Justin Sullivan

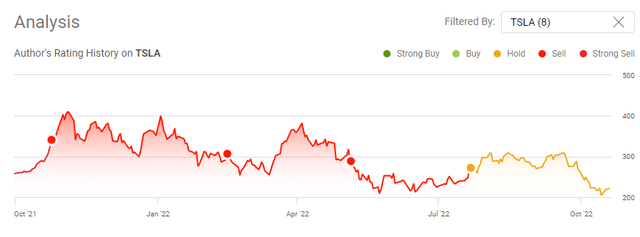

I was arguably one of the largest bears when it came to Tesla (NASDAQ:TSLA) on Seeking Alpha, and one of my articles amassed over 3,100 comments without a single response from me. After the Q2 earnings call, I changed my investment thesis from being bearish to neutral, and I am on the verge of turning bullish on TSLA. I am not quite there yet, but the progress and success that TSLA has produced are undeniable. I had 3 major issues with TSLA when I was bearish. Those were: the valuation based on its free cash flow (FCF), 100% of its gross profit and net income were generated from the automotive segment, and TSLA didn’t have a vehicle at a price point that was appealing to the average consumer. Q3 2022 marked the second consecutive quarter where TSLA generated a gross profit outside of the automotive segment. TSLA generated $3.3 billion in FCF, pushing its valuation to a more attractive level based on its TTM FCF, and Elon Musk provided insight into a more affordable vehicle from TSLA on the Q3 earnings call. Elon Musk took the fight directly to the auto industry titans, and against all odds, he succeeded. He continues to defy the odds and prove the bears wrong. I was a shareholder of TSLA by default when I was bearish as my wife had invested in TSLA but as time progresses and shares decline in price, TSLA is really starting to look interesting. TSLA has had a rough year as it’s declined by over -48% in 2022, but just because it was overvalued doesn’t mean that my investment thesis can’t change and that I wouldn’t buy shares at a valuation that was appealing to me.

Tesla has proved me wrong, and is no longer just an automotive company

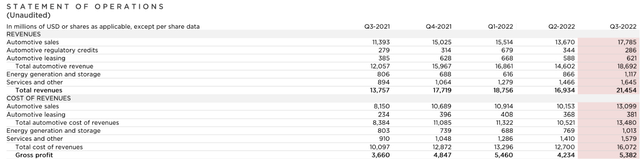

TSLA proved me wrong, and I tip my hat to them. For a period of time, I would go back and forth with readers in the comment section about how TSLA was purely an automotive company, but this is no longer the case. Q3 2022 marks the second quarter where TSLA generated gross profit outside the automotive segment. TSLA operates in 3 business segments: automotive, energy generation and storage, and services & other.

In Q3, TSLA increased its energy storage deployments by 62% YoY to 2.1 GW, making the first quarter over the 2GW mark. TSLA is seeing demand for its storage products continue to exceed its ability to supply the demand, which is a great problem to have. TSLA is ramping up production at its Megapack factory in California to address the outsized demand. In Q3, solar deployment increased 13% YoY to 94 MW. TSLA recognized YoY growth in its residential projects. In the services and other segment, TSLA’s paid supercharging grew more than 3x and is working on accelerating the deployment of future charging stations.

In Q3 2022, TSLA lost money from these business segments as they generated a combined $1.7 billion in revenue and spent $1.71 billion to produce it. While TSLA has had a diversified business that spans outside of automotive, it’s never broke even or created a gross profit until recently. Over the past year, TSLA has grown these business segments by $1.06 billion, which is a 62.47% growth rate. In Q2 2022, TSLA went from a -$79 million gross profit in Q1 to an actual gross profit of $153 million. In Q3, TSLA expanded on this success and generated $170 million of gross profit as these segments produced $2.76 billion of revenue at the cost of $2.59 billion.

