sefa ozel

It doesn’t take a clairvoyant with a crystal ball or even Michael Burry to see the US is fast headed towards a recession as the fed grapples with inflation and pumps the handbrake, sending the economy into a skid.

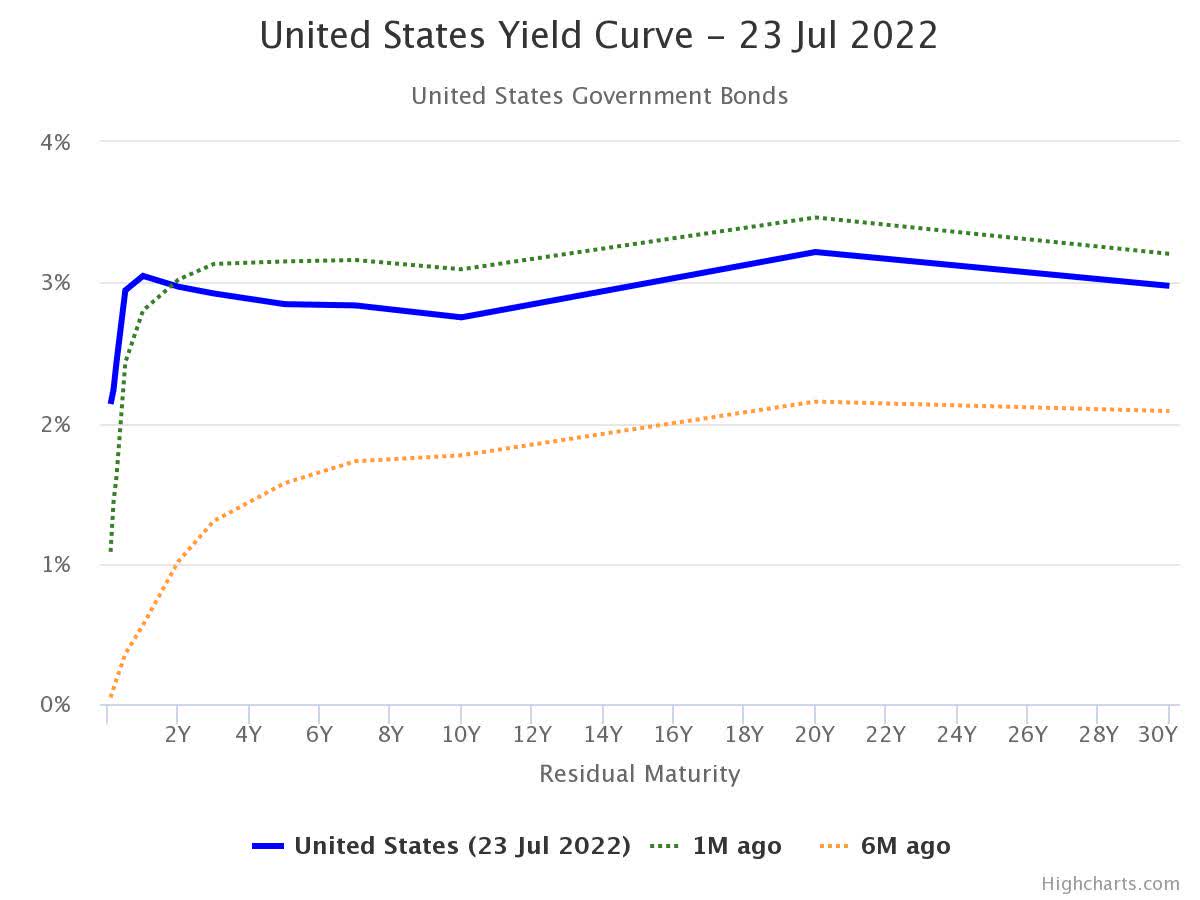

Take a quick peak at the US yield curve, and you’ll see a very worrying inversion of the curve which has only grown bleaker in the last month. Bloomberg estimates the likelihood of a recession at 38% in a report given persistent inflation, crashing crypto markets and consumer sentiment at record lows.

HighCharts.com

Bloomberg’s economic models point to an early 2023 recession, and with that in mind, now would be a great time for investors to begin considering what to do with their portfolios and how to set them defensively for a downturn.

Ranking Recession Readiness is a series of articles I’m authoring based on academic research along with advice from business leaders who took their firms through the Great Recession of 2008, to help investors identify which top 100 US firms are positioned to strive through a downturn, and which firms will stumble.

Today we’ll be looking at a behemoth of the technology space, Microsoft (NASDAQ:MSFT). It’s a firm that needs no introduction really, so let’s get into the details of what makes it such a fantastic recession-ready firm.

