PhoThoughts/iStock Editorial via Getty Images

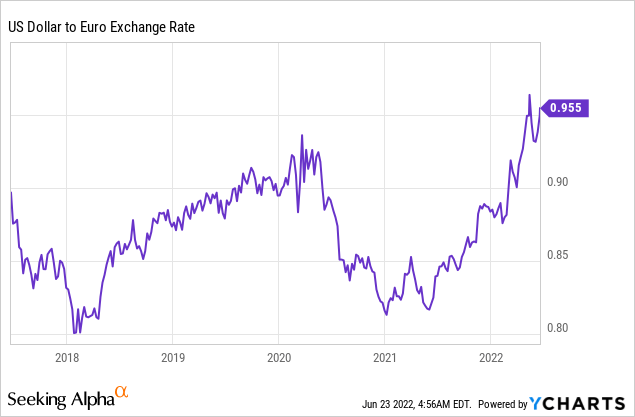

Lately, the U.S. dollar (“USD”) has appreciated significantly against the euro. This makes investing in U.S. companies a little less attractive than investing in European companies. For this reason, I have been using screeners to find high-quality stocks that (preferably) report in euros but get a significant amount of their revenues in USD. One company that I recently came across is Puma (OTCPK:PMMAF, OTCPK:PUMSY), a sports brand from Germany. In this article, I will do a deep dive into the company and explain why it might be an interesting stock to add to your portfolio.

The company

Puma was founded in 1948 in Herzogenaurach by Rudi Dassler, the brother of the founder of adidas (OTCQX:ADDYY, OTCQX:ADDDF), Adi Dassler. The brothers used to own the Gebrüder Dassler Schuhfabrik (a shoe factory) before they got into a fight and decided to split the company. This divided the village of Herzogenaurach into two camps, Puma and adidas. Adi Dassler’s focus was more on product development (which was what most employees were keen on, so Adi got 2/3rd of the employees), while Rudolf Dassler’s focus was more on sales. One brilliant example of Puma’s sales and marketing tactics was the FIFA World Cup of 1970, when they paid Brazil’s star player, Pelé, $120.000 to tie his laces, putting the focus on his shoes.

Shoe of soccer star Pelé (Puma)

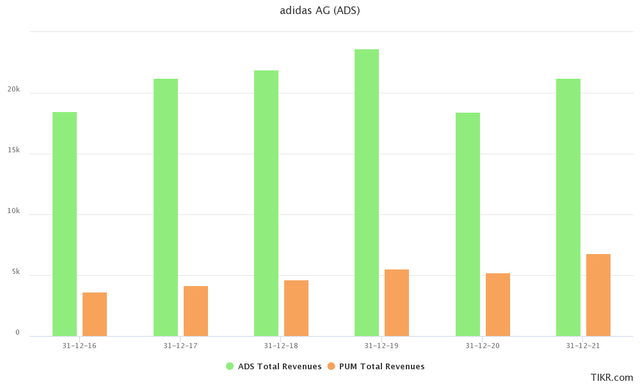

Nowadays, Puma and adidas are active in many sports such as Soccer, Handball, Motorsport, Golf, Track and Field, and Basketball, and their products aren’t limited to shoes anymore. Out of the two companies, adidas has a significantly higher market share, with revenues more than triple those of Puma.

adidas, Puma revenue past 5 years (TIKR.com)

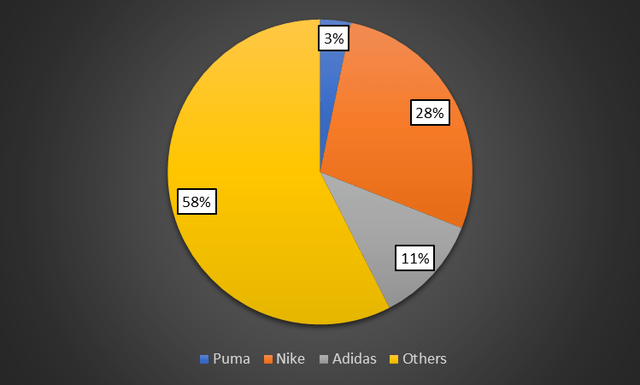

If we look at the entire sports apparel market, Puma is approximately the third company by market share, trailing aforementioned adidas, and Nike (NKE), who combined had a market share of approximately 40% in 2020.

Market share sports apparel (Fortune Business Insights, TIKR, Author)

Performance

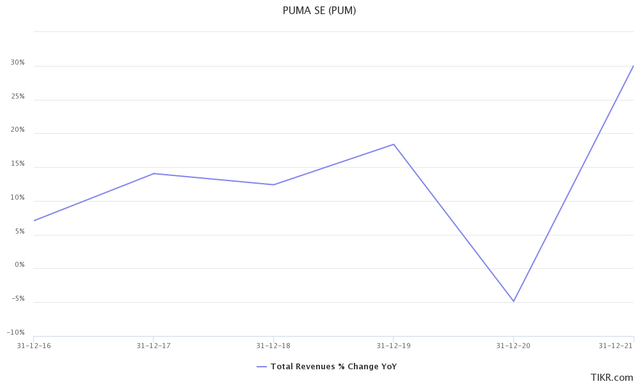

We already took a quick look at the revenue and market share of Puma, but it is also interesting to see how much Puma grew its revenues over the past few years. During the past 5 years, Puma achieved a revenue CAGR of 13.4%. The company had 1 year in which its revenues didn’t grow, which was during 2020, when revenues were significantly impacted by Covid-19.

Puma revenue growth (TIKR.com)

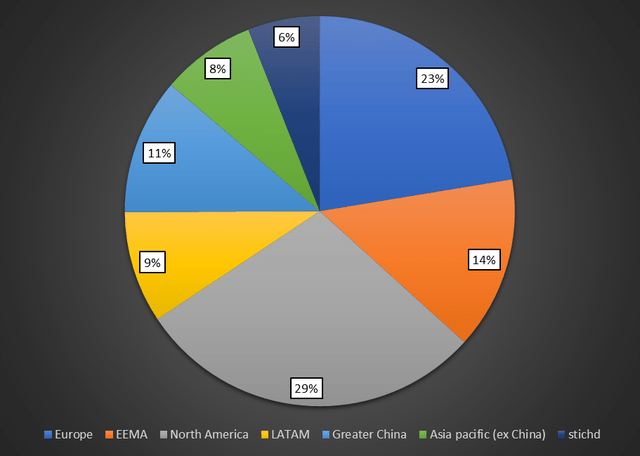

When we look at the division of revenues over the different countries, we can see that Puma earned approximately 29% from the U.S. Given the fact that the USD has appreciated against the euro and that the company reports in euros, this could have a significant impact on revenue in the current fiscal year.

Division of revenue per region (Puma, Author’s illustration)

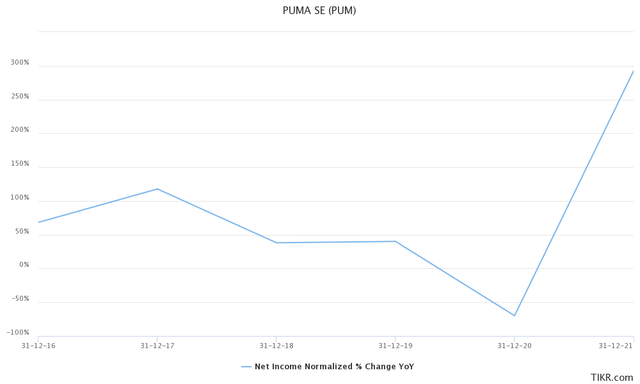

It is also important to see how much of the revenue drips down to the company’s net income. Over the past 5 years, Puma’s net income has increased by more than revenue due to improving margins. The jump in net income margin was most significant in 2017, which, according to the annual report, was due to improvements in sourcing, an increase in higher-margin products, higher own retail sales, and selective price adjustments.

