Brandon Bell/Getty Images News

We have had a strong bearish view of Shopify Inc.(NYSE:SHOP). When we covered it in April, we expected another 45% drop for the year. The stock handily beat our expectations and delivered far better price performance than we expected.

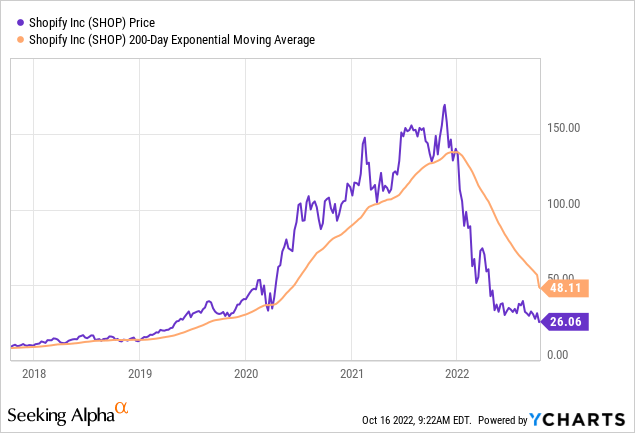

Seeking Alpha

But with all trends, you have to watch out for the bend and we are going to tell you why it is risky for bears to push hard ahead of Q3-2022 results. We also update our longer-term outlook.

Retail Sales Holding Up Better Than We Expected

Shopify is retail exposure, pure and simple and on that front the consumer is holding up better than we would have expected at this point. U.S. retail sales grew in the past three months by over 7.0% year over year. This is actually faster than what we saw in the quarter previous to that. Our analysis of JPMorgan Chase’s (JPM) earnings also suggests that the consumer remains strong, for now. Mastercard Incorporated’s (MA) data suggests that e-commerce is once again taking share from stores and spending remains robust on services.

Near Term Estimates Look Set For A Beat

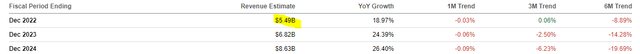

There is a large bifurcation in our views on SHOP’s 2022 estimates and those beyond that. For 2022, we are beginning to see analysts getting close to the truth.

Our own estimates for 2022 were just $5.2 billion when we wrote about SHOP the last time around (See, Bear Thesis Proceeding Flawlessly). Those were based on expectations of a sharp deceleration in consumer spending. Based on the strength in the consumer, we have no choice but to upgrade our estimates for 2022 to $5.5 billion.

Going beyond, we see no chance of SHOP meeting 2023 and 2024 expectations. The recession outlook from our point of view is delayed, not canceled.

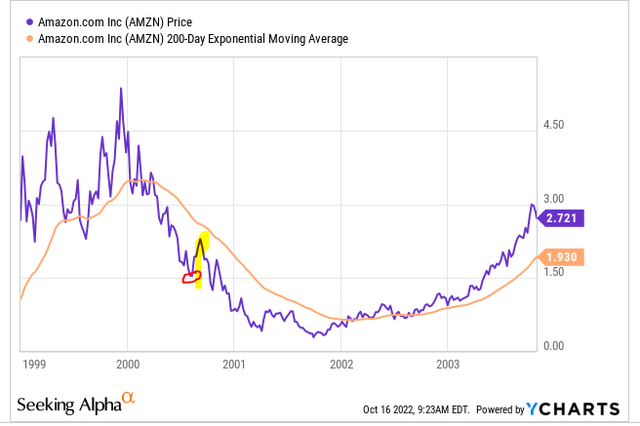

SHOP Trading Far Below Moving Averages

Currently SHOP trades well below its 200-day exponential moving average and has done for a long time.

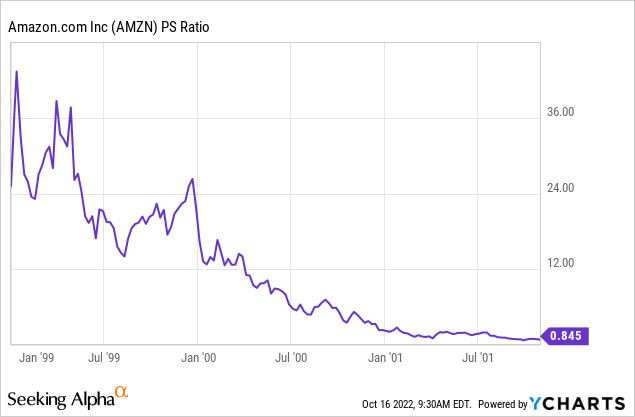

Aa analogy we can think of is Amazon.com (AMZN) in the dotcom bust. We think we are at a similar point shown on the chart below where a brutal countertrend rally can materialize.

