Jaiz Anuar

Synchronoss Technologies (NASDAQ:SNCR) has come a long way in improving its financial results. It used to be buffeted with high cost and a death spiral 14.5% yielding preferred stock which it finally got rid of in June 2021.

The company has three segments:

- Personal cloud (65% of revenue Q3/22), which is the fastest growing segment and also generates the highest margins. It offers white-label cloud storage, mainly for carriers like AT&T (T) and Verizon (VZ) as major customers.

- RCS messaging, the next-generation messaging platform which has the main Japanese carriers as clients (but also some revenue from Italy with its Email suite). Verizon has also jumped on board here, but that’s still in its infancy.

- Digital portfolio, part of the latter (DXP) was sold to iQmetrix in March/22 for $14M (closed in May/22).

Positive developments

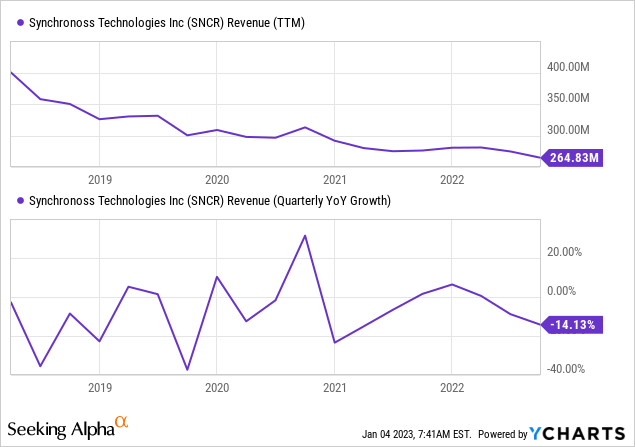

Despite the depressing picture painted by the above figure, we see a number of positive developments that are contributing to an improving perspective, despite the ugly revenue headline.

Personal cloud is doing well

Growth will have to come from adding features and users at existing customers (like AT&T and Verizon) and gaining new customers (which they look like doing as they announced a letter of intent with a global tier 1 carrier).

5G should open more use cases and storage needs and carriers increasingly bundle services, often including cloud storage which should also act as a tailwind.

FWA (fixed-wireless access) opens up the enterprise and home internet market for carriers and a host of new connected device types, in need of storage for the data they produce.

The main KPIs:

- Cloud subscribers +15%, which was the 10th consecutive double-digit growth quarter.

- Cloud invoice revenue, which is the best proxy for cash +6.8% to $37.8M, and +70.8% YTD.

The company extended its contract with AT&T and added a provision to its contract with Verizon to leverage its private storage infrastructure. Most notable, it signed a letter of intent with a new global tier 1 carrier, that will provide roughly $1M in professional services in Q4 and some $50M for the duration of the contract.

It added new cloud features like backtrack (recovering from ransomware or malware), secure folder, and Genius (machine learning) for photo optimization.

RCS

In RCS (rich communications services), they just reached 32.5M subscribers in Japan with their main carrier customers (NTT DOCOMO, KDDI, Softbank), up 62% since November 2020, introducing innovative features:

it now supports public personal identification (JPKI) with My Number cards, allowing the users to open a bank account or use a credit card with easy and secure verification of the identity via +Message, delivering more engaging experiences within the mobile ecosystem.

The combined thrust of US carriers for introducing RCS has fallen apart and Verizon is going alone as a Synchronoss customer, but it’s early days yet. Encouraging is that they are seeing A2P traffic on their RCS platform with Verizon, and are anticipating more brands coming on board.

One of the main growth drivers here is A2P (app to person), which is used by businesses as a low-cost way to market via chat applications as 98% of messages are opened by the receiver. RCS offers more features here.

Digital

The company’s digital services will be rebranded into NetworkX as its core value proposition (for carriers) is to significantly increase the utilization of network infrastructure assets and services while reducing costs.

It consists of two platforms, ConnectNX and spatialSUITE. The ConnectNX platform evolved from its iNOW and Virtual Front Office products and enables partners to conduct business on a blockchain-distributed ledger.

It signed a multi-year deal for ConnectNX with Consolidated Communications, a leading broadband business solution provider

The spatialSUITE platform is a network design and digital infrastructure management platform used by customers across industries, including Comcast, Rogers, and Lumen Technologies.

