tum3123

Main Thesis & Background

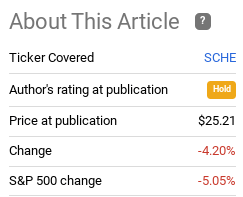

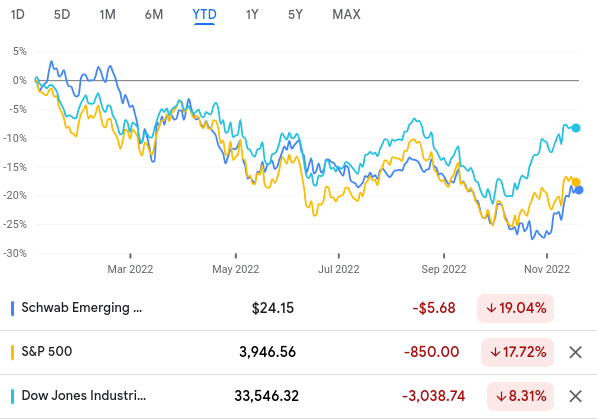

The purpose of this article is to evaluate the broader emerging markets equity market, with a specific look at the Schwab Emerging Markets ETF (NYSEARCA:NYSEARCA:SCHE). This is a passive ETF for emerging markets exposure, and one I have dabbled with in the past. However, in mid-2022 I turned to a more cautious outlook on emerging markets as a whole. I saw more value in U.S. and foreign developed markets, and explained why this past summer. In hindsight, this caution made sense, although the S&P 500 has seen weakness as well over the same time period:

Fund Performance (Seeking Alpha)

As I look ahead to 2023, I continue to believe SCHE (and emerging markets as a whole) is not where I want to tack on more risk. There are positives to be sure, such as lower valuations and the potential for a post-Covid lockdown boon across China in particular. But I see other headwinds that balance out these factors. These include an overreliance on China, rising geo-political headwinds, and general global economic weakness. Therefore, a “hold” rating continues to look appropriate, and I will explain why in more detail below.

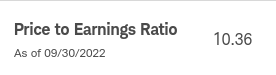

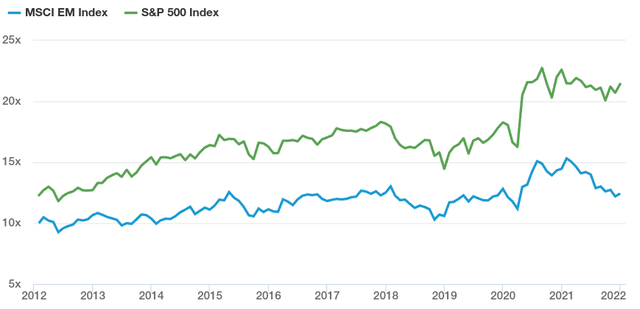

SCHE Seems “Cheap”, But How Useful Is That?

To begin, I want to focus on valuation. At first glance, this may seem like a surefire reason to buy SCHE (or any other EM-focused ETF). The simple logic is that SCHE looks cheap – and it is – when we compare current P/E’s against the S&P 500:

SCHE P/E (Charles Schwab)

S&P 500 P/E (Multpl.com)

With a valuation roughly half of the S&P 500, SCHE has the potential for a strong buy case. The fund offers diversification across the globe, away from the Tech-heavy S&P 500, and also has a marked valuation advantage. This begs the question – why not rate this a “buy”?

On the surface it would be hard to argue against buying on those merits. But if we dig a little deeper it makes me question how useful the valuation advantage really is. What I mean is this: EM equities are often much cheaper the U.S. stocks (or other developed markets for that matter), yet their performance consistently disappoints. In that light, is buying because the fund is “cheaper” really worth it?

If we look at 2022, we see the answer to that question would have been a resounding “no”. When the year got underway, EM equities were sharply cheaper than the S&P 500. This led many pundits to declare this sector theme a buy as the valuation advantage was glaring:

Relative Valuations (Start of 2022) (Lazard Asset Management)

The problem is, this valuation gap didn’t do much for actual performance in 2022. Now that we have hindsight to guide us, we see that SCHE under-performed the S&P 500 by a slim margin, and the DOW Jones Industrial Average by a wide margin (as of 11/18/22):

YTD Performance (Google Finance)

The takeaway for me is that being cheaper didn’t do much for SCHE this year. That doesn’t mean 2023 will be the same – but it could be. My point here is not to suggest valuation does not matter, because it does. But I want to emphasize that buying SCHE simply because it is cheaper is not likely to return “alpha”. I will need other compelling reasons to buy this fund before pulling money from my domestic-oriented portfolio and in to SCHE. Absent those other reasons, valuation alone does not get me excited enough to buy.

