cemagraphics

As 2022 draws to a close, I think we can all agree that, from the point of view of many investors, it was a spicy meatball. Both stocks and bonds dropped precipitously, with the (TLT) ETF down about 31% year to date, and the (SPY) ETF down about 21% year to date. After a surprisingly social Christmas season for me this year, I’ve come to the conclusion that people are much more concerned about return “of” capital, rather than return “on” capital. Because I absolutely live to give you people what you want, I’m going to offer up what I consider to be relatively safe, steady, but underfollowed name for your enjoyment and edification. Today I’ll be writing about Stella-Jones Inc (OTCPK:STLJF). I first bought this stock way back in February of 2018.

I added to it just under a year and a half later. I thought I’d check back to see if it makes sense to add at current levels. I’ll make that determination by looking at the financial history here, and by looking at the valuation.

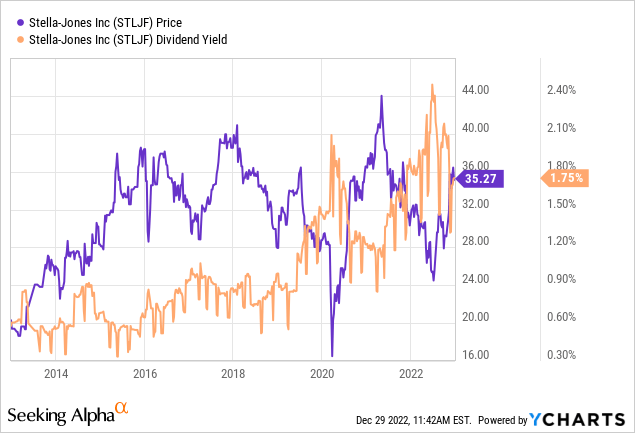

Welcome to my ubiquitous “thesis statement” paragraph. It’s here where I offer my readers the “gist” of my thinking up front. This potentially insulates them from the tedium within. This is helpful for many because my writing can be “a bit much.” I think this is a growth company, as evidenced by the fact that they’ve grown revenue at a CAGR of about 14% over the past decade, while growing net income at a CAGR of about 12%. Additionally, management has rewarded shareholders handsomely by raising the dividend in each of the past seven years. In spite of all of this, the stock is trading near record low valuations, and the dividend yield is near record highs. For that reason, I’ll be adding to Stella Jones over the next few days.

Company Background Of This Non-Correlated Stock

Before getting into the analysis proper, I think it would be helpful to introduce the company to investors, as it’s neither well known nor well covered on this platform. Stella-Jones is a producer and marketer of pressure treated wood products. The company supplies North America’s Class 1 and short haul railways with railroad ties. It also supplies electrical utilities and telecommunications companies with utility poles. Finally, it manufactures and distributes residential lumber and accessories to retailers throughout North America.

As of January 1st of this year, the company operated 27 wood treating facilities in The United States, and 15 in Canada, and a total of 12 pole peeling facilities. This is basically a “play” on North American infrastructure spending by utility companies and by the Class 1 railroads.

