blinow61

As consumer prices started inching up last year and forecasts for them were even direr, stocks like the multinational oil giant Shell (NYSE:SHEL) looked like an excellent inflation hedge. And indeed, the Shell share price has risen some 33% year-on-year (YoY). However, this overall trend obscures the fact that since mid-2022 it has been trading largely flat, losing gains made in the first half. This article explores whether this current trend is a sign of things to come or whether there is more steam in the stock. This analysis is based on the outlook for commodity prices and Shell’s correlation with them as well as the evolving macro situation. It concludes, contrary to popular opinion, that it’s best to start preparing to sell it while the price is still high, even at attractive valuations, because the cycle is turning against it.

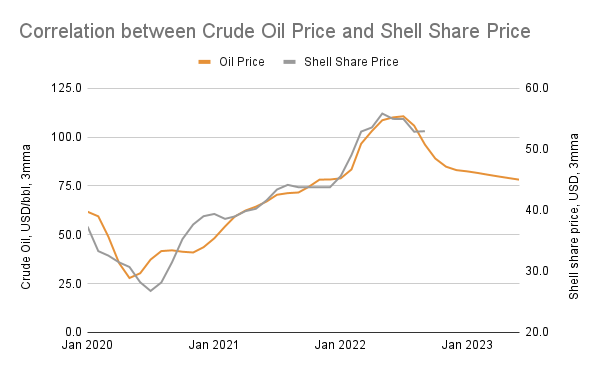

A strong correlation between oil and the Shell share price

A potentially good predictor of the Shell share price is the oil price, with which it has been highly correlated over the past two years. The correlation coefficient for the 3-month moving average (3mma) for both data series is at 0.96 over the period. A perfect positive correlation has a value of 1, indicating that this coefficient reflects a strong positive correlation.

Note: Figures from October 2022 onwards are Crude futures’ prices (Sources: Yahoo Finance, IndexMundi, MarketWatch Author’s estimates)

This is also evident visually (see chart above). After rising steadily from mid-2020 onwards, both series have started declining since around the middle of 2022. Keeping this in mind, a 20% drop in crude oil prices since the end of June is bad news and could even explain investor ambivalence towards the stock recently. It also follows that if oil prices fall further, Shell’s price could quite likely decline too. Crude futures are pencilling in a steady fall, declining to $77.4 a barrel for WTI in June 2023, which is another double-digit decline from the present levels. There’s still hope for the Shell share price, however, if the two de-couple.

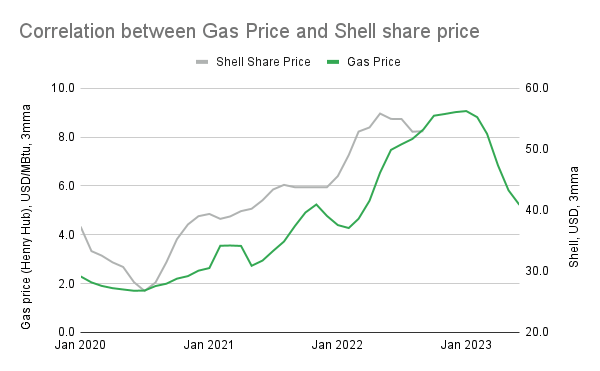

Hope persists with elevated gas price

Diverging trends between oil and gas prices encourage this hope since Shell extracts and markets both commodities. Gas prices have a strong correlation with the Shell stock as well, particularly as they too have been rising since Russia’s invasion of Ukraine. For the last two years, the correlation coefficient for their 3mma is at 0.9, which is not quite as strong as that for oil price but still significant. Note that correlation doesn’t automatically imply causation and can even reduce at some point, though in this case, it’s fair to say that rising gas prices have in fact helped Shell.

Note: Figures from October 2022 onwards are EIA forecasts (Sources: EIA, Yahoo Finance, Author’s Estimates)

The divergence between oil and gas prices visible now is also encouraging. Gas prices (at the Henry Hub) continue to rise even while crude oil prices are declining. On a CAGR basis, they have risen 9% each month in 2022 up to August. From this perspective, the fact that Shell’s Integrated Gas segment, which includes the exploration, extraction, operation and marketing of gas and gas products, saw a 147% YoY growth in adjusted earnings for the first half of 2022 outstripping the 135% increase for the company as a whole is encouraging. This is especially because the segment has a big 38% share in the company’s earnings. Forecasts from the US’s Energy Information Agency show that gas prices could stay elevated until March 2023, which means that Shell’s financials and its share price have hopes of sustaining for the next two quarters.

Challenging outlook for 2023

However, they are forecast to start declining then on and in April 2023, gas price is expected to drop by 21% YoY. This is an addition to the already weak oil price outlook. Underpinning the existing as well as impending weakness in energy prices is the pessimistic global macroeconomic outlook, which indicates a demand slowdown as well. Oxford Economics has recently reduced its world growth forecast by 0.66 percentage points to 1.7% for 2023, down from 2.8% in 2022. Goldman Sachs has also just slashed its 2023 outlook for US growth to just 1.1%, which is significant considering the country is the biggest energy consumer in the world after China. Keeping these developments in mind, we can well see how Shell’s earnings are likely to be affected by this time next year. In fact, analysts’ estimates at Seeking Alpha already expect 2023 revenues to decline by almost 8% YoY and earnings per share by 15%.

The question of valuation

None of this needs to matter, in theory, if the stock is undervalued because it can still hold potential for future gains. And the Shell share price is indeed undervalued compared to the energy sector. Both its current price-to-earnings ratio (P/E) and its forward PE for GAAP earnings are lower at 5.6x and 4.2x than the sector averages at 9.7x and 7.75x respectively. Other market valuations like the forward P/E for non-GAAP earnings, price-to-sales (P/S) and EV/EBITDA and EV/Sales also show the same trends.

Interestingly, the P/E for the energy sector as a whole is lower than the 19.5x level for S&P 500 (SP500), which should make it attractive and Shell even more so. Yet, the limited upside for the sector and the stock at the current stage of the business cycle makes it unconvincing to hold on to them for much longer. I have been bullish on the Shell stock for a while, and even put a buy rating on it in my last article, since which time it has risen by 25%. Even now, fundamentally the company is fine, but the first signs of a turning in the tide against it are visible.

Conclusion

The company’s Q3 2022 results due in late October could potentially show some impact right away, though it will fully be visible only by Q2 2023. In the meantime, the Shell share price is going nowhere fast. And so far as the stock markets can lead data releases, the softening in its price could continue from now on. In this scenario of an expected reduction in energy prices, poor macroeconomic outlook and the slowing down in demand that goes with it, it seems unlikely that the stock will find favor in the foreseeable future. It’s best to sell while the stock is still relatively high.

Be the first to comment