Wagner Meier/Getty Images News

Investment Thesis

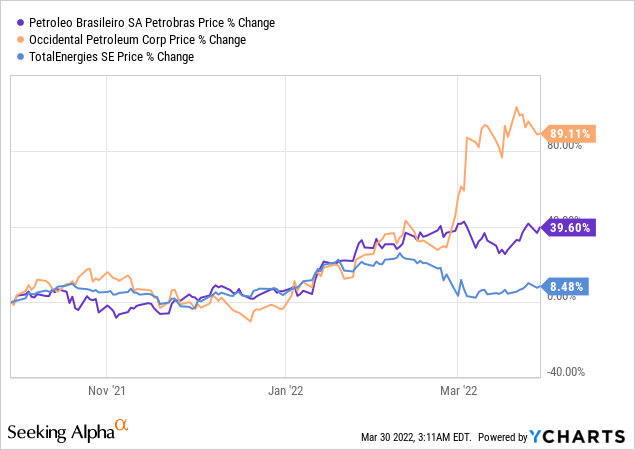

Petrobras (NYSE:PBR) is a beneficiary of higher oil prices, and for now, with its 14% dividend yield, it appears to be still cheaply valued. However, Petrobras is in a country that is consistently embroiled in problems.

The most recent charge has been the right-wing and populist Brazilian President Bolsonaro kicking out Petrobras’ CEO Joaquim Silva e Luna.

The markets for their part haven’t been all that perturbed by this turn of events. However, given that there’s already so much risk in investing in oil and gas companies, why add yet another layer of exogenous risk to a bullish investment thesis?

Even though I’m super bullish on oil, I’m not willing to get involved in Petrobras. Here’s why:

Investor Sentiment Pipes Up

There’s no denying that oil companies are very well-positioned to benefit from the strong WTI prices we are seeing. However, the truth of the matter is that oil prices can also rapidly fall too. That risk never goes away.

Consequently, there’s a lot of ”commodity risk” inherent in this trade already. Why add yet another criterion of risk by investing in a country that has questionable financial controls and policies?

On the other hand, confounding my argument is that there are plenty of aspects to be bullish about Petrobras. But those same considerations are just as pertinent in other oil and gas companies, without having to take on the ”Brazil-risk” profile.

Indeed, let’s discuss the opportunity here.

Petrobras’ Revenue Growth Rates Will Stay Elevated in 2022

Petrobras revenue growth rates

In the graphic above I’ve used $USD denominated revenues at the time of the quarterly press releases, thus the growth rates may be slightly different from what you see in other financial outlets. However, for our purposes, these are accurate.

Why Petrobras? Why Now?

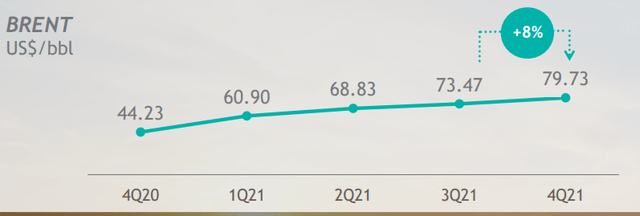

When it boils down to it, there’s no doubt in anyone’s mind that Petrobras’ free cash flows will be stronger in 2022 than it was in 2021. After all, in 2021 global oil prices were much lower, as you can see below.

Petrobras Q4 2021

Indeed, many companies are now expecting that oil prices will average around $80 WTI in 2022. What’s more, given that WTI is around $100 right now, and we are already at the end of Q1, this means that the likelihood of WTI averaging $80 or even higher improves.

Petrobras’ Free Cash Flows For 2022 Will Be Stronger

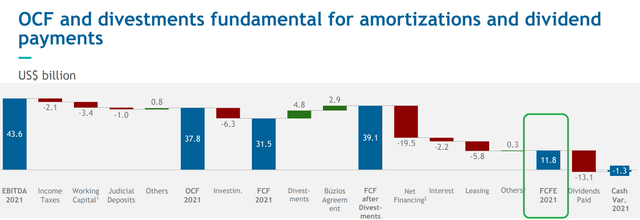

Next, let’s discuss Petrobras’ free cash flows.

Petrobras investor presentation

On the one hand, Petrobras has a very high dividend yield of 14%. That’s clearly high, not only when compared against companies in the S&P 500 (SPY), but also when compared against other oil and gas companies.

On the other hand, as you can see in the green box, free cash flows after interest payments were only $11.8 billion in 2021, which means that its underlying dividend is too high that it prevents Petrobras from meaningfully deleveraging its balance sheet.

PBR Stock Valuation – Not That Cheap

As I already alluded to throughout, Petrobras isn’t the best oil and gas play available in the market right now.

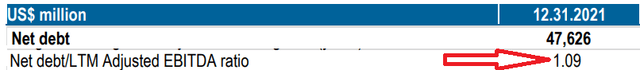

Petrobras Q4 2021

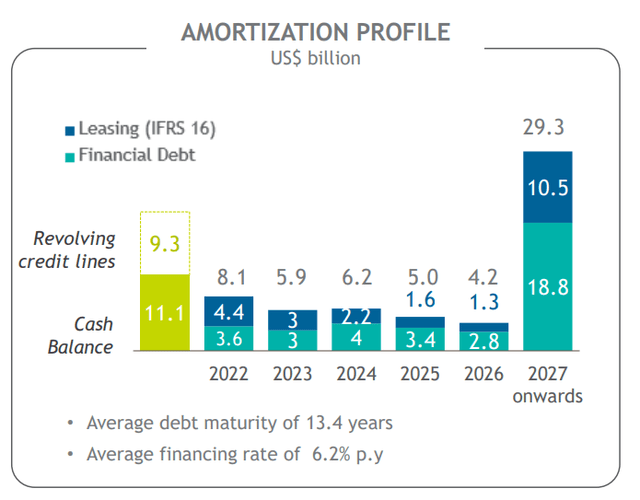

Case in point, while many investors are quick to highlight that its net debt to EBITDA profile ended Q4 2021 at just 1.1x, we have to remember that Petrobras holds nearly $48 billion worth of debt, see above.

Petrobras Q4 2021

What’s more, as you can see above, the average financing rate for Petrobras stands at 6.2%. In a time when many global markets have dramatically lower rates, this puts Petrobras’ shareholders at a meaningful disadvantage, as bondholders are going to be paid at very high rates of return before shareholders get hold of any excess free cash flows, after dividends.

Indeed, if you think that many junk bonds trade with coupons of around 8% to 10%, with Petrobras being leveraged with rates of 6.2%, it’s simply not attractive enough.

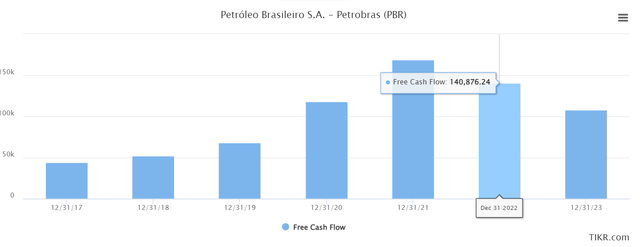

Tikr.com, PBR, free cash flow

On the other hand, as you can see above, many analysts are pricing in that Petrobras’ free cash flows (before interest) could drop from around $39 billion (fx-adjusted) in 2021 to around $35 billion this year.

However, common sense dictates that these estimates are woefully incorrect and overdue for analysts’ upgrades given the current WTI prices.

The Bottom Line

To sum it all up, this is a very mixed investment.

While I recognize that in investing you never really have a clear outlook and that anyone that thinks there is a clear outlook is the ”patsy at the table”.

Indeed, there are always going to be unknown unknowns that complicate the investment thesis. However, in the case of Petrobras, there are very clear known factors that meaningfully disrupt investors’ likelihood for compelling returns.

In the first instance, government interference is running rife throughout the company. Secondly, investors are asked to pay for such a leveraged company, at a time when many peers are now operating with seriously lean balance sheets and already repurchasing large sums of shares.

All considered I contend that there are much better investments in this space. Whatever you decide, good luck and happy investing.

Be the first to comment