Peter Austin/iStock Editorial via Getty Images

Short-term benefit: Macroeconomic growth slowdown pushes consumer downgrade cycle

Due to the government crackdown and random outbursts of the pandemic across China, China’s macroeconomy has been experiencing a major slowdown in growth. The real estate sector (including infrastructure) accounts for 18% to 30% of China’s GDP according to analysts such as Goldman Sachs. Most of the Chinese elites’ own houses (mostly apartments) and correlate their wealth status to their house prices. Since the crackdown on China’s real estate sector (the famous three red lines) many top real estate companies have experienced a major credit crunch and a decline in home deliveries. Evergrande, which is at the center of the real estate deterioration, was unable to deliver houses due to sudden disruption of funding from banks which resulted in the provincial government stepping in. Recently, many large real estate companies are delaying their annual report release date. Why? A reasonable guess would be that the financial results are so devastating that some “makeover” is required. Since the real estate sector accounts for a large proportion of China’s overall economy, its deterioration will propagate to other sectors. As China’s economy continues to deteriorate in the short term, people’s earning power will deteriorate and so will their consumption level. Consumers will likely to 1) buy items with similar functionalities but at lower prices; 2) buy only the necessities (e.g. food, fruits, expendables) and forego the “luxury” spending (e.g. spa, sports, etc.); and 3) reduce their overall level of purchase. Pinduoduo (NASDAQ:PDD) is a company known for selling economical products because their products are 1) outdated or have been in the inventory for a long time, 2) have minor defects, and 3) sourced directly from small factories. With the consumption downgrade tailwind and the breakdown of offline retail due to China’s tight control (look what is happening now in Shanghai), more consumers will begin to look for discounted products online, giving PDD a strong push in user growth and average spending per customer.

Long-term benefit: Promotion of common prosperity drives the sale of agricultural products

Even though the voice of promoting common prosperity has quieted down since economic growth has stagnated, increasing farmers’ average income is still one of China’s communist party’s main agendas. To the party, political stability can only be achieved if the major proportion of the population is satisfied. And because most of China’s population are farmers (roughly 800 million out of 1.3 billion), their job stability and income level are paramount to the party. PDD provides an efficient platform for farmers or dealers to sell their products everywhere in China. Farm products account for 12%-13% of PDD’s GMV in 2020 and this category is growing fast. Building a localized and vast network of farm products is extremely time-consuming because 1) farmers/local dealers are very difficult to communicate with because of their lack of education, 2) farmers/local dealers are scattered across China (the average size of farmland in China is 5000 square meters compare to US’ 1.8 million square meters). Therefore, having a farm product network in China can be a strong moat in fending off other competitors. However, PDD’s current network is not a moat yet. Firstly, PDD has accumulated a large number of consumers by offering them huge incentives. The farmers/dealers are attracted to the platform because of the large consumer base. Secondly, the switching cost of these farmers/dealers to other platforms is very low at the moment. PDD lacks control points over its vendors. Realizing that the network moat is weak, PDD introduced various initiatives to fortify it. To increase vendor/dealer switching cost, PDD 1) develop its own software for vendors that simplify procurement, logistics, and payment; 2) provide technological solutions that increase productivity (e.g. automation, temperature control, greenhouse). By gaining a deep understanding of farming, PDD will be able to become an “insider” rather than just a platform provider. In the end, PDD can become an “integrator”, consolidating farmlands and providing the technological tools to further enhance productivity and unwrap the power of scale of economy in China’s farming industry. By then, PDD will have an unbeatable moat that requires little investment and will last a long time.

PDD’s further growth heavily depends on rising average spending per buyer

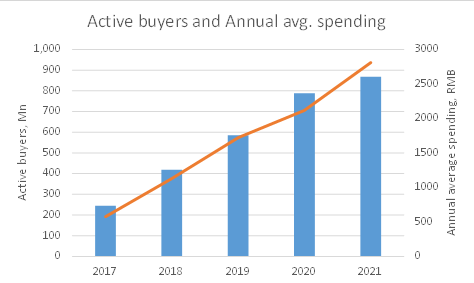

The following chart displays PDD’s active buyers (in Mn) on the left axis and average spending per buyer (before returns, in RMB) on the right axis.

PDD annual report

The number of active buyers reached 869 million by the end of 2021. This means that about 70% of China’s population buys products with PDD. Taobao (including Tmall) has 811 Mn active consumers by the end of March 2021. From the graph, we can see that the rate of buyer growth has slowed down significantly in the last 2 years. From 2021 to 2020, active buyers only increased by 80 million. My expectation is that PDD’s active buyers will reach a peak of around 970 million by 2023, adding 50 million in 2022 and another 50 million in 2023. Afterward, it would stop growing. Because of slow growth in active buyers, PDD’s future revenue will heavily rely on an increase in average spending per user.

PDD’s average spending per buyer (calculated as total GMV divided by active buyers) has increased from RMB 576 to RMB 2,810 in 2021. This is due to both increasing purchase frequency and average order price. Taobao’s (including Tmall) average spending per buyer reached RMB 9,240 for the fiscal year ended March 2021. PDD has captured two major trends which I’ve described above and I believe its average spending per user will continue to grow to reach close to RMB 5,000 in 2025, which is about 1/2 of Taobao’s current level.

PDD’s revenue and profit estimation

PDD’s two major revenue streams in 2021are online marketing services and commission fees. Online marketing services are basically advertising revenue PDD receives when vendors bid for advertising displaces in banners, search rankings, etc. Commission fees are revenue generated when a transaction takes place (it is calculated by GMV multiplied by the monetization rate). In 2021 PDD’s total revenue is RMB 93,950 Mn, of which 86,704 Mn came from online marketing services, accounting for 92% of the total revenue. Commission fees generated RMB 14,140 Mn in revenue. The rest comes from merchandise sales, which have shrunk close to 0 by Q4 and will likely be irrelevant in the future. Let’s take a closer look at PDD’s marketing revenue.

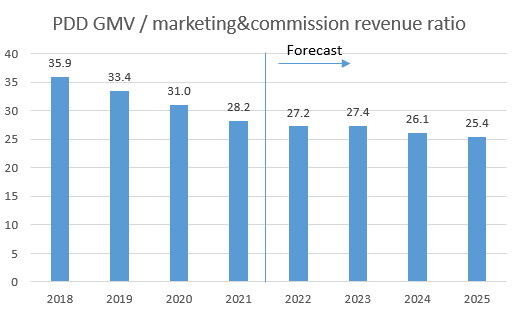

I believe whether or not a vendor chooses to advertise on an e-commerce platform is highly correlated to its return on investment. In other words, if a dollar spent on advertising will generate an X dollar amount of increase in sales, an advertiser would do it. Of course, there are other factors to consider such as exposure, brand promotion, etc., but ROI is an important measurable metric. If we use GMV divided by Marketing and commission revenue, we can get a rough sense of the merchant’s return on marketing investment (shown below):

PDD annual report

PDD’s marketing ROI ratio is 28.2 in 2021. Compare this to Alibaba’s 24.5 for the FY ended March 2021, I believe PDD can further increase its advertising price given that its user base is close to Taobao’s.

To estimate PDD’s commission revenue, we have to estimate its monetization rate. For the past few years, PDD’s commission revenue stayed between 0.33% to 0.38% but jumped to 0.58% in 2021. In the long-term, I believe PDD will increase its high-value SKU offerings such as electronics, fashions, and branded products which will boost its monetization rate to around 0.6%.

