zennie/E+ via Getty Images

Royal Caribbean Cruises Ltd. (NYSE:RCL) could surpass its 2019 pre-pandemic annual revenue performance in 2023, according to Wall Street analysts. The consensus revenue estimate among 14 analysts covering the stock is $12.56 billion for the twelve months ended December 2023. The most bullish annual revenue projection came in at $13.87 billion and the least bullish came in at $11.28 billion. By contrast, RCL’s revenue for the twelve months ended Dec 2019 was $10.95 billion, as per the company’s financial statements.

RCL’s efforts to turn around its fortunes in the wake the pandemic-induced slowdown are beginning to bear fruit. From an operational standpoint, the business is back to generating positive operating cash flows. For the second quarter ended June, RCL generated almost $500 million in operating cash flow. EBITDA was $124 million and turned positive in May, a month before expectations, according to Naftali Holtz, the company CFO. Although RCL’s total liabilities increased by close to $10 billion from $17.58 billion in 2019 to $27.17 billion in 2021, the business was by Q2 generating enough cash from operations to cover its capital costs.

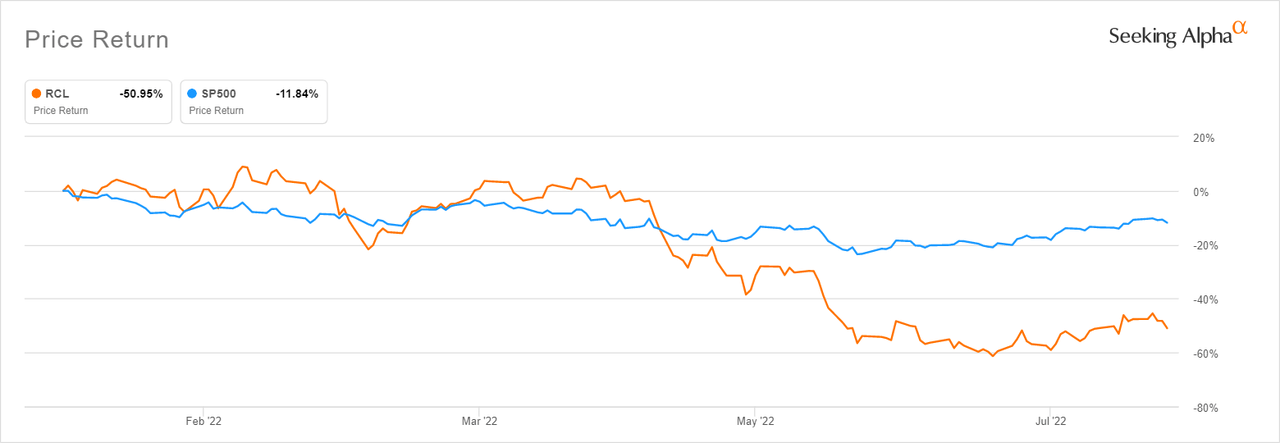

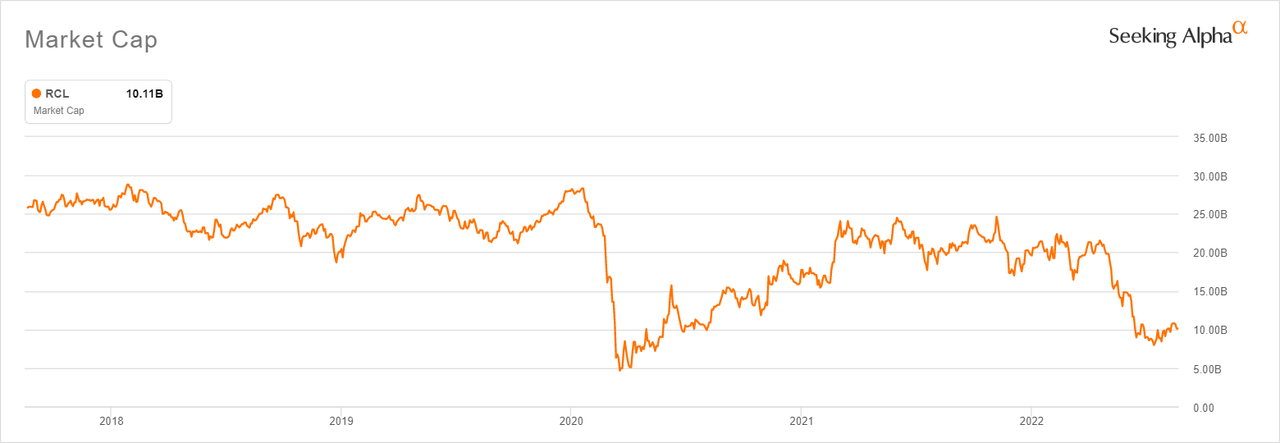

RCL’s recent operational performance, coupled with analysts’ topline estimates for 2023 paint a picture of a company on the verge of a historic turnaround. The stock performance, in contrast, paints the picture of a company sailing stormy seas. RCL is down more than 50% YTD vs the S&P 500’s 11.84% decline. On a five-year time frame, the market cap of $10 billion (at the time of writing) is at the lowest level its been with the exception of the March 2020 downturn caused by the stock market crash that occurred after the WHO declared Covid-19 to be a global pandemic.