How To Play It

From a short side perspective, covering here is possibly the best bet as the next $10 is more likely to be up rather than down. If we got that up move, it would be incredibly hard to hold on as profits evaporate.

We see this discretion as the better part of valor and hence are upgrading SHOP to a Hold/Neutral rating until we see a better short side setup.

From the long side perspective, we reiterate our view that if the global leader in e-commerce, AMZN, bottomed at under 1X sales, SHOP will drop at least to that valuation today.

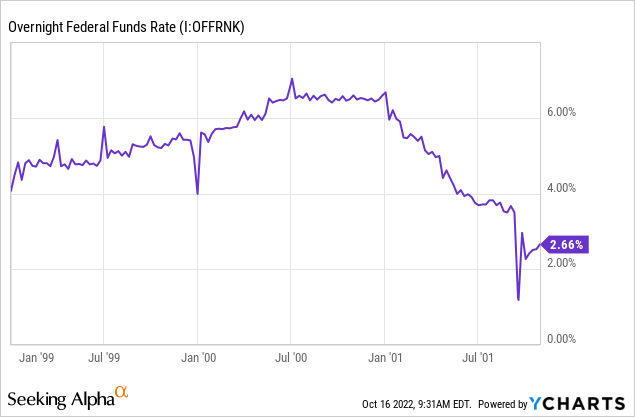

Keep in mind that Federal Reserve was easing aggressively in that timeframe.

With today’s tightening, we would expect a far worse outcome ultimately, and hence we would look for a single digit price number (or perhaps a reverse split which often marks major bottoms) on SHOP before we waded into a long position.

If we were to play the bullish side today though, options can offer an interesting route.

Ratio-Call Spread

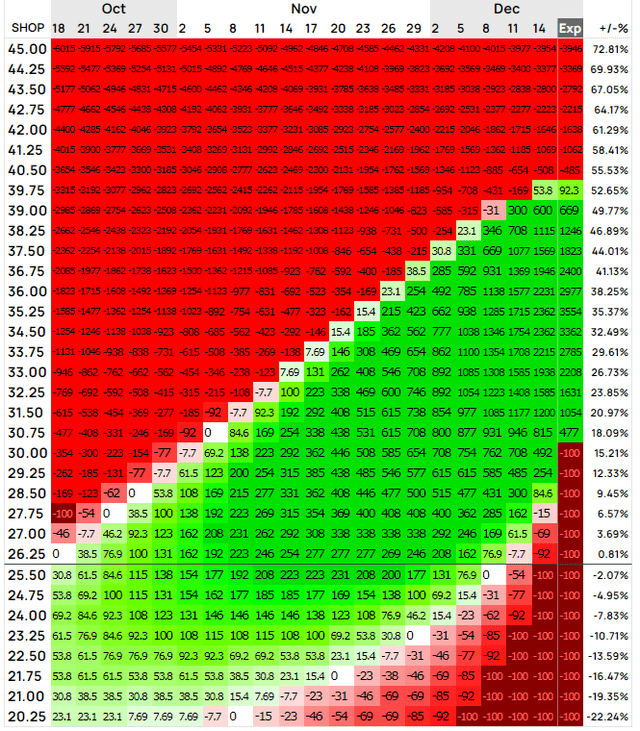

Ratio Call spreads have three components. One long call purchased, and two short calls sold at a higher strike price out-of-the-money. The short calls will generally have the same strike price, although there is no fixed rule on this. All three options have the same expiration date. Ratio call spreads may be opened for a net debit or a net credit, depending on the pricing of the options contracts. In the case of SHOP we would look at the December 2022 $30 and $35 strikes.

Buying $30 calls and selling twice as many $35 calls allows an approximate cost-free entry. This strategy has a nice payoff between $30-$35 which we see as the upper limit of any countertrend rally. The holder of these contracts is still protected between $35 and $40 (while making less and less money) and loses money only above $40 where a synthetic short position is established.

Verdict

Bears have been right on SHOP and the only bull thesis comes from “Hey look, there’s growth”. But you have to weigh the cost of that growth and the fact that SHOP is not producing any free cash flow. You have to also weigh that the most optimistic earnings estimates still make the stock ridiculously expensive and that is after ignoring stock-based compensation. Finally, we have the most hostile central bank policies and we will see a crushing final valuation as a result in our opinion. But nothing runs in a straight line and rebalancing sentiment is key to delivering our $3.00 final target on SHOP. We would look for an upside move in the next 3 months or so before we dance on the downside again.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment