skodonnell/iStock via Getty Images

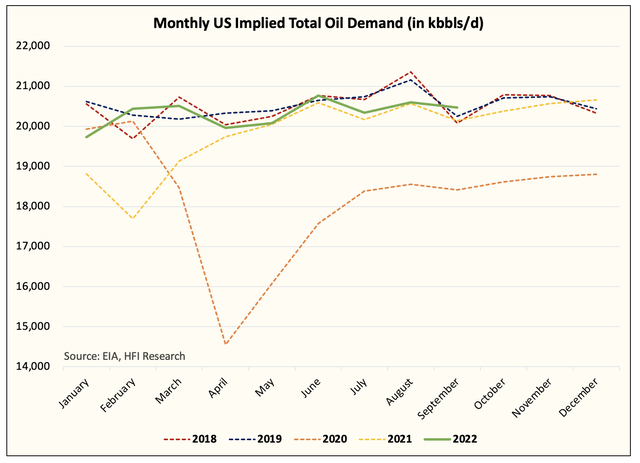

EIA PSM is out today and the September implied US oil demand came in at ~20.47 million b/d. This is ~222k b/d higher than September 2019.

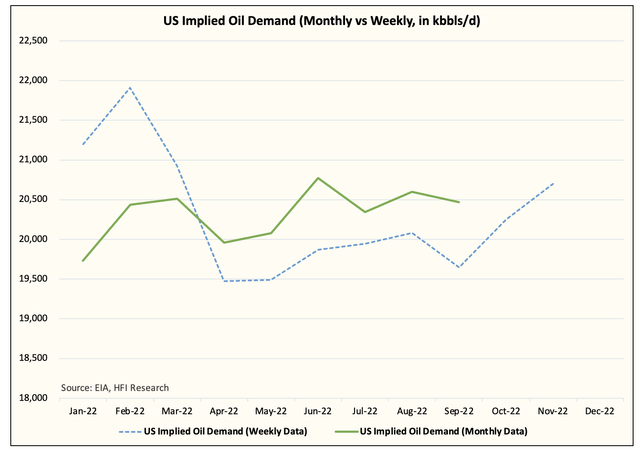

In comparison to the more flawed EIA weekly implied oil demand estimate, the monthly oil demand came in ~825k b/d higher than the weekly (20.47 vs 19.645).

As you can see in the chart above, EIA weekly implied oil demand estimates have been persistently below that of the monthly. This may change, however, as EIA weekly estimates have been trending higher since September.

With implied oil demand in September coming in above 2019, why is the title of this article talking about concerns?

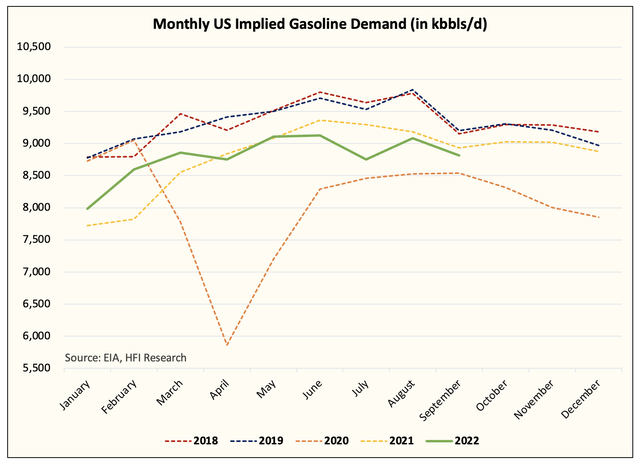

Well, all you have to do is look at this chart below illustrating US gasoline demand.

By this point, if you still hang onto the belief that EIA’s data is unreliable, then you just have cognitive dissonance. It is clearly evident based on the chart above that US gasoline demand is weak, and most of that is likely related to price.

For those of you that say that this is the result of work-from-home, we would just point out that 2022 implied gasoline demand has averaged below 2021 (when work-from-home still existed) since April this year. This is likely the result of the spike in oil we saw following March more than anything else.

Now if the theory is right that high oil prices impacted demand, then over the coming months, we should see implied gasoline demand pick up (via the monthly demand data).

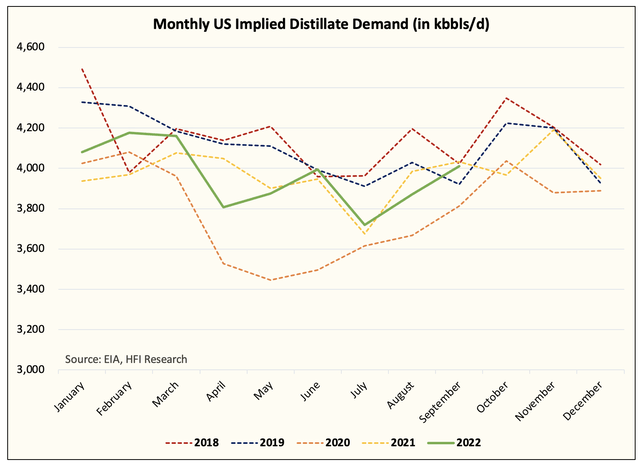

Other than weaker than expected gasoline demand, the other demand factors are holding up ok.

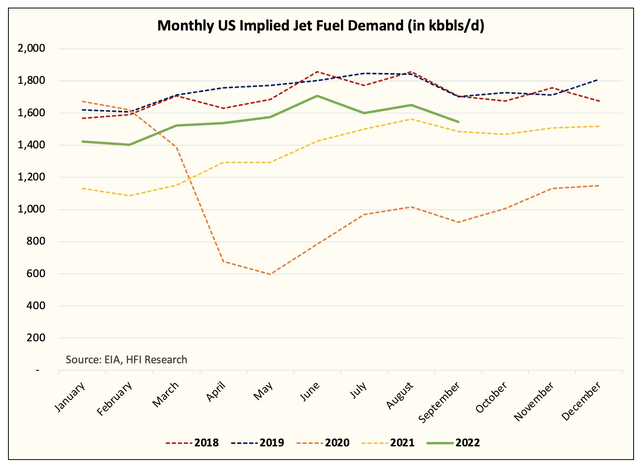

Distillate demand is in line with the seasonal averages, while jet fuel demand is higher y-o-y but below that of pre-COVID levels.

In 2023, we expect jet fuel demand to further recover while gasoline demand should improve given the recent price drop. Every other demand segment in the report was higher y-o-y resulting in the surprise to the upside for total oil demand.

Conclusion

Total US oil demand came in stronger than expected, but concerns remain around gasoline demand. With the demand weakness we saw post-April, it is notable that higher prices will likely impact demand going forward, so the oil market will set a certain upper boundary as we wrote back in June.

But the good news is that despite the oil price increase, other demand segments were not impacted, and given the absolute strength, we think market watchers may be far too pessimistic about the overall demand outlook going forward.

Over the next few months, we need to see gasoline demand recover given the latest price drop.

Be the first to comment