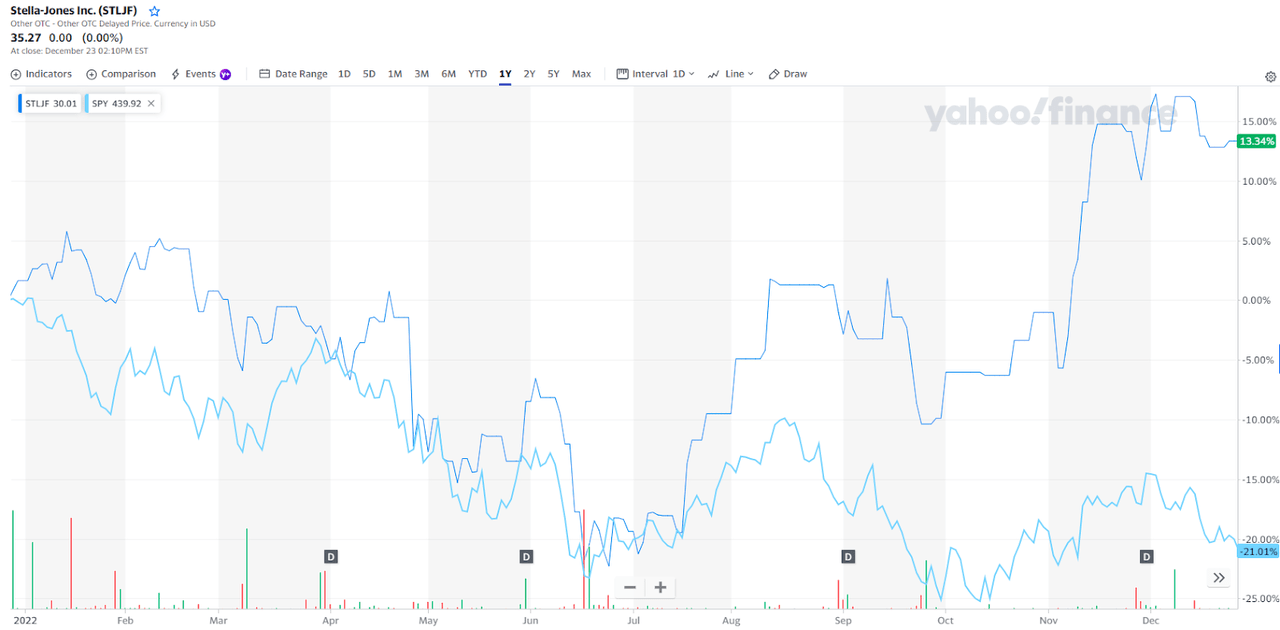

I particularly like the company because the stock is not always highly correlated to the overall market. Because people love pictures, here’s a picture of the stock’s relative performance so far in 2022.

Stella Jones V SPY (Finance.Yahoo.com)

The stock generally tracked the S&P 500 until the late summer, at which point it started to massively outperform the S&P 500.

The Railway Tie Association (yes, there is such a thing) predicts stable demand for the product in the face of the predicted upcoming recession and ongoing labor woes. For that reason, I think there’s still some growth here, and I’d be very happy to buy more of this stock if the stars align.

Financial Snapshot

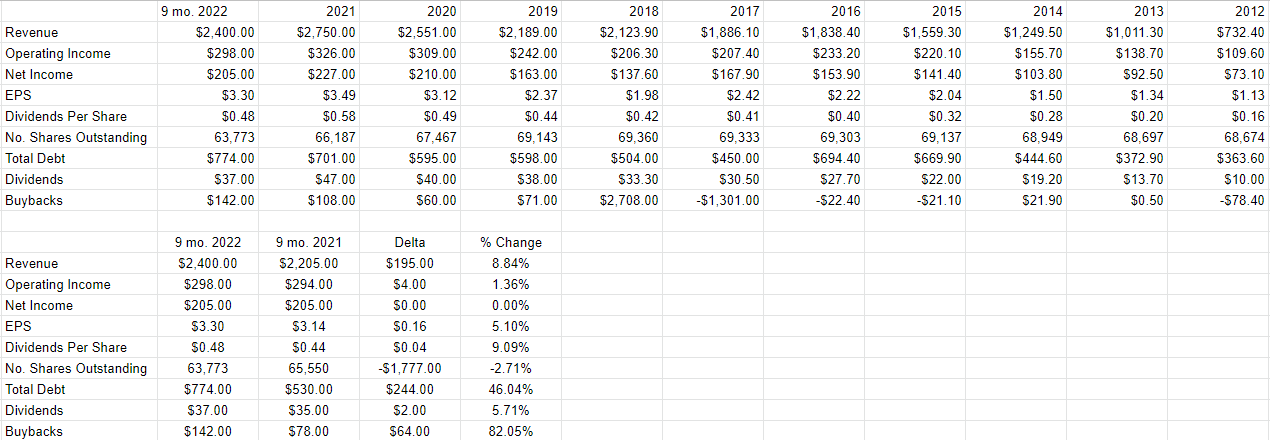

I feel sort of strange writing about Stella-Jones because I’m a complainer, and there’s little for me to complain about here. The company has grown rather well over the past several years, with revenue having grown at a CAGR of 14% over the past decade, and net income up at a CAGR of about 12% over the same time period. The growth seems to be intact here, given the past nine months. Specifically, revenue during the first nine months of this year is up about 9% relative to the same period a year ago. Although net income hasn’t risen, EPS were up about 5% on the back of a strong buyback program. Additionally, the company grew the dividend yet again, which extends the track record of dividend raises to 7 years.

Finally, the capital structure is relatively secure in my view. Although the level of debt is up dramatically over the same period a year ago, it’s still “only” $774 million Canadian dollars on a company that generates annual net income of about $227 million.

I’d be very happy to add to my Stella Jones position at the right price.

Stella Jones Financials (expressed in Canadian dollars) (Stella Jones investor relations)

The Stock

Those of you who read my stuff regularly for some reason know that I have talked myself out of some great investments with the phrase “at the right price.” As a starting position, I’m not willing to overpay for an investment, because what the market giveth, the market eventually taketh awayeth. So just because a company like Stella Jones is growing well, that’s not enough in my view. This is because “companies” and “stocks” are different things. It’s also time for me to be a total “buzzkill”, as the young people say, because I remind investors that a great, solidly profitable company like this one, can be a terrible investment at the wrong price.

