Stanley Black And Decker Scott Olson/Getty Images News

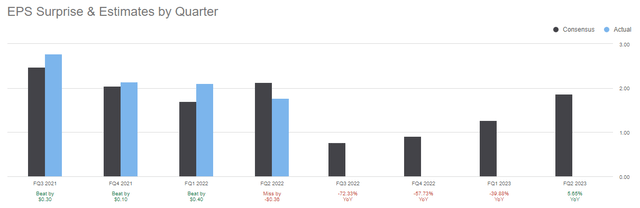

Since my last article on Stanley Black & Decker, Inc. (NYSE:NYSE:SWK), shares have broadly underperformed the market. Clearly, my timing was off, but we’ll see if the underlying thesis is still intact. For starters, SWK shocked the market by cutting its earnings guidance from $9.50-$10.50 to $5.00-$6.00 over consumer demand and its scheduled pricing increases. That’s the worst level since FY13, which printed an EPS figure of $4.98.

In a way, this validates the bearish thesis that SWK will need to work through an inventory overhang. Analysts have been bringing up the concern that SWK is not only losing sales from consumer demand weakness, but also due to competition. If that’s the case, management will have even greater difficulty raising prices in order to meet competitors and thus establish pricing equilibrium in the marketplace.

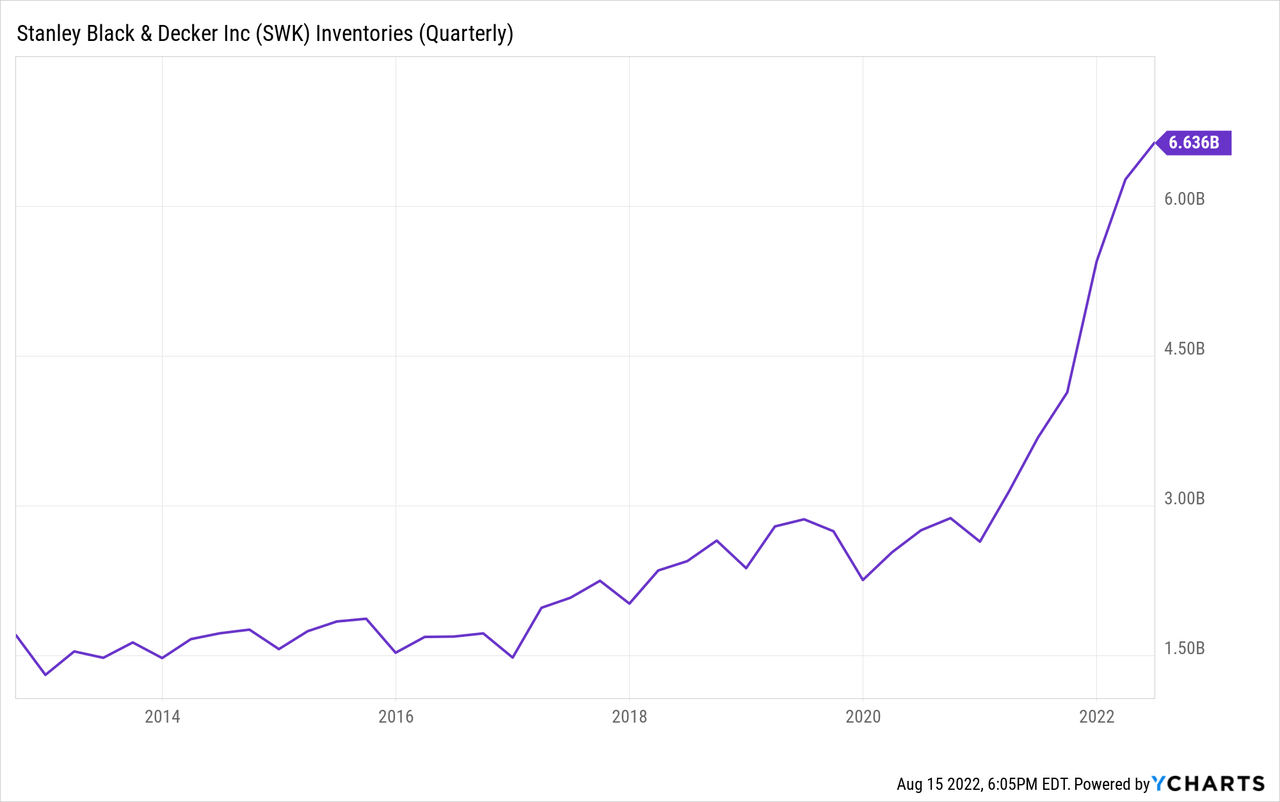

