Laurence Dutton

Thesis

Cambria Tail Risk ETF (BATS:TAIL) is a vehicle that aims to protect an investor’s portfolio from significant downside market risk. We stumbled upon this name earlier in the year when we were scouring the market for appropriate hedges for our portfolio. What we found out after analyzing TAIL was that it is a quasi-bond fund, composed of mainly Treasuries and some S&P 500 puts. As per the ETF’s literature:

The Fund intends to invest in a portfolio of “out of the money” put options purchased on the U.S. stock market. TAIL strategy offers the potential advantage of buying more puts when volatility is low and fewer puts when volatility is high. While a portion of the fund’s assets will be invested in the basket of long put option premiums, the majority of fund assets will be invested in intermediate term US Treasuries. As the fund is designed to be a hedge against market declines and rising volatility, Cambria expects the fund to produce negative returns in most years with rising markets or declining volatility.

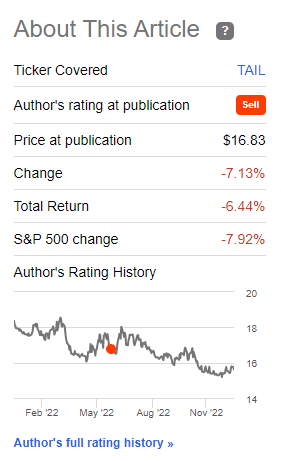

While in a normalized interest rate environment TAIL would achieve its stated goals due to the negative correlation between bonds and equities, in today’s environment it has not. We have seen a massive move down in equities and a substantial move up in yields this year. The down move in equities has been driven by a re-pricing of the risk-free rates offered by the Fed. It has been an inflation driven move in both asset classes, that drove us to assign TAIL a Sell rating earlier in the year. The fund is down more than -7% since:

Rating (Author)

We can see how on a price basis TAIL has lost more than -7%. The move has been driven by both the loss in price on the treasuries portfolio as well as the expiration of some of the puts without being triggered. 2022 has seen a very tough market develop, one that has not been linear.

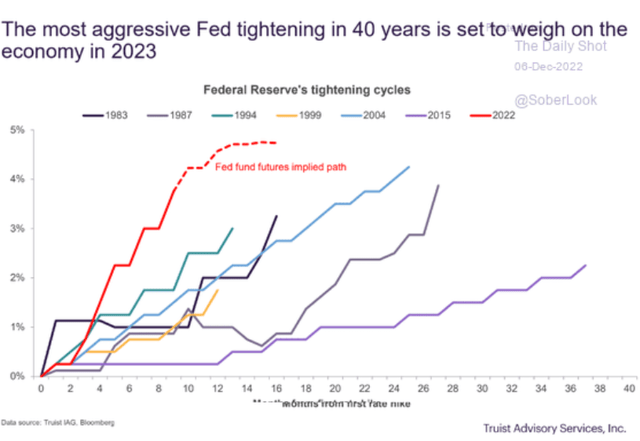

From a rates perspective, 2022 has seen one of the most aggressive Federal Reserves on record:

The net result of the violent rise in rates has been a crushing move on bond prices. Across the duration curve yields have risen 200 bps and more, creating a massive downdraft in bond prices. TAIL holds 10-year treasury bonds, which have suffered significant losses this year.

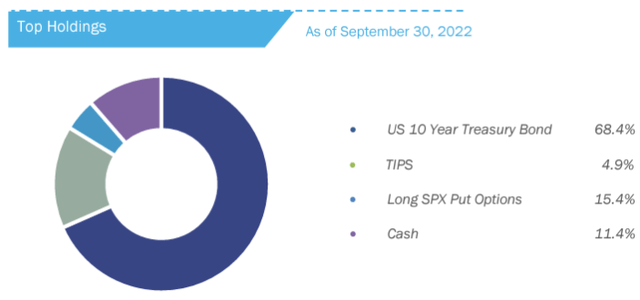

TAIL Holdings

The fund holds a mix of treasury bonds, cash and put options:

TAIL Holdings (Fund Fact Sheet)

The idea behind TAIL’s construction, is that in a normalized interest rate environment, a risk-off move comes with higher bond prices and higher volatility in equities, hence all its components are set to gain value.

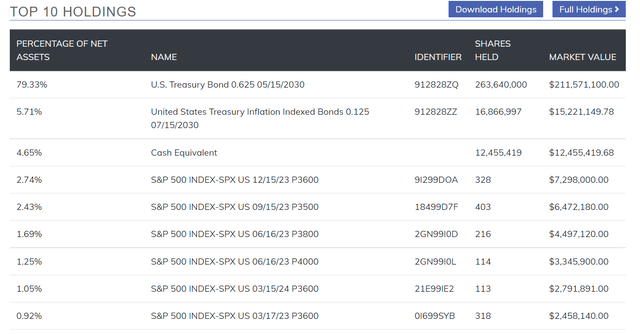

Let us have a closer look at some of the holdings:

There are a number of put options layered in this portfolio. Let us take an example – ‘S&P 500 INDEX – SPX US 03/17/23 P3600’ put option. This is a March 2023 S&P 500 put option that has intrinsic value if the index is below 3600 at that point in time. What does this mean? Unless the index goes below that value in March, the option can expire worthless. The fund does bode an active management, so we are assuming it will be traded away at some point, but the main takeaway here for a retail investor is that tail hedges via put options are not linear – if the index goes to 3000 tomorrow, but come March 2023 it is back to 3800, then the put option expires worthless without active management.

Active management is key in ensuring a portfolio of put options is maximized from a value perspective. All put options experience time decay (theta in option greeks terms) and market sell-offs are not linear. The best example for this issue is what happened to the S&P 500 in the past months – while the index went all the way down to 3600 in September, it has rebounded since, and about to close the year above that level. A December 2022 put option with a 3600 strike is set to expire worthless in a couple of days, despite the massive down move in the index in September/October.

Conclusion

TAIL is an interesting fund. The vehicle contains treasuries and S&P 500 put options, and is meant to protect an investor’s portfolio from significant downside market risk. The fund contains an overweight position in 10-year Treasuries, a TIPS bond and S&P 500 put options. While in a normalized interest rate environment we would see a negative correlation between bonds and stocks, 2022 has been different. The move down in equities this year has been driven by higher rates, which have taken a toll on government securities as well. We believe most of the move higher in rates is now behind us, thus the 10-year treasury component for TAIL has stabilized. We believe the fund does a good enough job in managing the time decay on its put options, and going forward it will again provide for some protection on the downside in risk-off environments for stocks. We are therefore moving from Sell to Hold on this name after the drawdown.

Be the first to comment