Justin Sullivan

Investment Thesis

Roku (NASDAQ:ROKU) has been on a massive and consistent slide since its highs. In fact, anyone that’s come to the stock at any point in the past 3 years is now holding a loss. Today, nobody considering buying Roku can likely think of anything positive to say about the company.

Yet, as I look through and consider the company rationally, and objectively, with no skin in the game here, I believe that the stock offers investors a fair margin of safety.

I estimate that Roku is priced at 17x next year’s run-rate EBITDA.

That’s a valuation that’s starting to become interesting.

The Market Has Been Undiscerning, Leading To Frustration

The bear market that we are in today didn’t start in 2022. A great many companies peaked in February 2021 and a proportion would go on to give their last breath in the summer of 2021.

And since that point, the market has been sell-off countless names. And even though today a lot of investors are waking up and readying headlines postulating the depth of the recession that we are about to enter, here’s a fact.

Small and medium cap stocks have already been in this bear market for at least 12 to 15 months, and some have been selling off for 18 months already!

Think of names such as DraftKings (DKNG), Chewy (CHWY), Palantir (PLTR), and Block (SQ), to name a few. And sure, we can all agree today that they should never have become as expensive as they did, in an era of easy money.

But the fact stands that even though these businesses have very little overlap, the market has been punishing these names for nearly 18 months.

What’s Next For Roku?

I believe that it’s safe to assume that we are much closer to the bottom now than we are to the top.

Indeed, even if the market was to come down another 10% or so, given that we are already down 24% from the peak, statistically speaking, the risk-reward today is quite good.

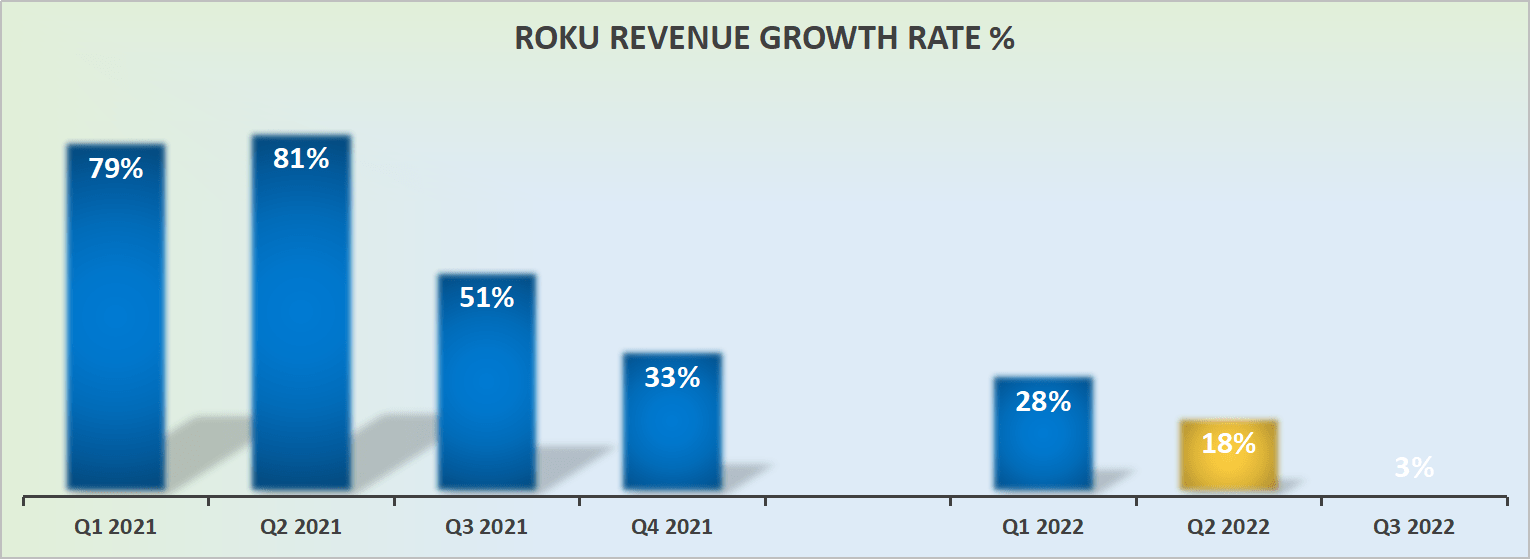

ROKU revenue growth rates

Now, let’s be honest, Roku’s guidance for Q3 is nothing short of horrible. There’s very little positive we can say about Roku’s mid-single revenue growth rates.

And then, the problems get even worse as we get into Q4. The reasons for this are twofold.

In the first instance, the comparables with the prior year are still tough.

Secondly, and more pertinent, as we progress into Q4, the economy is tinkering on the verge of substantial recession.