The company sold its DXP and Activation businesses to iQmetrix in March/22 for $14M (closed in May/22) of which they have received $7.5M.

Finances are improving

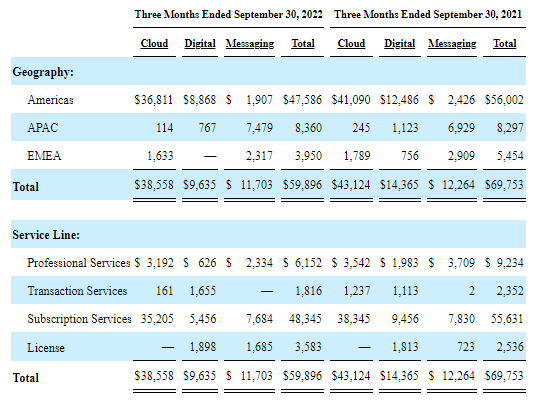

From the 10-Q:

SNCR 10-Q

- Operating income improving a lot as OpEx fell from $53M in Q3/21 to $36.2M in Q3/22.

- YTD Adj EBITDA +20% to $37.2M and 20% AEBITDA margin (+500bp)

- Adj free cash flow +$6.6M to $2.8M y/y

- Financial improvements despite one-off headwinds in Q3

- Recurring revenue 83.7% of revenue down 290bp q/q

- $11.8M improvement to operating income driven by a $21.7M reduction in costs and expenses during the period resulting in a $55M improvement YTD

About those one-off headwinds (Q3CC):

An expected $4.2 million run-off in deferred revenue, the $2 million impact from the sale of the DXP and Activation assets earlier this year, $1.8 million in unfavorable revenue impact from foreign exchange

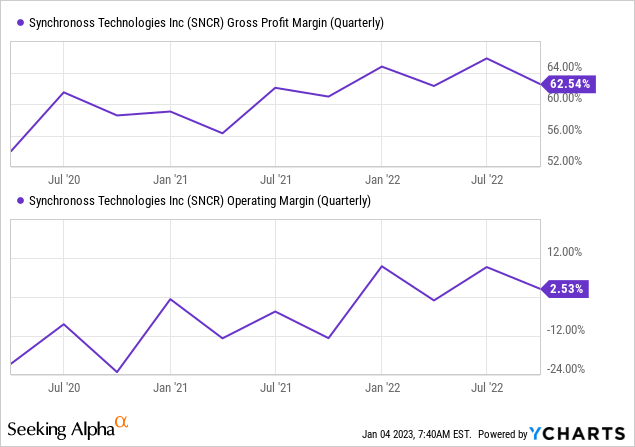

The trend in gross and operating margins is clearly up:

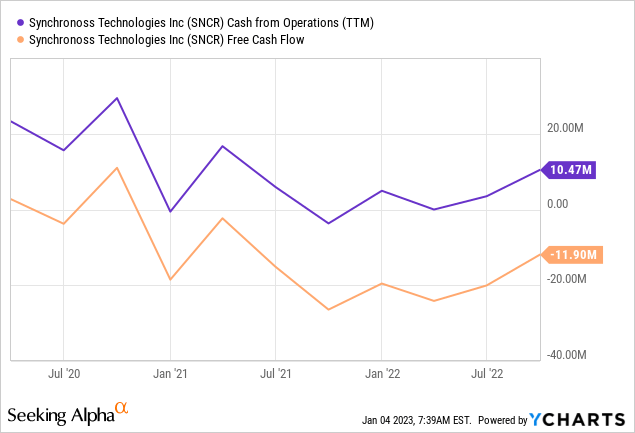

Gross margins rise on cost savings and product mix, which is shifting in favor of the higher-margin personal cloud. Operating costs have been driven down by cost-cutting (and a divestiture). Operational cash flow is already in the black and free cash flow is almost there (the graph is on a TTM basis), it was just a negative $700K in Q3.

The debt in the form of notes carrying a rate of 8.375% interest is a bit of a problem as that amounts to $11M in interest payments a year. The notes expire in 2026.

Then there are $75M of non-convertible series B preferred shares which Riley took as part of the refinancing last year. These fetch a dividend of 9.5% in 2021 rising to 13.5% in 2022 and 14% in 2023, payable each quarter. so that’s another $10.5M in dividends a year (from 2023 onwards).

