

M&A is an important component of our system of capitalism even if at times it leads to what Peter Lynch termed “diworsification”. Small biotech companies that might not have the manufacturing expertise or distribution networks of their larger pharma brethren, benefit from big pharma acquisitions. The same could be true for two companies in a highly competitive market that may not survive on their own but stand a chance as a combined stronger company (Office Depot and Staples come to mind). Finally, smaller private startups benefit from acquisitions that reward years of hard work and investment. The unlocked capital not only rewards investors but also flows to the next generation of innovators.

I hope that Chair Khan and other regulators keep this broader context in mind as they review the next set of deals that cross their desks.

Be the first to comment