Remember, This Is A Big Play On China

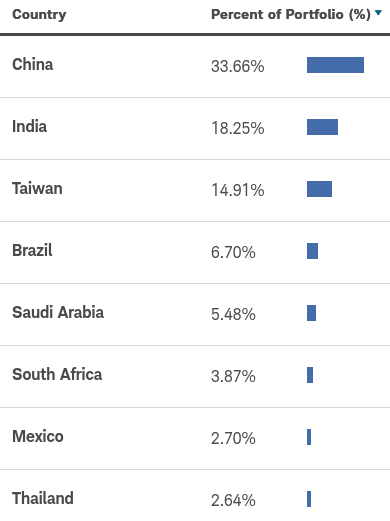

Digging deeper in to SCHE specifically, I want to remind readers this is a bull play on China (if one is to buy this fund). While SCHE is for “emerging markets”, this often means an overweight allocation to Chinese equities. At time of writing, SCHE has just over one-third of its total assets directly allocated to that country:

SCHE Country Breakdown (Charles Schwab)

I am not saying this is good or bad, but something readers need to be aware of before diving in. In 2022 this exposure has not been helpful for the fund – driven primarily by restrictive Covid policies and uncertainty around the political tenure of Xi. As we move in to 2023, there are signs some of those Covid-restrictions could ease up. There is also more certainty around Xi’s leadership. He has secured another term and has solidified his power by appointing loyalists to key positions. Whether or not this is going to be good for investors remains to be seen.

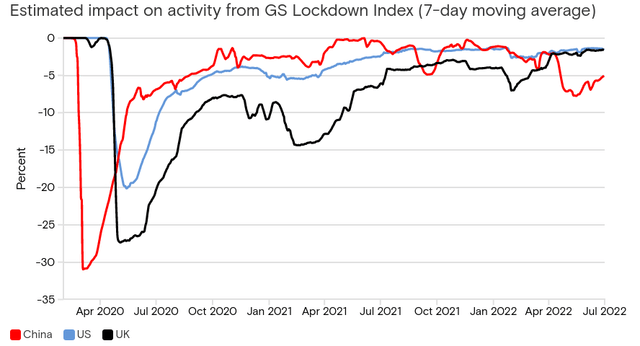

If we look back at why this exposure has pressured SCHE, quite a bit of it stems from China’s zero-COVID policy. This has been a drag on the country’s economic growth. While some investors are banking on a re-opening play and therefore buying stocks in anticipation of that, I wouldn’t get too carried away just yet. A dramatic shift away from this policy seems unlikely in the short-term. Yes, there is a bull case when the country re-opens but when that will happens remains uncertain. For the time being we have to accept that China’s approach has had a negative impact on economic growth on a relative basis:

Lockdown Impact Index (Goldman Sachs)

There are certainly two ways to view this. One way is that there is amplified opportunity here as China re-opens. This has been “conventional” wisdom I am starting to see from some analysts and sell-side investment banks. The logic goes that China has been disproportionately impacted by Covid restrictions, and will therefore see stronger gains when it comes out of it.

But I take the other, more cautious, view. A re-opening would be broadly good for stocks. But I just don’t see a straight line forward with this reality. I would expect China to be more open next year than this year, but with hiccups along the way. That tells me there is no need to rush in now at these levels after SCHE has already seen a nice boost in the short-term.

Furthermore, Covid is not the only headwind. Geo-political risks abound between Taiwan and the U.S., along with other nations in the Asia-Pacific. This is similar to the valuation attribute I mentioned above. If Covid re-opening was the only factor influencing my China outlook, then a buy case would be easy to make. But it isn’t the only factor.

