RiverNorthPhotography/iStock Unreleased via Getty Images

Introduction

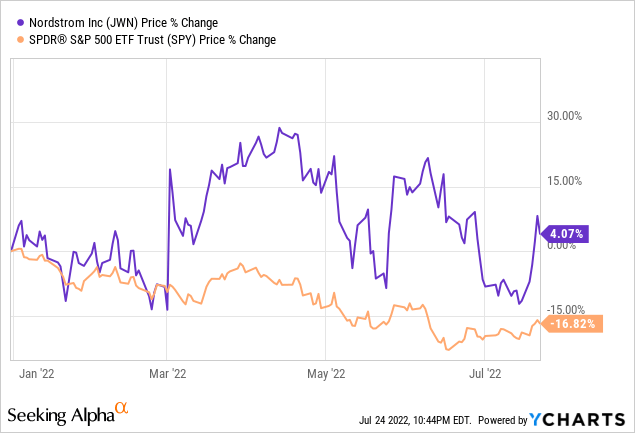

Over the past year, Nordstrom (NYSE:JWN) stock has gained 4.07% of its market value while the broader market has declined by 16.82%.

However, I see many bullish signs in favor of this company. I believe that JWN stock should be bought for many reasons: an improved business strategy, recovering financials, shareholder-friendly decisions, and more. Let’s dive into the primary drivers for my assumptions on this bullish outlook.

Company Activity

After Q1 2022, one of Nordstrom’s primary strategic focuses is to elevate its merchandise approach to further improve consumer stickiness. Evolution is at the forefront for Nordstrom and part of this includes a new retail strategy for advancing supply chain productivity, digital capabilities, establishing convenient local stores, and most notably, partnerships to boost growth. I am especially optimistic about Nordstrom after seeing successful implementations of their recent partnership with retailers Allbirds and ASOS in late May. Here is a good quote from Tacey Powers, Executive VP and General Merchandising Manager of Shoes, that demonstrates the outlook on this:

Partnering with a sustainability leader like Allbirds allows Nordstrom to better act on our brand promise to deliver the most relevant selection from brands that matter most to our customers. We look forward to growing our partnership with a unique and values-driven brand and expanding our Sustainable Style assortment.

Nordstrom is continuing to develop more personalized styling services towards their customers and partnerships like these are keeping Nordstrom relevant in modern consumers’ minds. Offering products from retailers with a proven positive customer retention rate such as Allbirds and ASOS will increase customer spending and, thus, benefit the company in the long run.

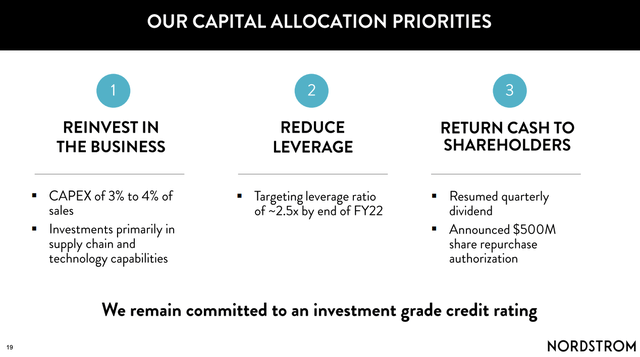

In addition, investors would be pleased to note the firm’s commitment to shareholder value as one can see in Nordstrom’s Q1 2022 earnings call report: capital allocation priorities. On May 24th, Nordstroms Board of Directors authorized a $500 million share repurchase plan. This is likely due to management’s realization of the current undervaluation of its business and goes to show their confidence in the company’s financial stability and future outlook. This makes the stock more financially attractive and Nordstrom is seeing good momentum already, generating high revenue and EBITDA values compared to its sector median.

