Rastan

Investment Thesis

Tellurian (NYSE:TELL) remains a highly speculative stock. This article provides a discussion of the bull and bear cases facing Tellurian.

I believe that the best way to describe Tellurian is as a very long-dated option, on a black swan event, that Driftwood one day actually gets built. Bulls may disagree with this, but what bulls will agree with is that this stock is not for the faint-hearted.

So, let’s get to this story’s next episode.

Tellurian’s Tales

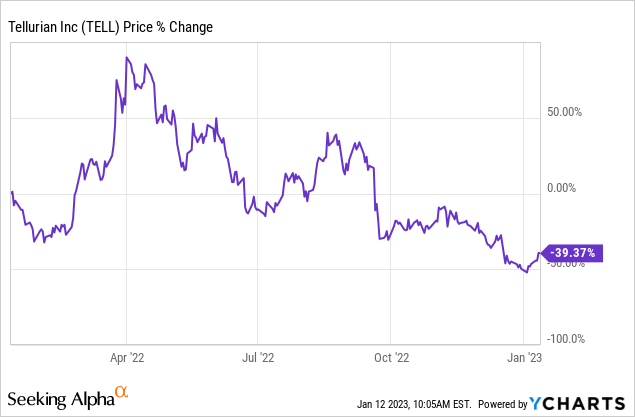

Since I wrote Pipe Dream, Tellurian’s share price has taken a tumble. Why? Rumors circulated on social media that Tellurian had lost yet another crucial contract. I’ll address this momentarily.

Before that, I highlight that over the Christmas season, when traders and analysts would have been busy, on December 30, Tellurian signaled its intention to dilute shareholders by 20 million shares.

This is not a significant dilution and amounts to less than 4%. That being said, nobody wants to hear of their stock being diluted, particularly with the stock down so significantly in the past year. The timing of this stock issuance is suspicious, to say the least.

Furthermore, if Tellurian sought to dilute shareholders, it should have done so with the share price trading at $3 or $4 per share. Not at less than $2 per share. This is not a hindsight remark. But common sense. Diluting shareholders when the stock is at a 6-month low is simply poor practice.

Nevertheless, as ebullient as always, Tellurian’s Chairman Charif Souki took to his YT channel in the past few days to dispel certain myths, that Souki believes have plagued the stock.

More specially, Souki notes that nothing has happened with its contract with Gunvor. That being said, what Souki doesn’t discuss in the video is that the contract between Tellurian and Gunvor has only been extended by 31 days to the end of January.

Tellurian’s Prospects for 2023

Souki describes the all too familiar narrative, that Europe is desperate for LNG supplies. Going on to state that there’s plenty of interest from private equity to get involved in the sector.

I believe that anyone reading this knows the spiel well. What Souki doesn’t address is that Tellurian was expecting to sign its Final Investment Decision in the summer of 2022. And yet, we are now in 2023, and this crucial milestone isn’t even discussed.

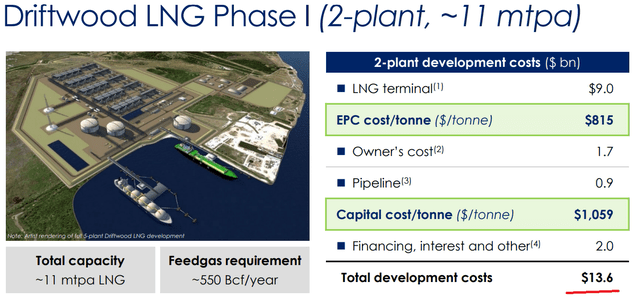

Recall, this is Tellurian’s vision. To build Driftwood, a large, fully integrated LNG facility. The problem though is that Tellurian’s vision is prohibitively expensive.

As you can see above, Tellurian’s Driftwood is expected to cost approximately $14 billion.

How Much Shareholder Dilution?

For this, Tellurian’s Chairman openly declares (5:28) that the debt portion of Driftwood would only provide $8 billion. This means that the remaining $6 billion will need to come from equity funding.

Presently, Tellurian’s market cap is around $1 billion. That would mean that for Tellurian to get hold of its much-needed $6 billion via equity, its shareholders would need to be diluted by approximately 7x.

The Bottom Line

In sum, there are three items overhanging Tellurian. Tellurian has no signed Final Investment Decision. Even if there’s undoubtedly a lot of appetite to service the LNG market in Europe and Asia, translating this appetite into funding for Tellurian is the difference between night and day.

Next, Tellurian’s share price is trading at a multi-year low. This means that investors simply aren’t buying into Souki’s vision. Yet another problem.

Finally, even if Driftwood was to be built at some point in the future, investors’ prospects will be capped, as Tellurian’s equity would need to be diluted approximately 7x.

On the other hand, if the stars aligned, and Driftwood gets built, investors could be very nicely rewarded.

Be the first to comment