Cynthia Parris/iStock via Getty Images

Investors were expecting Sunrun’s (NASDAQ:RUN) fiscal 2022 third quarter results to be strong, but they got a gangbusters earnings report which initially saw common shares surge nearly 19% in the trading day following publication. There was a lot for investors to be excited about, including year-over-year revenue growth that was up by 44% and a near doubling of value per subscriber on a sequential basis.

The results are a strong vote of confidence in home solar, which has had its strong share of naysayers over the years. Indeed, most home solar companies from Sunrun to SunPower (SPWR), Sunnova (NOVA), and Pineapple Energy (PEGY) are still unprofitable on a GAAP basis and burning cash many years after they were founded. But this ignores the broader context of the inherent scale that comes with a growing customer install base and greater pricing power.

Growth Is Going Gangbusters

Revenue for the company’s fiscal 2022 third quarter was $631.9 million, a 44% increase from its year-ago quarter and a beat of $63.28 million on consensus estimates. The reason for such strong growth was multifaceted.

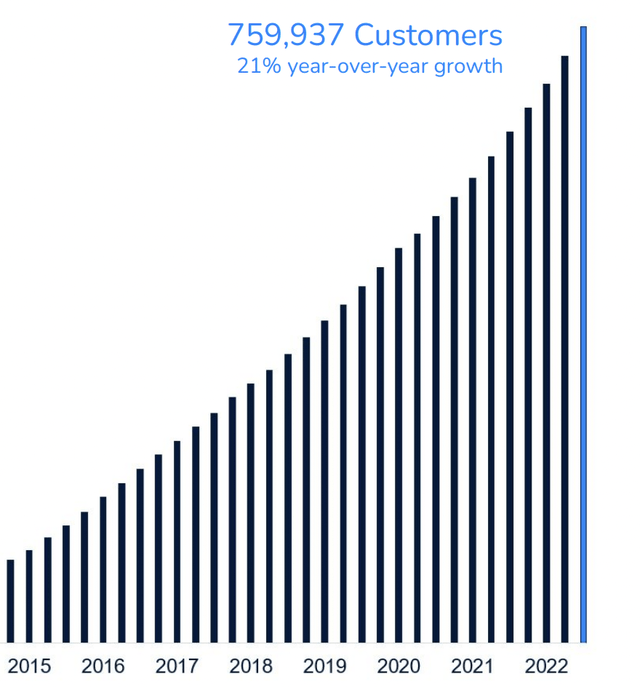

First, the company signed up a record number of customers for its total to reach just under 760,000. This was an increase of 21% over the year-ago quarter. More US households looked to home solar to decouple from fossil fuel-heavy power grids, enhance resiliency in the wake of extreme weather events seen during the quarter including Hurricane Ian, and reduce skyrocketing utility bills.

Secondly, the company grew new home solar installations by 17% year-over-year to 256 MW. This exceeded the midpoint of its guidance range but was dampened by the hurricanes in Florida and Puerto Rico hitting sales and installation activities in September. The company expects its solar energy capacity installed base to increase by at least 25% for the full fiscal year 2022. Next year will likely see growth come in even more strongly as the Inflation Reduction Act continues to kick in to provide homeowners with dual 30% tax credits on solar systems and energy storage technologies. This would see Sunrun’s customers get nearly a third of their home solar cost back.

Finally, the value of each Sunrun subscriber rose to $13,259, up from $7,910 in the prior quarter as the company used its scale to hike prices without hurting underlying demand momentum. Indeed, it added 35,760 customers during the period, including 25,468 subscriber additions. A subscription allows households to lease a home solar system for a monthly fee and with an almost zero-dollar down payment. Total subscribers as of the end of the quarter were just under 640,000 for annual recurring revenue of $969 million. The average contract life remaining stood at 17.6 years.

Sunrun recorded a gross profit of $110.6 million during the quarter, up sequentially from $89.5 million and by 20.5% from the year-ago figure. However, cash burn from operations was still negative at $90 million. This was a material improvement from an operational cash burn of $180 million in the year-ago quarter. The improvement came from enhanced pricing combined with positive cost-efficiency efforts during the quarter. General and administrative expenses declined by 6.4% year-over-year to a new low of $1,100 per new customer addition. This was a 20% improvement from the year-ago figure. New partnerships were also formed, including with Puerto Rico’s electric utility provider that will see Sunrun develop a 17 MW virtual power plant.

Short-Term Volatility Should Be Viewed In Context

Sunrun’s common shares have all but given back their IRA-inspired rally as the broader macroeconomic environment continues to simultaneously present challenges and new opportunities. Fundamentally, the company’s subscription model and cost-efficiency measures have opened up a pathway to profitability just as consumer demand for home solar is set to explode higher on the back of the IRA. With this now forming a significant part of the bull case, the potential switch of both the Senate and the House from the current administration has been flagged as a risk. So it is important to note that none of the IRA’s provisions can be scrapped as long as the President remains in office.

With COP27 underway, more spotlight will be shone over the next few weeks on the importance of companies like Sunrun in the long drive to decarbonization. Hence, the pullback of the company’s commons raises the spectre of alpha in the years ahead once the IRA actually starts feeding more rapidly through to subscriber growth and potential profitability.

A decade-long environment of growth boosted by tax credits and a healthy policy environment lies ahead for Sunrun. The decarbonization of energy now forms one of the most immediate post-pandemic needs for US policymakers racing to reduce the country’s contribution to anthropogenic climate change Sunrun could make a good addition to a climate focus investment strategy, but the near-term upside will be limited against continued market volatility.

Be the first to comment