PDD was able to reduce its marketing expense while increasing its revenue

Investors’ major concern about PDD was its ability to maintain revenue growth without providing heavy incentives to customers. In 2021 Q4, PDD proved that it was able to accomplish this task. PDD’s marketing expense as a percentage of total revenue was 69.2% in 2020. It begins to drop in 2021, reaching 58%, 45%, 47%, and finally 42% in 2021 Q1, Q2, Q3, and Q4 respectively. If we compare YoY data, we can see that the change in S&M expense decreased by RMB 3,347 Mn while revenue increased by RMB 683 Mn. Even though the increase in revenue is low compared to other quarters, PDD’s profitability greatly increased, reaching an operating margin of 25% for 2021 Q4. However, we still need to closely monitor the next few quarters’ financial results to see whether a true inflection point is reached. For my forecast, I have decided to increase marketing expense by an absolute amount, RMB 3 Bn per year, instead of as a percentage of revenue. This would result in the ratio of sales and marketing expense to revenue dropping to 30.4% by the year 2025, which is still significantly higher than Taobao’s 11.4% in 2021. If PDD was able to further grow its revenue and reduce its reliance on incentives to keep users, marketing expenses as a percentage of revenue would continue to drop.

Risks: regulatory and “brand ceiling”

The major risk PDD faces are regulatory. However, unlike Alibaba which faces regulatory risk both from China and the US, PDD mainly faces delisting risk in the US if the relationship between the US and China deteriorates. As of May 5, 2021, there were 248 Chinese companies listed in the US with a total market capitalization of $2.1 trillion (source). US’ stock total market cap is around $55 trillion as of Dec. 2021 (source). This means that Chinese companies account for around 4% of the total US stock market cap. Even though the percentage is insignificant, delisting all Chinese stocks would send a message to investors both in the US and around the world that investing in China is not welcomed. This would result in two outcomes that are not favorable to the US. First, since China is the only large economy that is growing, investors would not be happy if they cannot get involved. Second, a shut-off from the US would force Chinese companies to list on the Hong Kong exchange, creating competition for the US exchanges. Therefore, I believe the US would make a reasonable effort to keep the Chinese companies listed on the US market and China would likely compromise and make certain regulatory adjustments.

The second risk PDD faces is what I call the “brand ceiling” growth risk. This risk arises when a brand’s image is fixed in the customers’ minds when it was first introduced that any effort to increase its value would require significant investment. Take Audi for example, it took them over 10 years to try to transform their brand into a luxury vehicle brand because it was first introduced as a vehicle for the masses. It is easy for a prestigious brand associated with high value to provide economical offerings (e.g. iPhone’s SE product line) but very difficult the other way around. PDD is likely to face this challenge in the near future as it tries to increase average spending per customer. To get around this risk, PDD can launch a new higher-end platform similar to what Taobao did with Tmall.

Valuation

The valuation methodology I have used is 1) forecast PDD’s earnings in the year 2025, 2) apply a reasonable P/E ratio to calculate the future market cap, and 3) discount the market cap to the current year. Based on my assumptions, in 2025, PDD’s revenue would reach RMB 187 Bn from RMB 94 Bn in 2021, a CAGR of 19%. PDD’s operating income would reach RMB 62Bn from RMB 7Bn in 2021 and the operating margin would increase from 7% in 2021 to 33% in 2025. Note that PDD’s operating margin already reached 25% in Q4 2021. Alibaba’s e-commerce platform’s operating margin is estimated to be 40%-50%. As a result, PDD’s net income is calculated to be around RMB 64 Bn in 2025. Based on my assumption, PDD’s average spending per buyer is only around RMB 5,000 in 2025, it still has the potential to grow. I have applied a P/E ratio of 20 in 2025 to get a market cap of RMB 1.28Tn in 2025, which is around $205Bn. Using a discount rate of 10%, PDD’s 2021 year-end implied market cap is $140Bn. Applying a 30% margin of safety, the intrinsic market cap is $42Bn, which is equivalent to about $70 per ADS. This implies an upside potential of 55%.

Conclusion

PDD’s short-term growth is driven by consumption downgrade and long-term growth is fueled by its agriculture initiatives as well as its push into higher-value products. The two major risks are delisting risk and growth stagnation due to the branding ceiling. Based on reasonable assumptions with a 30% margin of safety, PDD still has about 50% upside potential.

Be the first to comment