AutumnSkyPhotography

Investment Thesis

In my recently released article on Texas Instruments (TXN), which you can find here, I started with the following:

I am a big fan of the semiconductor space and I like a lot of companies in it. I know there are a lot of different visions on how the industry will be going forward, and I have heard people say they expect the sector to have peaked and will never reach higher levels again. I find this very hard to believe and I remain very bullish on the semiconductor sector in general. I believe the ongoing digitalization will continue for years and decades to come and semiconductors will be the literal new oil and be the engine of our society. For all future innovations, higher-performance semiconductors will be needed, and this will keep pushing the sector to innovate. So, no, the semiconductor sector is far from done growing. According to a report from Allied Market Research, the semiconductor market is expected to hit over $1 trillion by 2031, growing at a 6.21% CAGR.

Mckinsey expects the semiconductor market to reach this market size by 2030, at a CAGR of 6-8%.

As stated above, I remain extremely bullish on the semiconductor industry, and I think one of the companies with the largest exposure to secular trends is QUALCOMM Incorporated (NASDAQ:QCOM). Qualcomm has an exposure, and a strong position, in industries like automotive, 5G, IoT, smartphones, smart cities, and AI. I believe Qualcomm will be one of the fastest-growing stocks over the next decade, supported by a low current valuation and exposure to high-growth sectors. Qualcomm looks perfectly positioned to benefit from the ongoing digitalization. Their smartphone business might not be the fastest growing going forward, but it does offer a strong cash flow to the company and enough funds to invest in higher growth areas such as AI and automotive. I am very impressed by the exposure Qualcomm has to these industries and I remain very bullish on the company.

I am not so bullish on the economy, though. The current economic circumstances make it hard to decide when to invest. I cannot say for sure whether this may be the bottom or not. Maybe the markets will keep going down over the next year or so. Honestly, this does not matter for my investing thesis. I will keep buying companies that I believe are at a fair valuation and for which I see long-term growth potential. Qualcomm is one of these companies.

Qualcomm reported its 4Q22 and FY22 results on November 2nd, and at the time of writing this, on November 3rd, the stock is down by 7.4%. The results clearly were not received well by investors at all. So where did it go wrong for Qualcomm during the quarter?

These latest results seemed like a good moment for me to write my initial thesis on Qualcomm after owning the stock for a few years now. I believe the stock is being oversold as a result of the weakening economy

Financial results

Qualcomm reported very solid results for their fourth financial quarter and beat both top and bottom-line estimates by analysts. Revenue came in at $11.4 billion, with 22% growth YoY. The QCT (Qualcomm CDMA Technologies) reported record revenue of $9.9 billion and record EBIT of $3.4 billion (34% margin), increasing 34% YoY. Combined revenue for IoT and automotive reached $2.3 billion which shows how strong these segments are growing thanks to the continuing digital transformation. These segments saw record revenue numbers across the board with record revenue for handset ($6.6 billion), automotive ($427 million), and IoT ($1.9 billion).

To dive a bit deeper into automotive, Qualcomm reported that the total design win pipeline increased again to a total of $30 billion, up by $10 billion compared to the previous quarter. This shows the incredible strength of this segment and promising signs of strong future revenues.

QTL (Qualcomm technology licensing) reported revenues of $1.4 billion, which was below guidance with margins still at a high 69%, but this was at the lower end of guidance as well.

Qualcomm returned a total of $1.3 billion back to its shareholders in the form of dividends and share buybacks.

Management said the following:

We are pleased to report another strong year, despite the macroeconomic challenges, as we continue to execute our strategy of transforming Qualcomm from a wireless communications company for the mobile industry to a connected processor company for the intelligent edge.

Qualcomm delivered an outstanding quarter despite all the economic headwinds and growth remained strong. In fact, this was the case over the full year. Qualcomm, of course, also presented its FY22 results. It has been a record year for Qualcomm as revenue increased by a strong 34% YoY and EBIT grew even stronger by 47% YoY just as EPS did. Total revenue for the year was $44.2 billion and EBIT came in at $16.6 billion with EPS of $12.53.

