sarkophoto/E+ via Getty Images

Over the last couple months, I have been looking for new ways to get more energy exposure, as I think the sector is set to continue its outperformance of the last couple years. I covered a couple of these in a recent article on Transocean (RIG), an offshore drilling company, and Peabody Energy (BTU), a coal company. Today’s article will be another speculative idea in the energy sector, Pantheon Resources (OTCQX:PTHRF).

Company Overview

Pantheon is a small cap exploration and production company focused on the North Slope of Alaska. The company has a primary listing on the London Stock Exchange under the ticker PANR. The company also has a US OTC listing (PTHRF), but I would stick with the LSE ticker if your brokerage has it available. While the company isn’t going to see cash flows like the rest of the energy sector has over the last couple years, they are sitting on some impressive assets.

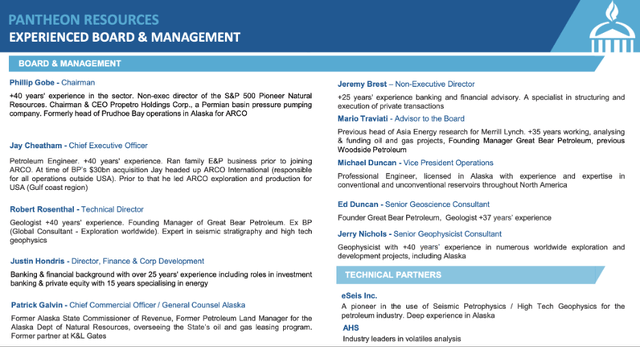

The company already had 153,000 acres on the North Slope, and they recently acquired another 40,000 acres. While the federal government has been limiting the energy industry over the last couple years, 100% of Pantheon’s acreage is on state lands instead of federal. Based on management estimates, they are expecting over 2B barrels of recoverable resources on their acreage. I am taking management estimates with a grain of salt, but Pantheon does have an experienced with the year endboard.

Board & Management (pantheonresources.com)

I spent a couple hours poking around the company’s website and investor presentations, and there is a lot of information that potential investors could find interesting. They talk about the different oil fields and the expected potential for each one.

Financials

The most recent financials available online is the interim report for December 31, 2021. The income statement is going to show continued losses until the production starts coming online. On the balance sheet side, the assets consist primarily of the exploration assets ($195.7M) and cash ($92.7M). This is against $55.8M of convertible debt on the balance sheet. We will see how the business progresses as they continue to develop their resources.

Keep in mind that this was nine months ago, so there should be some update with the year-end financials (Pantheon’s year end is 6/30/2022). If the release date on the year-end report is similar to last year, we should get an update on the company by early December. I will be keeping an eye on their operational updates as well, but the stock has turned into a controversial topic in recent weeks on social media.

Battle of the Bulls & Bears

I spend plenty of time looking for new investment ideas, here on Seeking Alpha as well as from financially focused Twitter (TWTR) accounts (Fintwit). Pantheon has its fair share of bulls and bears that have been active in recent weeks. There are claims that Pantheon is a fraud and a pump and dump from bears, but bulls point to the resources in the ground and the huge potential if Pantheon can develop these resources. If you have Twitter and are interested in Pantheon, type $PANR into the search bar. You will get results ranging from shorts talking about their reasoning to long threads on the company’s assets and their potential.

Pantheon definitely falls into the speculative bucket for me, but I recently set a small limit buy order at $70 per share on the PANR ticker. The stock has had a rough start to the week (down about 20%) as it was recently reported that short selling firm Muddy Waters has taken a short position against Pantheon. I’m curious to see what they have to say because they haven’t actually released the short report yet (it’s Tuesday evening as I write this).

This won’t play out overnight, but I will be keeping eye on Twitter to see how things develop. If the bears are right, shares of Pantheon are worthless and massively overvalued today. If the bulls are right, it’s hard to even predict what the upside is. If the resource estimates aren’t overstated (some on Twitter are even expecting an upgrade), shares of Pantheon are selling at a steep discount right now with a market cap of $713M.

Conclusion

This article is a little different than my typical article, but it was a company I found interesting and wanted to write up. Investors should do their own research and come to their own conclusions on Pantheon, but I’m willing to take a flier on the company to see how things go over the next couple years. If you are interested, I can certainly recommend checking out the Twitter feed for PANR. It’s free and there are a lot of interesting insights on the company. You also get to see both sides of the argument, from bears gloating about the recent price decline, to bulls talking about the asset base or recent operational results.

The company has an experienced board, and depending on a couple factors, I might add to the position if I get more confident in the potential of the company. The company recently expanded their acreage, and the assets Pantheon is sitting on could be huge if the estimates are accurate. If it is an option, I would recommend the LSE ticker because it is more liquid than the OTC listing. It’s hard to predict what the return for shares could be if the bull case plays out, but I plan to be along for the ride. A stock like Pantheon isn’t for everyone, but it could be worth a closer look.

Be the first to comment