MoMo Productions

Lately, the housing market has been a very questionable place for investors to rely on. With rising interest rates aimed to combat mounting inflation, as well as concerns about the economy more generally, a wave of pessimism has infected the housing market more than many other industries. One player in this space that has continued to do really well this year from a fundamental perspective is Skyline Champion (NYSE:SKY), a specialty prospect that generates revenue largely from the production of factory-built homes throughout North America targeted toward lower-income individuals.

Although shares of the company were rather pricey compared to more traditional home builders, I was previously optimistic about its prospects because of growing backlog and the fact that its offerings do prove to be effective at securing homes for those who otherwise couldn’t afford them. And with rising home prices, I felt as though more and more people would be directed to a player like this. This ultimately led me to rate the company a ‘buy’ when I wrote about it in July of this year. Even though financial performance achieved by the company has continued to impress, my overall assessment of it has changed for the worse because of a decline in backlog combined with a deteriorating housing market. While I suspect the company would do well for its shareholders in the long run, I do now believe that a more appropriate rating at this time is a ‘hold’, reflecting my belief that it should generate returns at more or less match the broader market for the foreseeable future.

A change in expectations

When I last wrote an article about Skyline Champion in July of this year, I found myself quite bullish on the firm. I was impressed by the attractive growth that the company had seen even though there were fears concerning the economy more broadly. At the same time, however, investors were grappling with the fact that shares were falling at a rate that was faster than the broader market’s decline. While this was a negative, I felt as though the company’s fundamental condition was robust and that shares were finally cheap enough to consider buying. Unfortunately, the stock has continued to fall, dropping in value by 10.3%. Normally, this would be painful. But considering the 10.6% decline experienced by the S&P 500 over the same timeframe, I consider the drop acceptable.

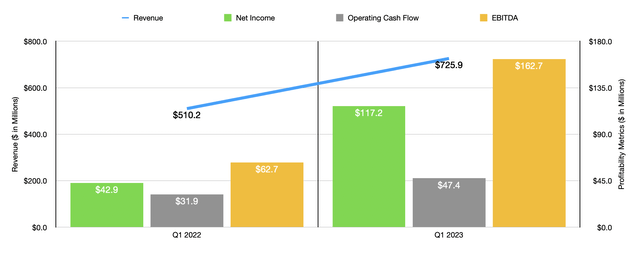

Interestingly, this decline in price came at a time when fundamental performance achieved by the company was incredibly robust. Since I last wrote about the company, we have had data covering the first quarter of the firm’s 2023 fiscal year come out. During that quarter, sales came in strong at $725.9 million. That’s 42.3% higher than the $510.2 million generated the same quarter one year earlier. At the end of the day, this increase was really driven by a couple of key factors. First and foremost, we saw the number of homes that the firm sold in the US rise from 6,372 in the first quarter of its 2022 fiscal year to 6,813 the same time this year. And second, the company saw pricing for these homes, on average, climb from $71,800 to $97,000. To put in perspective just how fast pricing has increased, consider that pricing in the fourth quarter of the firm’s 2022 fiscal year was $87,800. Sequentially, this translates to an increase of 10.5%. The company also saw pricing in its Canadian operations rise year over year, increasing from $98,300 to $128,000. However, the number of homes sold there actually dropped from 385 to 352.

Despite the lower volume in Canada, the company did see its profit figures improve drastically. Net income in the latest quarter totaled $117.2 million. That’s significantly higher than the $42.9 million reported the same time last year. Operating cash flow rose from $31.9 million to $47.4 million. Even more impressive was the increase seen by EBITDA. That metric ultimately rose from $62.7 million in the first quarter of the 2022 fiscal year to $162.7 million the same time this year.

All of this is great in and of itself. We also have another great thing about the company. And that is the excess cash that’s on its books. This was another thing that drew me to the company in the past. Cash in excess of debt currently totals $451.35 million. That’s about 14.2% of the company’s market capitalization as of this writing. This creates a tremendous amount of safety for the company should the market turn against it. At the same time, if the company does not need that money to stay afloat, it can prove beneficial in growth initiatives moving forward. Regardless, it’s a great thing to see. But what did scare me a little bit about the company in the latest quarterly filing is the fact that backlog has actually dropped. At the end of the quarter, backlog came in at $1.4 billion. Just one quarter earlier, it totaled $1.6 billion. That was up from the $1.5 billion reported for the third quarter of 2022 and compared to the $858.6 million in backlog the company had at the end of its 2021 fiscal year.

In its quarterly report, the company tried to play backlog off as a positive. After all, it was still higher than the $1.2 billion on the company’s books as of the end of the first quarter of its 2022 fiscal year. However, the company did mention that longer lead times caused by larger backlog, as well as rising interest rates and changing prices, could result in higher cancellations. To make matters worse, customers are able to cancel at any time without penalty, meaning that continued deterioration in the market could prove problematic for the business. Although not a perfect data point to look at considering the nature of the houses it builds, it does help to look at some housing data that’s on the market. For the month of August, for instance, the US Census Bureau and the US Department of Housing and Urban Development stated that, in the month of August, new home sales were 0.1% below what they were in August of 2021. This on its own would not be worrisome. However, building permits for privately owned housing units authorized in the month of August were down 10% compared to what they were in July and we’re down 14.4% compared to what they were in August of 2021. The data for both housing starts and housing completions is slightly more bullish. But the building permits data is almost certainly the most valuable leading indicator for what the future holds.

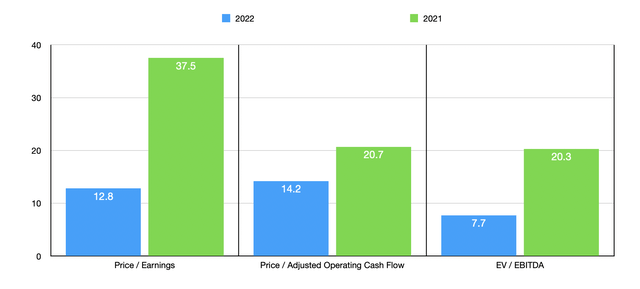

If shares of the company were trading at remarkably low levels, I wouldn’t mind this. After all, its excess cash would allow it to weather virtually any meaningful storm. However, using data from both the 2022 and 2021 fiscal years, you can see, in the chart above, how shares are priced. On an absolute basis, particularly when it comes to the EV to EBITDA approach to valuation, shares don’t look bad at all. But as you can see in the table below, the company is more expensive than five similar firms on both a price-to-earnings basis and on an EV to EBITDA basis.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Skyline Champion | 12.8 | 14.2 | 7.7 |

| Meritage Homes (MTH) | 3.1 | N/A | 3.0 |

| Century Communities (CCS) | 2.6 | 25.7 | 3.4 |

| Beazer Homes USA (BZH) | 1.8 | 16.9 | 6.0 |

| Legacy Housing Corporation (LEGH) | 6.7 | 6.7 | 5.2 |

| Lennar Corporation (LEN) | 5.2 | 12.9 | 4.0 |

Takeaway

What data we have right now suggests to me that market conditions are continuing to worsen. We are already seeing some impact on Skyline Champion in the form of reduced backlog. To be fair, shares of the company don’t look all that pricey. In fact, they look quite affordable on an absolute basis. But relative to other home builders, the stock does look a bit lofty. All of these factors combined have led me to be less bullish than I was earlier this year. Because of that, I’ve decided to revise my rating down from a ‘buy’ to a ‘hold’ until the dust settles or at least we see some clarity start to form.

Be the first to comment