Puma net income margin (TIKR.com)

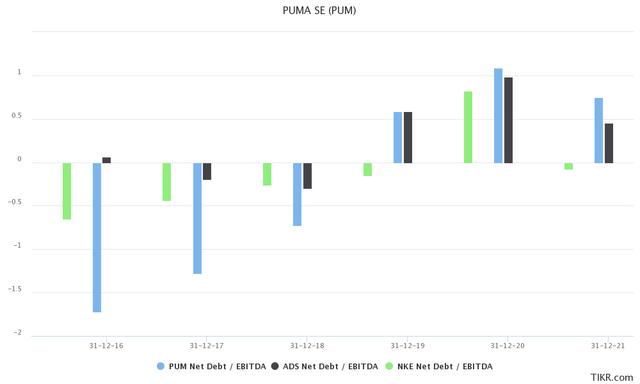

Besides revenue and net income, I also like to look at the financial health of the company. Personally, I prefer to look at the company’s net debt to EBITDA compared to its peers, and the debt-to-equity ratio. This gives a general idea about the strength of the company and if investors should worry about the company.

Puma currently has a net debt to EBITDA ratio of 0.75x, which is very low. Nevertheless, its main competitors, adidas and Nike, have a lower net debt to EBITDA at 0.47x and -0.07x respectively. In my opinion, it’s not a shame to have a slightly higher debt than adidas and Nike as a net debt to EBITDA below 1 is still very impressive. The company’s debt-to-equity ratio is 61.6%, which should also not worry investors too much. Personally, I prefer companies with a debt-to-equity ratio below 100%, as this gives the company more flexibility in the future.

Net debt to EBITDA CCA (TIKR.com)

Valuation

To value Puma I used the following methods: a DCF, Forward EV/EBITDA, and the company’s mean LTM PE, and LTM EV/Revenue. I like to use multiple methods and take the average of the results, as this decreases the influence of overly optimistic or pessimistic valuation methods.

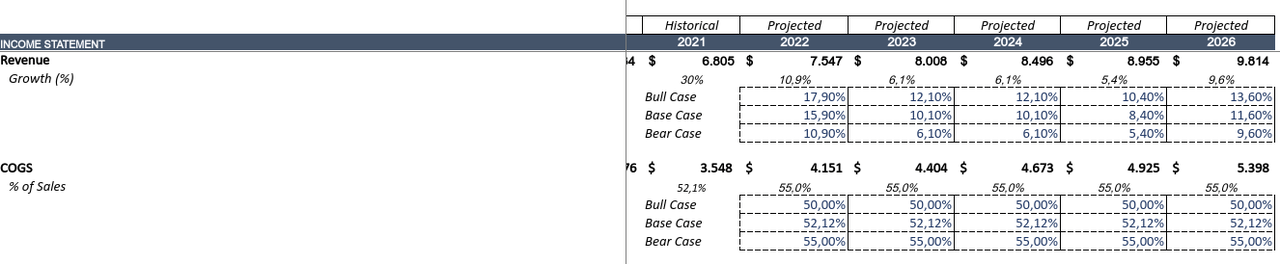

For my DCF and Forward EV/EBITDA, I like to make use of multiple cases: a bear case, a base case, and a bull case. This is done because we are unable to perfectly forecast the future. The revenue growth is based on the analyst forecasts, and the COGS is based on the COGS over the past three years and adjusted based on my overall expectation of the company in that environment. For Puma, this gives the following results:

Estimations used (Author)