A development that keeps me up at night is how the U.S. may get drawn in to a regional dispute between China and Taiwan. Pressures are already intensified, especially on the backdrop of Nancy Pelosi’s visit to Taiwan this past summer. Expanding on that, in September the US Senate Foreign Relations Committee approved the Taiwan Policy Act (TPA). This legislation provides $4.5 billion in weapons and security assistance to Taiwan over the next four years. It also formally designates Taiwan as a major non-NATO ally, compelling the U.S. to impose sanctions on Chinese financial firms in response to any hostile actions in or against Taiwan.

While this Act still needs approval from Congress, this was a direct refute of China’s ambitions with respect to Taiwan. We can debate the merits of this holistically, but in my mind this is a net negative for investors in China, especially if a tit-for-tat strategy emerges from the Chinese government as a result. This clouds my outlook for both Chinese and Taiwanese equities, which combine to make up over half of SCHE’s total assets under management.

I Prefer A Contrarian Approach To EM

My next thought looks at EM as a whole. As my followers know, I like to move in and out of non-U.S. positions for diversification and when I perceive relative value. This strategy has served me well over the years, although EM didn’t do much for me in the first half of 2022. When it has done well in the past, it is usually when I bought against the grain. What I mean is – I bought it when the market sentiment was against it and investors were fleeing. That often represents the best time to buy, EM or otherwise.

This thesis is another supporting factor of why I am not very interested in SCHE at the moment. The market does not appear to be agreeing with me on a cautious outlook, preferring instead to dive in to EM equities. In fact, when we exclude China from the equation, foreign investors have been pouring money in to Asian equities at a rate that we rarely see:

Foreign Fund Flows (Yahoo Finance)

What I draw from this is that investors have been rotating in to EM equities, specifically Asian EM equities. With the rebound we have seen across the space in the past month or so, this makes me cautious. I want to be going against the trend when it comes to initiating a position in this more volatile asset class. Buying in now seems a little bit late to the game. This reality supports my neutral/hold outlook and suggests that patient investors will probably be able to scoop up this fund at a better price in the future.

The Global Economy Is Struggling

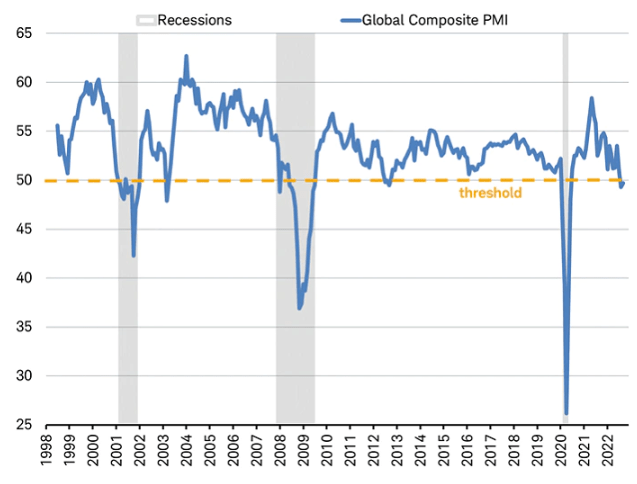

My final thought is simply to suggest to readers to be selective with their purchases over the next few quarters. There are a lot of risks out there – continued interest rate hikes, geo-political tensions across Europe and Asia, and a difficult macro-economic environment. Whether one is considering EM stocks or developed stocks, we should be taking in to account the fact that global economic activity has been on the decline. As measured by the Global Purchasing Managers Index (PMI), we see there has been a steady drop on a year-over-year basis:

Global PMI (World Bank)

This simply isn’t the backdrop I want to get overly bullish on a fund that is exposed to countries across the globe. I think a more tactical approach is warranted, again supporting my hold rating for SCHE.

Bottom-line

Emerging markets have not been the place to be this year. In fairness, that can be said for a lot of sectors/themes. But as I look ahead to 2023 I see some of the same headwinds pressuring funds like SCHE. The dollar remains strong, oil prices have been volatile, and territorial disputes in eastern Europe and Asia are not making the investment picture any brighter around the globe. Throw in the potential for slowing economic activity and higher interest rates, and I must caution readers from getting too bullish on SCHE. As a result, I will continue to maintain a “hold” rating on this fund, and I suggest investors approach new positions selectively at this time.

Be the first to comment