After five years these shares can be redeemed in cash (the $75M plus accumulated dividends) or 1.5x the shares (plus accumulated dividends). No kidding.

Valuation

Some data:

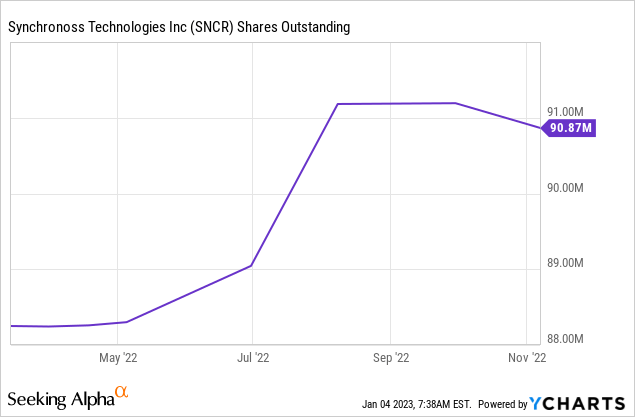

- 90.9M shares outstanding

- 2.6M options

- There is quite a number of unvested items, like 4.8M unvested RSU and 6.2M unvested cash units so the share count could rise further

- $22.6M in cash

- $134.2M in debt

- $75M in preferred non-convertible series B shares (at present at a $73M redemption value)

- FY22 revenue guided at $256M

- Market cap (at $0.6 per share) of $56M

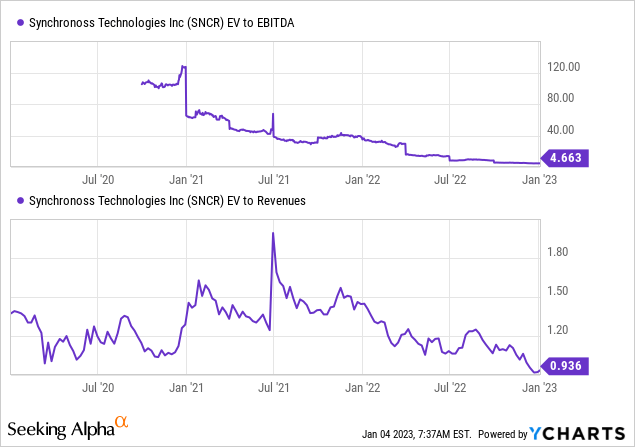

- EV of $240.7M

So the shares trade at 0.94x FY22 EV/S. There is a potential for these series B shares to create havoc as investors (Riley) have the right to redeem them in normal shares at 1.5x $75M + accumulated dividends.

So keep an eye on an item in its accounts called Liquidation value. Apparently, they have been paying the dividends in cash until today as (10-Q, our emphasis):

As of September 30, 2022, the Liquidation Value and Redemption Value of the Series B Preferred Shares was $73.0 million… On April 1, 2022 the Company paid in-kind the accrued Series B Perpetual Non-Convertible Preferred Stock dividend of $2.4 million. On April 18, 2022, the Company made a $2.5 million principal and interest payment to redeem 2,438 shares of Series B Preferred Stock. On May 10, 2022, the Company made an additional $4.4 million principal and interest payment to redeem 4,300 shares of Series B Preferred Stock. On October 3, 2022 the Company paid the accrued Series B Perpetual Non-Convertible Preferred Stock dividend of $2.3 million in form of cash.

But whether they’ll be able to keep doing that remains to be seen.

Analysts expect an EPS of $0.20 this year, falling to $0.14 next year, which surprises us given the ongoing improvements, the recent revaluation of the yen and the signed letter of intent with a global tier 1 carrier. In any case, the shares are trading on low multiples.

Conclusion

- There is considerable financial progress at the company even despite falling revenues.

- While Q3 was plagued by one-off headwinds, Q4 looks better as the yen is rising again and the company signed a letter of intent with a global tier 1 carrier.

- While the company got rid of its death spiral preferred stock that had accumulated to a $278.5M liability rising at 14.5% a year, it’s not entirely out of the woods with some $21.5M in interest and dividend payment obligations a year on its existing debt and preferred shares. Operational cash flow is not yet large enough to deal with that.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment