Source: Pixabay

Introduction

On February 20th, 2019, I wrote an article titled “Realty Income: Rotational Strategy Could Provide A 20% Dividend Increase”. I had several goals with that article. The first was to warn investors about the inherent riskiness of REITs. My assessment is that there is no such thing as a “sleep well at night” REIT, and there are no true “blue chip” REITs. REITs are inherently risky because they pay out the vast majority of their profits in the form of dividends, which means that they don’t have any cushion to fall back on in times of crisis, especially if credit tightens for an extended period of time. Because of this dynamic, if an investor chooses to invest in a REIT, they absolutely must require that it has a high dividend yield in order to compensate for that risk, and also that it has a reasonably good business. I think it’s fair to say that Realty Income (O) has a reasonably good business. The problem in recent years is that investors were not being properly compensated for the inherent risk. As I said in February 2019:

In my opinion, an investor is taking on a lot more risk with Realty Income at these levels and not getting very much reward in return…

… Realty Income is expensive relative to itself, to its historic yield, and to the broader real estate index. Even if one likes the long-term prospects of the company, they would be wise to rotate out and get defensive now.

The truth is, I could have chosen dozens of REITs the past few years and written essentially the same thing about them. I chose Realty Income because it has generally been perceived as one of the best REITs, and I figured if I could make a persuasive case against it, then investors could see that the same principles could be applied to virtually the entire REIT complex.

I also wanted to provide an alternative strategy for buy-and-hold investors who I knew were soon to suffer huge drawdowns from investments like this one. Since I knew that many buy-and-hold investors were retail investors that were focused on dividend income, I framed my argument as a way to increase one’s dividends by rotating out of Realty Income when it was expensive and into some more attractively valued alternative ETFs, and then rotating back into the REIT stock after the price had dropped. By doing so, one could increase the number of Realty Income shares they owned without spending any extra money, and by increasing the number of shares owned, they could increase their dividend income.

For example, if you own 10 shares of a stock that trades at trades at $100 per share and pays a $4 dividend (4% dividend yield), then you receive $40 worth of dividends from that stock each year. If you increase your shares by 20% for free, you now own 12 shares instead of 10, and you are collecting $48 worth of dividends per year instead of $40 (20% more) even if the company still pays a 4% dividend yield.

So, how did I suggest investors do this?

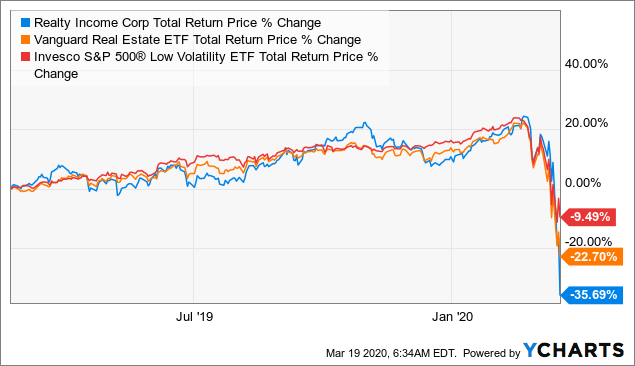

I suggested that investors sell Realty Income and rotate their funds into two ETFs: a 50/50 mix of the Vanguard Real Estate ETF (VNQ) and the Invesco S&P 500 Low Volatility ETF (SPLV), and then, when Realty Income stock eventually underperformed these alternatives, they could rotate back into Realty Income and gain at least 20% more “free shares”, which would, in turn, increase their dividend income by 20%. Here’s how the ideas have performed since my February 2019 article:

Data by YCharts

Data by YCharts

The two combined ETFs are down about -16.10%, while Realty Income is down over double that about at -35.69%. An investor could now rotate back into Realty Income and purchase +30.46% more shares than they had back in February 2019. In other words, if a person owned 100 shares of Realty Income back in February 2019, they could now take their ETF money, even though it is lower than what they started with, and buy 130 shares of Realty Income stock today. That increase in share count corresponds to an equivalent increase in dividend income.

I now consider this rotational idea successful and complete.

Is this a unique decline?

I’m sure that I’ll get a few responses that nobody could have predicted this virus-driven sell-off, that we couldn’t have known the direct effect it would have on retail establishments and that I just got lucky with the Realty Income call. I know if I was a reader, perhaps reading my work for the first time, that’s probably what I would assume as well. But I have two counterpoints I would like to share that might change your mind.