Taking the first point first, the business generates revenue and profits, and the stock is a speculative instrument that gets traded around based on long term expectations about the business. Given that the financial statement valuation of the business is “backward looking” and the stock is a forecast about the distant future, there’s an inevitable tension between the two. The tension is highlighted by the fact that the business is about selling railway ties, power poles etc. The stock, on the other hand, is a piece of virtual paper that is traded around, buffeted by a host of factors having little or nothing to do with the underlying business. One of the things that affects the performance of a given stock, for example, is the crowd’s ever-changing views about the desirability of “stocks” as an asset class. There’s no way to prove this definitively, as it’s an obvious counterfactual, but a reasonable argument could be made to suggest that Stella Jones would have done even better in 2022 had the market not dropped 21%. I don’t know if you follow the financial news, but the mood about “stocks” as an asset class has been mixed lately. This attitudinal shift may have resulted in a bit of a reduction in the demand for the shares of robust companies like this one.

So this is why I consider the stock as a thing distinct from the business. The former is often a poor proxy for what’s going on at the company, and I think it’s possible to profitably exploit this disconnect. In my view, the only way to successfully trade stocks is to spot the discrepancies between what the crowd is assuming about a given company and subsequent results. What I want to see in this regard is a stock that the crowd is somewhat pessimistic about that goes on to exceed expectations. When the crowd is pessimistic, the shares are cheap, which is why I try to buy only cheap stocks.

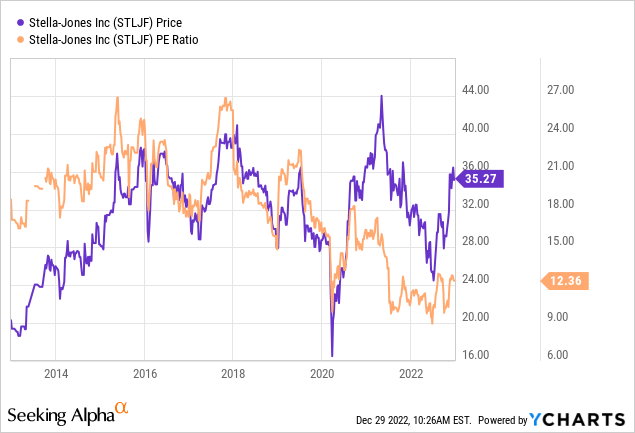

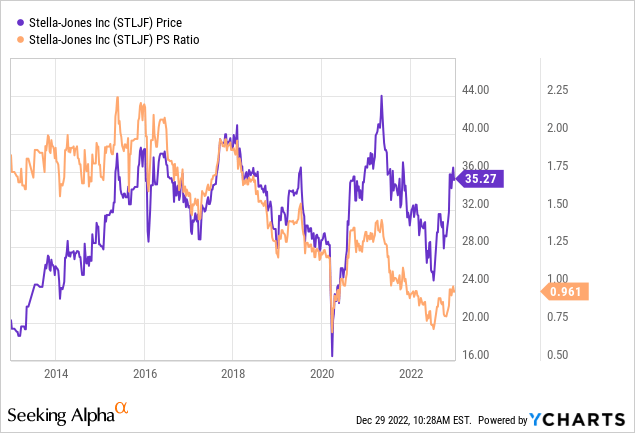

In my previous piece, in case you’ve forgotten, I got excited about this company because the shares were trading at a PE of about 21. Fast forward to the present, and the shares are quite cheap in my estimation, which is odd given the growth on display. The PE is near a decade low of about 12.4, and the market is paying only $.96 for $1 of sales. I like the combination of a growth business trading near record low valuations. I also like the fact that the dividend yield is sitting near the high side per the following:

My regulars know that I think ratios can be instructive, but I also want to try to work out what the market is “thinking” about a given investment. If you read my stuff regularly, you know that the way I do this is by turning to the work of Professor Stephen Penman and his book “Accounting for Value” for this. In this book, Penman walks investors through how they can apply some pretty basic math to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in this formula. In case you find Penman’s writing a bit opaque, you might want to try “Expectations Investing” by Mauboussin and Rappaport. These two have also introduced the idea of using the stock price itself as a source of information, and we can infer what the market is currently “expecting” about the future. Applying this approach to Stella-Jones at the moment suggests the market is assuming that this company will grow earnings at a rate of only ~.5% in perpetuity. I consider that to be a pretty pessimistic forecast for any company, but is especially so in this case in my view.

Given all of the above, I’ll be adding to my position here. I really like the fact that this growth company continues to fly under the radar of most investors. I really, really like getting robust growth for a cheap price.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment