Scott Olson

Procter & Gamble (NYSE:PG) is able to effectively fight against inflation through its pricing power, brand loyalty, and the demand for its everyday household products. The company also pays an attractive dividend, as it has grown for 65 years, which proves that inflation and recessions have not been an issue to the dividend. With a possible recession on its way, PG is better set up now to navigate a downturn than ever before, as the company has shed discretionary brands while focusing on essential products. An earnings report is coming in late July, and consensus analysts expect a revenue of $19.43 billion and an EPS of $1.24. However, actual EPS and revenue can likely come out higher than these estimates, based upon the earnings and revenue surprises over the past 16 quarters. If a recession officially comes, private label brands could bring greater competition to PG. However, the company has navigated the Great Depression, inflation, multiple recessions, and World Wars in the past, which makes competitors less of a pressing issue for PG. The stock is currently overvalued, and the share price could continue to drop due to momentum. Investors should wait for a margin of safety before getting involved with PG, which is why I will apply a Hold rating.

Inflation Brings Dividend Opportunities

The consumer price index report for June showed inflation rising 9.1% from a year prior. This is the fastest inflation increase rate since 1981. Soaring inflation has had a direct impact on PG. As of April, the company increased its consumer goods prices for the fourth time in one year. Yet, this has not been a huge problem, as it can effectively combat inflation through the use of its pricing power and its strong brand loyalty. PG has $10.29 billion in cash, which can also help protect the company and give it some flexibility during times of uncertainty.

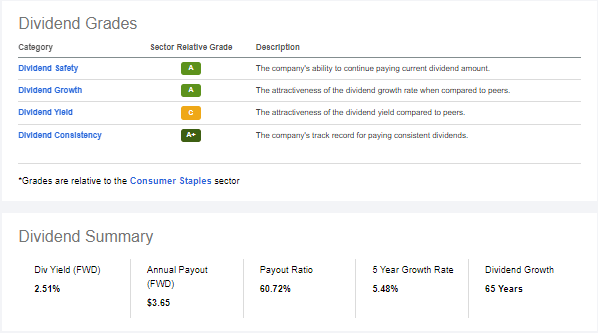

During times of inflation, investors may want to get involved with dividends. PG could be an attractive option for dividend investors, as the company has been consistently growing its dividend payments for 65 years. The company’s cash payout ratio it 60.72%, while it pays a $3.65 annual dividend. This equates to a 2.51% yield at the time of writing this article. PG is a fairly safe dividend option and has very impressive and consistent growth. Overall, PG could be a good buy for dividend investors.

PG Dividend Grade (Seeking Alpha)

Better Set Up For A Recession Now

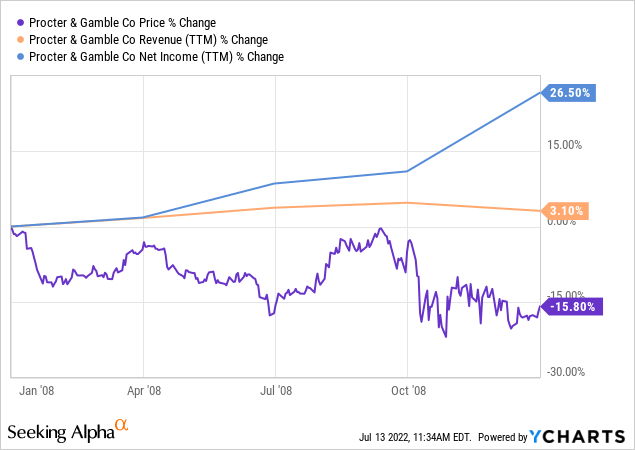

Atlanta’s Federal Reserve Bank has reported that the U.S. is likely already in a recession. However, PG is reasonably protected from a possible upcoming recession due to the company’s recession resistant products. Many of its products are everyday household items that will still be purchased during downturns. Also, PG was founded in 1837, which means that the company was able to withstand and survive the Great Depression, inflation, multiple recessions, and World Wars in the past. During the 2008 recession, PG was able to pretty effectively navigate the economic downturn, as the company increased its revenue and net income throughout the recession.

On top of this, PG is much more suitable to manage a recession now than the company has ever been before. Over the past few years PG has shifted its focus which better prepares the company for a potential downturn. CFO Jon Moeller has noted PG’s recent decisions.

In recent years, the company has shed brands it considers discretionary and focused on essential products that consumers buy even when household budgets tighten.

PG Could Outperform Expectations In Its Upcoming Report

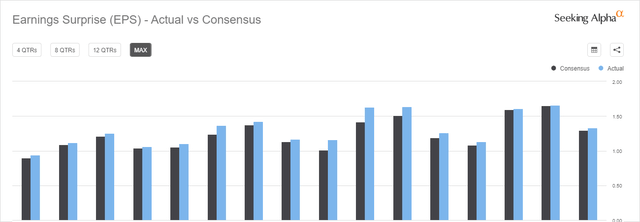

PG is expected to report earnings on July 29. Consensus analysts expect revenues of $19.43 billion and an EPS of $1.24. These estimates would mean a decrease in EPS and an increase in revenue from the previous quarter. In 3Q22, the company posted an EPS of $1.33 and a revenue of $19.38 billion. It is noteworthy that PG has beat analyst estimates for EPS in every quarter since 4Q18. PG has been consistently performing above expectations in regard to EPS. This means that it is very likely that PG will report an EPS above $1.24 for 4Q22. The company’s average earnings surprise over the past 16 quarters is 5.47%. If this is applied to the current analyst expectations, PG may actually report an EPS of $1.31

PG EPS Surprise (Seeking Alpha)

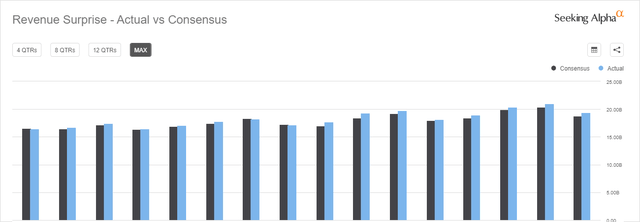

Additionally, PG has been pretty consistent in regard to revenue expectations. The company has beat analyst expectations for revenue 13 times, while falling below estimates just 3 times. Its average revenue surprise over the past 16 quarters is 1.9%. If this is applied to the current analyst expectations, PG may actually report a revenue of $19.8 billion.

PG Revenue Surprise (Seeking Alpha)

Private Label Competition Could Pick Up During Downturns

PG’s brand strength and loyalty is a significant reason that the company is able to outperform private label and cheaper competition. During the Great Recession, there was an increase in demand for private label over name brand companies because they were cheaper. Retailers often prefer private label products because they generate higher profit margins than national brands. On average, private label products produce 35% profit margins compared to the 26% national brands produce. This is not great news for PG with inflation on the rise and a potential recession likely. It may be tough for the company’s name brand products to compete against private label products that seem to do better during times of uncertainty. However, PG was able to get through the Great Recession and has overcome private label competitors in the past, which should be a good sign going forward.

Valuation

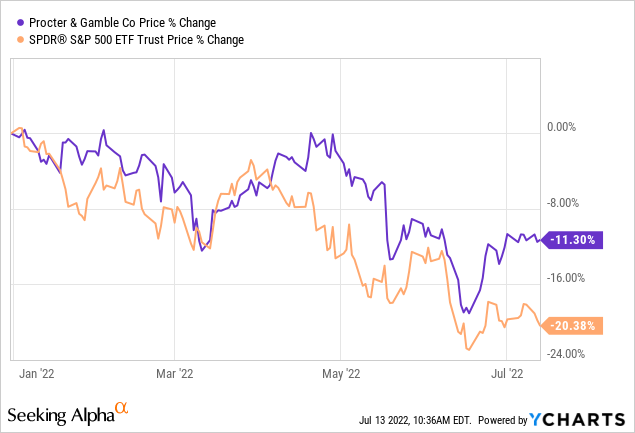

PG is currently outperforming the market by over 9%, but the share price is down by over 11% YTD. PG may continue to drop because of momentum due to inflationary and recessionary threats. It could be valuable to wait for a margin of safety before buying into PG.