My first counterpoint is that this is not the first time I have successfully shared this strategy with Realty Income. Back in 2016, in my article “If I Were Retired and Owned Realty Income, This is What I Would Do”, I shared a similar strategy, except I suggested shareholders sell Realty Income and buy Berkshire Hathaway (BRK.A, BRK.B) until the price of Realty Income came down. That strategy worked out in a matter of months and netted about +19.4% more shares for investors who followed it. There was no coronavirus then and there was no recession. Yet, the strategy still worked, and it’s publicly documented in real-time here on Seeking Alpha.

I also want to point out that Realty Income was not the only stock I successfully suggested this strategy for. From January 2018 through March 2019, I wrote 30 bearish articles in my “How far could they fall?” series about cyclical stocks and suggested investors rotate out of them into more defensive positions as a way to increase the number of shares they currently owned. Realty Income now becomes the 25th stock to be successfully rotated with free share gains out of the 30 I wrote about. Here are the others:

All of these trades were publicly documented with articles on Seeking Alpha, and I have one more that is ready to rotate back in for some gains as well. That will leave us 4 positions that I am still tracking in which defensive ETFs haven’t yet produced free share gains. 20 of these 30 ideas were completed before the emergence of the coronavirus, so I don’t think it’s reasonable to assume the coronavirus alone was responsible for Realty Income’s current decline or for the strategy’s overall success.

With a sample size this large from 2018 through early 2019, the odds that my success can be chalked up entirely to luck are fairly slim.

REIT Research and When To Buy

Since REITs are highly cyclical and generally unsuitable for buy-and-hold investors, in late 2019 I decided to conduct some new and original research in order to develop a trading strategy specifically designed for REITs. I was in the final stages of that research, which I shared with members of the Cyclical Investor’s Club, when this downturn started. This research/strategy is totally original and is not being used by any other analysts. It accepts that REITs are inherently risky investments and capitalizes on the momentum-driven reflexivity of the real estate market, while at the same time demanding that investors be properly compensated for the risks they take with these investments. In short, the strategy is designed to avoid the worst drawdowns in the worst REITs, while benefiting from the momentum that better-quality REITs can achieve over the long term (but not necessarily forever).

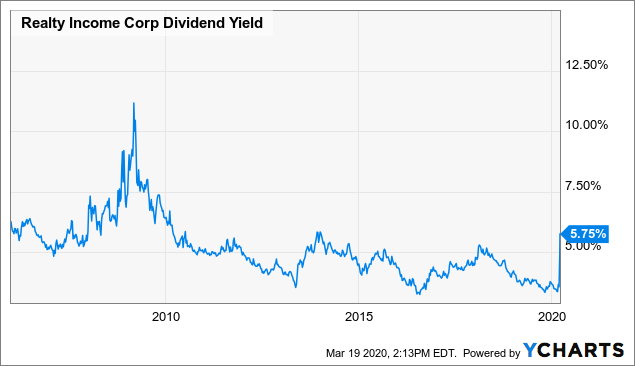

As I write this, Realty Income is yielding about 6%, but the yield has been much higher in the past.

Data by YCharts

Data by YCharts

During the last recession, the yield grew larger than 10%. At that time, investors were being adequately compensated for Realty Income’s risk. The question is, now that we are going into a recession, what yield should we demand from Realty Income if we assume the REIT can continue to pay it? (So far, I haven’t seen evidence that they won’t be able to pay it, but that could change if things get really bad for an extended period of time.) Judging from what we might have been able to get historically, and taking into account Realty Income’s inherent risk, I would demand a dividend yield of at least 8% as an investor. That works out to a price of about $35.00 per share, and that’s the price I think investors would at least be fairly compensated for the risk they were taking.

Conclusion

Investors, because they are human, are very susceptible to stories. I see a lot of stories from analysts about what the future might hold, how safe or unsafe a dividend might be, how great a business is or is not. Much less time is spent on how investors are compensated for risk. REITs pay out most of their earnings in dividends. The dividends are your compensation. Make sure as an investor you demand high enough dividends to offset the risk.

Given the nature of the current downturn, it’s best if we just admit upfront that we do not know what the downside will be or how to perfectly assess the risk rather than create a speculative story about it. But one thing we can do is not accept compensation that is obviously too low as investors were doing with Realty Income last year at this time. We can also take small, 1-2% portfolio positions in stocks and spread our bets around as a way to limit risk. If Realty Income hits $35.00, I will likely start a small position – but not before then.

If you have found my strategies interesting, useful, or profitable, consider supporting my continued research by joining the Cyclical Investor’s Club. It’s only $29/month, and it’s where I share my latest research and exclusive small-and-midcap ideas. Two-week trials are free.

Disclosure: I am/we are long BRK.B. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment