Justin Sullivan

Thesis

SoFi Technologies, Inc. (NASDAQ:SOFI) is slated to release its Q2 earnings card on August 2. The market has battered SOFI investors, but it held its June lows resiliently.

In our previous article, we also revised our Sell rating to Speculative Buy, as we noted its bottom and more reasonable valuation. Our thesis has largely played out as SOFI has surged more than 20% since our previous article, outperforming the SPDR S&P 500 ETF’s (SPY) 5.8% gain.

Notwithstanding, we believe that SOFI is unlikely to be re-rated markedly from here, given its unprofitability. However, management highlighted that it has a line of sight toward GAAP profitability at a mid-June conference. Therefore, if SoFi continues to execute well in its fastest-growing financial services segment, it could gain tremendous operating leverage.

Our revised valuation model indicates that the market could ask for significant free cash flow (FCF) yields to compensate for the risks of holding the stock. Unless the market is willing to re-rate it higher (i.e., demand for lower yields), SOFI could struggle to outperform from here.

Consequently, we revise our rating from Speculative Buy to Hold. We urge investors who followed our previous Buy rating to consider layering out/cutting exposure. New investors can consider waiting for a deeper retracement before adding exposure.

Lending Segment’s Weakness Worried The Market Amid Macro Headwinds

SoFi’s lending business is critical to support the company’s profitability as its nascent financial services business gains traction. Therefore, we believe that the market has justifiably de-rated SOFI, as lending is a cyclical business that an economic slowdown or recession could impact. SoFi also accentuated in its filings (edited):

Our Lending and Financial Services segments may be particularly negatively impacted by worsening economic conditions that place financial stress on our members resulting in loan defaults or charge-offs. Declining economic conditions may also lead to either decreased demand for our loans or demand for a higher yield on our loans. The longevity and severity of a downturn will also place pressure on lenders under our debt warehouses, whole loan purchasers, and investors in our securitizations. (SoFi 10-Q)

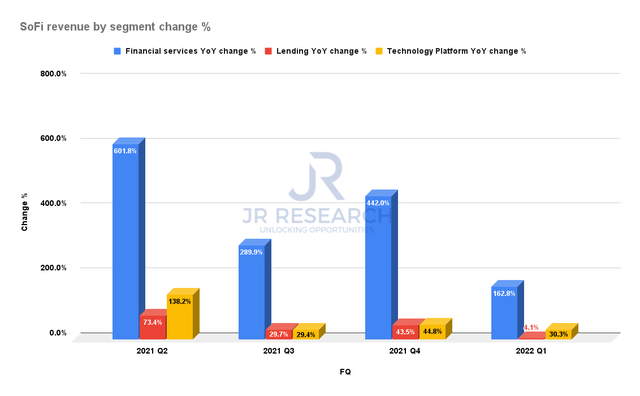

SoFi revenue by segment change % (Company filings)

Consequently, investors can glean the dramatic slowdown in its lending segment (coupled with the student loans challenges). The company delivered revenue growth of just 4.1% in Q1. Furthermore, home loans could also come under further pressure in Q2, as mortgage rates surged to new highs in the quarter, which impacted home sales. Hence, we believe that SoFi’s Q2 profitability could be at risk.

Notwithstanding, the market is forward-looking. We also believe its recent fall to its June lows reflected such headwinds. Therefore, unless SoFi issues a profit guidance in its Q2 card that significantly disappoints, SoFi should sail along just fine.

And SoFi Could Gain Leverage Rapidly

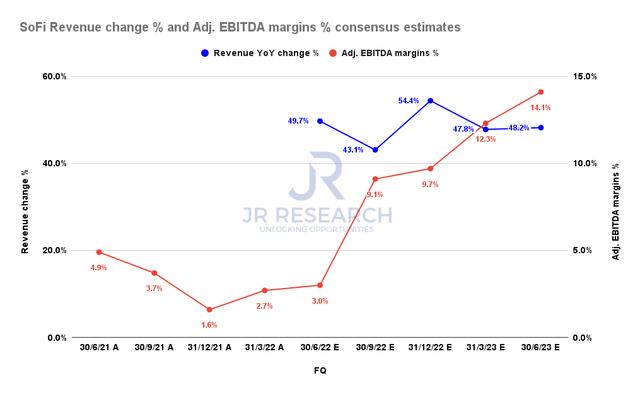

SoFi revenue change % and adjusted EBITDA margins % consensus estimates (S&P Cap IQ)

The consensus estimates (generally bullish) suggest that SoFi could continue gaining operating leverage rapidly through FY23 while growing its revenue fast.

Management also highlighted its confidence in its outlook on GAAP profitability. CEO Anthony Noto accentuated (edited):

So our lending business is very profitable. And the financial services business, that’s the area where we have the most margin expansion. By the end of this year, our variable profit in financial services will be positive after marking and that includes acquisition costs within marketing. And then, by the end of 2023, it will cover our fixed cost. We also expect that to get our stock-based compensation down to the high-single digits by 2024. And that’s when we’ll bring all the pieces together for GAAP profitability. (Morgan Stanley US Financials, Payments and CRE Conference)

Consequently, we believe it could help re-rate SOFI higher if the market gains confidence over its execution. Nevertheless, it remains incumbent on SoFi to prove that it can deliver, given its unprofitability.

SOFI – Unlikely To Be Re-rated In The Near Term

| Stock | SOFI |

| Current market cap | $6.38B |

| Hurdle rate [CAGR] | 5% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 23% |

| Assumed TTM FCF margin in CQ4’26 | 46.4% |

| Implied TTM revenue by CQ4’26 | $3.94B |

SOFI reverse cash flow valuation model. Data source: S&P Cap IQ, author

We applied a market-underperform hurdle rate of 5% in our model. We also used a “very high” FCF yield to model the current valuation dynamics.

SOFI last traded at an FY24 FCF yield of 20.4%. At its June lows, the stock was supported at an FY24 FCF yield of 27.8% (considered too high). However, the market rejected further buying upside in May at an FY24 FCF yield of 17.8%. Therefore, we believe a yield of 23% is appropriate for now.

Given the high yields required by the market, it’s evident that the market remains tentative over its path toward profitability.

Even though we expect SOFI to achieve our revenue target implied in our model at the current levels, SOFI could underperform (given the market-underperform hurdle rate). Therefore, until SOFI gets materially re-rated, we think it’s critical to be nimble and not hold the bag.

Is SOFI Stock A Buy, Sell, Or Hold?

We revise our rating on SOFI from Speculative Buy to Hold.

Our thesis on SOFI has largely played out, as it gained more than 20% from our previous update. Therefore, investors who followed our rating are encouraged to cut exposure and rotate.

Our valuation model suggests that the market remains tentative over re-rating SOFI until management can demonstrate a clear path toward profitability.

Be the first to comment