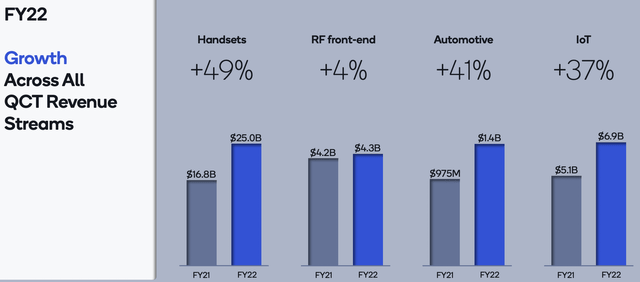

Growth for the full year was mainly driven by strength in their products with their QCT segment growing revenues by 39%. QTL was flat YoY and was somewhat of a disappointment. Qualcomm saw incredible growth across all product segments as can be seen below.

So why did the stock drop so much on the next day of trading? The answer is the outlook.

Qualcomm has guided for 1Q23 revenue of $9.2 – $10 billion and EPS of $1.72 – $1.92. Both are below last quarter’s revenue and EPS and below analyst estimates. Analysts guided for revenue of $12.05 billion and EPS of $3.34. It should not really come as any surprise as there is a global slowdown in consumer spending and an increase in inventory in many categories. Qualcomm was never going to be immune to this and I just think analysts were still being way too optimistic about the outlook for Qualcomm. A slowdown was inevitable and here it is. Qualcomm explained that its business is currently being impacted by (1) Demand weakness and (2) elevated channel inventory.

- Qualcomm had already warned in previous quarters that a slowdown in handset sales and consumer IoT was coming. Since then, the macroeconomic environment has weakened. Qualcomm now expects handset volumes to decline by low-double digits YoY during the 2022 calendar year. This is worse than previously anticipated. I am not particularly worried about the slowdown in handset growth, or even the decrease in total sales, as the general long-term growth trend is still intact, and Qualcomm has a very strong position in the segment.

- The elevated inventory also did not come as a surprise as this was already seen industry-wide over previous quarters. It was just a matter of time before this would hit Qualcomm as well. The rapid easing of demand in combination with the easing of the supply chain resulted in elevated inventory across many businesses. This is what Qualcomm said about this:

Based on our current assessment, we estimate that there are roughly 8-10 weeks of elevated inventory. We believe this may take a couple of quarters to work itself through, with more than half of the inventory drawdown completed in the first quarter.

Where the weak outlook is not great in the near term, the long term is still very much intact, and Qualcomm had a few strong announcements that show the business growth is far from over. Let’s have a look at Qualcomm, the fundamentals, growth opportunities, and recent announcements.

Qualcomm Inc.

Qualcomm is an American multinational corporation with its headquarters in San Diego, California. Qualcomm creates and builds semiconductors, software, and services related to wireless technology. The company is mostly associated with its Snapdragon chipsets used in most android smartphones, but the company has a way wider portfolio of products. Qualcomm owns patents to the 5G and 4G mobile communication standards and is therefore a very important player and huge beneficiary within the shift towards 5G. The company is a fabless company which means it outsources semiconductor manufacturing to other companies.

Qualcomm product overview (Qualcomm)

Nowadays Qualcomm has over 170 offices in 30 countries worldwide. With a market cap of over $114 billion, it is one of the largest semiconductor companies worldwide.

Qualcomm has exposed itself over time to more and more high-growth sectors and industries.

Handsets

Qualcomm holds a very strong position within the handset semiconductor space with its Snapdragon products and 5G modems. Qualcomm led the global SoC market with a 44% market share. The global SoC market grew by 23% during the first quarter of 2022 showing the growth opportunity within this segment. According to Fortune Business Insights, the global smartphone market is still far from growing, despite its incredible size of $484.81 billion. It is expected to grow at a 7.3% CAGR through 2029 to reach a small $800 billion by 2029. The growth in global smartphone sales will obviously benefit Qualcomm massively as it has a strong market share in smartphone SoCs. The handset segment earned $25 billion in revenue for Qualcomm in FY22. This is a very strong business for Qualcomm and will remain a cash generator for the next decade. Qualcomm is still working on increasing its market share and announced during the latest quarter that its snapdragon chipset will power Samsung’s (OTCPK:SSNLF) newest flagship foldable devices.

IoT

Qualcomm reported record revenue of $6.9 billion in FY22 for the IoT product segment. IoT is another secular growth industry to which Qualcomm has great exposure. Since this segment might be a little more complicated than handset, we will take a bit more of a dive into this product segment.

IoT stands for “Internet of Things” and defines as all devices connected through the internet to other devices creating a constant exchange of data between them. There will probably be more definitions of this, but this sounds as simple as possible. But what does Qualcomm mean to this business?

Qualcomm® IoT technologies and solutions utilize the real-world Connected Intelligent Edge to offer end-to-end, ready-to-deploy solutions so customers can digitally transform their businesses to optimize their operations, monetize massive amounts of data, innovate in new ways, and drive cost savings.

Qualcomm is a builder of software and semiconductors for IoT-related solutions. Qualcomm uses its dominance and knowledge of 5G to offer solutions that can process huge amounts of data, including video, AI, or real-time applications. IoT can help customers optimize their operational processes.

Our IoT solutions allow connected devices to communicate more efficiently to improve network efficiency, safety, interoperability, and capacity as billions of devices become interconnected.

IoT might not be the most known business within the portfolio of Qualcomm, but is a very fast-growing segment, which grew 37% YoY in FY22. The global IoT market is currently estimated to be worth $478 billion and is expected to grow at a whopping 26.4% CAGR through 2029 to reach a total of over $2.4 trillion. With the expertise of Qualcomm within the wireless connections industry and the ever-growing offering of new software solutions, Qualcomm is poised to benefit from IoT growth. The IoT growth is not expected to see a huge slowdown over economic cycles and during potential recessions, which means it remains a strong growth factor for Qualcomm, even during uncertain economic times and thereby potentially offsetting some losses within the handset product segment.

Qualcomm reported that it signed a multi-year strategic agreement with Meta Platforms (META) for its Snapdragon XR platform. This is what Qualcomm says about this technology:

Qualcomm Technologies is accelerating the future of extended reality (XR) with our Snapdragon® XR technologies, designed to seamlessly merge the physical world with digital. Our best-in-class XR solutions include processors, software and perception technologies, reference designs and developer tools that help create a new future of unlimited potential for both enterprise and consumers. With the combination of high performance and low power computing, 5G and AI, XR may have a greater impact on our world than PCs and smartphones combined.

This partnership with one of the leaders in the Metaverse is a very strong partnership for the further development of their IoT segment.

Automotive

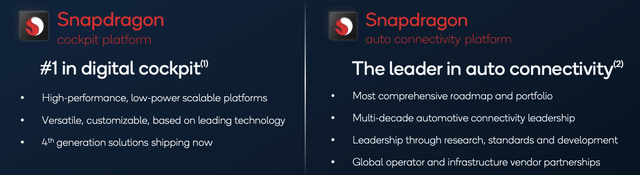

This product segment might be one of the most exciting ones to find within the stock market, with the increasing number of electric vehicles and massive expectations of future autonomous driving possibilities. Qualcomm has a strong position within this industry and as of the latest quarter, the company reported a backlog of $30 billion for the automotive segment alone. The FY22 revenue of $1.4 billion might not be that impressive and is only a small part of total revenue. The sector did grow by a strong 41% YoY, showing its potential. So, what products or services does Qualcomm offer for the automotive industry? Through their Snapdragon branded chipsets, they offer a lot of capabilities on connectivity and autonomy.

We allow automakers to deliver connected and intelligent experiences that are safer, customizable, and immersive with new technology features and digital services available on demand.

Their offerings can differ from the car’s software package, to internet connectivity and Bluetooth. The most promising part, of course, is autonomous driving software and hardware. Qualcomm offers these capabilities through its Snapdragon Ride platform. For context, the Snapdragon Digital Chassis by Qualcomm can provide assisted and autonomous driving technology as well as in-car infotainment and cloud connectivity.

As an integral pillar of the Snapdragon Digital Chassis™, the Snapdragon Ride Platform has gained momentum with a growing number of global automakers and Tier 1 suppliers since its launch in January 2020. At CES 2022, we announced the Snapdragon Ride Vision System—an expansion to the product portfolio featuring an open, scalable, and modular vision software stack built on an industry-leading 4-nanometer (4nm) processing node. The Vision System-on-Chip (SoC) is integrated with the proven Vision Stack, providing an optimized implementation of front and surround-view cameras for advanced driver assistance systems (ADAS) and automated driving (AD). When combined with the Snapdragon Ride Automated Driving Stack and an already wide range of hardware and software options, the Snapdragon Ride Platform has grown to become one of the most open, scalable, and customizable ADAS/AD solutions available today.

The autonomous driving industry is a very challenging one with a lot of competition from the likes of Mobileye (MBLY), Nvidia (NVDA), Tesla (TSLA), and Waymo (GOOG, GOOGL), for example. According to a recent report, the global market for autonomous driving chipsets alone is expected to reach $7.77 billion by 2025, from $1.83 billion in 2019. This is a very strong 38% CAGR. Qualcomm currently already dominates the automotive connectivity chipset market with an 80% market share and is therefore well positioned to expand this offering into the autonomous driving space. Qualcomm already announced that it will be powering the Cariad software department of the Volkswagen (OTCPK:VWAGY) group and, therefore, being the supplier for all brands within the group.

