chameleonseye/iStock Editorial via Getty Images

Intro

We wrote about Newmont (NYSE:NEM) in January of this year when we stated that gold miner remained an excellent income play. The pretense of our article was that investors needed to seriously consider Newmont (and the gold mining sector in general) as a new pasture for dividend growth strategies. Retirees for example looking for stable dividend income tend to steer clear of stocks like Newmont due to it being unproven in their eyes. This may be true when comparing the gold miner to a dividend aristocrat for example but one needs to look beyond companies’ respective track records and focus on which sectors are making money in May 2022.

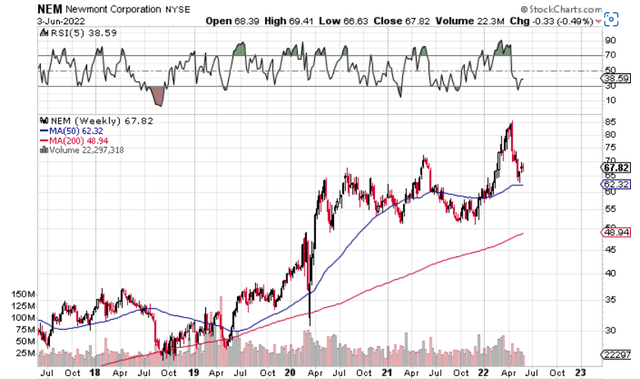

With respect to Newmont’s record, the gold miner has now paid a dividend to shareholders for the past 32 years and has grown the payout for the past 6 years straight. Newmont’s current forward yield is 3.2% with the annual payout having grown by almost 66% on average per year over the past five years alone. Furthermore, shares have more than doubled in value in this 5-year period. Given the trends in the Newmont’s dividend (which was derived from strong earnings growth), we stated in that January article that it was only a matter of time before the company’s 2021 highs would be taken out. This breakout actually happened earlier than we anticipated and although shares have come right back down to successfully test their 200-day moving average, Newmont’s confirmed pattern of higher highs leads us to believe sustained higher prices are on the horizon for the following reasons.

Higher Highs In Newmont (Stockcharts.com)

Newmont’s Profitability

Although operating cash flow of $4.13 billion over the past four quarters and an EBITDA margin of 36% outperform the gold mining sector by a significant margin, Newmont’s profitability still has serious potential for the following reason. Newmont’s assets at present total approximately $40 billion which mean they have grown by close to 100% over the past five years alone. However, from a profitability standpoint, the company’s assets as a whole are not returning (ROA of 2.64% over a trailing 12-month average) what they traditionally have returned (3.52% ROA average). Now given the 10%+ expected bottom-line growth this year along with encouraging recent earnings revisions, we would expect Newmont’s return on assets metric to consistently drift up towards its long-term mean. In fact, in solid outfits where earnings are rising, profitability metrics such as return on assets behave very much like valuation metrics in that they usually return to their means. Furthermore, there always is a time lag before new assets bear fruit with respect to strong profitability. Suffice it to say, given this potential, we are expecting the same this time around once more in Newmont.

NEM Stock Valuation

As alluded to earlier, elevated dividend growth rates in recent years in the gold mining sector should have been a wake-up call to dividend growth investors that this sector was the place to be to make significant gains. In saying this, Newmont’s forward GAAP earnings multiple of 21.78 & forward book multiple of 2.47 may look frothy to some investors when compared to near-term historic multiples. However, here is where investors need to be careful when trying to put a valuation on this stock. Why? Because gold mining companies over the past decade or so experienced many lean years due to a declining gold price which pretty much lasted from mid-2011 to the end of 2015 when the yellow metal bottomed out just above $1,000 an ounce. Suffice it to say, comparing Newmont’s current sales and assets to what investors have been accustomed to over the past decade is really a fool’s game as the average gold price (and consequently Newmont’s mines) had much less value overall all things remaining equal.

This is why we like to use the price action on the technical chart to advise us on entry and not historic valuation multiples which do not paint an accurate picture of Newmont. Could shares return for example to their 200-week moving average ($48.94)? Of course but that recent higher high as well as the successful test of the 50-week average leads us to believe that higher prices are around the corner. On the contrary, given Newmont’s first in the industry dividend policy, you can be sure that value investors would step in here indeed selling was to accelerate to the downside.

Conclusion

To sum up, given Newmont’s profitability trends and bullish technicals, we continue to believe Newmont is an excellent play for the dividend growth investor. We look forward to continued coverage.

Be the first to comment