mysticenergy

Introduction

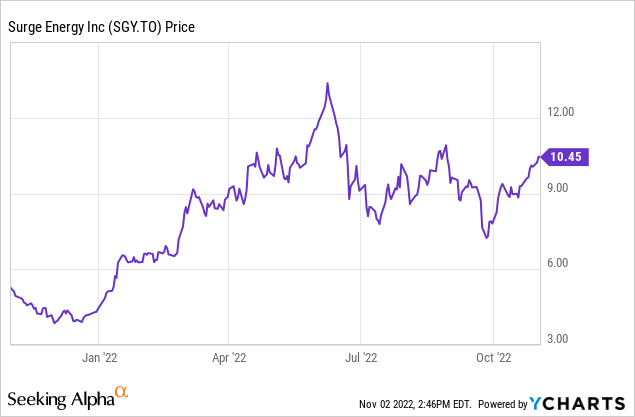

Surge Energy (TSX:SGY:CA) (OTCPK:ZPTAF) is one of the more intriguing Canadian oil and gas companies. I currently don’t have a long position in the stock, but I owned both issues of convertible debentures. Surge repaid one of those debentures before the maturity date, and the one remaining convertible debenture has a 6.75% coupon and matures in June 2024. I intend to hold that debenture until it matures or until it gets repaid ahead of time. Surge just released its Q3 results and as the net debt position continues to decrease, Surge Energy shareholders can look forward to seeing the shareholder rewards double by the summer of next year when the next debt threshold should be reached.

Decent production results and excellent financial results in Q3

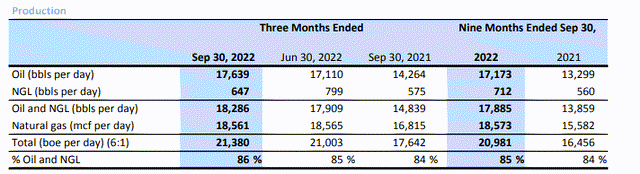

During the third quarter, Surge Energy produced an average of just under 21,400 barrels of oil equivalent per day, with approximately 86% of this equivalent number represented by oil and Natural Gas Liquids.

Surge Energy Investor Relations

The company was able to secure a price of just under C$103 per barrel of oil (including the impact of the hedges) while it sold the NGL at just under C$66 per barrel. The natural gas was sold at an average of C$5.21 per Mcf. I am quite happy with Surge’s realized natural gas price as the company achieved an average price level of about 20% above the AECO natural gas price thanks to its diversification into the US natural gas market as the Chicago Citygate natural gas price was US$7.38 (closer to C$10/mcf) which really helped to boost the average realized natural gas price.

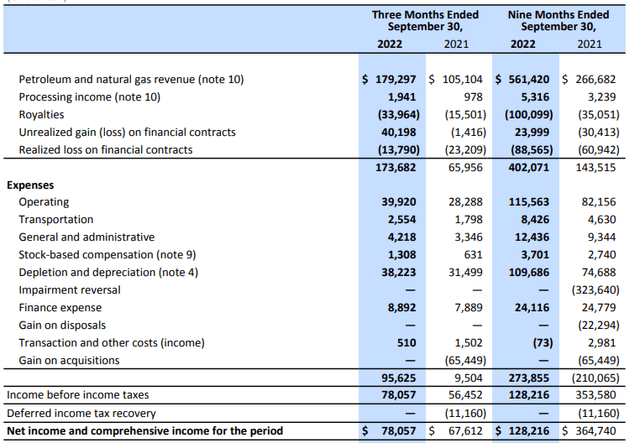

The total reported revenue from oil and gas sales during the quarter came in at just under C$180M and the reported net revenue (including the royalty payments and a net C$27M gain on the hedge book) was C$174M. Surge is still a low-cost producer as the total operating expenses came in at just under C$96M with in excess of 40% of these expenses consisting of non-cash depletion and depreciation expenses.

Surge Energy Investor Relations

The reported net income was C$78M for an EPS of C$0.93/share, but keep in mind this includes almost C$27M in hedging gains.

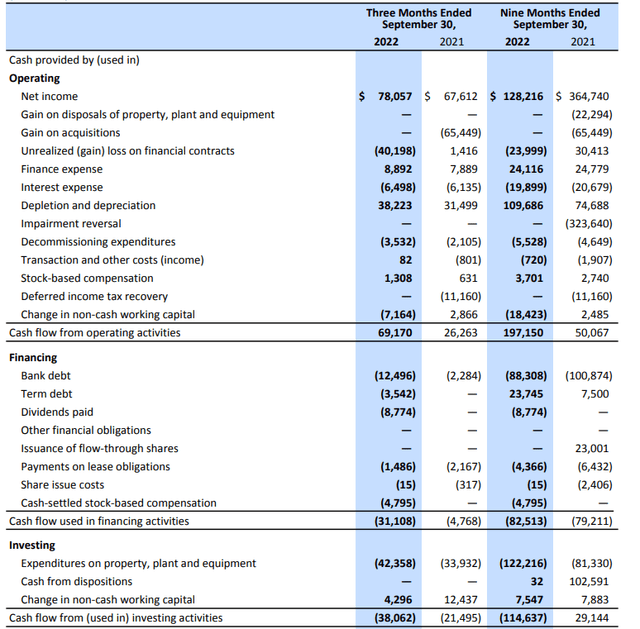

The cash flow statement provides more useful insights as it obviously excludes the non-cash hedging gains and losses. As you can see below, the total reported operating cash flow was C$69.2M, which increases to just under C$75M after adding back the working capital investments and deducting the C$1.5M lease payments.