A full breakdown of the methodology and explanation behind the calculations is available in my introductory article, Ranking Recession Readiness: Is Google Prepared For The Recession?

(Data & prices correct as of pre-market 13th July, 2022)

(The Top 100 US Firms referred to can be found on this Seeking Alpha screener)

Want to skip the articles and dive right into the data? You can download my data and calculations here and see how the Top 100 US Firms compare on Recession Preparedness

Microsoft’s Base Financial Health

First let’s start by assessing MSFT’s overall financial health, and getting a really good overall picture of how the firm is performing in today’s current operating environment, in order to give ourselves a good understanding before we look to the future.

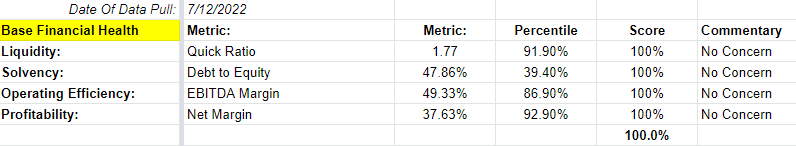

Author

First up, is MSFT’s base financial health, which shows us a really excellent picture of health. With a well-covered quick ratio for a worst-case scenario, very reasonable debt levels, strong operating efficiency and excellent net margins, MSFT is coming from a place of financial strength. Microsoft earns a perfect 100% score here.

Next, we dive into the obligations structure of MSFT’s debts.

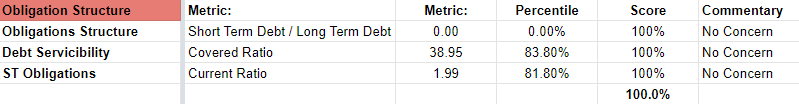

Author

Firstly, MSFT has no short-term debt, and the long-term debt that it does have is extremely well covered with a covered ratio of nearly 40. Lastly, Microsoft’s current assets exceed its current liabilities almost twice over, so a perfect 100% score, with no concerns score here, so next we’re on to dividends.

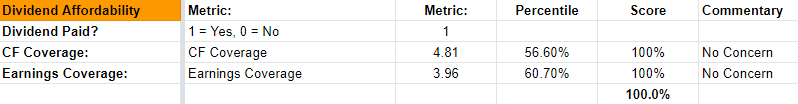

Author

Microsoft’s dividend is extremely well covered by cash flow and earnings, so no concerns here either, another 100% score.

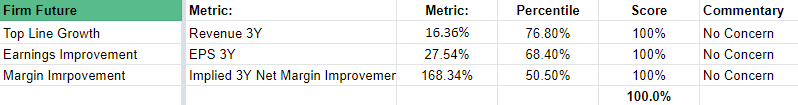

Lastly, we’re looking at Microsoft’s future outlooks.

Author

Strong forward-looking revenue estimates and increasing profitability show us Microsoft is extremely optimistic about its future, and this gives us no cause for concern.

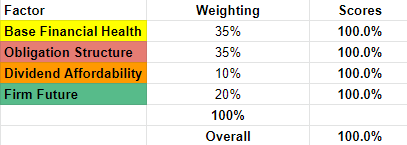

So overall, with perfect 100% scores in all areas, we can say Microsoft is operating with absolutely no cause for concern in the current environment.

Author

With this in mind, now let’s consider in more detail how Microsoft’s balance sheet is positioned to face an economic downturn.

Assessing Microsoft’s Recession Preparedness

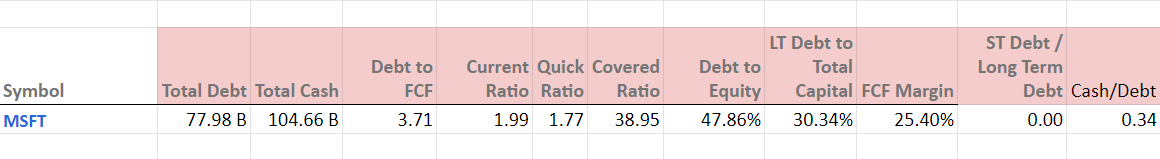

Based on the 2008 advice from business leaders, we first need to consider Microsoft’s debt and cash positions, and then look at liquidity and consider if the firm’s balance sheet presents any risks in the event of a downturn.

Author

Microsoft’s significant cash balance, which far outweighs it’s debt, gives it a fantastic defensive position (unlike Apple (AAPL), which has a nearly mirror-image balance sheet to MSFT).

MSFT also boasts a strong 25% FCF margin, which would allow the firm to pay off its debts 3 times over if it applied all of its FCF towards paying down debt.

We should see no concerns here, so let’s score each of these metrics, apply weights to the scores, and then rank Microsoft against the top 100 US firms.

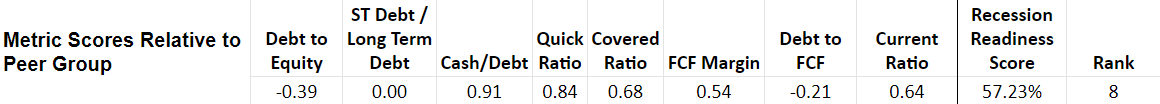

Author

With a recession readiness score of 57.23%, Microsoft has an extremely well-structured balance sheet heading into a recession, making the core fundamentals extremely attractive for investors searching for a defensive stock heading into a recession.

But let’s now look a little closer at the qualitative elements of Microsoft and apply the rest of the learnings from 2008 to Microsoft’s narrative and see how it looks.

A Deeper Dive Into Microsoft’s Recession Readiness

Reviewing the themes of advice from 2008, the next items to consider were reducing exposure to customer financials by minimizing accounts receivable, reduce costs associated with unsold stock by selling down inventory, cut costs aggressively but avoid layoffs, and lastly, invest in CAPEX while opportunity costs are low.

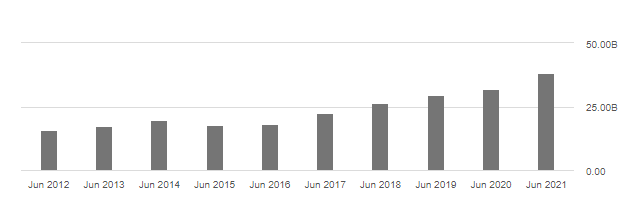

Let’s begin with looking at accounts receivable for Microsoft.

Accounts receivable $32.613B, 21.18% of total current assets, 9.46% of total assets (Seeking Alpha)

Here, Microsoft has one fifth of its total current assets in receivables, which is a large component but not overly concerning, and certainly expected for any firm with growth. However, given the nature of Microsoft’s services, it’s hard to see a scenario where customers won’t pay their bills for servers and equipment, else risk a complete shutdown of their IT infrastructure. So, Microsoft could almost be considered a business staple, with reasonably safe receivables.

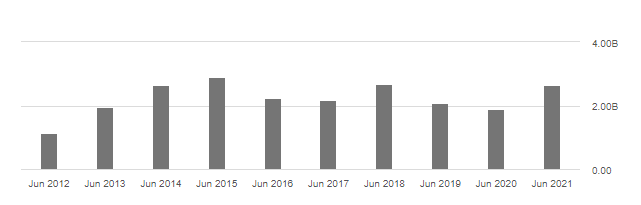

Next, we’re onto inventory.

Inventory $3.296B, 2.14% of total current assets, 0.95% of total assets (Seeking Alpha)

Despite the sheer size of the firm, Microsoft’s inventory assets are tiny compared to its current assets and total assets, so no concerns here.

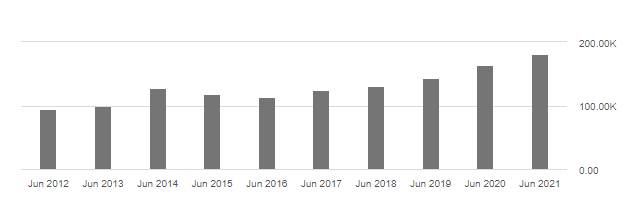

Next, we look at how likely it is Microsoft will consider layoffs in a recessionary environment.

Total employees 181,000, $1,063,850 revenue per employee, $400,309 profit per employee (Seeking Alpha)

Microsoft has been investing in growth through increasing headcount and given the substantial revenue per head and profit per head, it doesn’t appear like the firm will need to take drastic action like significant layoffs in the event of a downturn, so this aspect of the business appears relatively safe.

Lastly, we need to consider how likely it is that Microsoft will invest in CAPEX projects during a downturn. Given the nature of their field, and a $23B yearly R&D budget, Microsoft is certainly well positioned to deploy projects in this space and will likely benefit from its customers considering doing the same with upgrades to their own IT systems.

Closing Remarks

Microsoft scores perfect marks in all areas of the business heading into a recession, and it’s hard to see any major areas of risk for the firm.

I give MSFT a Strong Buy recommendation for investors looking at a recessionary defensive play but note that there is a non-zero level of risk associated with accounts receivable, and the balance sheet would be flawless if MSFT could minimize its debts further before a recession hits.

AAPL vs MSFT: I’d like to know your thoughts on AAPL vs MSFT, given the two firms have almost opposing balance sheets, which firm would you rather be holding in a downturn? Leave a comment below and let me know.

If you have any questions or would like to see any particular Top 100 US Firms assessed for their recession readiness, please leave a comment and let me know (I always do my best to monitor and respond to genuine comments!).

Be the first to comment