Hispanolistic/E+ via Getty Images

By Jill Mislinski

The Census Bureau’s Advance Retail Sales Report for June was released this morning. Headline sales came in at 1.00% month-over-month to two decimals and was above the Investing.com forecast of 0.8%. Core sales (ex Autos) came in at 1.04% MoM.

Here is the introduction from today’s report:

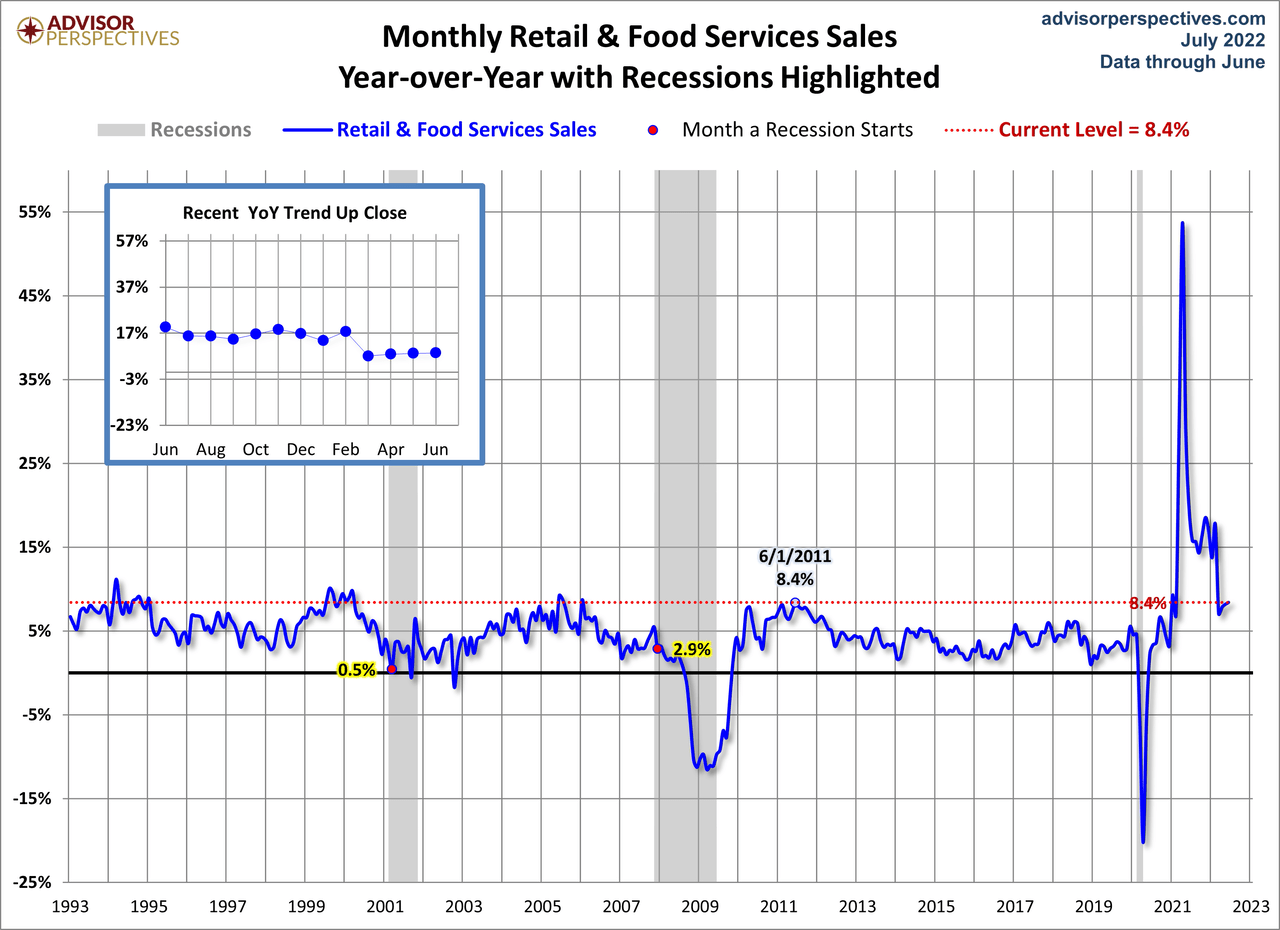

Advance estimates of U.S. retail and food services sales for June 2022, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $680.6 billion, an increase of 1.0 percent (±0.5 percent) from the previous month, and 8.4 percent (±0.7 percent) above June 2021. Total sales for the April 2022 through June 2022 period were up 8.1 percent (±0.5 percent) from the same period a year ago. The April 2022 to May 2022 percent change was revised from down 0.3 percent (±0.5 percent)* to down 0.1 percent (±0.3 percent)*.