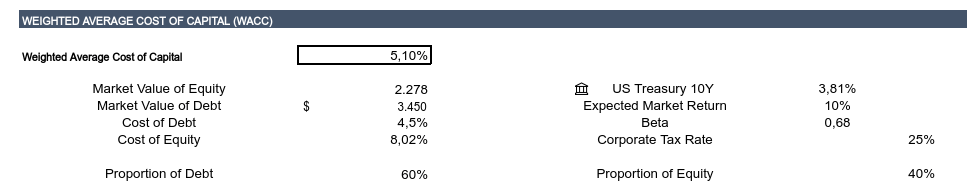

To discount future cash flows, we estimate the company’s weighted average cost of capital (WACC). The WACC is based on the company’s beta, my minimum required rate of return, the treasury rate +0.5% (as I expect this to rise), cost of equity and cost of debt. I also adjusted the cost of debt slightly to take into account that future borrowing will most likely have to be done at higher rates. This gave me the following result:

Puma’s estimated WACC (Author, Yahoo Finance, Annual Report)

The estimated growth rate in perpetuity is put at 1.5%, which is slightly below the 10-year US GDP CAGR. We further assume no stock buybacks and a dividend payout ratio of 30%. This gives a price target of approximately €69.58 based on the DCF. Puma’s EV/EBITDA has been approximately 20, given the current market uncertainty I revise this downwards to 15. This still gives me a price target of €101.79 or approximately €35 above its current price.

The other valuation methods which I use, the company’s P/E ratio and EV/Revenue are based on the company’s 10-year averages. The company’s 10-year average P/E, after taking out outliers, was 30 and its EPS during 2021 was 2.1, which gives a price target of €63. The company’s 10-year EV/Revenue was approximately 1.35 and its 2021 revenue was €6805.4 million. After multiplication, subtracting net debt and dividing it by the shares outstanding, I get a price target of €62.86.

If we combine all the price targets: €69.58, €101.79, €63, and €62.86, we get an average price target of €74.31. This gives an upside of approximately 15.6% over the price at the moment of writing.

Risks

FX risk

The company is listed on the Xetra and its main listing is traded in euros. Investors should take this into account before starting a position, as FX moves can have a large impact on actual returns. Given that the USD has recently appreciated against the euro, this risk is lower than a few months ago.

However, given the fact that the Eurozone is made up of multiple countries with different economies, it is a lot harder for the ECB to hike rates. For example, the economies of most Northern-European countries could use higher rates, but some of the Southern-European countries would get into trouble if the rates are hiked. Thus, the ECB is walking a tight rope here, which could mean that they are not as aggressive as the Fed, making the USD more attractive for investors. The reason for this is that you could still borrow relatively cheap in the Eurozone, exchange this for USD, and put it into a savings account, which would give investors a relatively risk-free return.

Supply chain

Puma is reliant on an effective supply chain, as some of its clothes are seasonal. If the company does not order in time or the supply chain is constrained, this could have a negative impact on the company’s performance. I estimate the chance of this risk to be moderate, as most companies have been dealing with supply chain constraints for the past 6-12 months. Therefore, I expect Puma to have a contingency plan by now, such as ordering way in advance and the impact to be moderate to low.

Recession

A lot of investors and analysts alike have been talking about a recession. A recession would have a negative impact on Puma and could lead to lower growth in the coming years. Nevertheless, I don’t expect a recession to have a huge impact on Puma. During the great financial crisis of 2007-2009, Puma’s revenue increased in two out of three years (2007 & 2008). The company has changed significantly since then, but the price point of most of its clothes is still slightly below Nike and adidas. This should mitigate some of the impacts of a recession.

Other things to take into account

Withholding tax

Puma is a German company, which means that you have to pay a dividend withholding tax. The dividend withholding tax in Germany is 26.375%. Due to the tax treaty between the U.S. and Germany, the dividend withholding tax should be 15%, so you might have to request the difference back from the German tax authorities. Before doing this, it would be smart to consult a tax professional.

Conclusion

Puma is an interesting company that has grown revenue and net income significantly over the past few years and has a low debt level. Due to the appreciating dollar, European stocks might be more interesting as you get more euros for your dollar. Nevertheless, as with any stock, the company is not risk-free and investors would have to deal with the German withholding tax. At the current price, I expect the benefits to outweigh the risks, and therefore, would rate the stock a buy. However, I do recommend investors to do their own due diligence before starting a position in Puma.

Be the first to comment