Hispanolistic/E+ via Getty Images

Thesis update

This is an update to my original Paymentus (NYSE:PAY) thesis.

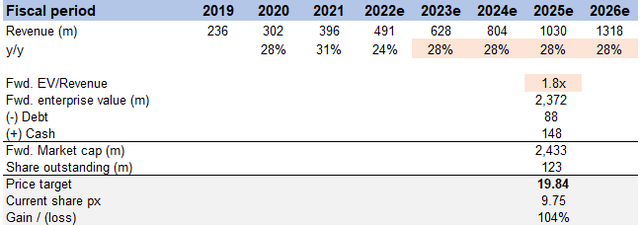

I continue to recommend going long on PAY ($9.75 as of this writing). It provides a service that benefits from the long-term trends in digital payments and has a solid go-to-market strategy to back up its strategy to gain market share in a sizable total addressable market. PAY’s value proposition should strengthen as the company pursues its growth strategy and introduces more products that customers want. I expect it to generate $1.3 billion in revenue in FY26, which, based on a 1.8x forward revenue multiple, would give it an equity value of $19.84 per share, or 104% more than it is now.

Something to note is, investors looking for clearer indicators of implementations and a path to profitability may be discouraged by management’s 4Q outlook, which may put a near-term overhang on the stock’s performance.

Earnings update

As a result of a rise in the net take rate and increased volume of transactions, PAY outperformed on both the top and bottom lines. Bookings are up 30% year-to-date, transactions are up 30% year-to-date, and PAY has visibility to a $600 million revenue run rate, which I believe should provide insight for the 2Q/3Q time frame next year. In addition, I thought PAY’s message on EBITDA margins was encouraging, and I think it sets the company up nicely to keep pushing for business efficiency gains. That said, I believe that near-term performance will be constrained by the continued possibility of implementation delays and inflationary impacts on margins.

Financials

Revenue of $128.2 million reported by PAY is higher than expected. Notably, larger billers drove the transaction upside, with little trickle-through from the higher transaction count due to the lower RPT on larger client flows. Although this trade-off is unclear at the moment, I will be happy if it means that large payer additions speed up network effects.

Operating expenses increased by 29% due to headcount growth, the Payveris acquisition, and new partnerships, resulting in a contribution profit of $51.1 million in the third quarter. The encouraging quarterly decline in G&A expenses can be attributed to PAY’s success in lowering the price tag for essentials like corporate insurance and new hire onboarding. It’s also good to see that PAY’s leaders are still committed to the company’s long-term strategic goal, even though doing so will put pressure on the company’s current margins by increasing investment in IPN and further penetrating their TAM.

Diversification

Since its IPO, when the majority of its customers were concentrated in the utility industry, PAY has made it a top priority to diversify its customer base. During the conference call, management discussed the successful rollout of a timeshare vacation club, a real estate company, the city of Baltimore, and a robust demand from the Bill Center bank channel. Thanks to the multiplier effect of network connections, the IPN flywheel facilitates effective new customer acquisition. To this point in diversification, management has done a great job of keeping the company focused on its original IPO objectives, which is a huge plus in my book.

Tracking data

FY22 guidance

The 2022 forecast was restated by management. Revenue for the year is projected to be between $485 and $492 million, or $120 and $127 million for the fourth quarter of 2022. Management is also maintaining its previous range of $200-204 million for contribution profit, which translates to $52.8-56.8 million for the fourth quarter of this year. Continued $25-28.5 million (12.5%-14% margin) adjusted EBITDA guidance suggests $6.6-10.1 million (12.5%-17.8% margin) in 4Q22. Management says that implementation delays, inflation, and pricing actions related to inflation will be very important in deciding whether the low or high end of 4Q guidance is reached.

Overall, I find the guidance to be reassuring, especially since management has reiterated it.

Valuation

Price target update

My price target for FY25 has been reduced from $24 to $19.84. This is to account for the decrease in forward revenue multiples from 2.2x to 1.8x. While I believe this is a short-term narrative phenomenon, I have remained cautious in terms of change in multiples. Given the sheer size of the TAM and the momentum of transaction growth, I continue to believe that PAY can continue to grow at pre-covid levels.

Conclusion

To summarize, I continue to believe that PAY is worth more than 100% of its current value ($9.65 as of writing). While management guided for 4Q, I believe these are just “noises” that should not cloud the judgement of any investors who are sitting on PAY for the long term. Investors should keep an eye on the north star, which is the very large TAM from which PAY can continue to capture market share. The shift in people’s preferences toward more convenient ways to pay bills will be the primary driver of PAY.

Be the first to comment