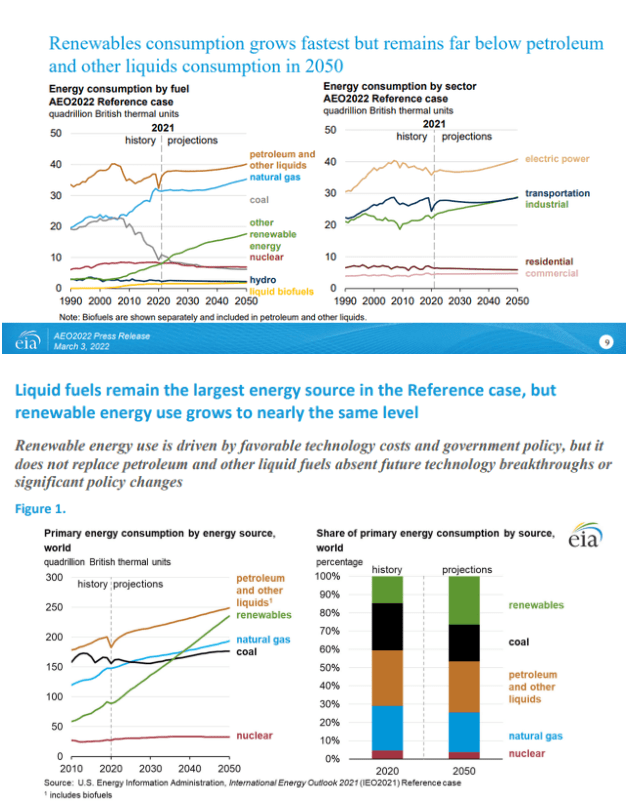

While these segments only generated 3.16% of TSLA’s quarterly gross profit in Q3, it’s much better than being in the red and illustrates a growth story. On 3/3/22, the EIA released its 2022 Annual Energy Outlook and indicated that renewables would more than double its position in the domestic energy mix when looking at energy consumption by fuel. The EIA publishes its international energy outlook every 2 years, and the last one was published prior to the war in Ukraine. On a global view, renewables are set to overtake natural gas and coal as the largest primary energy source by consumption just prior to 2040. By 2050, renewables will be the second largest primary consumption energy source globally and threaten petroleum and other liquids for the top spot.

TSLA’s track record has not provided a reason to doubt its success. Now that they are generating a gross profit from these other business segments, it’s realistic to think these lines could generate $1 billion or more of gross profit annually in the future. It’s going to take years to play out, but if TSLA can sustain this trajectory, the projected path in the energy sector could create many opportunities in the future to generate additional revenue. It’s very early to speculate what these sectors could turn into over the next decade, but I wouldn’t have a hard time believing that the 3.16% of gross profit these sectors generated in Q3 2022 could increase to 20-30% in the future.

EIA

Tesla has dismantled the bear thesis around increased competition and it could continue based on Elon Musk’s comments on the Q3 call

One of the most discussed bear theses was based around TSLA’s inability to capture a large portion of the auto market and that as traditional internal combustion engine (ICE) manufacturers transitioned to EVs, they would eat away at TSLA’s dominance in the EV market. While there was once a case for this logic, the bear thesis has turned into a bull thesis as TSLA has made myself and the rest of the bears eat our own words.