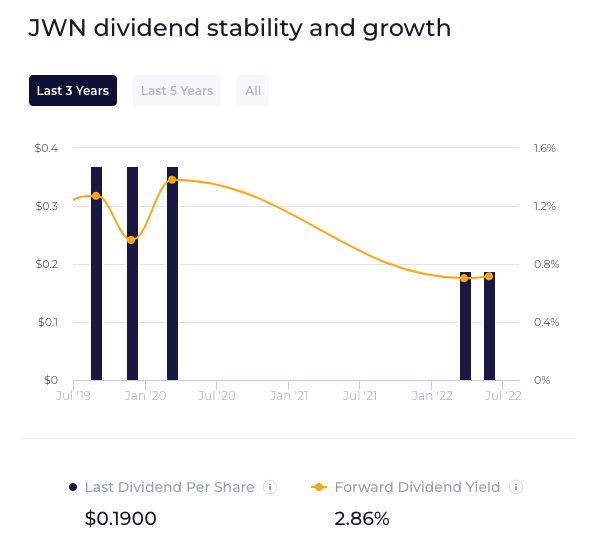

We’ve also been seeing Nordstrom’s resumption of its dividend plan and has already paid out shareholders 19 cents per share for the past two quarters at a yield of 3.47% based on its current stock price. This is good news since this shows that the company is dedicated to increasing shareholder value by using its excess capital effectively. Even though Nordstrom’s dividend history right now does not look as appealing compared to its pre-pandemic levels, I believe that the company is recovering well from its pandemic beatdown and is well-poised to gain momentum. So far, Nordstrom is listed in the top 75% of companies for dividends within the retail industry. They have reported an EPS of $2.20 (more than enough to cover their annual dividend per share of $0.38) with a sustainable payout ratio of 16.6%. I strongly believe in the fact that Nordstrom’s improved retail strategies will turn out to be a success and further will provide a leverage point that the company can capitalize on to improve its dividend metrics for the foreseeable future.

WallStreetZen

Valuation

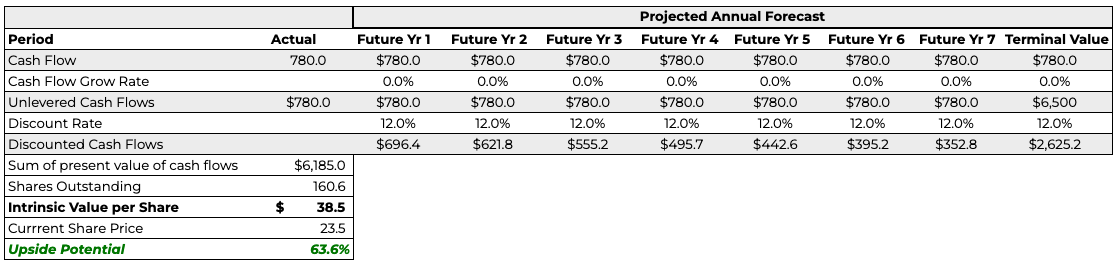

Nordstrom is financially sound and it is worth pointing out that metrics such as revenue are expected to grow at double-digits (exceeding pre-pandemic levels) with impressive free cash flow margins. Because of this, I decided to use the Discounted Cash Flow with a more conservative approach to yield the most accurate results. I based my model on a $780 million free cash flow ttm (via Yahoo Finance) to use the most recent FCF number (their fiscal year numbers would not account for recent data from 2022). Then, I assumed a rather conservative assumption of 0% for the terminal and FCF annual growth rate to get an intrinsic price of $38.50 representing a 63.6% upside from the current market price. Partnerships opportunities are already yielding exceptional results and growth rates may be much higher than my current conservative assumption. I see that this stock is heavily undervalued by the market and presents itself as a great buy opportunity given that the intrinsic value remains much higher than the current market values despite the conservative assumptions.

Google Sheets

Risk Headwinds

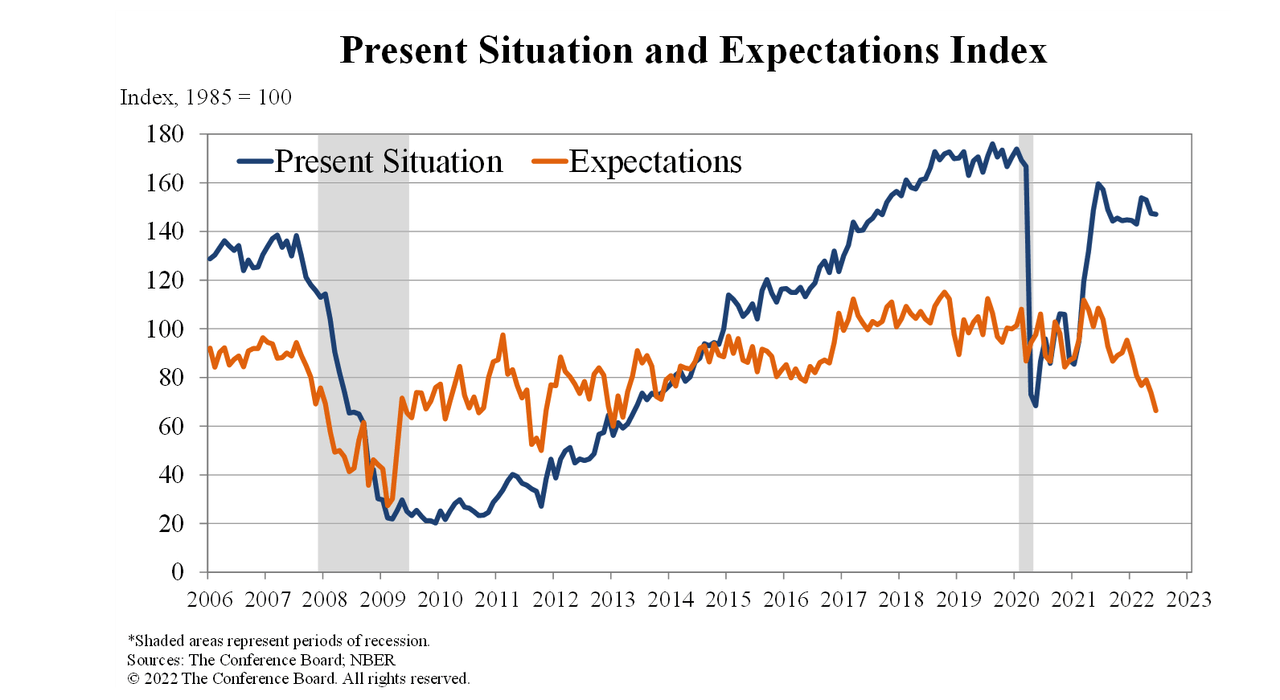

The biggest risk that I see for Nordstrom is the impact of increasing consumer concern about inflation and their financial well-being. The U.S. Consumer Sentiment/Confidence and the Expectations index has now declined to record lows. Here’s a quote from Lynn Franco, Senior Director of Economic Indicators at The Conference Board, recapping this shift in consumer sentiment.

While the Present Situation Index was relatively unchanged, the Expectations Index continued its recent downward trajectory—falling to its lowest point in nearly a decade. Consumers’ grimmer outlook was driven by increasing concerns about inflation, in particular rising gas and food prices. Expectations have now fallen well below a reading of 80, suggesting weaker growth in the second half of 2022 as well as growing risk of recession by yearend.

It is understandable that investors are pessimistic about where market conditions are headed and the effect of a recession could have a greater impact on the Retail Industry. However, I believe that Nordstrom is well positioned to tackle these incoming headwinds with its recent financial moves and diversification of its business model. Nordstrom’s revised retail strategy could further provide exceptional growth for the foreseeable future.

Conference Board

Competitor Comparisons

Lastly, I am optimistic about Nordstrom based on its competitive positioning within the Retail Industry. Nordstrom is still recovering nicely from the losses during the pandemic and still ranks relatively well (being placed 33rd) in the Retail Sector. To visualize this, I decided to create a table below to compare Nordstroms financial performances among competitors that income investors may seek out as an alternative such as Target (TGT), Dillard’s (DDS), and more.

As a result, my table shows that Nordstrom outperforms all of the companies listed with regard to shareholder return metrics (Dividend Yield and Return on Equity) from Yahoo Finance. Income-focused investors should be gravitating towards this stock especially since I see tons of growth ahead and financial metrics like these are likely to improve even more—higher dividend payouts, increased return on equity from share buybacks, and more. In my opinion, Nordstrom is actually well-positioned to advance as one of the retail industry leaders in a short amount of time.

| Company | Ticker | Dividend Yield | Return on Equity |

| Nordstrom | JWN | 3.47% | 96.42% |

| Ross Stores | ROST | 1.48% | 41.42% |

| Target | TGT | 2.82% | 45.53% |

| Macy’s | M | 3.47% | 51.19% |

| Urban Outfitters | URBN | 3.47% | 51.19% |

| Dillard’s | DDS | 0.37% | 62.64% |

| Gap | GPS | 7.20% | -2.74% |

| Abercombie & Fitch | ANF | 0.00% | 25.69% |

| Dollar General | DG | 0.90% | 37.25% |

Conclusion

Nordstrom is full of bullish tailwinds. Their revamped retail strategy, partnerships, and commitment to shareholder values with sound dividend recovery all are reasons for buying this stock. My conservative Discounted Cash Flow model resulted in an intrinsic price of $38.50 which represents a 63.6% underpayment by the market. While consumer concerns regarding the inflation rates are at all time high, I believe that Nordstrom is well-positioned among its industry and as a company as a whole to surpass these tailwinds. With all these reasons and more, I recommend a “Buy” for Nordstrom.

Be the first to comment