pabradyphoto/iStock via Getty Images

Earnings of Premier Financial Corp. (NASDAQ:PFC) will most probably dip this year on the back of higher provisioning expenses. Interest rate hikes will require greater provisioning for expected loan losses in the year ahead due to their impact on borrowers’ debt-servicing ability. Further, higher operating expenses and lower mortgage banking income will drag earnings. On the other hand, the management’s expansionary efforts and higher interest rates will likely boost the net interest income. Overall, I’m expecting Premier Financial to report earnings of $3.07 per share in 2022, down 9% year-over-year. The year-end target price suggests a high upside from the current market price. Further, Premier Financial is offering a good dividend yield for a bank holding company. Therefore, I’m adopting a buy rating on Premier Financial Corp.

Expansionary Efforts to Drive Loan Growth

After reporting loan growth of 7% (annualized) in the first quarter of 2022, the management is targeting full-year loan growth of 8%, as mentioned in the latest conference call. This target appears achievable because of Premier Financial’s recent expansion efforts. The company recently launched operations in Ann Arbor, Michigan. Further, the management has added 14 new members to the team so far this year, as mentioned in the conference call.

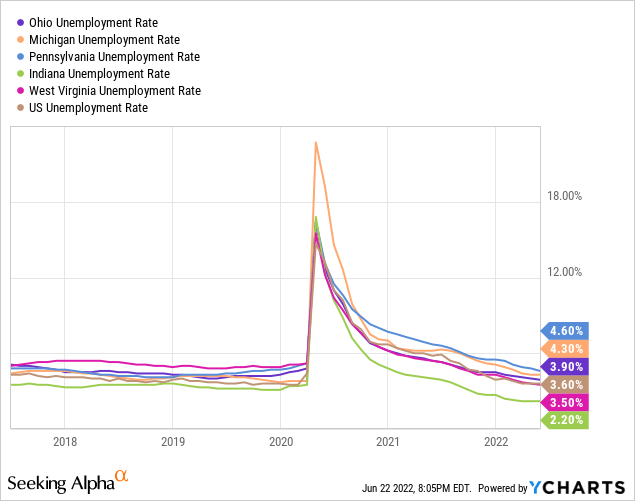

Economic factors can also improve the rate of loan growth in the year ahead. Premier Financial operates in several states, including Ohio, Michigan, Indiana, Pennsylvania, and West Virginia. The labor markets in these states, as well as the whole country, are quite strong, which bodes well for loan growth, especially consumer loans and residential mortgages. As shown below, the regional unemployment rates are back to at least the 2018 level, which bodes well for loan growth.

Overall, I’m expecting the loan portfolio to increase by 8% by the end of December 2022 from the end of 2021. Meanwhile, deposits will most likely grow in line with loans for the last three quarters of the year. The following table shows my balance sheet estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | |

| Financial Position | ||||||

| Net Loans | 2,322 | 2,512 | 2,746 | 5,409 | 5,230 | 5,647 |

| Growth of Net Loans | 21.3% | 8.2% | 9.3% | 97.0% | (3.3)% | 8.0% |

| Other Earning Assets | 327 | 344 | 386 | 1,039 | 1,490 | 1,546 |

| Deposits | 2,438 | 2,621 | 2,870 | 6,048 | 6,282 | 6,704 |

| Borrowings and Sub-Debt | 146 | 127 | 130 | 85 | 110 | 259 |

| Common equity | 373 | 400 | 426 | 982 | 1,023 | 995 |

| Book Value Per Share ($) | 18.6 | 19.5 | 21.4 | 27.3 | 27.5 | 27.6 |

| Tangible BVPS ($) | 13.4 | 14.5 | 16.2 | 17.6 | 18.3 | 18.1 |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

Moderate Rate-Sensitivity to Support Earnings

Premier Financial’s topline is moderately sensitive to interest rate hikes. This rate sensitivity is largely attributable to the loan mix, which is heavy on variable and adjustable-rate loans. These quick-to-reprice loans made up 54% of total loans at the end of March 2022, as mentioned in the presentation for May.

Unfortunately, a majority of the deposit book will also re-price immediately after every rate hike this year. These quick-to-reprice deposits, including savings, checking, and money market accounts, made up 61.1% of total deposits at the end of March 2022.

Due to the combination of the rate sensitivity of loans and deposits, the overall net interest margin is only moderately sensitive to interest rate changes. The management’s interest-rate sensitivity analysis given in the presentation shows that a 200-basis points increase in interest rates could boost the net interest income by 7.5% over twelve months. The Federal Reserve projects another 150 to 175 basis points increase in the Federal Funds rate for the year ahead. Considering these factors, I’m expecting the margin to increase by 15 basis points in the last three quarters of 2022 from 3.44% in the first quarter of the year.