RCL performance YTD vs the S&P 500 (Seeking Alpha) RCL market cap over the past 5 years (Seeking Alpha)

Overcoming the fears

Besides the general downtrend in U.S. and global equities in the first half of 2022, several factors have weighed on RCL’s stock performance. The first is the recession and inflationary headwinds impacting the consumer discretionary sector, the second is Covid-19 and the impact it has had on cruise lines, and the third is the mountain of debt RCL has taken up in the past three years to make it through the pandemic. Investors, however, need to reassess these fears in light of RCL’s key strengths to see them for what they are – misunderstood opportunities.

Investors have good reason to be cautious about investing in the consumer discretionary sector during a time of record inflation and possible recession. Consumers typically cut back on big ticket items in an inflationary environment or during a recession, leading to depressed earnings and contraction in share prices of companies in affected industries.

Cruise lines, however, are different from other industries in the consumer discretionary sector. Passengers tend to plan and book their vacations several months in advance. Recent economic data is therefore not always the most reliable indicator of demand. A more reliable indication is bookings and occupancy levels, also known as load factor in the cruise line industry. Load factors are edging up as more passengers reactivate their vacation plans after 3 years of waiting. RCL, for example, had a load factor of 82% at the end of Q2 and expects a load factor of approximately 95% for the third quarter and triple digits by the end of the year, signaling stronger demand than supply for its product.

