jetcityimage/iStock Editorial via Getty Images

Shares of T-Mobile (NASDAQ:TMUS) have been a rare bright spot in a challenging stock market, up over 10% the past year, far outpacing rivals AT&T (T) and Verizon (VZ), which are each down over 20%. This outperformance in the stock market mirrors TMUS’s outperformance in operating results. However, with shares having done so well, I believe the good news is more than fully priced into the stock and would recommend taking profits.

To reiterate, T-Mobile’s business is performing well as the company has taken share from Verizon and AT&T. Last quarter, it added 1.7 million postpaid customers with a churn that was below Verizon’s for the first time ever. These net adds beat VZ and T’s combined performance. This customer growth led to a 6% increase in revenue to $15.3 billion and a 10% rise in core EBITDA to $6.6 billion. Free cash flow was a strong $1.8 billion.

This revenue growth is being driven by winning over new customers, not raising prices. In fact, T-Mobile’s pledge not to raise prices despite a period of high inflation has clearly helped it win over customers. While the company has marketed this pledge as part of its disruptive image, this commitment is really a legacy of its pledge to the FCC not to raise prices for three years after its completion of the Sprint acquisition. It has been a shrewd marketing move to turn a regulatory concession into a pro-customer commitment, and we will see if TMUS begins to implement price increases when this commitment expires next April. Price increases could lead to revenue growth off of its customer base but also slow its momentum in winning over new customers.

T-Mobile has also closed the pricing gap more than might be expected given its marketing. In fact, its postpaid average revenue per account of $138 is slightly higher than Verizon’s.

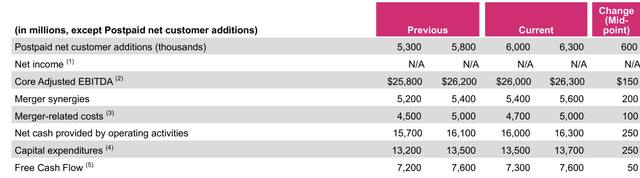

Based on the company’s strong Q2 results, it raised guidance across the board. TMUS expects to add over 6 million customers this year, driving over $26 billion in EBITDA and about $7.5 billion in free cash flow. When the company reports earnings in a few weeks, I expect another strong set of results. Subsequent to Q2, the company announced a $14 billion buyback program, including $3 billion it expects to repurchase over the balance of the year. That announcement points to ongoing strong operating performance.

For many years, TMUS was a discount carrier with a lower quality network-in other words you got what you paid for. While TMUS is trying to retain its discount pricing image, it has done so while greatly improving the quality of its network. In fact in some studies, T-Mobile has the best 5G network, though Verizon has been making up ground as it deploys C-Band spectrum. Other studies still put Verizon on top. Either way, it is safe to say that after years in which T-Mobile greatly lagged its competitors in network quality, it is now on par. A comparable network with price discipline has been a recipe for success.

As of Q2 2022, T-Mobile is the second largest wireless carrier with 110 million customers, well ahead of AT&T’s 102 million but far behind Verizon’s 143 million. Again, what T-Mobile has accomplished is extraordinary. After one being an after-thought alongside Sprint behind the “Big Two” of Verizon and AT&T, the US wireless market is now truly defined by the “Big Three” with TMUS a veritable peer competitor. That is why the stock has performed so well. At this point though, investor enthusiasm appears fully baked into the share price.

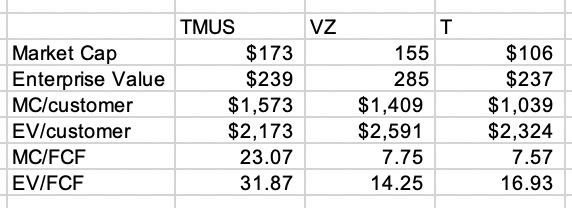

At a $138 share price, TMUS has a $173 billion market capitalization. Alongside that, T-Mobile carries about $66 billion in debt. For comparison, AT&T is worth $106 billion with $131 billion in net debt. Verizon has a $155 billion market capitalization with $130 billion in net unsecured debt. By market cap, TMUS is now the most valuable US wireless carrier, though its enterprise value still lags VZ.

While T-Mobile is growing, its $7.5 billion free cash flow is still below peers. Verizon is set to generate about $20 billion in free cash flow. AT&T anticipates generating about $14 billion in free cash flow. Below, you can see how TMUS’s valuation compares to AT&T and Verizon. On a free cash flow basis, TMUS screens much more expensive. On a price/customer basis, TMUS is more expensive on a market cap basis but not on an enterprise value basis.

My own calculations

It is important to note that while the wireless units drive the vast majority of value for AT&T and Verizon, they do have cash-flow generative wireline units with U-verse and FiOS respectively. That is one reason they generate more free cash flow than T-Mobile and overstate their multiples to wireless customers. In essence, TMUS needs to triple its free cash flow to reach the same FCF multiple as VZ and AT&T. While it may grow cash flow more quickly, this dramatic of an outperformance is unlikely unless you expect TMUS to win substantial shares of VZ/T’s existing customer base and cause their cash flow to decline. While TMUS is growing more quickly, we are not seeing evidence of substantial erosion of VZ or T’s wireless base.

Additionally, as noted above, T-Mobile’s network quality has improved, as they moved quickly on 5G, but Verizon’s network is comparable. Additionally, much of TMUS’s discount reputation actually is over-stated with revenue per account on the post-paid business comparable, and T-Mobile’s larger pre-paid business could face exposure from a weakening economy, given its lower-income customer.

The US wireless market is likely to be defined by significant competition as there are three strong competitors. TMUS’s valuation is discounting runaway growth, which will be difficult to continue in this environment. While increased buybacks can support the share price, trading at a 10% premium to VZ’s market cap/wireless customers is excessive given VZ’s premium brand, higher free cash flow, and wireline business. I would look for shares to fall toward $120 before I would consider buying. While owning TMUS over VZ has been the right trade the past year, I would take the profit and now sell TMUS to buy VZ.

Be the first to comment