Surge Energy Investor Relations

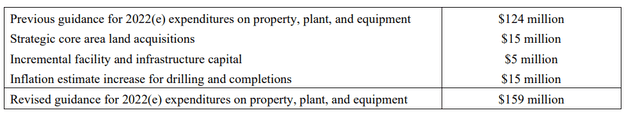

You also see about C$40.2M in unrealized gains was deducted from the cash flows, but this still means about C$13.8M in realized losses were included in the C$75M adjusted operating cash flow. On an underlying basis at C$120 WTI, the operating cash flow would actually have been almost C$90M. The total capex was C$42.4M, and Surge Energy remains on track to spend almost $160M this year (including acquisitions).

Surge Energy Investor Relations

The net debt continues to decrease fast

The strong cash flow also helped Surge to rapidly reduce its net debt. As of the end of September, Surge had just under C$49M in short-term debt and about C$196M in long-term debt. Subsequent to the end of the quarter, the C$44M in convertible debentures that made up the largest portion of the current debt was repaid (those were the 5.75% convertible debentures, which had a maturity date of December 2022). As of the end of September, the net debt had decreased to approximately C$240M. It should also see its interest expenses gradually decrease from now as the 5.75% debenture has now been repaid and as Surge’s continuous debt repayments will obviously also continue to reduce the gross debt.

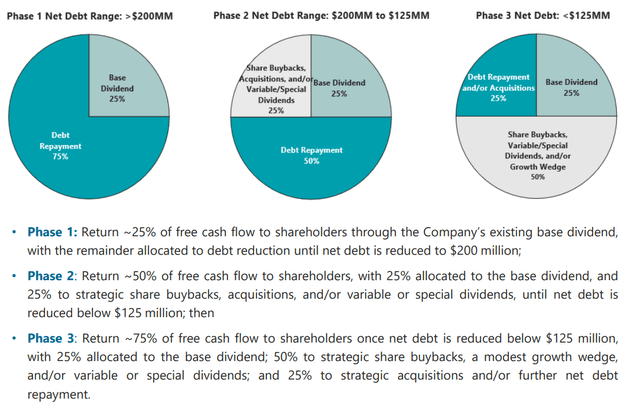

In its accompanying press release, Surge estimates it will reach the next net debt milestone (C$200M in net debt) by the end of Q2 2023. This estimate is based on US$80 WTI so every day the oil price exceeds that level will reduce the timeline to actually reach that C$200M level. And as you can see below, reaching C$200M in net debt will allow Surge to double its shareholder rewards.

Surge Energy Investor Relations

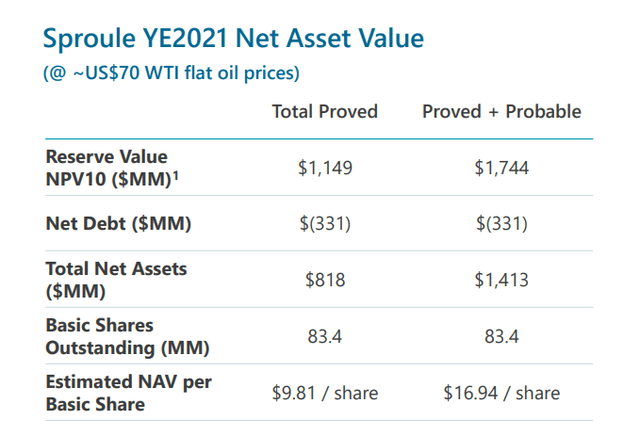

Surge is currently paying a monthly dividend of C$0.035 or C$0.42 per year for a current yield of approximately 4%. Once that new debt threshold is met, we will likely see a combination of higher dividend payments and perhaps a share buyback as the stock is still trading substantially below its NAV at US$70 WTI.

Surge Energy Investor Relations

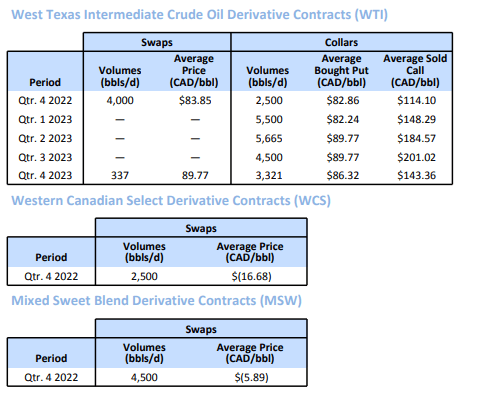

The remaining hedge book is dwindling down, and the following table shows all remaining hedges in place for the anticipated oil production.

Surge Energy Investor Relations

Investment thesis

I own the 2024 debentures of Surge Energy, and I have very little doubt the company will be able to repay these debentures when they mature in June 2024 (or even before that date). Surge Energy has its priorities straight as the immediate focus is still on reducing the net debt to a level below C$200M before increasing the shareholder payouts.

I am considering going long the common shares as well, but I’m in no rush as I need to be careful how I deploy my cash resources.

Be the first to comment