Retail trade sales were up 1.0 percent (±0.4 percent) from May 2022, and up 7.7 percent (±0.7 percent) above last year. Gasoline stations were up 49.1 percent (±1.6 percent) from June 2021, while food services and drinking places were up 13.4 percent (±3.9 percent) from last year. [view full report]

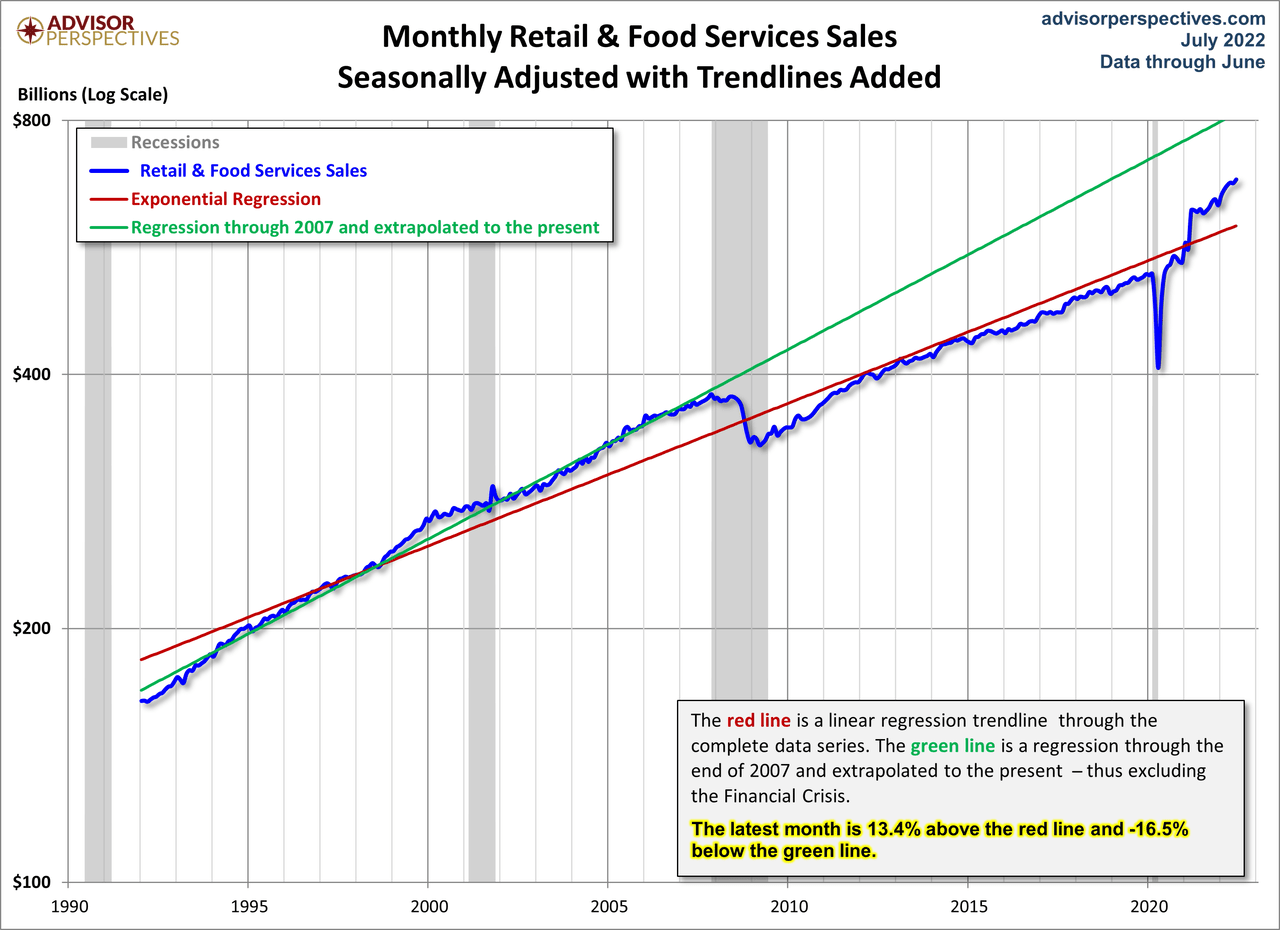

The chart below is a log-scale snapshot of retail sales since the early 1990s. The two exponential regressions through the data help us to evaluate the long-term trend of this key economic indicator.