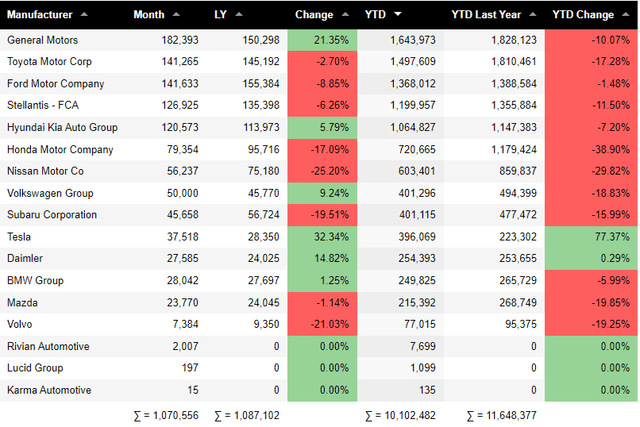

YTD, US auto sales have declined by 1.55 million units or -13.27% in 2022. General Motors (GM) has seen its US auto sales decline by -184,150 or -10.1% YTD compared to this period in 2021. All the top manufacturers have seen a YoY decline in sales YTD except for TSLA and Daimler. The 9 largest auto manufacturers, including GM, Toyota (TM), Ford (F), Stellantis (STLA), Hyundai (OTCPK:HYMLF), Honda (HMC), Nissan (OTCPK:NSANY), Volkswagen (OTCPK:VWAGY), and Subaru (OTCPK:FUJHY), have all seen their YTD sales decline and make up the majority of the 1.55 million lost auto sales in 2022.

TSLA has seen a 77.37% spike in the US market throughout 2022, compared to YTD period in 2021. TSLA’s sales have increased by 172,767 units, rising from 223,302 in 2021 to 396,069 YTD in the US market. What may be a more important number to look at is the total market share. TSLA had 1.92% of the US auto market share in the YTD period in 2021. TSLA has increased its foothold in the US and now represents 3.92% of all automobiles sold in the US YTD. Regardless of which piece of information was used for the bear thesis, from the cost and barriers to entry into their vehicles to increased competition, TSLA has proved everyone incorrect and has surpassed many expectations.

Most Americans do not have $49,940 in cash to spend on a Model 3 and need to either lease or finance their purchase. In 2022, the average household income in the US was $97,026. Based on the 2022 federal income tax brackets for married individuals filing joint returns, the average household would have paid $12,579.72 in taxes, prior to factoring state and local. For argument’s sake, I will use a 25% tax factor which would mean the average household would take home $72,769.5, which works out to $6,064.13 per month. After $4,500 down on a Model 3, the estimated loan at a 4.74% APR over 72 months is $724 / mo, and the estimated lease is $519. After the normal monthly bills, many families, even without kids, would be hard-pressed to fit these payments into their monthly bills. Previous conventional thinking had indicated that TSLA would have had a hard time converting as many customers as they have due to the barriers to entry and competition, but TSLA has proven all the bears wrong.

Elon Musk is about to prove everyone wrong again and what he said during the Q&A portion of the Q3 earnings call is critical to TSLA’s future as an automotive company. Elon Musk explained that the primary focus of the new vehicle development team is to develop a compact vehicle at a lower price point. He outlined that the engineering for Cybertrucks and Semi is complete, and they are going to take everything they have learned from the S, X, 3, Y, Cybertruck, and Semi and put that knowledge into their new platform. He believes they will be able to create a compact vehicle that will be cheaper, and most importantly, it may exceed all of the production numbers from TSLA’s other vehicles combined. The focus is on making 2 cars for the amount of effort it takes to make a Model 3.

I think the question becomes if TSLA can grow its US auto business by 77.37% YTD compared to 2022, without an option for the majority of Americans, what will happen if TSLA creates a sub $30,000 vehicle? If Elon Musk believes TSLA can take its knowledge and create a compact vehicle that has a competitive price point to Toyota, Ford, General Motors, and Honda, how much growth can TSLA achieve? Hypothetically, let’s speculate and say that by 2025 TSLA is producing a compact sub $30,000 vehicle. I don’t think it’s crazy for TSLA to march right into the top 5 selling auto manufacturers in the US, which would almost triple its sales from where it is YTD. It’s clear that TSLA is only gaining market share, and inflation or rising rates have not impacted its sales. I don’t think it’s a question of if, but when, for TSLA’s compact vehicle, and this could be the key to TSLA becoming the largest automotive manufacturer in the US by 2030.