Other car companies that partner with Qualcomm are Mercedes Benz (OTCPK:MBGAF), Stellantis (STLA), Hyundai (OTCPK:HYMLF), Renault (OTCPK:RNSDF), Volvo (OTCPK:VOLAF), and BMW (OTCPK:BMWYY).

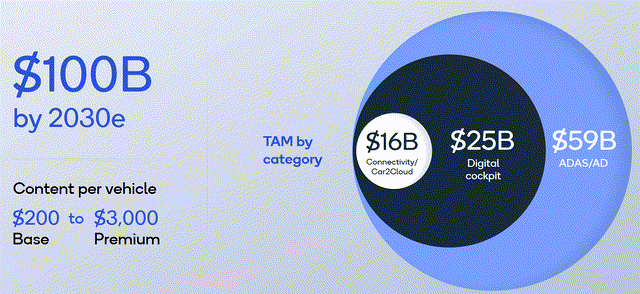

Qualcomm is very well positioned to benefit from industry growth as it already has a strong market position with the automotive industry and a $30 billion pipeline through agreements with some of the largest automakers. Qualcomm expects to be able to report $4 billion in revenue by 2026 and see this increase to $9 billion by 2029. Qualcomm sees a $100 billion TAM through its offerings in the automotive industry.

The growth and TAM Qualcomm is projecting are supported by the general growth of the automotive market and the incredible growth of the autonomous driving market which is expected to grow to a total market size of $200 billion by 2030, at a CAGR of 25.7%.

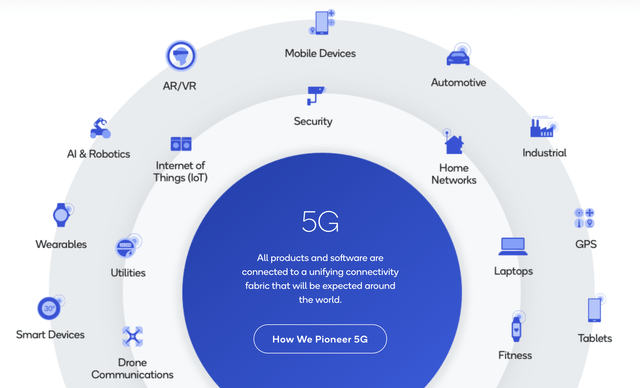

5G

Qualcomm is the biggest and most innovative player in 5G technology. This is a strength for Qualcomm as without their hardware 5G would not be possible. Qualcomm believes 5G will be the leading platform for this decade and beyond. It eventually sees a $13.1 trillion sales opportunity by 2035. 5G will play a crucial role in our society as everything is turning digital and more and more things are connected to each other. Qualcomm delivers 5G solutions for pretty much all different applications from smartphones to the automotive sector. The 5G market will remain a strong growth factor for Qualcomm products and is expected to grow at a 25.3% CAGR until 2027.

Balance sheet and valuation

Whether a company is a good investment goes further than just its growth opportunities and earnings. Valuation and balance sheet health are crucial as well. As of the latest quarter, Qualcomm had total cash, cash equivalents, and marketable securities position of $6.4 billion, which is significantly lower than the $12.4 it had one year ago. Qualcomm has a total debt position of $15.5 billion, pretty much the same as the $15.7 billion debt load one year ago. I always prefer companies with a positive net cash position as this gives them more flexibility during economic downturns. Qualcomm has a negative net cash position, but with a good cash amount and no short-term debt.

Qualcomm offers a very nice 2.89% dividend yield. This yield is over 50% higher than the sector average and receives an A- from Seeking Alpha Quant. The dividend is also rather safe as it only has a 25% payout ratio. Qualcomm has been growing its dividend at a 12% CAGR for the last 10 years now. Growth has come down over the last 3 years with just a 4% CAGR. Qualcomm does have a very strong dividend history and has been one of the best dividend payers within the semiconductor industry together with Texas Instruments. Qualcomm has been paying a dividend for 18 years now and has increased the dividend every single year.