The year-over-year percent change provides another perspective on the historical trend. Here is the headline series.

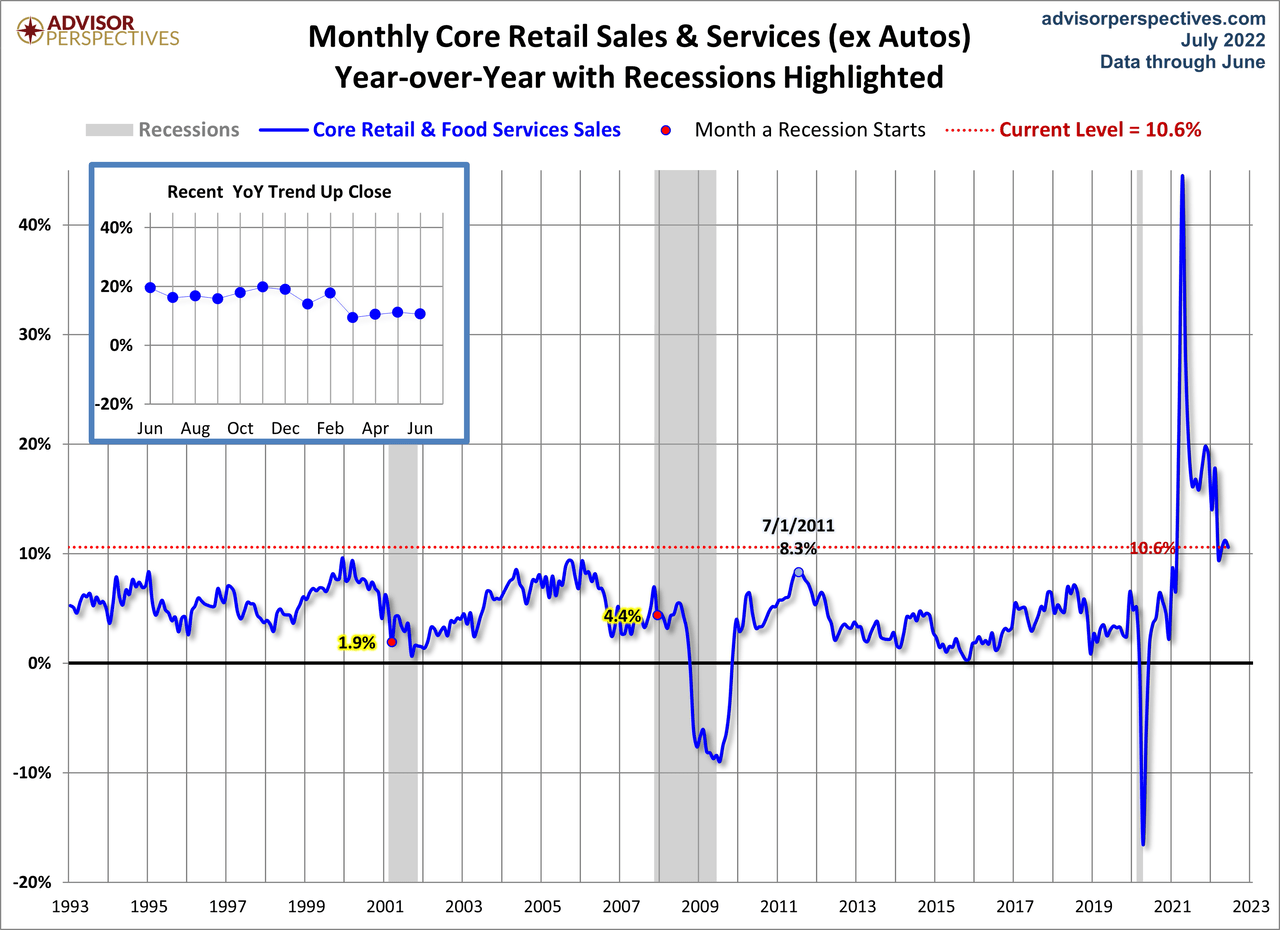

Core Sales

Here is the year-over-year version of Core Retail Sales.

