Alexandros Michailidis/iStock Editorial via Getty Images

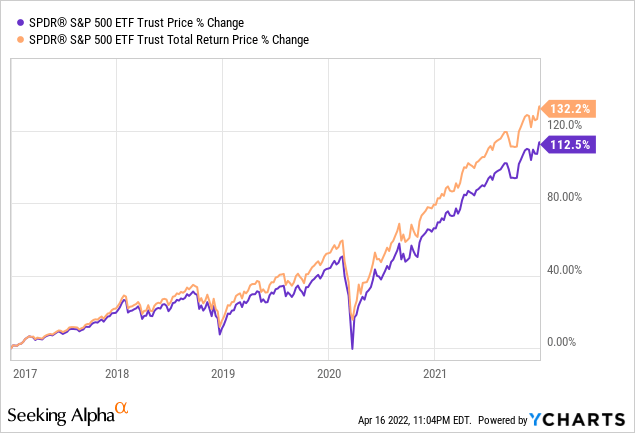

The last half-decade has been the best of times for investors as stocks have risen over 100% in the five-year span ending on Dec. 31st, 2021. The story has changed this year as investors have become more cautious, at least in part due to inflationary concerns. In the balance of this article, we will look at the reasons I believe that Pfizer (NYSE:PFE) is one stock that can survive, and possibly even thrive in a high inflation environment.

Market Returns Over the Past Five Years

COVID and Pfizer

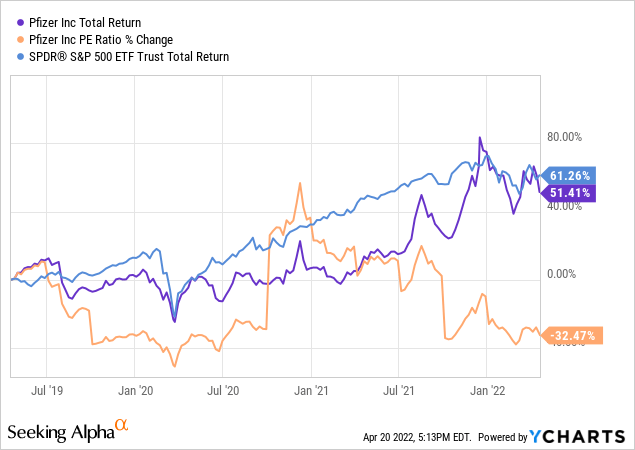

Pfizer headlines over the past couple of years have been dominated by COVID trends and that is understandable. The pandemic has affected and continues to affect all of our lives and COVID-19 vaccines are expected to account for 32% of Pfizer’s 2022 revenue. Yet, investors who avoid Pfizer because of a down-the-road reduction in COVID revenue may be making a mistake. As the three-year chart below shows, the market has already taken a possible revenue cliff into account and has valued the company more conservatively over the last couple of years. Specifically, Pfizer, while doubling profits last year, slightly lagged overall market returns. As investors have taken a conservative forward view, the valuation has retracted by 32.47%.

Pfizer’s Stock Returns and Valuation Over the Past Three Years

Quant Ratings

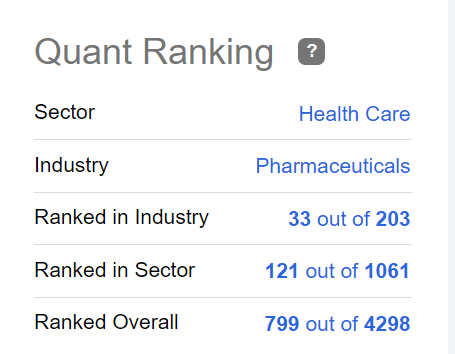

The numbers above addressed my first concern, which was that COVID profits may be temporarily inflating the stock price. As we’ve seen, Pfizer is currently valued as if all the COVID sales never existed. With that concern alleviated, let’s take a look at one of the more comprehensive rating systems for equities, the Seeking Alpha Quant Ratings. By taking valuation, projected growth, margins, and revisions into account, Quant ratings provide a comprehensive picture. It is worth noting that historically, stocks with the highest quant ratings have soundly beaten the market.

Pfizer ranks in the top 17% of all pharmaceuticals companies and if you take a look under the hood, you could make a case that the ranking should be even higher. The ranking system dinged PFE in the category of growth while also projecting the company to soundly outperform the sector in revenue growth, EBITDA growth, free cash flow, and operating cash flow going forward. I guess we could quibble on whether the rating should be higher but either way, the top 17% ranking is certainly solid.