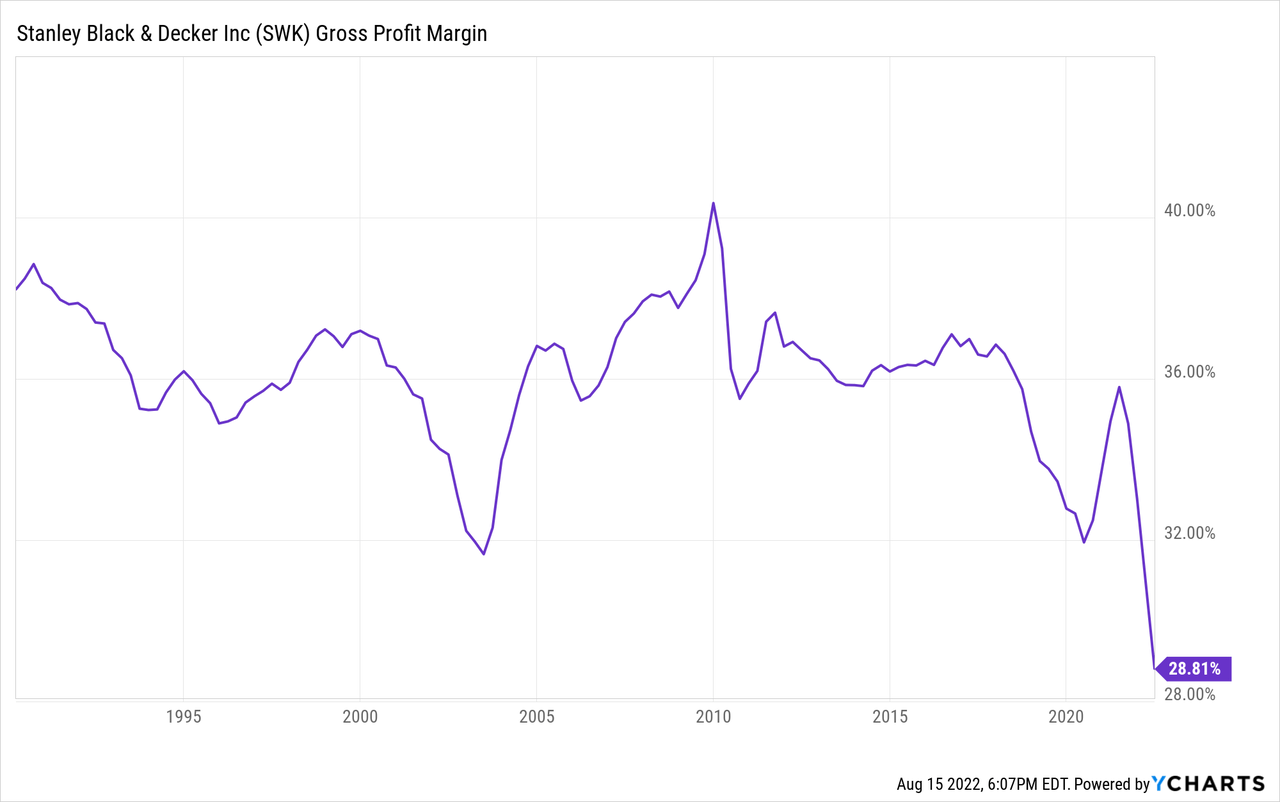

Clearly, the move from $3 billion to $6.6 billion will take some time to work through. Although it’s not as simple as carrying more than double its normal amount of units compared to its historical trend, there is some inflation pricing embedded in there. Nonetheless, it makes sense as to why there’s significant gross margin erosion from the levels the company has historically enjoyed.

Of course, demand weakness combined with the commodity headwinds experienced up until April 2022 will also keep gross margins under pressure. Management guided that this process will take about three to four quarters. Let’s assume four quarters minimum given the large inventory overhang relative to its historical trend. Based on the Q2 conference call, the core issue comes from Tools & Outdoor, where the top line is expected to compress by a significant degree:

“organic revenue is expected to decline mid- to high single digits with margins down on a year-over-year basis.”