These two considerations when combined lead me to believe that analysts’ expectations for Roku’s Q4 are still too high.

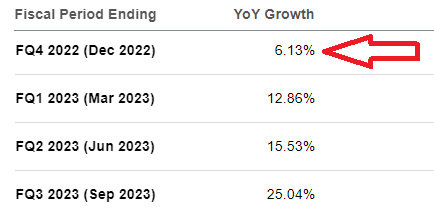

Analyst’s revenue growth consensus

That being said, I’m inclined to believe that despite the consensus revenue CAGR for Q4 being too high, I’m in the camp that believes when the economy starts to stabilize, the first sectors that will be forced to come back will be advertising.

And here I think Roku will succeed in gaining substantial traction and will positively impress investors.

How Will 2023 Shape Up?

The biggest advantage that Roku will have, I believe, will stem from the fact that during a cost of living crisis, many households will be forced to reconsider their streaming packages, such as Netflix (NFLX), Disney+ (DIS), Apple TV (AAPL), and others.

And I recognize that amongst affluent SA readers, the thought of canceling Netflix or other streaming platforms sounds prosperous! But the reality is that outside of our tight demographic, in the real world, households are fighting.

They are fighting high inflation. They are fighting higher mortgage payments. They are fighting high food prices. They are fighting high energy prices.

In essence, the amount of disposable household income is going to shrink in the coming months. And when that happens, everything that is non-discretionary will be re-evaluated.

Meanwhile, Roku already has 65 million active accounts that are on Roku’s platform as of Q2 2022. And this figure is growing at double digits, even now.

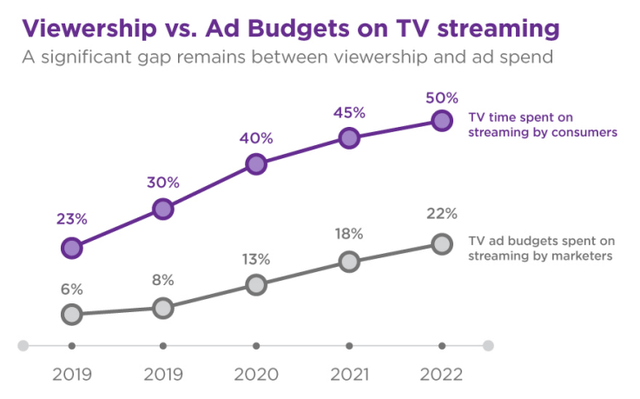

And when advertisers look to increase their spending when the economy stabilizes, where will they turn to?

Will they go to social media platforms, where costs have become prohibitive? Or will they migrate to CTV, where they can get very higher ROIs?

What’s more, Roku is able to know exactly what viewers are interested in and engaging with in real-time. This offers advertisers on Roku’s platform a direct channel to users with back-end measurable performance analytics.

Nevertheless, for Roku to be a real success in 2023, it will have to figure out how to bring more users onto its platform, while ensuring that its hardware isn’t being sold at a loss. Again, Roku isn’t without issues.

ROKU Stock Valuation – Difficult To Value

Despite my bullishness, I find it very difficult to come up with any sort of intrinsic value for a business that is likely to remain EBITDA negative for at least 2 more quarters. And then, I believe it will probably only at approximately 10% to 15% y/y in H2.

On the other hand, as I’ve alluded to throughout, Roku’s advertising customers have already been fleeing the platform for a while. And I believe that when they’ll return, at some point in 2023, Roku’s business model will benefit from its robust operating leverage.

That will mean that after all the cost-cutting that Roku has had to embrace in 2022, it will enter 2023 as a much leaner enterprise.

Assuming that Roku could exit Q4 2023 with somewhere close to 10% to 15% EBITDA margins, it’s entirely possible that Roku could see around $500 million of EBITDA as its run-rate exiting Q4 2023.

That would mean that today’s investors are paying 17x next year’s run-rate EBITDA.

Realistically, that’s not so cheap. But it’s also very far from shocking too. In fact, I remember not long ago a time when Roku was priced at 17x forward sales, don’t you?

The Bottom Line

Buying when others won’t is when the returns are made. And to be absolutely clear, this bullish recommendation is a reversal of my previous bearish recommendation.

I believe that if an investor doesn’t at least start to reconsider investing while there’s carnage all around us when the tide finally turns, it will be too late to think through where to go and what’s compelling and worth investing in.

That doesn’t mean that the skies are going to open up for Roku tomorrow morning.

But it does mean that there’s a lot of negative sentiment being factored into the share price already. And the time to start to become slightly bullish on a stock isn’t when the bottom is ”obviously” in, because when it’s obvious to me that the bottom is in, that will mean that it’s obvious to all. And that could be too late to reconsider this investment.

Be the first to comment