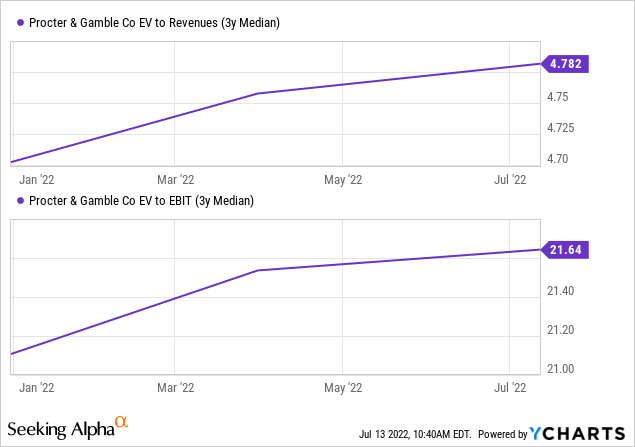

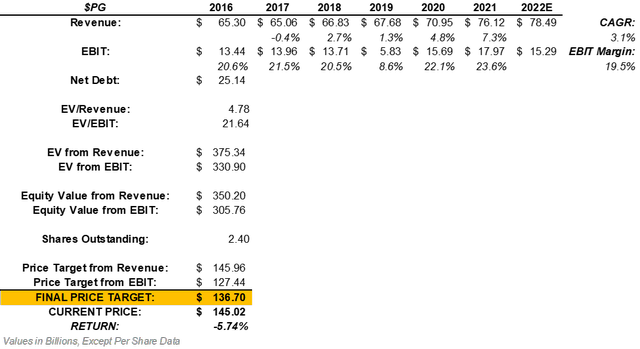

The last 6 years, PG increased its revenue from $65.30 billion to $76.12 billion. This indicates a CAGR of 3.1% which can be applied into the company’s next fiscal year. This projects the company to generate $78.49 billion in revenue in 2022. On top of that, PG has seen an average EBIT margin of 19.5%. Multiplying this margin by the estimated revenue of $78.49 billion projects the company to produce $15.29 billion in EBIT in the upcoming fiscal year. After multiplying these projections by its 3-year median EV/Revenue and EV/EBIT multiples, we can come to the company’s expected enterprise value.

After adjusting the company’s estimated enterprise values for net debt, we can find PG’s projected equity value from revenue and EBIT. Dividing the equity values by the current number of shares outstanding and averaging the price targets bring us to a final price target of $136.70. This means that PG stock could return a downside of 5.74%.

PG Valuation (Created By Author)

The Takeaway For Investors

PG has pricing power and brand loyalty to combat inflation during times of uncertainty. Most of the company’s products are also recession resistant and are everyday household items which will always be in high demand. The company pays an attractive, consistent, and growing dividend which may interest dividend investors. PG has recently shifted focus to essential products, which better sets the company up for inflation and recessions. The upcoming earnings report could bring in higher EPS and revenue than expected. Private label brands could be greater competition to PG during a recession, but the company has certainly fared well during downturns in the past. PG stock is currently overvalued and the share price is down over 11% YTD, despite outperforming the market. Momentum could mean that the price will drop even further, meaning that investors should wait for a margin of safety before buying into PG. The company is reliable and trustworthy, but investors should halt in order to get more value out of the stock. Therefore, I will apply a Hold rating to PG.

Be the first to comment