This scenario, in my mind, is a perfect storm and we’re in the midst of a recession. We can see that even industry leader, Techtronic Industries Co. Ltd. (OTCPK:TTNDY), owner of Milwaukee, is under pressure with its stock down by nearly 45% off its highs, quite similar to SWK. However, TTNDY management claims that organic growth continues to be robust despite the macroeconomic environment. I think that clearly calls out SWK’s underperformance and means they have their work cut out for them.

Capital allocation has also been tough. Total debt has reached a staggering $11.2 billion, which is above-average leverage. Moreover, SWK implemented an accelerated buyback in early 2022 but has since stalled the buyback until cash flow performance normalizes. In other words, the company made a fundamental mistake of buying back shares at an elevated price eliminating the opportunity of buying them at much lower levels beneath $100/per share.

So to sum things up, bears should take a bow for calling out the SWK weak performance and arguable lack of foresight. The question now, however, is where do we go from here?

Is The Kitchen Sink In?

Hard to say definitively, but there’s a good chance that management gave us the kitchen sink given the severity of the earnings cut. It’s not every day that management that has a history of being stewards of shareholder value revises TTM diluted EPS from $11.05 to $5.50 from one year to the next, which is a 50% reduction. Unless the economy falls into a deep, protracted downturn, I think the company’s operating performance will bottom out here in 2022.

On a macro level, overall U.S. construction spending is floating around all-time highs, housing starts continue to be strong in 2022, and input commodity prices appear to have peaked in March/April. These tailwinds already exist in SWK’s performance, but commodity disinflation should materially benefit gross margin in 2023.

More internally, one prong of the transformation is that SWK’s oil & gas (acquired in 2010 for $445 million and formerly known as CRC-Evans). In 2021, the segment generated about $140 million in revenue, and although the sale amount is undisclosed, SWK will incur a write-down ranging from $125 to $200 million. At face value, the loss is about one-third of the acquisition price, but keep in mind that SWK marked these assets for sale at a time when oil prices were trading hands above $100+/barrel. As a general rule of thumb, oil & gas assets valuations tend to move in sync with energy prices. So while I’m not making an oil price prediction, I think the timing of this transaction is quite good. The sale also allows management to focus its attention on its two primary operating units, i.e. consumer products and industrial tools.

Industrial also continues to be a bright spot as segment revenue was up 8% versus 2021. Additionally, management expects that there will still be significant growth due to its strongly recovering end markets, specifically aerospace and auto:

“achieve high single-digit to low double-digit organic growth, driven by innovation, pricing and cyclical recoveries across much of the portfolio.”

Turning to cost reductions, management outlined a variety of ways to improve performance (my emphasis in italics).

- Product price increases combined with disinflationary commodity pressures align with a 35+% gross margin target. I agree, particularly as this aligns with historical levels.

- Cut operating costs for cumulative savings of $1 billion by the end of 2023 and $2 billion within three years expected through supply chain simplification, SG&A, and corporate overhead. Possible, but cost reductions often come from layoffs that can hurt employee morale, increase turnover, and weaken customer/product knowledge.

- Debt elimination to improve leverage and reduce net interest expenses. Very doable. As SWK works through its inventory, it should provide an outsized working capital swing to reduce its debt balance and interest burden. Maintaining an investment-grade credit rating will support its equity valuation.

Currently, investors are working under the baseline of about $5.5 EPS. Management specifically identified that once it executes on all of these items, EPS should revert towards $7 or higher. I think that’s achievable but the onus is on management to restore investor confidence. Earnings estimates are calling for some normalization by Q2 2023:

SWK Earnings Estimates (Seeking Alpha)

At $100 per share, $7 EPS equates to ~14x earnings, which is selling at a slight discount to the S&P 500’s 17x forward earnings. My best guess is that the kitchen sink quarter is official in and that the stock will continue to “bottom out” around current levels before moving higher in 2023.

Bottom Line

Since we’re already in a recession, the argument becomes about how long does it last and how deep will it be. For the economy in general, I think there’s more pain to come even moving into 2023. Optically, SWK’s next quarter will be even worse as it looks to move through its inventory overhang. However, management has already outlined a tough-to-swallow scenario for shareholders, and having it out in the open for everyone to see is helpful. While SWK is not without risk, I prefer to be a buyer when there’s blood in the streets. How do you think SWK will perform? Let me know in the comments section below. As always, thank you for reading.

Be the first to comment