Quant Rating (Seeking Alpha)

Inflation Resistant

The current inflation rate stands at 8.5%. That is about four times the historical average. We can’t know for sure what that will mean for investing in the next couple of years but it would stand to reason that if consumers did pull back, it would be in the area of discretionary spending. Things like luxury items, entertainment, and travel could take a hit. If you are looking for “business as usual” in inflationary times, big pharma would seem to be a solid bet.

Let’s put a face on it. Just imagine Aunt Martha saying, “I was going to refill my diabetes medication but last week when inflation hit 7%, I decided not to.”

Those conversations just don’t happen. Medications are seen as a necessity. What’s more, the cost of medications, or vaccines for that matter, is not likely to change during inflationary times. Insurance companies or the government cover most of the cost and the smaller percentage that consumers pay does not change from month to month. Furthermore, medications are much less costly than alternative treatments, which are not covered by insurance.

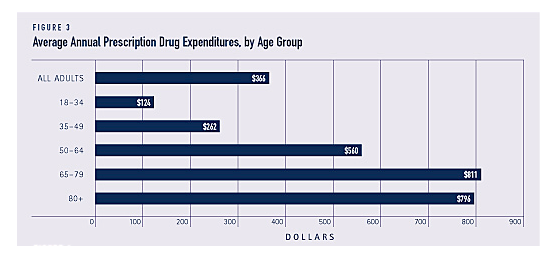

Demographic trends also lend stability to pharmaceutical companies’ prospects. Our population is aging. According to Rural Health, our 65 and older population is expected to increase by 90 million. With average prescription expenditures for the 65 and older crowd being approximately double the 35-64 group, overall prescription spending is almost sure to increase.

Prescription Expenditures By Age (Georgetown University)

Comparison to Peers

Next, we’ll take a look at how Pfizer compares to its Big Pharma peers. I will note for this section I did omit Johnson and Johnson (JNJ) since medical devices and consumer purchases account for $40 Billion of JNJ’s sales.

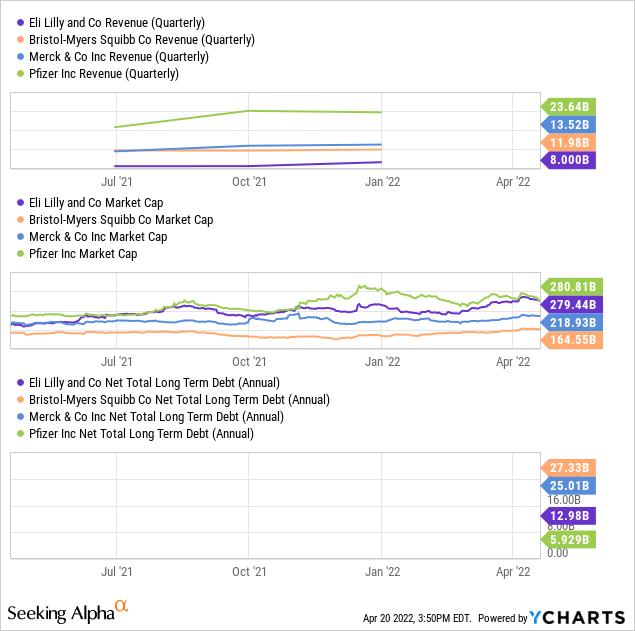

Taking a look at the other giants in the industry, the metrics below seem to favor Pfizer. Pfizer has the highest revenue by far and it is fair to note, that it would have the highest revenue even without COVID vaccine contributions. It also has the cleanest balance sheet with about 25% of quarterly revenue in net debt. All the other companies listed have at least four times the debt/revenue ratio. Finally, Pfizer’s market cap is higher than its peers but is significantly discounted when combined with the other metrics.

