Joe Raedle

Thesis

Nike, Inc. (NYSE:NKE) is slated to report its highly anticipated FQ1’23 earnings release on September 29. We highlighted in our early August update encouraging investors to add exposure, as we postulated that NKE had formed its long-term bottom.

However, NKE has pulled back further from its mid-August highs, losing further upward momentum ahead of the broad market. As a result, it underperformed the market and even broke below its early July lows.

We believe the weakness in NKE over the past month could be attributed to Nike’s global operations, impacted by the dollar index’s seemingly “unstoppable” surge.

As a result, the market has likely de-risked NKE’s valuations further in anticipation of a weaker-than-expected Q1 card. Furthermore, China’s industrial production remains tepid, coupled with weak consumer discretionary spending. Therefore, the recovery in Nike’s China growth story would likely be delayed further, but there are reasons to be optimistic, as we shall discuss subsequently.

NKE’s valuation remains subdued and is relatively attractive at the current levels, given the recent battering. Therefore, we maintain our conviction that its long-term bottom remains intact. In addition, investors should note that global supply chain headwinds and global freight costs have eased further into September.

Hence, a critical impediment to Nike’s recovery cadence has been mitigated, bolstering our thesis of a long-term bottom in Nike. Therefore, all eyes will be watching China’s 20th CPC National Congress in October and whether President Xi Jinping will stoke China’s economy back into life after he secures his unprecedented third term. Tailwinds from China would be highly constructive to Nike’s EBIT profitability through the cycle.

We believe there are reasons to be optimistic, and therefore reiterate our Buy rating on NKE heading into its upcoming earnings release.

Nike’s China Segment Could Recover In H2’22

China’s economy has been in the doldrums over the past year, hobbled by its stringent zero COVID policy and exacerbated by its property market malaise. However, we believe there are reasons to be sanguine that the Chinese economy looks ready to emerge from its nadir in H2’22, ahead of the US economy entering its coming recession.

Notwithstanding, recent data showed that China’s industrial profits fell from the January-August period by 2.1% YoY. However, China’s National Bureau of Statistics (NBS) highlighted that August’s decline in profits “narrowed from a month earlier.”

Furthermore, NBS also indicated that profits at foreign firms “is showing signs of a rebound” in August, suggesting that the worst seen in China’s economy could be over.

Deutsche Bank (DB) also telegraphed its confidence that it sees data pointing to a sequential recovery in China’s economy in Q4, with a loosening of its tight zero COVID restrictions a possibility after the CPC National Congress in October. In addition, DB expects more fiscal policy boosters to help stimulate China’s economy moving forward, given the limited scope of its monetary policy tools.

Therefore, we deduce that the possibility of a progressive recovery in its China segment could be in the works, providing tailwinds to mitigate potential earnings pressure from a coming US recession.

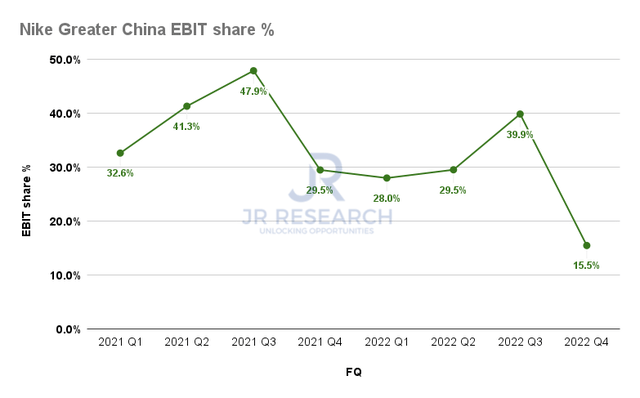

Nike Greater China EBIT share % (Company filings)

The Greater China region has been a critical driver of Nike’s EBIT (Nike Brand). However, the destruction in the Chinese economy has led to China’s EBIT share falling to 15.5% in FQ4’22 (quarter ended May 2022).

Therefore, we posit the recovery in China could be beneficial to help stem earnings pressure from the coming US recession. As a result, Nike could potentially deliver upside earnings surprises in FY23, as we believe the Street had already de-risked their near-term estimates on China’s recovery.

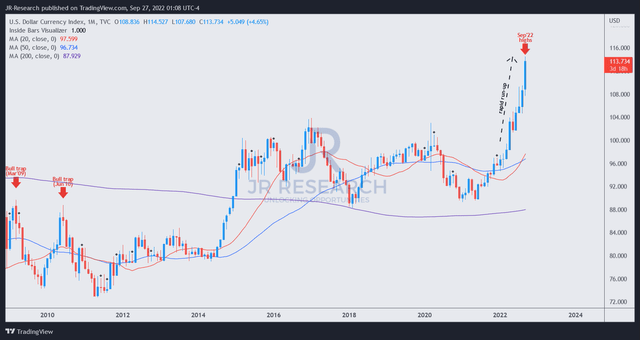

Dollar index price chart (monthly) (TradingView)

Furthermore, we assessed that the recent surge in the dollar index had put further pressure on Nike’s revenue and earnings. Investors should note that Nike derives only 41.76% of its revenue from North America. Hence, Nike’s massive global footprint has proved to be a dampener on its revenue base in 2022, given the dollar’s record surge.