Hike in Interest Rates Bodes Ill for Credit Quality

After last year’s significant provision reversals, the level of reserve releases will likely decline to the pre-pandemic level this year. Allowances were 142.07% of nonperforming loans at the end of March 2022, which is not a comfortable level in my opinion, especially when the Federal Funds rate is likely to reach 3.5% by the year-end. The high interest rate will take a toll on borrowers’ ability to service their debt. Moreover, there are slim chances of a recession in late 2022 or early 2023. In my opinion, Premier Financial will want to build up its loan loss reserves just in case a recession materializes.

Moreover, the anticipated additions to the loan portfolio will require provisioning for expected loan losses. Overall, I’m expecting the provision expense, net of reversals, to remain above normal this year. I’m expecting the net provision expense to make up 0.18% of total loans in 2022. In comparison, the provision expense averaged 0.09% of total loans from 2017 to 2019.

Expansionary Efforts to Boost Operating Costs

Premier Financial’s noninterest expenses were up 6.4% year-over-year in the first quarter of 2022. Despite this surge, the management mentioned in the conference call that it expects operating expenses to be around $162 million for 2022, up by only 2.6% year-over-year. This target appears overly optimistic given not only the recent performance but also the recent expansion in Ann Arbor and the new hires. Further, the inflationary environment should lead to wage pressure in the year ahead. Therefore, I’m expecting the actual noninterest expenses for the year to exceed the management’s goal. Overall, I’m expecting noninterest expenses of $165 million for 2022, 2% higher than the management’s target.

Expecting Earnings to Dip by 9%

The anticipated increase in provisioning for loan losses and noninterest expenses will likely lead to an earnings decline this year relative to last year. Further, the mortgage fee income will likely decrease in 2022 because of lower refinancing activity. Higher interest rates will end any benefit of mortgage refinancing, which will reduce the total mortgage banking income for the year compared to last year.

On the other hand, high-single-digit loan growth and decent margin expansion will likely lift the top line, thereby supporting earnings. Overall, I’m expecting the company to report earnings of $3.07 per share in 2022, down 9% year-over-year. The following table shows my income statement estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||

| Income Statement | |||||||

| Net interest income | 97 | 108 | 116 | 208 | 227 | 245 | |

| Provision for loan losses | 3 | 1 | 3 | 44 | (7) | 10 | |

| Non-interest income | 40 | 39 | 45 | 81 | 80 | 69 | |

| Non-interest expense | 85 | 89 | 97 | 165 | 158 | 165 | |

| Net income – Common Sh. | 32 | 46 | 49 | 63 | 126 | 111 | |

| EPS – Diluted ($) | 1.61 | 2.26 | 2.48 | 1.75 | 3.39 | 3.07 | |

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) |

|||||||

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, the threat of a recession can increase the provisioning for expected loan losses beyond my estimates.

Combination of High Price Upside, Good Dividend Yield

Premier Financial is offering a remarkable dividend yield of 4.7% at the current quarterly dividend rate of $0.30 per share. The earnings and dividend estimates suggest a payout ratio of 39% for 2022, which is below the five-year average of 43%. Therefore, the outlook of earnings decline poses no threat to the dividend level.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Premier Financial. The stock has traded at an average P/TB ratio of 1.65 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 14.5 | 16.2 | 17.6 | 18.3 | ||

| Average Market Price ($) | 29.4 | 28.8 | 19.8 | 30.2 | ||

| Historical P/TB | 2.03x | 1.78x | 1.12x | 1.65x | 1.65x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $18.1 gives a target price of $29.8 for the end of 2022. This price target implies a 15.7% upside from the June 22 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.45x | 1.55x | 1.65x | 1.75x | 1.85x |

| TBVPS – Dec 2022 ($) | 18.1 | 18.1 | 18.1 | 18.1 | 18.1 |

| Target Price ($) | 26.2 | 28.0 | 29.8 | 31.7 | 33.5 |

| Market Price ($) | 25.8 | 25.8 | 25.8 | 25.8 | 25.8 |

| Upside/(Downside) | 1.7% | 8.7% | 15.7% | 22.8% | 29.8% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 11.2x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 2.26 | 2.48 | 1.75 | 3.39 | ||

| Average Market Price ($) | 29.4 | 28.8 | 19.8 | 30.2 | ||

| Historical P/E | 13.0x | 11.6x | 11.3x | 8.9x | 11.2x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $3.07 gives a target price of $34.4 for the end of 2022. This price target implies a 33.4% upside from the June 22 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 9.2x | 10.2x | 11.2x | 12.2x | 13.2x |

| EPS 2022 ($) | 3.07 | 3.07 | 3.07 | 3.07 | 3.07 |

| Target Price ($) | 28.3 | 31.3 | 34.4 | 37.5 | 40.5 |

| Market Price ($) | 25.8 | 25.8 | 25.8 | 25.8 | 25.8 |

| Upside/(Downside) | 9.6% | 21.5% | 33.4% | 45.3% | 57.2% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $32.1, which implies a 24.6% upside from the current market price. Adding the forward dividend yield gives a total expected return of 29.2%. Hence, I’m adopting a buy rating on Premier Financial Corp.

Be the first to comment