Big Pharma Companies and Comparisons of Revenue, Market Cap & Net Debt

More on Valuation

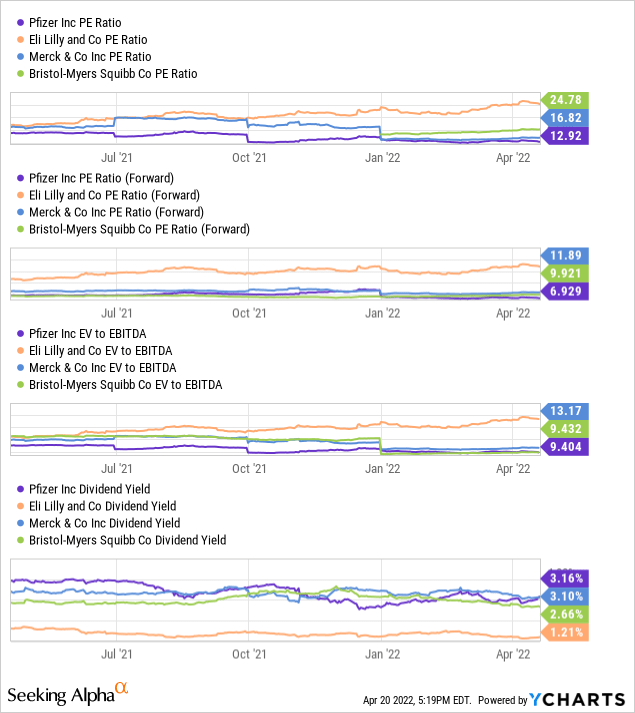

Diving deeper into valuation metrics, we take a look at PE, Forward PE, and EV/EBITDA. Pfizer, compared to its peers, appears to be the best bargain. Now, it is fair to recognize that 32% of next year’s revenue will be COVID vaccine-related and that bump won’t last forever, but even if we adjust for that 32%, Pfizer would have the lowest PE and Forward PE, while coming in second to Bristol-Myers Squibb (BMY) on the EV/EBITDA metric. I included the dividend yield on the bottom chart to indicate another margin of safety.

Valuation and Dividend Metrics for Big Pharma Companies

Associated Risks

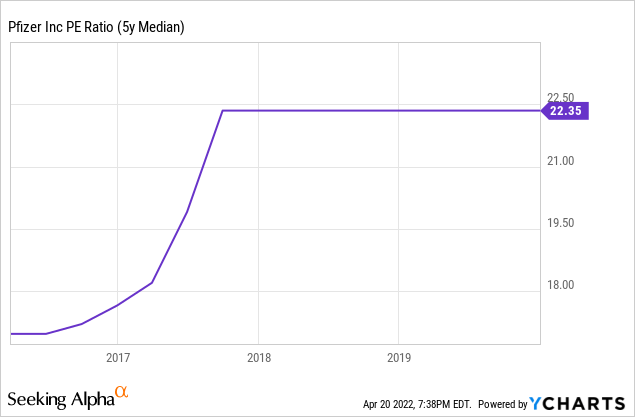

The biggest risk, obviously, comes with expected reductions in growth and earnings in 2023 and beyond, when COVID products are expected to be in less demand. Others may disagree, but I believe that risk is already factored in. Pfizer currently has a Forward PE of 6.93. When we compare that to the historical median PE prior to COVID, we already see a massive discount.

Pfizer Five Year Median PE

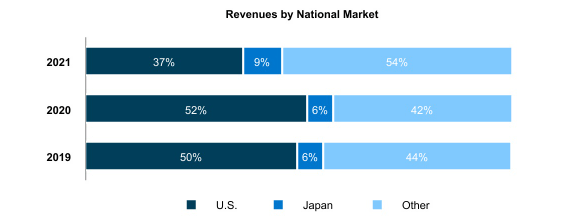

Pfizer also faces risks that are typically associated with any pharmaceutical company. Pfizer currently has 89 products in its product pipeline. Obviously, if there are an unusual number of hiccups in the approval process, that will affect profits. In addition, Pfizer has been getting a higher percentage of overall revenue from international markets which naturally lends itself to a little more risk.

Pfizer Revenue by Market (Pfizer SEC Filing)

Final Thoughts

With inflation sitting north of 8%, we want to invest in equities that will allow us to retain our buying power. Pfizer is currently sitting 21% off its 52-week high and is carrying a valuation that is deeply discounted from its historical norms. When we factor in the 3.16% dividend, we would be targeting a 5.4% annual stock appreciation to keep our buying power. If we crunch the numbers, that means we need to have confidence Pfizer stock will appreciate from its current price of $49.80 to $55.32 two years from now. Taking everything into account, I believe this is a low-risk inflation-resistant stock and if you can get an entry in the $50 range, the risk-reward factor is in your favor.

Be the first to comment