Justin Sullivan

Thesis

Rivian Automotive, Inc.’s (NASDAQ:RIVN) Q2 earnings card demonstrated that the company is on track to meet its FY22 production guidance of 25K, despite being buffeted by ongoing macro headwinds and supply chain challenges. Therefore, on the surface, it was a mixed performance by the company but otherwise interpreted as positive by the market.

We tagged RIVN with a Sell rating in our pre-earnings article as we had anticipated a bad reaction to a mixed/poor Q2 card. But, it appears that the market has already moved past Rivian’s near-term challenges (supply chain, costs headwinds) and focusing on its ability to ramp production. Notably, we believe it’s important to accord due credit to management, as it performed admirably by maintaining its production guidance of 25K, despite having produced about 6,954 vehicles in H1.

Therefore, Rivian expects a marked production ramp in H2 as it also prepares for adding a second shift to its general assembly by the end of Q3.

As a result, we believe the market has already adjusted its expectations of RIVN, with the stock likely bottoming out in May for the medium-term. Therefore, it’s looking increasingly likely that buying sentiments have returned decisively to support RIVN’s recovery in its bullish bias as it takes its production ramp to the next stage.

We revise our rating on RIVN from Sell to Speculative Buy.

Rivian’s Management Is Getting Its Act Together

EV investors should recall that Lucid’s (LCID) Q2 release demonstrated how challenging it is for upstarts to get their production act together. However, despite the challenging macro environment and supply chain disruptions, we are assured by Rivian’s ability to navigate its production ramp capably. Management also highlighted the increasing confidence that it has earned with its suppliers, as CEO RJ Scaringe articulated:

Bringing on a second shift involves making sure the supply chain is capable of supporting it, as we talked about before. It wouldn’t make any sense for us to have to hire a whole second shift and then have the line still waiting for parts. So first and foremost, we’ve been very much emphasizing supplier readiness to support this, and have worked very closely to look at any parts that we think are constrained or may be constrained. (Rivian FQ2’22 earnings call)

Rivian produced 6,954 vehicles in H1. Therefore, the company needs to produce about 18K of vehicles in H2, which suggests that it sees a significant ramp. Consequently, we think it highlights that Rivian is starting to get its act together as it ramps its EDV production for Amazon (AMZN), which should improve the confidence in the e-commerce retailer to follow through with its 100K orders.

However, the production costs for H2 are expected to lead to a worse-than-expected $5.5B in adjusted EBITDA losses (up from $4.9B previously) for FY22. Still, we believe the company needs to ramp production quickly to benefit from its fixed costs leverage, which would drive down costs and improve efficiencies markedly through FY24. CFO Claire McDonough articulated:

It’s really driven by us ramping our plants and our productivity within our 150K units of installed capacity within Normal that allows us to really leverage all of those fixed overhead and costs associated with our large-scale production facility. We see 2024 as really that pivotal year for us in driving a step change in terms of the underlying gross margin expectations within the business, as we have a couple of significant factors that are starting to impact our underlying unit economics. (Rivian earnings)

As a reminder, Rivian is expected to achieve a planned capacity of 350K (including first phase Georgia) before 2024, as it ramps production. Given the reaction to RIVN’s price action, it appears that the market has moved on from focusing on its near-term headwinds and giving space for management to prove its ramp capability.

Is RIVN Stock A Buy, Sell, Or Hold?

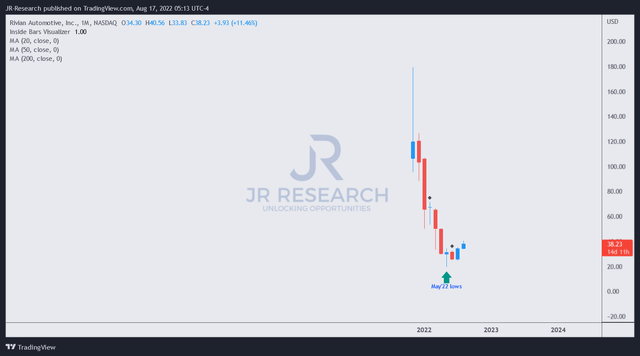

RIVN price chart (monthly) (TradingView)

We noted that RIVN bottomed out in May, likely its medium-term bottom. While we had anticipated decisive post-earnings weakness, we are now convinced that its bottoming process is credible and likely to undergird a medium-term bullish recovery in RIVN.

While we expect near-term volatility, we encourage investors to capitalize on potential downside volatility to add exposure, as this recovery looks robust.

We revise our rating on RIVN from Sell to Speculative Buy, with a price target of $50 (an implied upside of 31%).

Be the first to comment