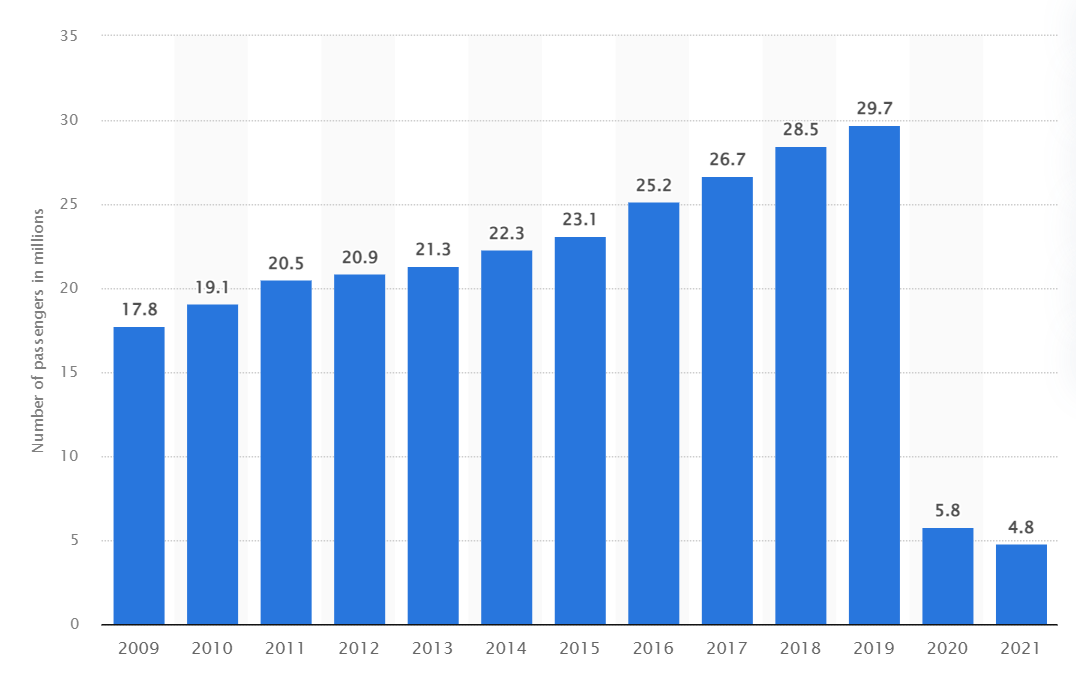

Moreover, the cruise line industry has been steadily growing in the last decade. This trend is expected to resume following the pandemic-induced disruption. Cruise Lines International Associated (CLIA), the industry trade group, forecasts passenger numbers will exceed pre-pandemic levels by the end of 2023.

Number of Ocean Cruise Passengers Worldwide 2009 – 2021 (Statista)

Cruise lines are also able to protect margins more effectively than other businesses during times of inflation. This is because the increased acquisition costs of products and services sold onboard can easily be passed down to passengers who don’t have access to substitute providers of these products and services while voyaging the high seas.

The Covid-19 pandemic also seems to be in the rear view mirror. The CDC has removed all risk advisories on cruise travel. While new variants may emerge, the pace of vaccinations globally suggest that the Covid-19 virus is unlikely to cause the level of disruption we’ve seen in the past.

Smooth sailing

When it comes to the issue of debt, the important factors to consider besides how fast debt has grown are: what is the debt being used for, what is the cost of servicing the debt relative to operating cash flow, and how has management shielded stockholders.

RCL’s net interest expenses before the pandemic were $285.1 million in 2016, $267 million in 2017, $300.9 million in 2018 and $381 million in 2019. This represented between 3-4% of total annual revenue for all the respective years. After the pandemic, net interest expenses jumped to $832 million in 2020 and $1.2 billion in 2021, in line with the huge increase in liabilities. Given consensus revenue estimates for 2023 of around $12.56 billion (and no new debt issued but old debt refinanced ), we are looking at credit costs of around 10% of total revenue for the coming year. That level of indebtedness, while historically high, is not alarming considering the debt was taken to literally put the business on life support. They did not take debt to fund a risky new venture. It’s also worth reiterating that by Q2 2022, RCL had gotten back to generating enough cash to meet its capital costs.

RCL’s debt maturities for the remainder of 2022 are $1.6 billion and $5.7 billion for 2023. It will be important to see if the management can refinance the debt on more favorable terms given the tighter financial conditions in the debt markets today. That said, RCL’s debt levels relative to its operational cash are manageable. They also don’t put it at a competitive disadvantage as cruise line operators globally have had to turn to corporate debt markets to survive the downturn during the pandemic.

We foresee smooth sailing ahead for RCL, despite fears over general economic conditions and its debt burden. Moreover, RCL is better for investors than its peers because it did not raise dilutive financing during the pandemic, even when competitors like Carnival Corporation (CCL) and Norwegian Cruise Lines (NCLH) went all out to dilute common stockholders. RCL’s total common shares outstanding were 254.8 million in Dec 2021 vs 208.8 million shares in Dec 2019. CCL, in comparison, had 1.13 billion shares in Nov 2021 vs 683 million shares in Nov 2019. NCLH had 416.9 million shares in Dec 2021 vs 213.1 million shares in Dec 2021.

Conclusion

RCL is a strong turnaround play that is currently able to meet its operational and capital costs without further capital injection. The industry overall is also recovering strongly as covid-19 fears recede. RCL has also proven to be more shareholder friendly than CCL and NCLH. Building a position in RCL now before the stock catches up with the improving conditions and prospects of the underlying business looks like the smart thing to do.

Be the first to comment