As for valuation, Qualcomm receives a B+ from Seeking Alpha Quant. The company is valued at a forward P/E of just 10.27 and therefore 42% undervalued compared to the sector average. This valuation is impacted by the dependence on income from Apple (AAPL) and the possibility of Apple leaving as a customer of Qualcomm, which I will talk about in the risks section. Qualcomm also carries a way lower valuation because of its exposure to a highly cyclical industry such as smartphone sales. As we saw during the earnings call, Qualcomm is already guiding for a double-digit drop in smartphone sales, which has a significant impact on their handset business which accounts for about 60% of revenue.

This extreme cyclicality in an already cyclical sector pushes down on the valuation of Qualcomm. This does make Qualcomm very low-valued right now and a very interesting buy. Analysts are already guiding for a negative 9% growth for FY23. For this reason, I believe a lot has already been priced in. I am becoming more negative about the economy by the day, and I expect that analysts’ estimates will need to be guided even lower toward a double-digit loss for Qualcomm over FY23. But that would not change the fact that Qualcomm is very low valued at current prices. Those who can manage to look through the current economic weakness can benefit from the great secular growth trends to which Qualcomm has a lot of exposure. Analysts are projecting 13% growth for Qualcomm in FY24. To complete the full analysts’ expectations, analysts expect EPS to drop by a massive 19% in FY23 and to bounce back up by 21% in FY24.

Risks

A lot of companies are giving very negative outlooks for the following quarter and analysts are forced to lower their expectations. The economic outlook is not looking good with the FED continuously increasing the interest rates and inflation remaining high. A recession seems inevitable. An economic slowdown and a potential recession will have a significant impact on Qualcomm and a lot of its customers. As mentioned before, global smartphone sales are expected to come down by double-digits this year and I don’t expect next year to be much better, probably even worse.

A consumer spending slowdown will result in less spending on expensive items and people will probably wait with buying a new phone or car. The automotive sector is also one which will be hit with lower sales numbers and businesses will need to consider which IT spending is necessary. I expect Qualcomm to report negative revenue growth of mid-double-digits in FY23. Some product sectors will continue to grow, even during a slowdown. Automotive revenue will continue to grow double digits as the shift towards EV and autonomous driving will be strong enough to offset the drop in car sales.

Where the global phone market is expected to drop, Apple reported another increase in iPhone sales during their latest quarter. Apple uses the 5G modem chip from Qualcomm to power its iPhone 5G connection. Apple has been working on building its own modem chip for a couple of years now. Last June a report came out that Apple once again failed to build its own chip and was forced to keep using the 5G modem chip from Qualcomm. In 2019, Apple bought the modem division from Intel, and ever since there has been the threat of Apple being able to make its own 5G modem. Since Apple is the largest customer of Qualcomm, losing Apple as a customer would have a significant impact on revenue. Since Apple failed so far, it was forced to sign a new agreement with Qualcomm to keep using its modems until 2026 (in 2019 after multiple lawsuits). Apple does keep challenging Qualcomm and the threat of losing Apple as a customer will remain, as explained in this report.

The final risk I would like to discuss is the lawsuit ARM launched against Qualcomm about using its patents. The suit threatens Qualcomm’s expansion plans as it was trying to use Nuvia to compete more directly with Apple chips and to possibly crack the server chip market, which is a huge growth industry. Qualcomm acquired Nuvia at a price of $1.4 billion in 2021. The ARM licenses are crucial if it wants to expand into the data center market, where Intel and AMD are currently the most dominant. The acquisition would enable Qualcomm to produce chips competitive to the M-series in the Mac computers from Apple. To produce these products, it used the ARM licenses which Nuvia owned. ARM says the license didn’t transfer to Qualcomm when it bought Nuvia. ARM says Qualcomm needed its consent to use Nuvia’s custom core designs and terminated the Nuvia license in March 2022. The lawsuit won’t have an incremental impact on revenue for Qualcomm, but it will be crucial to its future growth plans and expansion plans into the CPU business for laptops and data centers. We will have to wait and see how this works out, but I left these growth opportunities out of this report, as these were still too much of a guess for now.

Conclusion

I hope this article gave you some great insides into the recent financial results of Qualcomm and the huge future potential of the company. I remain a buyer of Qualcomm and hope to add to my position in the near future. Qualcomm has incredible potential thanks to its exposure to high-growth industries. The company does carry some serious risks, with most of them being near-term risks. As a long-term investor, I am focused on the long-term opportunity for Qualcomm and this, to me, outweighs the near-term risks. I rate Qualcomm a buy at current prices but do recommend easing in slowly as we have no certainty as to where the economy is headed, and lower prices may very well be possible in the near term. Buy on weakness.

Be the first to comment