labsas/iStock Unreleased via Getty Images

Mixed FQ1 earnings results

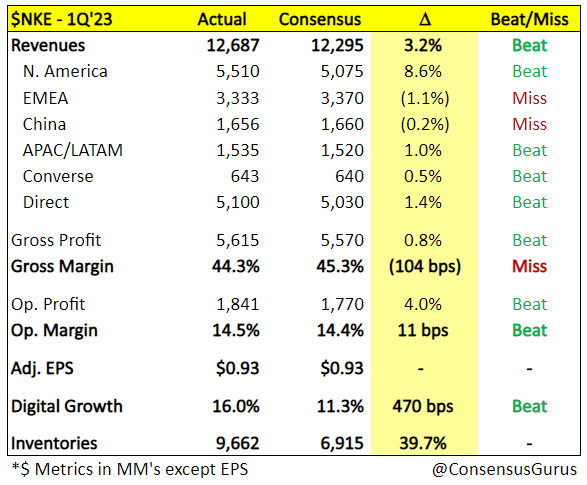

After the bell, investors received mixed FQ1 (ended August) results from Nike (NYSE:NKE) that made them nervous enough to send shares down more than 9% after hours. Revenue of $12.7 billion (+4% YoY / +10% CC) beat consensus estimates thanks to Nike Direct and Nike Brand Digital which grew 14% and 23%, respectively. Gross margin of 44.3% came in below estimates by 104 bps, due to (1) higher markdowns in North America (both in Direct and Wholesale), (2) higher supply chain costs and (3) negative FX impact given a stronger dollar. Net income of $1.47 billion (-22% YoY) represented a net margin of 11.6% vs. 15.3% in 2021, driven by higher overhead expense and a tax rate of 19.7% vs. 11% in 2021. Diluted EPS of $0.93 saw a 20% decline against $1.16 last year.

ConsensusGurus

There’s an inventory problem

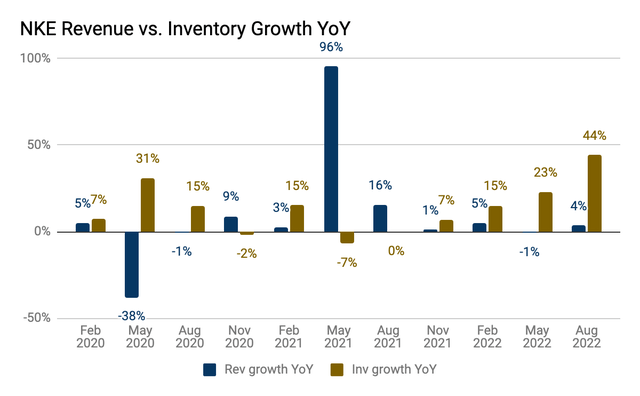

What really got the market worried was inventory, which saw a 44% YoY increase to $9.7 billion in the August quarter. This was driven by high levels of in-transit stock due to supply chain challenges. Like many other companies during the pandemic, Nike was aggressive in ordering inventory from suppliers. While this was understandably the right thing to do given the circumstances, the problem now is that consumer demand isn’t on the same page when inventory finally arrives at the warehouse. This means getting rid of extra stuff with discounts (particularly with apparel in North America), which naturally hurts gross margin.

From the above graph, we can see that Nike experienced a significant revenue contraction in the May 2020 quarter when the pandemic first hit. In the subsequent quarters, inventory growth was modest until demand recovered more quickly than anticipated in the May 2021 quarter. As the purchasing team began to increase inventory aggressively and tried to manage delays caused by supply chain challenges, revenue growth was again not able to catch up with incoming stock in the past few quarters.

To deal with excess inventory, Nike will liquidate extra stock aggressively in the November quarter (FQ2) and will tighten up purchasing in 2HFY23.

And a China problem

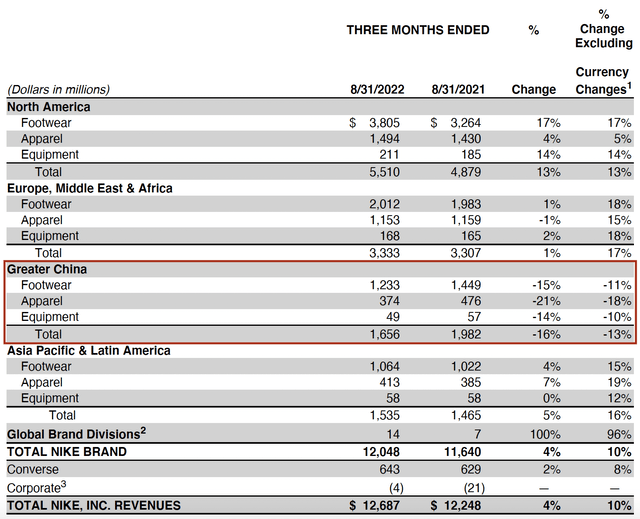

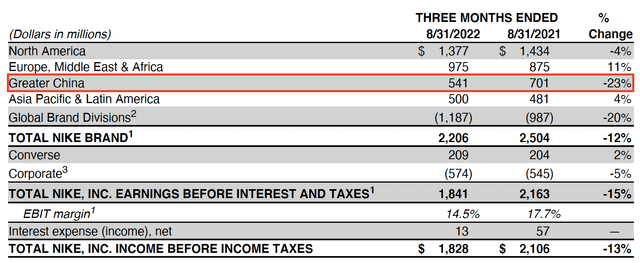

Nike’s revenue in the Greater China declined for the 3rd straight quarter. Sales in the August quarter saw another 13% drop in constant currency after a 20% decline in the May quarter. The challenges in China still largely revolve around strict Covid restrictions, with increasing concerns over a slowing economy driven by soft exports and a troubling property market. As a percentage of total sales, China was 13% in FQ1 vs. 16% in 2021.

With contracting revenue comes contracting EBIT. Nike’s EBIT in the Greater China region fell 23% in FQ1 to $541 million, representing 25% of total EBIT vs. 28% in 2021. If there’s one piece of good news about China, it’s that inventory was down 3% YoY.

FY23 (ending May 2023) outlook

- Revenue growth of low double digits in constant currency and low to mid-single digits assuming 800 bps of FX headwinds.

- GM to decline 200-250 bps to 43.5%-44%, reflecting 150 bps from higher markdowns, >100 bps from supply chain cost, and 70 bps from FX headwinds.

- FX impact of $4 billion on revenue and $900 million in EBIT.

- SG&A to increase high single digits driven by investment in direct sales, offset by limited headcount growth.

- A mid to high teens tax rate due to lower stock-based compensation.

Doing some quick math, FY23 revenue of $47.6-$49 billion is below the current consensus of $50 billion and EPS of ~$2.60 is also below the $3.72 consensus. Considering stock fell to $86.4/share after hours, the forward P/E is now at 33x, a premium relatively to the broader market. In my view, this is likely a very demanding multiple in the current market as much as some may think the worst has been priced in.

Final thoughts

Nike is an industry stalwart going through inventory issues that management is quite familiar with, much like other retailers from Walmart (WMT) to Target (TGT). The more challenging problem is whether sales in the Greater China region (13% of revenue) will return to its glory days now that the Chinese economy is in a difficult state. I originally had a Buy rating for Nike per this article published in March, but that turned out to be too optimistic. Given the current macro backdrop and the stock’s still premium valuation, I believe it’s more prudent to move to a neutral rating until things start to look better.

Be the first to comment