Even though Tesla missed on revenue estimates, this was a solid quarter, and its valuation is looking more enticing after each earnings report

TSLA produced $21.45 billion of revenue in Q3, which was a miss of $510 million, but it exceeded on EPS, generating $1.05 per share, which was a $0.04 beat from the $0.99 the street was looking for. From a numbers standpoint, there was nothing to dislike. TSLA generated $5.38 billion of gross profit, which is a 25.09% gross profit margin in Q3. TSLA had a record quarter when it came to net income, generating $3.69 billion in profits, which is a 17.19% profit margin. TSLA produced $5.1 billion of cash from operations, which was another record, and generated $3.3 billion of FCF in the past quarter. As I outlined earlier, I was impressed with TSLA’s ability to build on Q2’s gross profit outside of automotive, and this area grew QoQ in Q3 by $17 million.

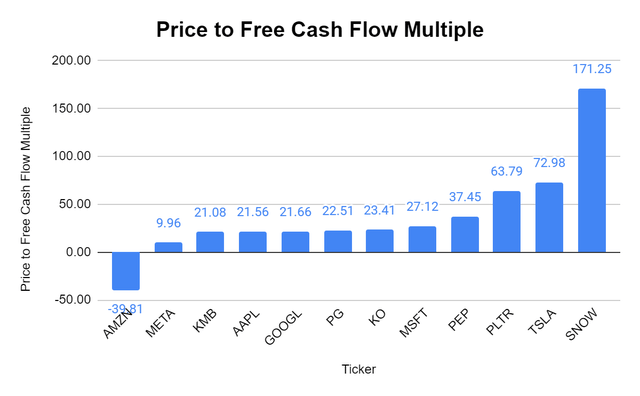

Many people, including myself, have always looked at TSLA’s valuation as a reason to be bearish. Putting market and investor sentiment aside, the numbers are the numbers, as $1 of revenue and $1 of Free Cash flow [FCF] equals $1 of revenue and $1 of FCF regardless of the company’s name or sector it does business in. With every investment an investor makes, they are paying the present value for a company’s current and future cash flow. FCF is often looked at as one of the best measures of profitability as FCF excludes the non-cash expenses of the income statement and includes spending on equipment and assets as well as changes in working capital from the balance sheet. To some investors, FCF is more important to analyze than net income because it’s harder to manipulate as it is a true indication of the company’s cash. FCF is also the pool of capital that companies can utilize to repay debt, pay dividends, buy back shares, make acquisitions, or reinvest in the business. With every share of stock purchased, you’re getting an equity share of the business in return, and your shares represent a portion of the revenue and earnings generated. This is why my preferred valuation metric is price to FCF.

Prior to the Q3 earnings release, TSLA had a price-to-FCF multiple of 93.86x based on its current market cap. After the updated numbers, its price to FCF multiple has decreased to 72.98x. The combination of TSLA’s market cap declining and its FCF increasing has caused its FCF multiple to decline substantially throughout 2022. Looking at a bunch of other companies, TSLA’s valuation is starting to come down to reality. In the 2018 fiscal year, TSLA generated -$221 million of FCF, and in almost 4 years, its FCF has increased to $8.92 billion.

I think shares of TSLA are really starting to look attractive, especially since there is a real runway of future potential ahead of it. Due to TSLA’s FCF growth, I would get bullish around 40-45x its FCF, and I can’t believe I am about to say this, but TSLA could be a buy at these levels for investors who have an elevated tolerance of risk. TSLA has fallen over -48% YTD, and its metrics have only improved.

Steven Fiorillo, Seeking Alpha

Conclusion

I am not quite there yet, but I am starting to gravitate toward being bullish on TSLA. TSLA is doing everything right, they are defying the odds and taking market share away from the legacy auto manufacturers. TSLA is no longer a one-trick pony and has built upon its gross profit outside of autos from Q2. One of the most bullish aspects of the Q3 call was Elon’s comments on the future compact vehicle. TSLA has proved everyone wrong, and if Elon says they will have a competitive-priced compact vehicle that will exceed the production numbers of the rest of TSLA’s models, I have to believe him. TSLA’s valuation is getting much more reasonable, and it’s quite possible I could turn bullish over the next several quarters based on its valuation. TSLA has the ability to become the largest auto manufacturer in the US, and I only see its top and bottom line growing.

Be the first to comment