Notwithstanding, we postulate that the surge is ultimately unsustainable, driven mainly by the Fed’s hawkish posture to raise rates at an accelerated pace.

But, as rate hikes are expected to slow from December 2022, as they approach the Fed’s median terminal rate of 4.6%, the upward momentum in the dollar would likely find significant pressure. We maintain our conviction that the mean reversion potential in the dollar index is massive in the medium-term.

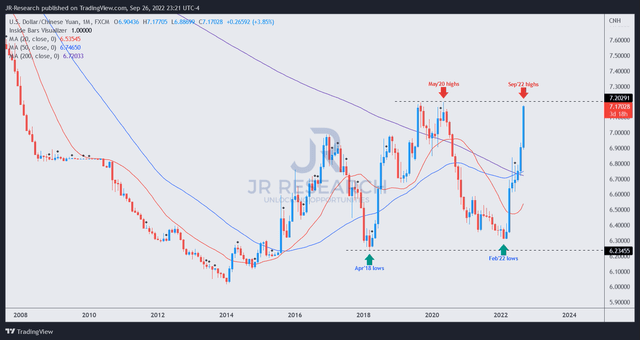

USDCNY price chart (monthly) (TradingView)

Also, we gleaned that USD’s record surge against the RMB in 2022 is likely near its top. We are highly confident that the sharp momentum spike in the USDCNY is unsustainable and is looking ominously configured for a massive collapse moving ahead.

The market has drawn currency traders in rapidly, in their attempts to exploit the limitations of China’s monetary policy, given its economic malaise, by betting at record levels against the yuan.

However, with the interest rate differentials expected to narrow from 2023 and its unconstructive price structure, we are confident that it should provide a meaningful tailwind to Nike’s global business in 2023.

Is NKE Stock A Buy, Sell, Or Hold?

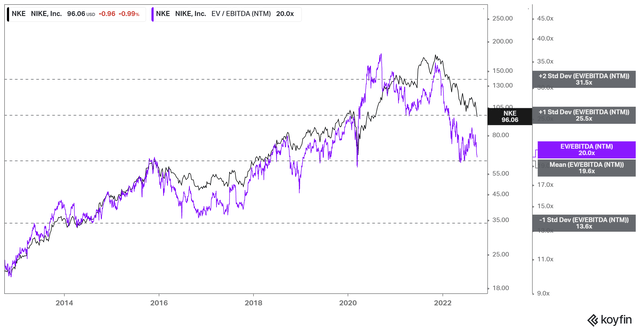

NKE NTM EBITDA multiples valuation trend (koyfin)

NKE’s NTM EBITDA multiples have retraced to its 10Y mean, supporting its bottom in June and the March 2020 COVID lows.

Therefore, we are confident that NKE should continue to see robust valuation support at the current levels, despite the potential for near-term downside volatility.

We are confident that Nike’s globally diversified business model, China’s upcoming economic recovery, and the mean-reversion of the USD should bolster our thesis of a medium-term recovery in NKE. Furthermore, the supply chain tailwinds have already eased markedly, with cost inflation down further since Nike’s Q4 update.

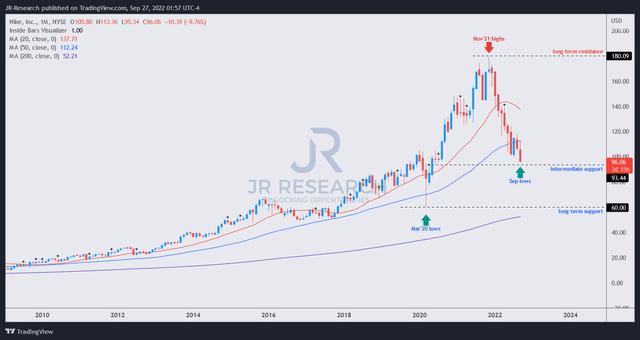

NKE price chart (monthly) (TradingView)

We gleaned that there could be near-term downside volatility which could send NKE down toward its intermediate support ($93). However, given the battering in its valuations and medium-term tailwinds moving ahead, we remain confident of its long-term bottom at the current levels.

Therefore, we urge investors to capitalize on the pessimism in NKE to add more positions.

As such, we reiterate our Buy rating on NKE.

Be the first to comment