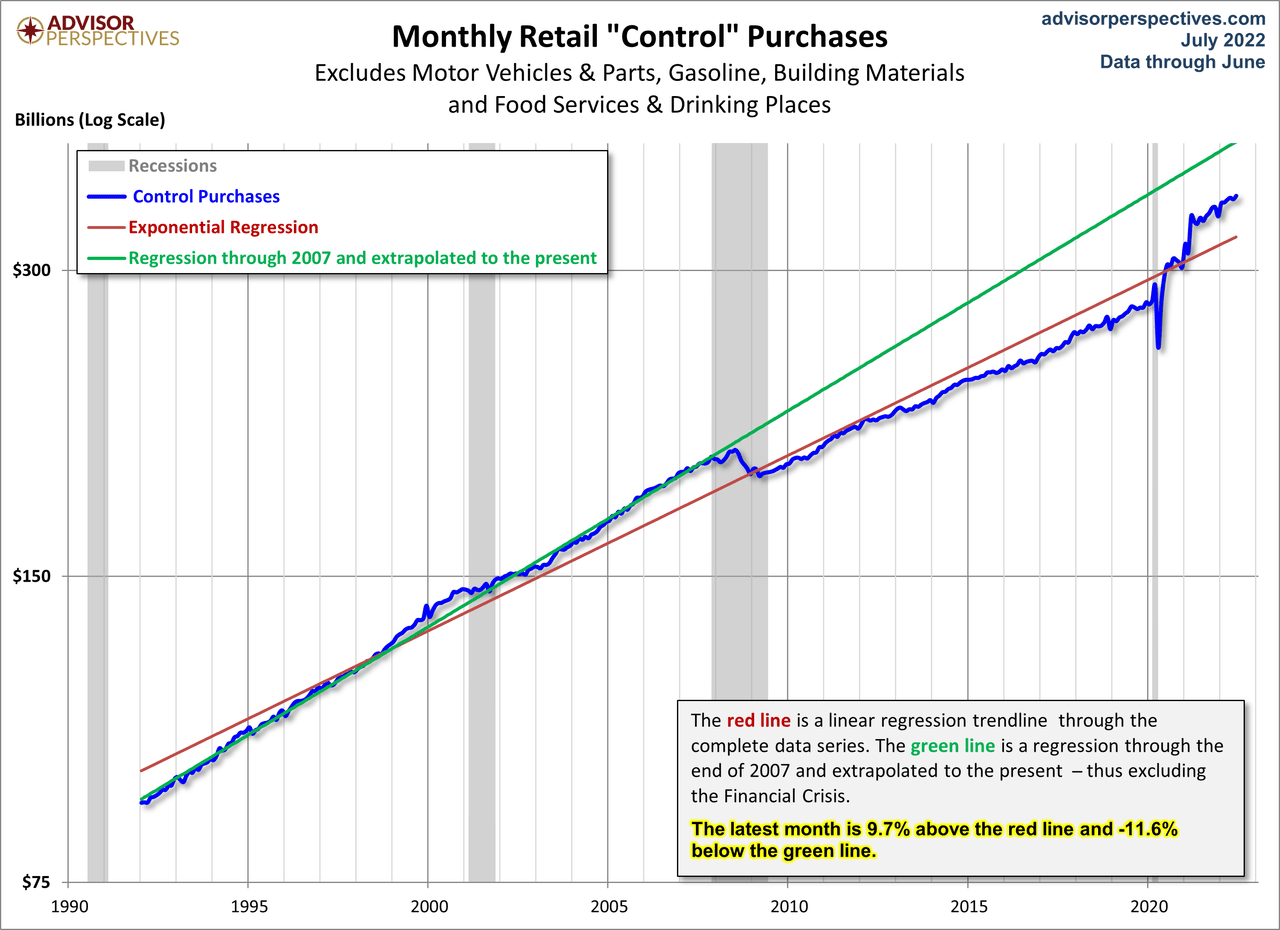

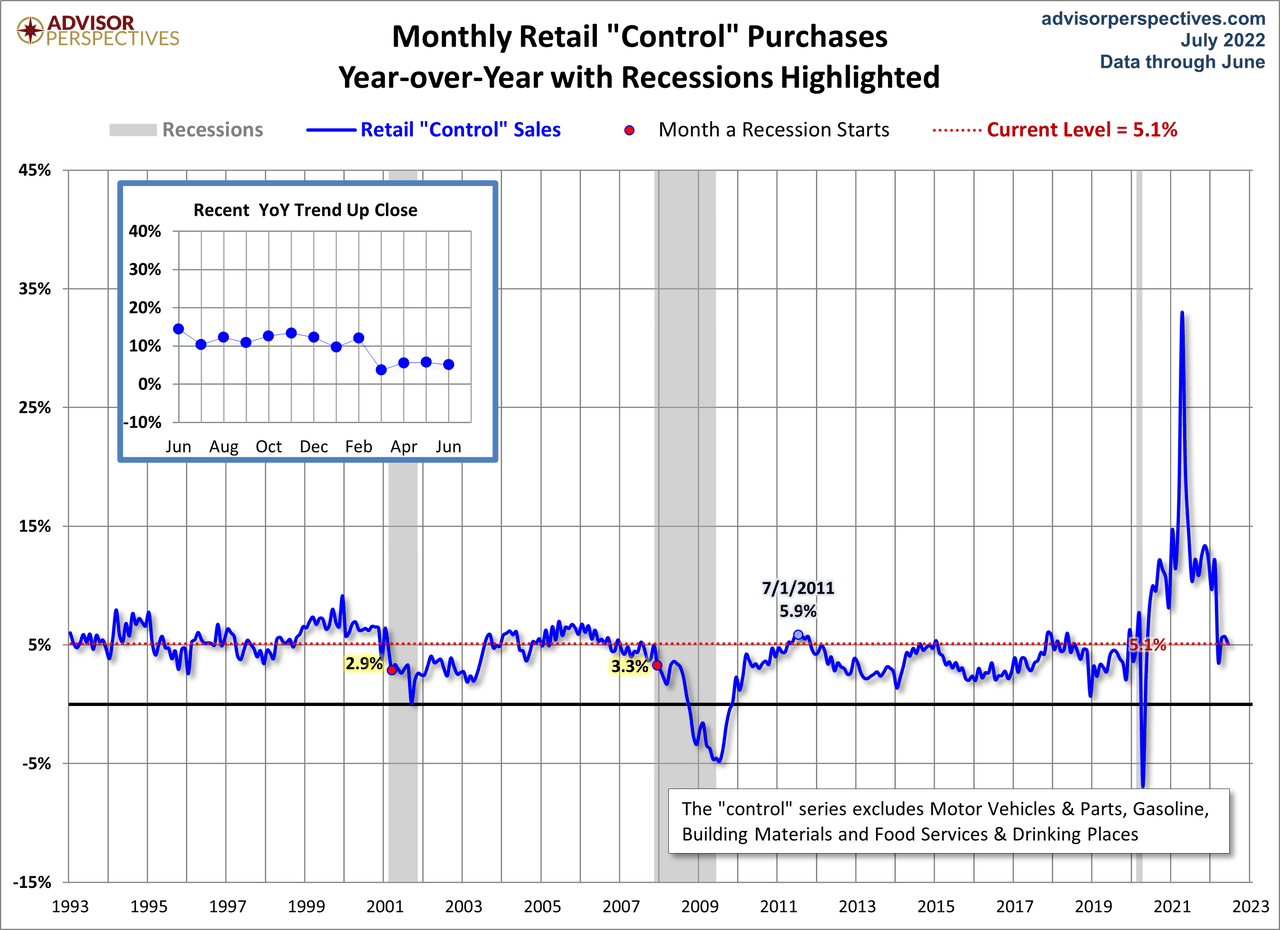

“Control” Purchases

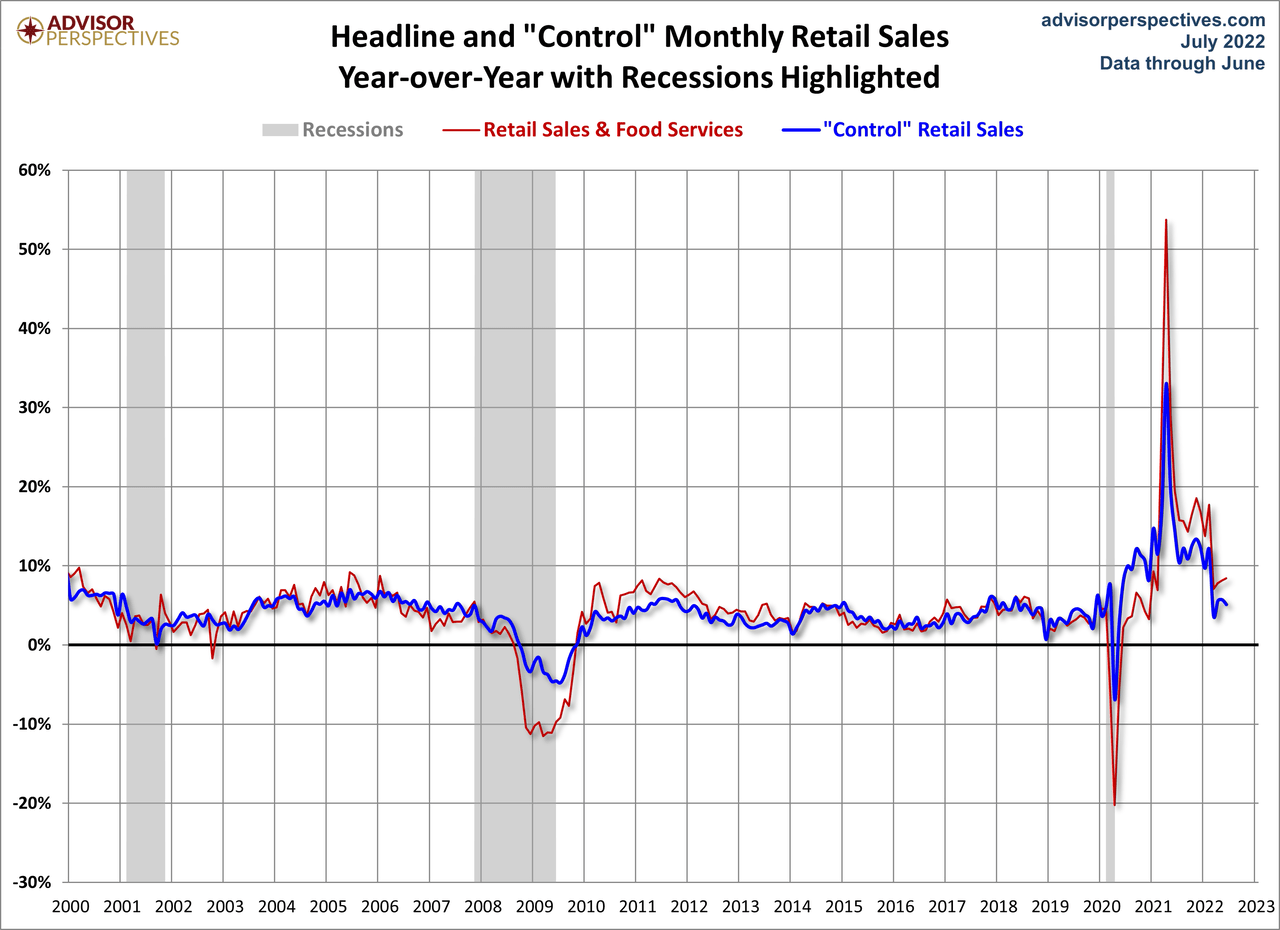

The next two charts illustrate retail sales “Control” purchases, which is an even more “Core” view of retail sales. This series excludes Motor Vehicles & Parts, Gasoline, Building Materials as well as Food Services & Drinking Places. The popular financial press typically ignores this series, but it’s a more consistent and reliable reading of the economy.

Here is the same series year-over-year.

For a better sense of the reduced volatility of the “Control” series, here is a YoY overlay with the headline retail sales.  Bottom Line: June headline, core, and control saw minor increases and were better than forecasts.

Bottom Line: June headline, core, and control saw minor increases and were better than forecasts.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment